Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,095

GBP/USD: consolidating at record highs 22.01.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on GBP/USD for a better understanding of the current market situation and more efficient trading.

Current trend

GBP is trading down against USD during today's morning session, correcting slightly after yesterday's renewing record highs since May 2018. The decline in the instrument is largely due to technical factors, while fundamentally the picture changes only slightly.

Moderate support for USD is provided by rather positive macroeconomic statistics from the US, which entered the market on Thursday. The number of initial jobless claims for the week ending January 15 fell from 926K to 900K, while investors expected a decrease in the figure to 910K. Continuing Jobless Claims were revised down from 5.181M to 5.054M with the forecast for growth to 5.4M.

In turn, GBP is under slight pressure on Friday after the publication of GfK Consumer Confidence. In January, the index fell from –26 to –28 points, while the market expected a decline to –29 points.

Support and resistance

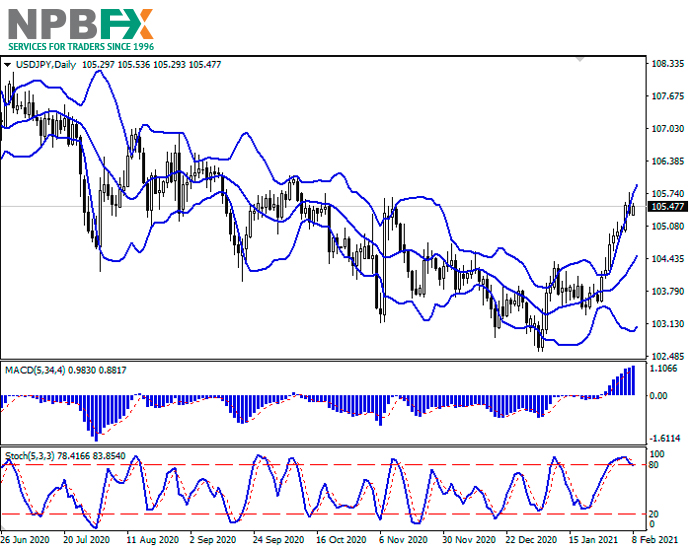

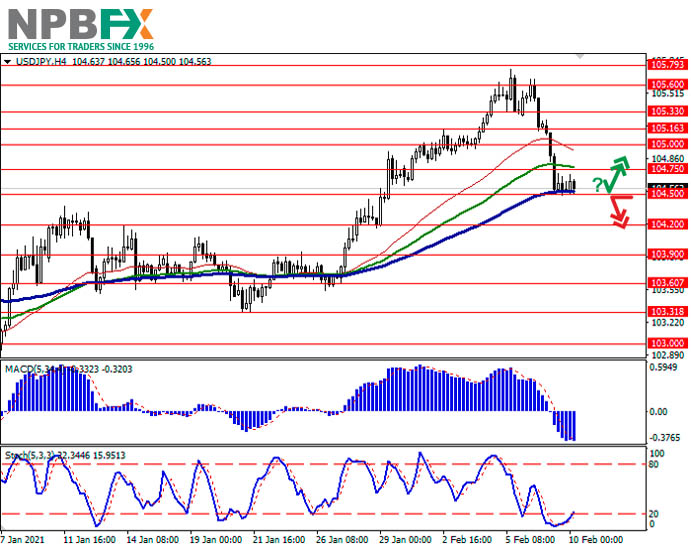

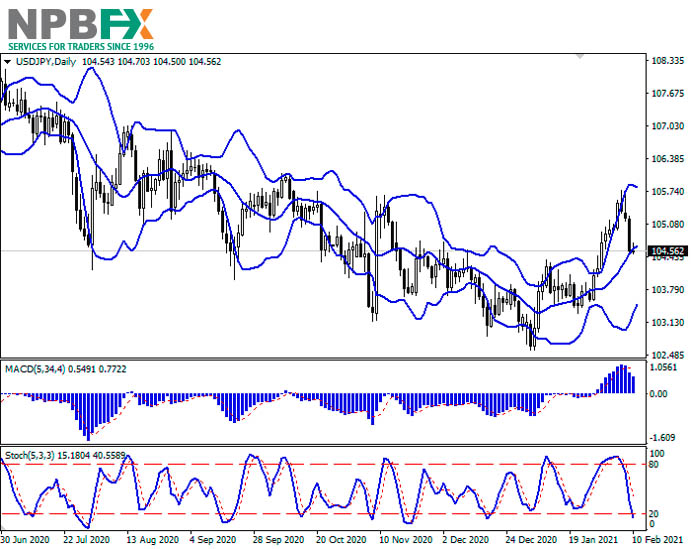

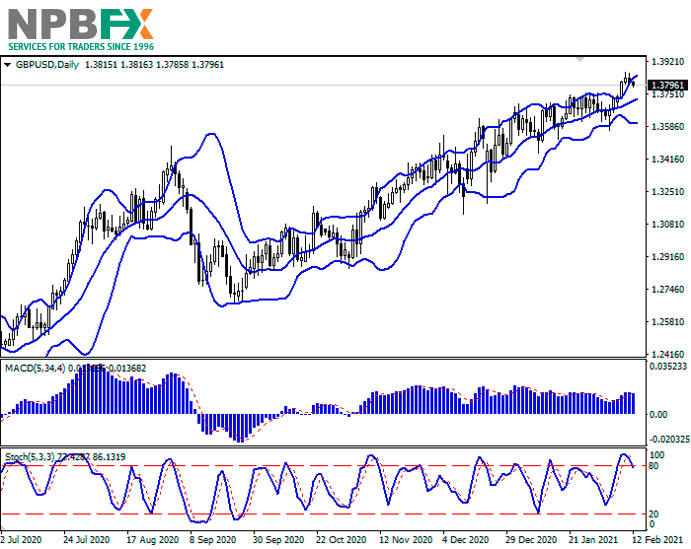

The Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the development of "bullish" sentiments at the moment. MACD indicator is growing preserving a buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought instrument in the ultra-short term.

Resistance levels: 1.3760, 1.3834, 1.3900.

Support levels: 1.3700, 1.3650, 1.3600, 1.3552.

Trading tips

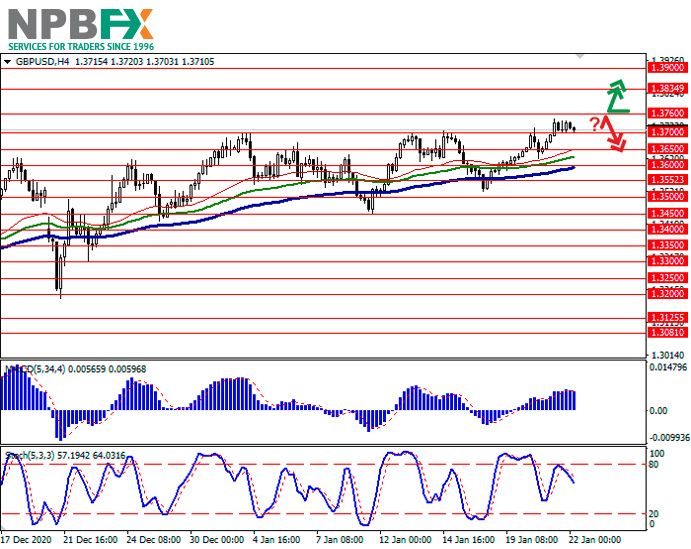

To open long positions, one can rely on the breakout of 1.3760. Take-profit – 1.3900. Stop-loss – 1.3680. Implementation time: 2-3 days.

A rebound from 1.3760 as from resistance followed by a breakdown of 1.3700 may become a signal for new sales with the target at 1.3600. Stop-loss – 1.3760.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on GBP/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on GBP/USD for a better understanding of the current market situation and more efficient trading.

Current trend

GBP is trading down against USD during today's morning session, correcting slightly after yesterday's renewing record highs since May 2018. The decline in the instrument is largely due to technical factors, while fundamentally the picture changes only slightly.

Moderate support for USD is provided by rather positive macroeconomic statistics from the US, which entered the market on Thursday. The number of initial jobless claims for the week ending January 15 fell from 926K to 900K, while investors expected a decrease in the figure to 910K. Continuing Jobless Claims were revised down from 5.181M to 5.054M with the forecast for growth to 5.4M.

In turn, GBP is under slight pressure on Friday after the publication of GfK Consumer Confidence. In January, the index fell from –26 to –28 points, while the market expected a decline to –29 points.

Support and resistance

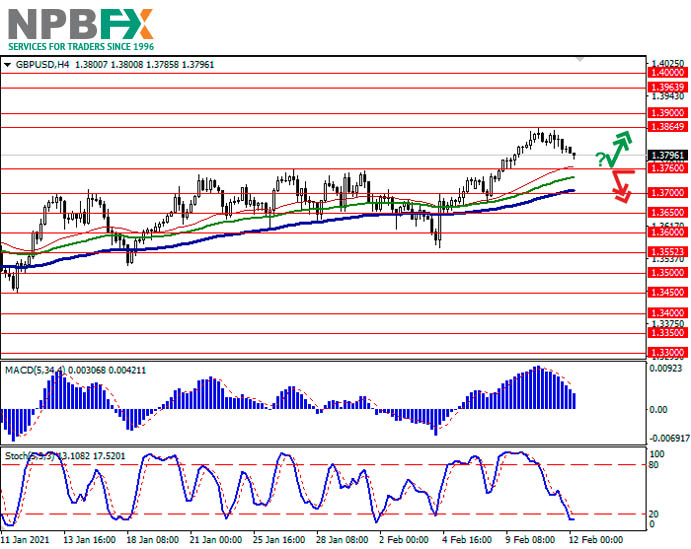

The Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the development of "bullish" sentiments at the moment. MACD indicator is growing preserving a buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought instrument in the ultra-short term.

Resistance levels: 1.3760, 1.3834, 1.3900.

Support levels: 1.3700, 1.3650, 1.3600, 1.3552.

Trading tips

To open long positions, one can rely on the breakout of 1.3760. Take-profit – 1.3900. Stop-loss – 1.3680. Implementation time: 2-3 days.

A rebound from 1.3760 as from resistance followed by a breakdown of 1.3700 may become a signal for new sales with the target at 1.3600. Stop-loss – 1.3760.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on GBP/USD and trade efficiently with NPBFX.