SOLID ECN LLC

Solid ECN Representative

- Messages

- 512

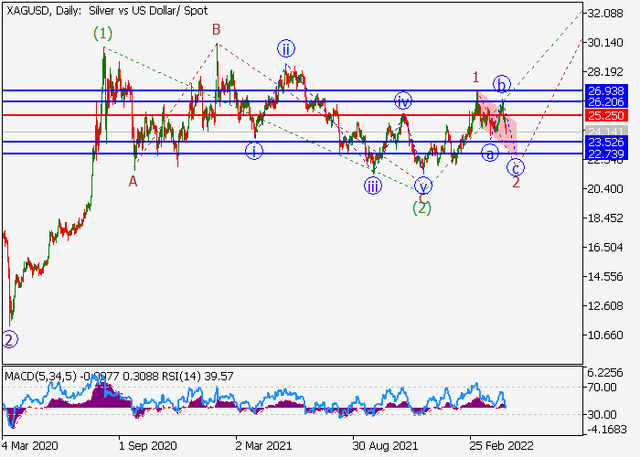

Silver prices show a weak increase during the Asian session, retesting the level of 25.50. The instrument has been developing a fairly active uptrend since April 6, retreating from local lows since the end of last month and receiving support from statistics on record inflation in the world. Given the high Consumer Price Index in the US, which reached 8.5% in March, as well as the growing geopolitical uncertainty against the backdrop of the development of the Russian-Ukrainian conflict and severe anti-COVID restrictions in China, the demand for defensive assets remains elevated.

Macroeconomic statistics released the day before showed an increase in annual consumer inflation in the US to 8.5%, which was a new record high for 41 years. At the same time, a sharp tightening of the US Federal Reserve's monetary policy is expected in May: in addition to the expected rate hike by 50 basis points at once, a quantitative tightening program may also be launched to correct its balance.

Additional support for the metal comes from the prospect of a gradual lifting of COVID restrictions in China, while the restoration of industrial activity. The Chinese authorities announced the easing of a number of quarantine measures in parts of Shanghai, which will affect almost 5 million people, since there were no new cases of coronavirus infection over the past two weeks. Silver, unlike gold, is more actively used in industry, and therefore reacts sharply to such factors.

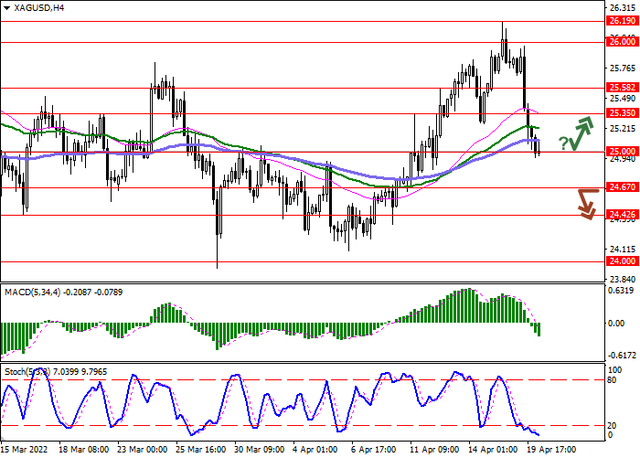

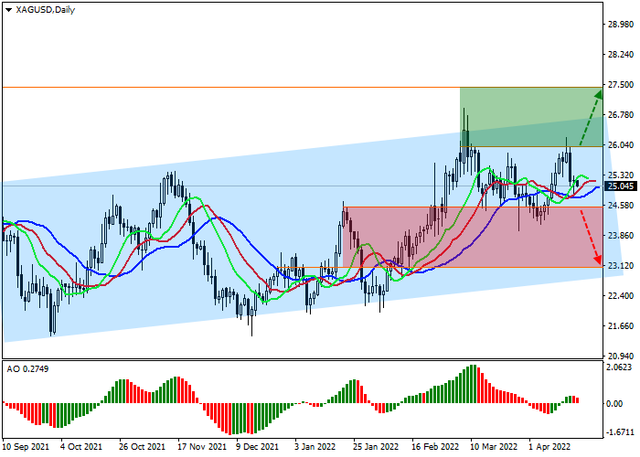

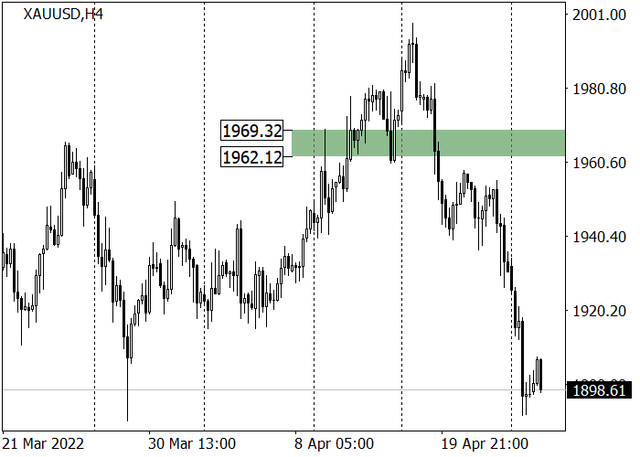

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range remains practically unchanged, limiting the development of "bullish" dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

Resistance levels: 25.58, 26, 26.27, 26.57 | Support levels: 25.35, 25, 24.67, 24.42

Macroeconomic statistics released the day before showed an increase in annual consumer inflation in the US to 8.5%, which was a new record high for 41 years. At the same time, a sharp tightening of the US Federal Reserve's monetary policy is expected in May: in addition to the expected rate hike by 50 basis points at once, a quantitative tightening program may also be launched to correct its balance.

Additional support for the metal comes from the prospect of a gradual lifting of COVID restrictions in China, while the restoration of industrial activity. The Chinese authorities announced the easing of a number of quarantine measures in parts of Shanghai, which will affect almost 5 million people, since there were no new cases of coronavirus infection over the past two weeks. Silver, unlike gold, is more actively used in industry, and therefore reacts sharply to such factors.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range remains practically unchanged, limiting the development of "bullish" dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

Resistance levels: 25.58, 26, 26.27, 26.57 | Support levels: 25.35, 25, 24.67, 24.42