ForexBrokerInc

ForexBrokerInc Representative

- Messages

- 9

Monday Market Update 15/06

Looking at this week’s economic calendar schedule, the main focus of currency markets will be on the US dollar as FED is due to release its monetary policy statement and announce interest rate decision on Wednesday.

While the main focus will be on FED this week, there are some important data points that will drive interest in the British Pound with Tuesday’s Inflation Data release, Wednesday’s Vote on interest rates and Unemployment figure as well as Thursday’s Retail sales data signals a volatile week for Pound lies ahead.

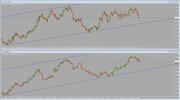

Technical view on Pound Dollar.

The Pound Dollar traded strongly last Friday but this week open trims gains on the cable as traders will be offloading their long positions before the huge impact news.

Our view on the Cable remains bullish but better opportunities to long should come at around 1.5430 rate. Cable traders will be looking for a daily close above last week’s high at just under 1.56 while looking to protect 1.5430 – 1.54 as daily close below will signals that sellers are in the driving seat to push the Pound lower versus the Dollar targeting low 1.52 rates.

Euro Dollar

Euro Dollar traders are looking for more direction as current level is around an average exchange rate taking last week’s trading rates into consideration. In a couple of hours ECB’s president Mario Draghi is due to testify on monetary policy before the European Parliament’s Economic and Monetary Affairs Committee and this event should bring some volatility to Euro Dollar.

Current technical setup suggests a drop to 1.11 rate, which could see another good buying opportunity. As long as Euro Dollar trades within the raising channel, any bigger drops will be seen as good buying opportunity, but break and close below 1.10 will upset buyers who will then be looking to off load their long trades from 1.0850. It seems that for Euro Dollar to break above 1.14, a dovish statement and no change in interest rates from FED will be enough.

Last but not least let’s take a look at US Dollar versus the Canadian Dollar

The loonie remains in a retracement since the drop last week but current 2350 or possibly even 2380 area may be seen as a good opportunity to short again and in line with our expectations from last week.

Next target for sellers will be 1.21 where another 50-70 point retracement can be expected. On the other side, a break above 1.24 could signal a resistance test of the declining trendline at around 1.2520.

We advise our clients to be on top of the economic calendar events and use stop loss on each order.

Looking at this week’s economic calendar schedule, the main focus of currency markets will be on the US dollar as FED is due to release its monetary policy statement and announce interest rate decision on Wednesday.

While the main focus will be on FED this week, there are some important data points that will drive interest in the British Pound with Tuesday’s Inflation Data release, Wednesday’s Vote on interest rates and Unemployment figure as well as Thursday’s Retail sales data signals a volatile week for Pound lies ahead.

Technical view on Pound Dollar.

The Pound Dollar traded strongly last Friday but this week open trims gains on the cable as traders will be offloading their long positions before the huge impact news.

Our view on the Cable remains bullish but better opportunities to long should come at around 1.5430 rate. Cable traders will be looking for a daily close above last week’s high at just under 1.56 while looking to protect 1.5430 – 1.54 as daily close below will signals that sellers are in the driving seat to push the Pound lower versus the Dollar targeting low 1.52 rates.

Euro Dollar

Euro Dollar traders are looking for more direction as current level is around an average exchange rate taking last week’s trading rates into consideration. In a couple of hours ECB’s president Mario Draghi is due to testify on monetary policy before the European Parliament’s Economic and Monetary Affairs Committee and this event should bring some volatility to Euro Dollar.

Current technical setup suggests a drop to 1.11 rate, which could see another good buying opportunity. As long as Euro Dollar trades within the raising channel, any bigger drops will be seen as good buying opportunity, but break and close below 1.10 will upset buyers who will then be looking to off load their long trades from 1.0850. It seems that for Euro Dollar to break above 1.14, a dovish statement and no change in interest rates from FED will be enough.

Last but not least let’s take a look at US Dollar versus the Canadian Dollar

The loonie remains in a retracement since the drop last week but current 2350 or possibly even 2380 area may be seen as a good opportunity to short again and in line with our expectations from last week.

Next target for sellers will be 1.21 where another 50-70 point retracement can be expected. On the other side, a break above 1.24 could signal a resistance test of the declining trendline at around 1.2520.

We advise our clients to be on top of the economic calendar events and use stop loss on each order.