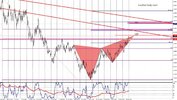

4H Butterfly "SELL" has failed.

Bigger AB-CD on Daily has reached 127.2% target and is about 30 pips away from 161.8% target.

Smaller AB-CD on Daily has just reached 127.2% target. 161.8% target is at 1.3690.....

Sive, when we encounter completion targets of patterns and resistance like we did a few days ago at 1.3485 area, would it be wise to anticipate this resistance by setting a short order just above the resistance so you can catch the top to sell it (if market does not proceed up of course) or would it be better to just wait for some intraday patterns to short it?

Should we ever anticipate a short (or long) by putting the short order just above the resistance when we know market has completed multiple targets and at resistance? Or is that too risky and not a good move because we have no clear patterns?

Thanks, Sive!

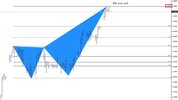

Bigger AB-CD on Daily has reached 127.2% target and is about 30 pips away from 161.8% target.

Smaller AB-CD on Daily has just reached 127.2% target. 161.8% target is at 1.3690.....

Sive, when we encounter completion targets of patterns and resistance like we did a few days ago at 1.3485 area, would it be wise to anticipate this resistance by setting a short order just above the resistance so you can catch the top to sell it (if market does not proceed up of course) or would it be better to just wait for some intraday patterns to short it?

Should we ever anticipate a short (or long) by putting the short order just above the resistance when we know market has completed multiple targets and at resistance? Or is that too risky and not a good move because we have no clear patterns?

Thanks, Sive!