Vlad RF

RoboForex Representative

- Messages

- 487

Best Long-Term Trading Strategies: “Daily Breakout and Moving Average”

Author: Andrey Goilov

Dear Clients and Partners,

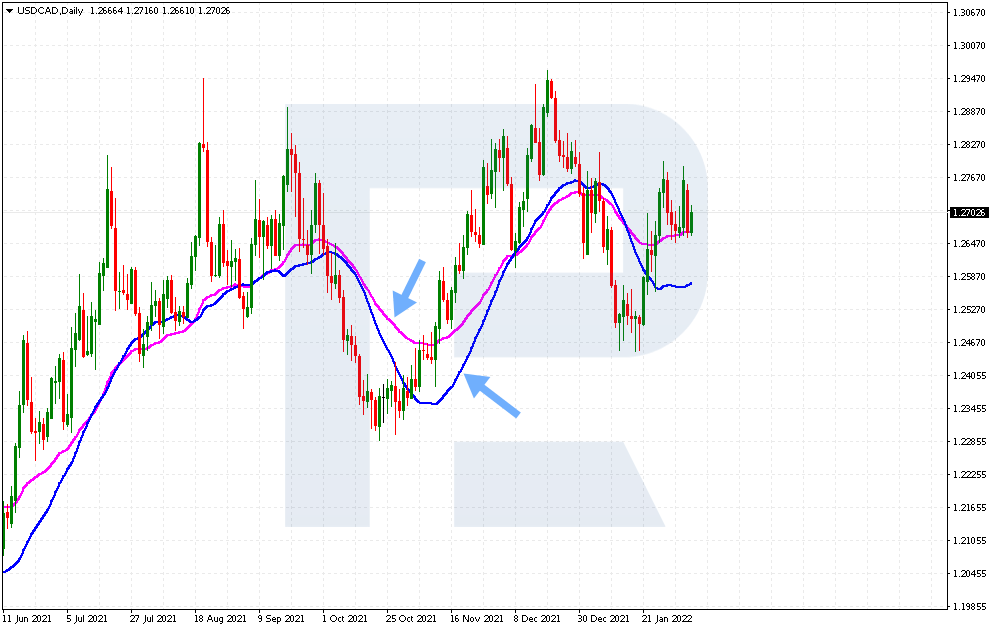

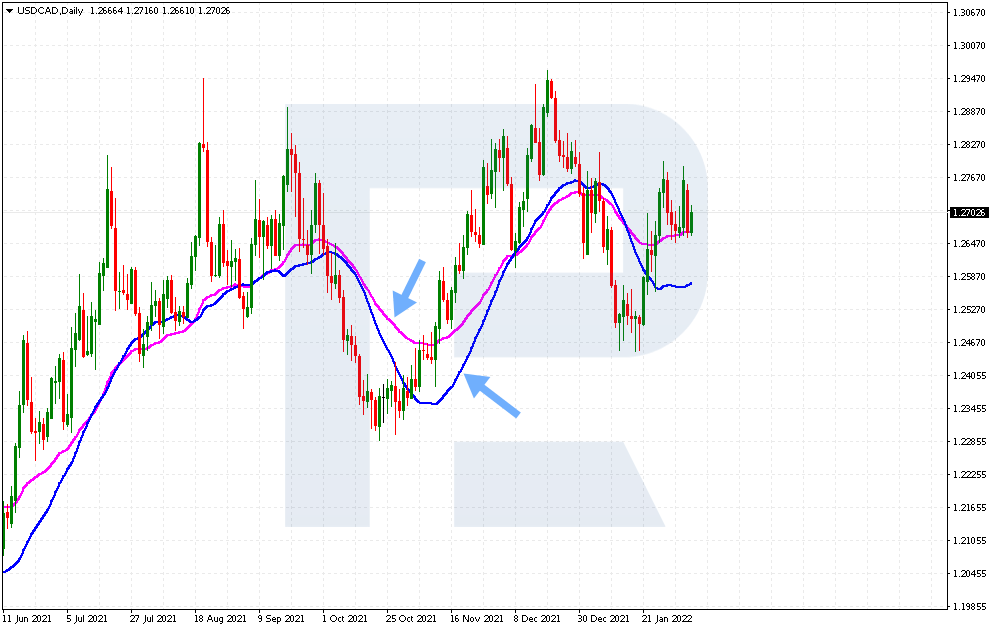

Almost any trend strategy uses Moving Averages as they help traders to quickly define the trend. However, the tactics named “Daily Breakout and Moving Average” works differently.

According to this strategy, a trader will trade against the direction of Moving Averages. In order to do that, they will have to follow quite unusual rules of using Moving Averages.

If Moving Averages show a bullish trend, then a trader should look for a signal to sell. If Moving averages show a bearish trend – vice versa, a trader should look for a signal to buy. It turns out to be some kind of a countertrend strategy.

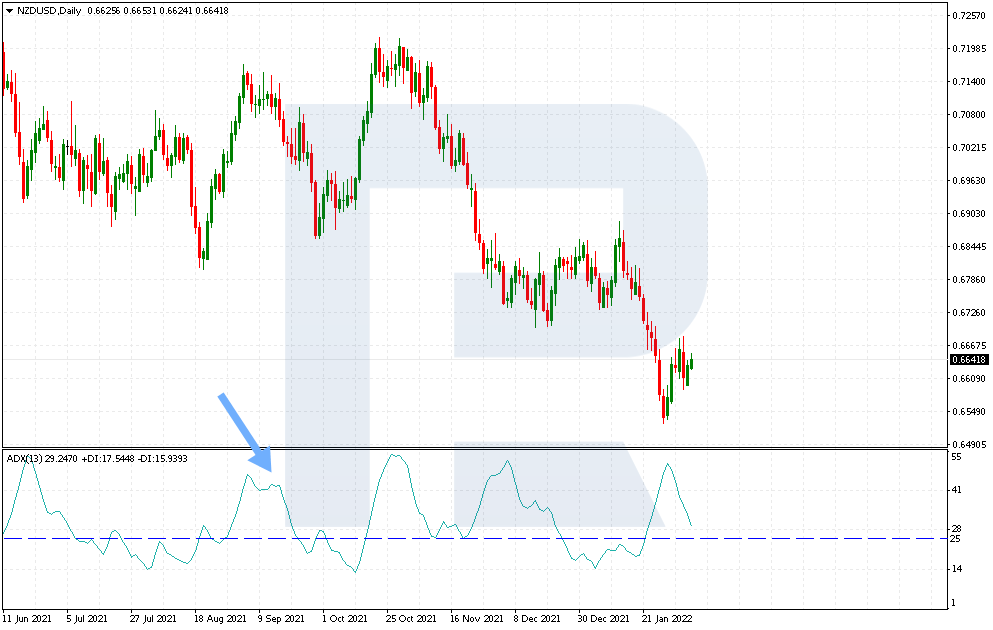

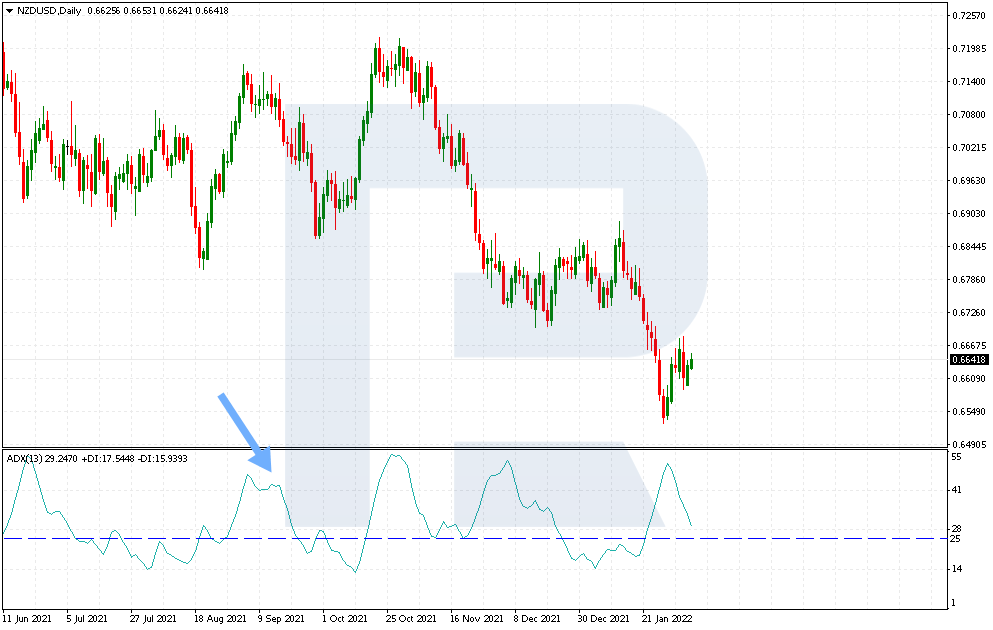

More to that, the ADX indicator is usually added here to get a confirmation to enter the market. This combination of indicators allows to “catch” the completion of the current tendency ahead of time.

Authors of the strategy believe that it can be used for working with any instrument but only on a daily timeframe.

The article goes into the details of the “Daily Breakout and Moving Average” strategy – we’ll discuss how to trade against the dominating tendency and try to “catch” a breakout using simple indicators.

How to customise indicators to trade by the strategy

To use the strategy, you need to apply three indicators to a daily time frame.

1. Simple Moving Average (SMA) with a period of 20, building at the lowest prices and choosing Low. An arithmetical average that uses the lowest prices over the period instead of the closing prices.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Andrey Goilov

Dear Clients and Partners,

Almost any trend strategy uses Moving Averages as they help traders to quickly define the trend. However, the tactics named “Daily Breakout and Moving Average” works differently.

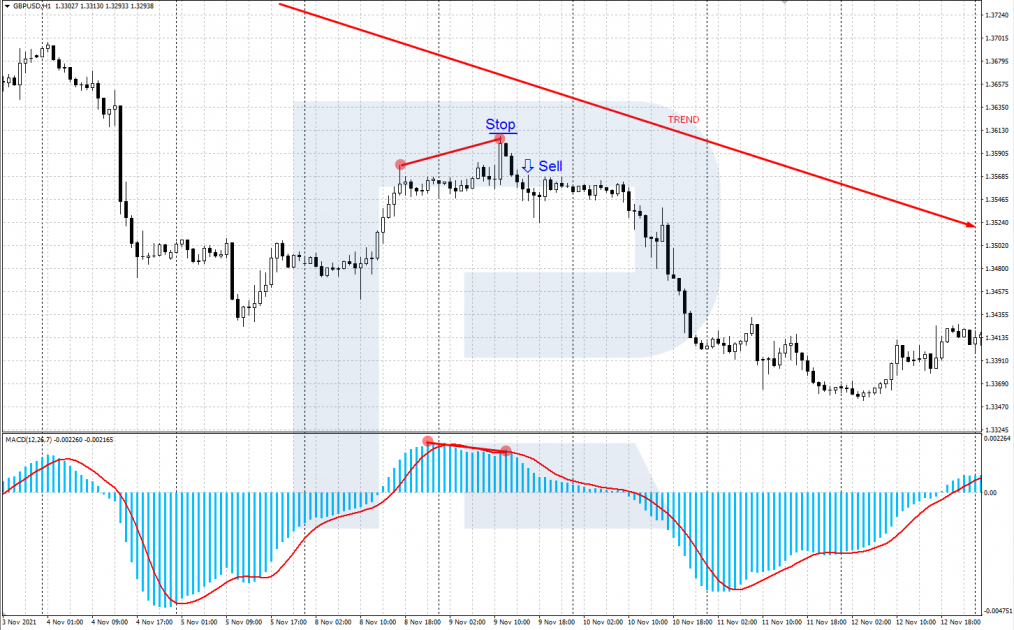

According to this strategy, a trader will trade against the direction of Moving Averages. In order to do that, they will have to follow quite unusual rules of using Moving Averages.

If Moving Averages show a bullish trend, then a trader should look for a signal to sell. If Moving averages show a bearish trend – vice versa, a trader should look for a signal to buy. It turns out to be some kind of a countertrend strategy.

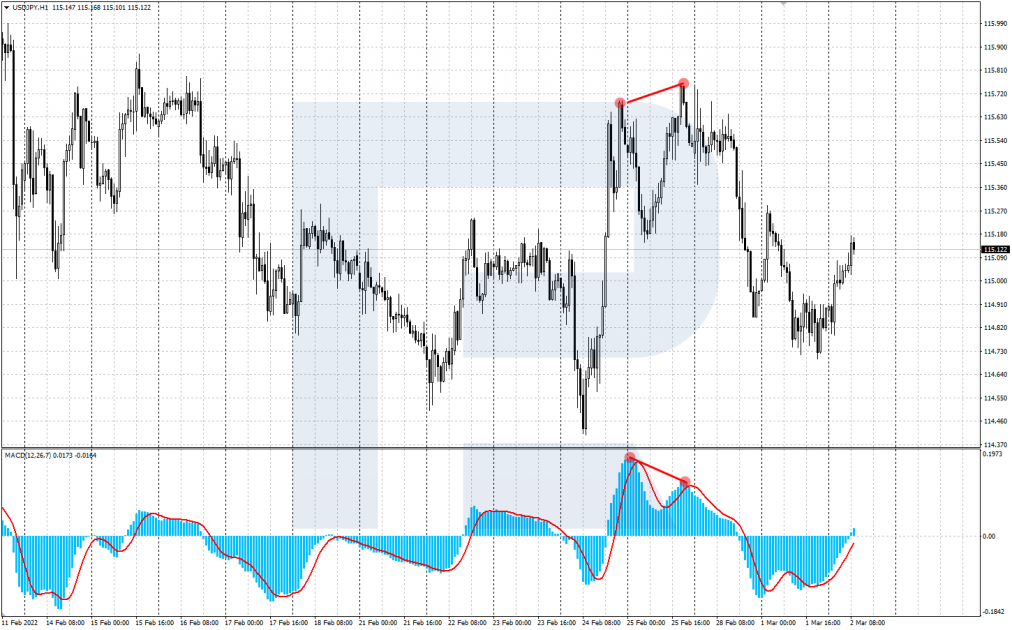

More to that, the ADX indicator is usually added here to get a confirmation to enter the market. This combination of indicators allows to “catch” the completion of the current tendency ahead of time.

Authors of the strategy believe that it can be used for working with any instrument but only on a daily timeframe.

The article goes into the details of the “Daily Breakout and Moving Average” strategy – we’ll discuss how to trade against the dominating tendency and try to “catch” a breakout using simple indicators.

How to customise indicators to trade by the strategy

To use the strategy, you need to apply three indicators to a daily time frame.

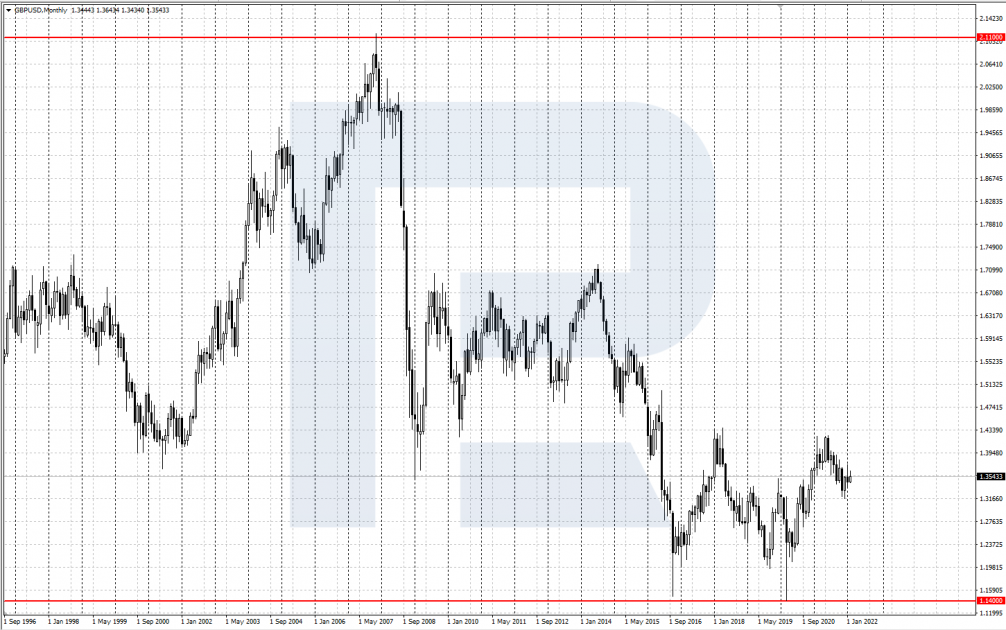

1. Simple Moving Average (SMA) with a period of 20, building at the lowest prices and choosing Low. An arithmetical average that uses the lowest prices over the period instead of the closing prices.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team