Vlad RF

RoboForex Representative

- Messages

- 487

How to Trade Dragon Pattern: Manual

Author: Andrey Goilov

Dear Clients and Partners,

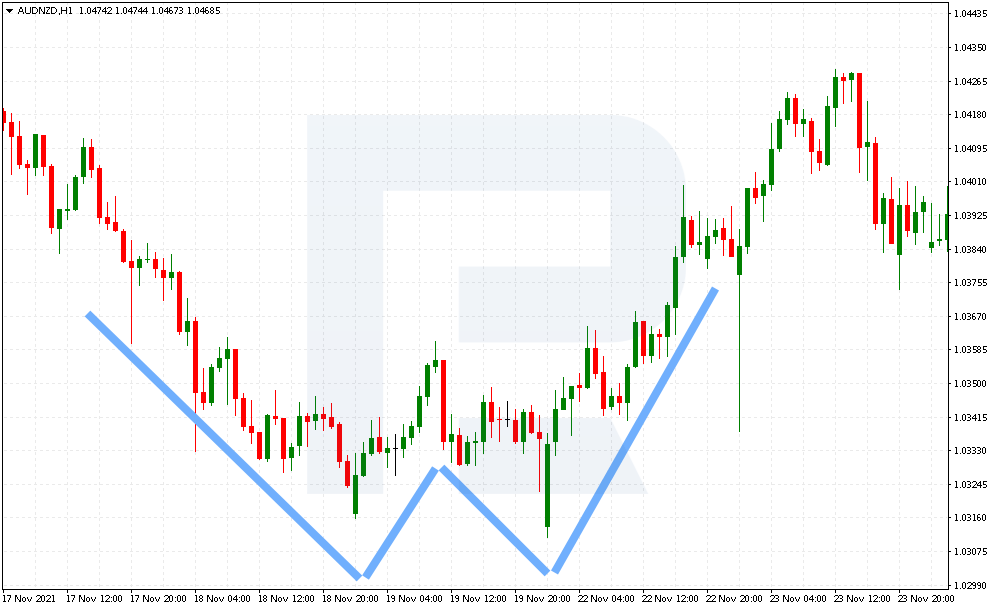

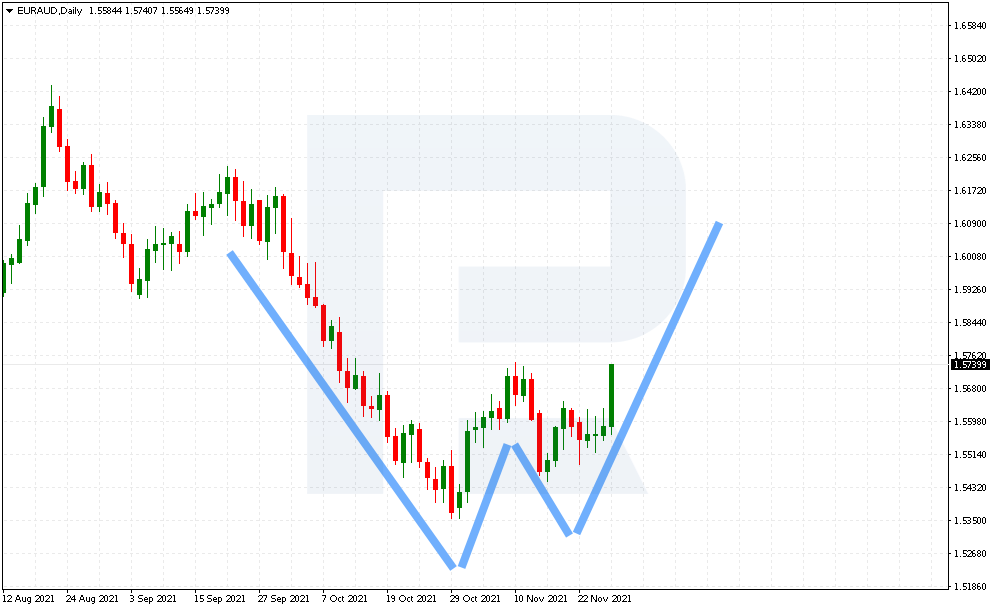

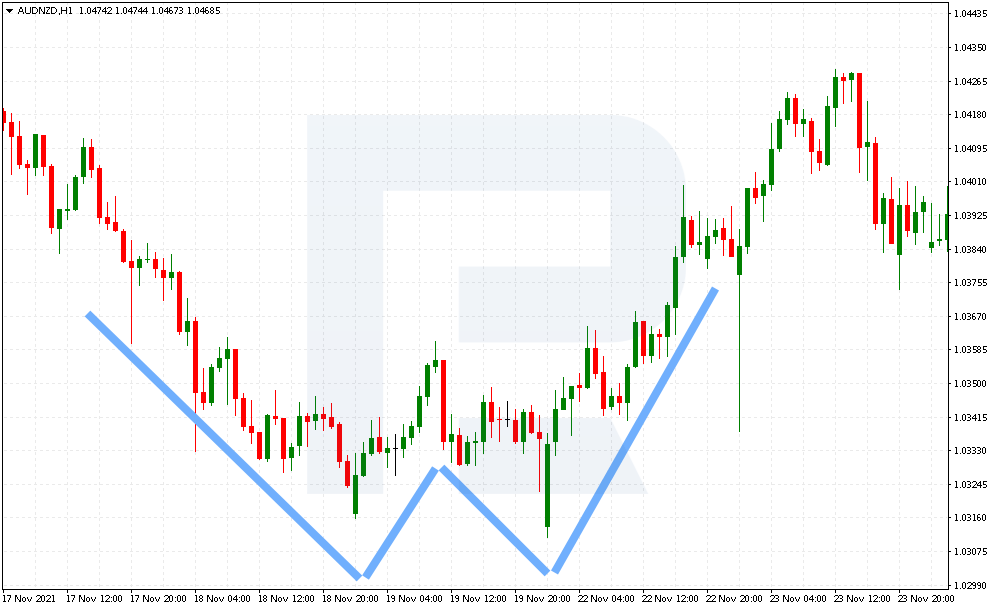

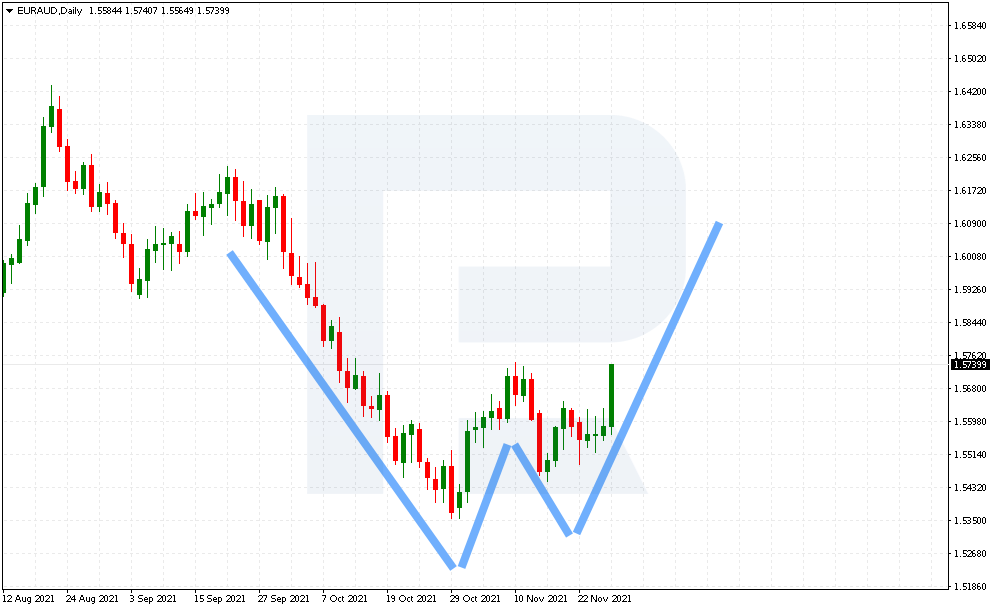

In technical analysis, there are patterns that can help you catch a market reversal on time. Among strong patterns, people name Double Top and Double Bottom, a.k.a. W-top and M-top.

Fairly enough, the market does not normally reverse by a single strong movement in the opposite direction. Most often, it forms a reversal pattern to get started.

Apart from using classical reversal patterns, some traders modernize identification and trading rules of existing structures. One example is the Dragon pattern.

The Dragon pattern looks very much like a Double Bottom but features some unique rules that identity it as a separate pattern, not a classical price structure. As the author puts it, the Dragon can be traded on various timeframes, while a low risk-to-profit ratio makes it even more attractive for traders.

The article is devoted to distinguishing the Dragon from a classic Double Bottom, the rules of trading, levels of taking the profit and leaving the market if necessary.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Andrey Goilov

Dear Clients and Partners,

In technical analysis, there are patterns that can help you catch a market reversal on time. Among strong patterns, people name Double Top and Double Bottom, a.k.a. W-top and M-top.

Fairly enough, the market does not normally reverse by a single strong movement in the opposite direction. Most often, it forms a reversal pattern to get started.

Apart from using classical reversal patterns, some traders modernize identification and trading rules of existing structures. One example is the Dragon pattern.

The Dragon pattern looks very much like a Double Bottom but features some unique rules that identity it as a separate pattern, not a classical price structure. As the author puts it, the Dragon can be traded on various timeframes, while a low risk-to-profit ratio makes it even more attractive for traders.

The article is devoted to distinguishing the Dragon from a classic Double Bottom, the rules of trading, levels of taking the profit and leaving the market if necessary.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team