ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2020 April 1

Personal opinions today:

Last night, the Chicago PMI and the consumer confidence index fell, adding to expectations of a weak US ADP payroll and the US Markit and ISM Manufacturing PMI final . Dow futures, the dollar index, and crude oil prices fell. Today, the market will be watching U.S. ADP payrolls for March as a guide to nonfarm payroll expectations and an assessment of the U.S. unemployment rate, which would affect the dollar, Dow futures, and crude oil prices over the next two days.

In Europe today, the focus will be on German retail sales in February, the German and Eurozone Manufacturing PMI for March and the Eurozone unemployment rate for February. The consensus data forecast was lower on expectations that Europe would be affected by the coronavirus outbreak, and it is believed that limiting the rise of European currencies is likely to be bearish ahead of the release of European data. Separately, when U.S. markets open, keep an eye on U.S. ADP payrolls and the Manufacturing PMI for March. Depending on the extent of the weak data, the direct negative dollar index and the U.S. Dow futures range. Keep in mind that if the U.S. data is weak, European currencies, commodity currencies, and gold and silver prices will have a chance to ride the wave. U.S. futures and delivery prices are likely to fall, and U.S. crude oil futures could test significant support levels of $19 to $18.

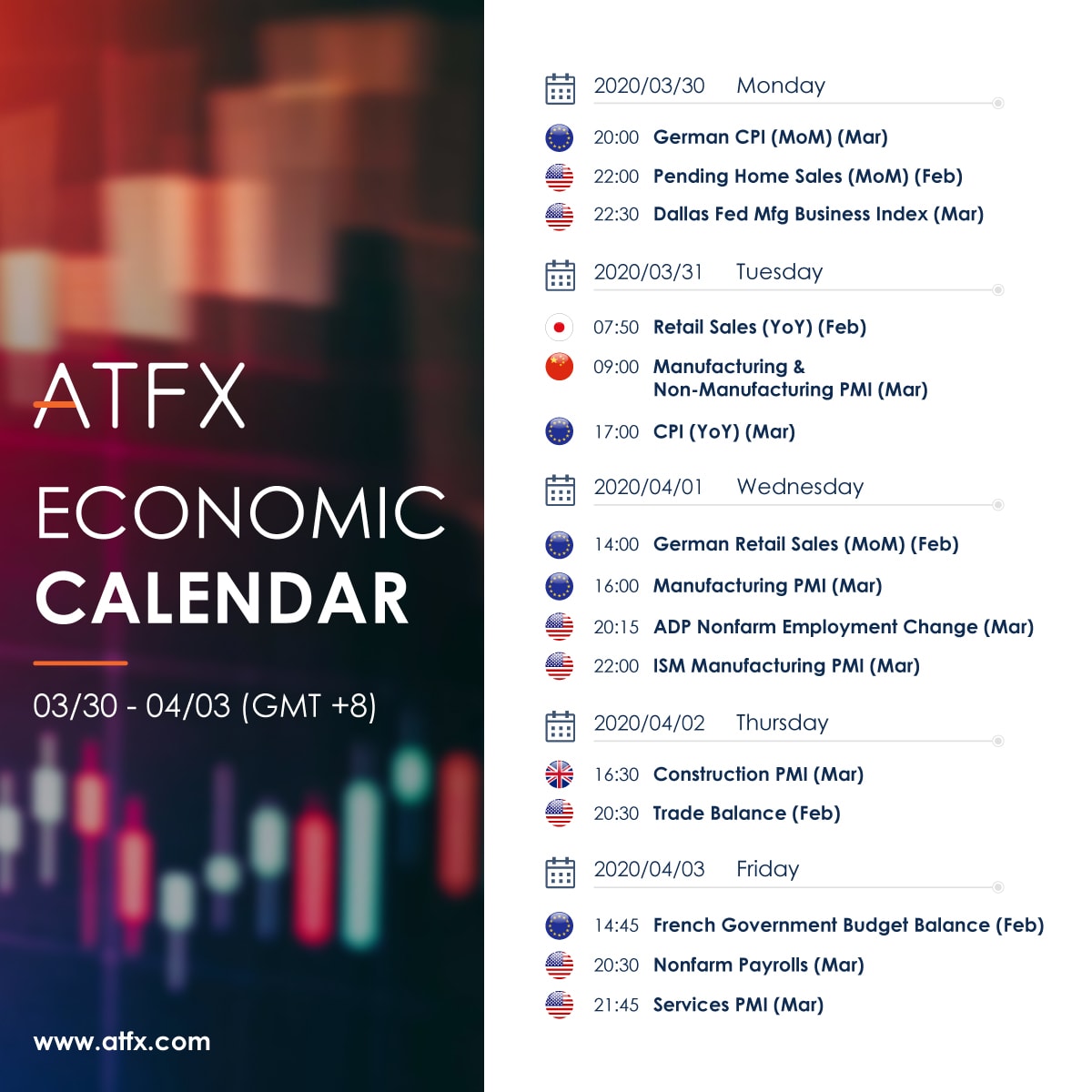

[Important financial data and events to watch]

Note: * denotes importance

09:45 China Caixin Manufacturing PMI in March **

14:00 Germany retail sales in February* *

15:30 Swiss PMI in March * *

15:50 French Manufacturing PMI for March* *

15:55 German Manufacturing PMI final in March * * *

16:00 Eurozone Manufacturing PMI final in March ***

16:30 UK Manufacturing PMI for March ***

17:00 Eurozone unemployment rate in February **

20:15 US ADP payroll * * *

21:45 US Markit manufacturing PMI final * * *

22:00 US ISM manufacturing PMI * * *

22:30 US EIA crude oil inventory change * *

EURUSD

1.1055/1.1070 resistance

1.0950/1.0925 support

Investors are betting that European economic data in March will be hit by a pandemic, with weak economic and data. Weak European data is expected to weigh on the Euro today. The Euro was seen in the 4-hour chart, with important support at 1.0950 and 1.0925, and resistance at 1.1055 and 1.1070. If EURUSD breaks through resistance, it could extend its gains against the dollar, test the 1.11 level.

The pound to dollar

1.2460/1.2485 resistance

1.2285/1.2265 support

Eurozone and UK data were expected to weaken, with pound would test $1.2285 or $1.2265 support. Investors are expected to wait for U.S. ADP payrolls after European markets today. Believe in the bearish dollar, would see the pound upward. Technically, the resistance range of 1.2460 or 1.2485 is expected to be tested.

Australian dollar/US dollar

0.6185/0.6200 resistance

0.6095/0.6075 support

Today, China Caixin manufacturing PMI for march rose in line with yesterday's official manufacturing PMI, while the Australian dollar remained at 0.61 against the U.S. dollar, more bullish. It is believed that investors expect the weak PMI and job data released in the United States tonight, which could benefit from the US dollar's decline and the Australian dollar's upward tentative rebound.

Dollar to yen

108.05/108.25 resistance

107.25/107.05 support

Dow futures and the Nikkei often lead the dollar against the yen. Yesterday, the analysis said the dollar could test the 107 level against the yen if Dow futures and the Nikkei fall. Early in Asia, the dollar was trading at 107.25 yen. If Dow futures and Nikkei continue to fall, technically, the dollar/yen correction 50% in March, with the first support level at 106.40 and the next level at 105.20. The first significant resistance level is now estimated at 108.25.

US dollar/Canadian dollar

1.4255/1.4275 resistance

1.4045/1.4025 support level

Crude oil prices continue to decline trend, bearish Canadian dollar. The U.S. dollar fell and the Canadian dollar gained on expectations of weak U.S. economic data. The U.S. dollar could rise to $1.42 against the Canadian dollar if crude oil prices fall sharply.

US crude oil futures

21.90/22.20 resistance

19.95/19.65 support

As global crude oil demand slowed, Saudi producers continued to discount and announced an increase of 400,000 barrels a day to 1m b/d from 600,000 b/d. Believe that U.S. crude oil prices continue to limit the $25 key resistance range. Combined with investors' expectations of weak U.S. manufacturing PMI and ADP private payroll data in March, crude oil prices were bearish. Technically, watch out for wave resistance at $21.90 and $22.20, respectively. First key support at $19.65.

Gold

1610/1613 resistance

1570/1567 support

Recent this analysis points to, gold price and silver price adjust together. Preliminary estimates of gold prices tested $1610 support level also breached. Silver fell in step with gold, but less than gold. Now, if investors expect weak Manufacturing PMI data in Europe and the U.S. today, watch for a possible rebound in gold and silver prices. Technically, gold prices rebounded sharply after hitting $1,567, with investors expected to place bids below $1,580. Investors can use this as a reference price and strategy to look for the first significant resistance level at $1,613.

Dow Jones industrial average futures US30

21950/22135 resistance

21295/21075 support

Dow futures fell as investors downplayed the outlook for the economy and corporate earnings amid a pandemic in the United States, believing the rebound in Dow futures would be limited. As expected yesterday, U.S. manufacturing PMI, ADP private market job data are expected to be weak, Dow futures fell. If the adjusted wave estimation is used, the short-term support is at 21295 and 21075. The next level targets are 20,755 and 20,435, respectively.

BTCUSD:

6800/ 7000 resistance

5700 / 5550 support

The federal reserve launches No limited QE program. Technically, the bitcoin price would rebound. The bitcoin price is looking for $6800 or $7000 resistance. If the bitcoin price breaks $7000, it would test $10,000.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.