Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

EUR/USD Daily Update Tue 09, August, 2011

Good morning,

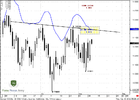

today is really few that I can add to weekly analysis. Market has accomplished first part of our trading plan - continued a bit higher on Monday, then turned to retracement and has reached 1.4150-1.42 support area. According to our trading plan - now it's time to enter long.

Currently I do not see any clear Buy patterns around right shoulder on 4-hour chart, except 0.618 Fib support that is logical for H&S and respect of this level by the market.

So, you can enter differently -wait for clear pattern to buy on 5- min chart, enter just from the level but with reduced volume etc - this is a question of risk management and personality.

Logical stop is below 0.88 support on 4 hour chart, if you trade intraday H&S ro below the low of 1.4041 o daily - if you trade Daily "piercing in the cloud pattern" and H&S.

Nearest target - 1.4450 - 0.618 of daily H&S and neckline, 1.0 of 4-hour H&S, daily overbought and weekly pivot resistance 1.

As we've said, the major advantage of current situation that you can enter with great risk/reward ratio, since market now stands very close to crucial point of both patterns.

Good morning,

today is really few that I can add to weekly analysis. Market has accomplished first part of our trading plan - continued a bit higher on Monday, then turned to retracement and has reached 1.4150-1.42 support area. According to our trading plan - now it's time to enter long.

Currently I do not see any clear Buy patterns around right shoulder on 4-hour chart, except 0.618 Fib support that is logical for H&S and respect of this level by the market.

So, you can enter differently -wait for clear pattern to buy on 5- min chart, enter just from the level but with reduced volume etc - this is a question of risk management and personality.

Logical stop is below 0.88 support on 4 hour chart, if you trade intraday H&S ro below the low of 1.4041 o daily - if you trade Daily "piercing in the cloud pattern" and H&S.

Nearest target - 1.4450 - 0.618 of daily H&S and neckline, 1.0 of 4-hour H&S, daily overbought and weekly pivot resistance 1.

As we've said, the major advantage of current situation that you can enter with great risk/reward ratio, since market now stands very close to crucial point of both patterns.