tickmill-news

Tickmill Representative

- Messages

- 79

US appears to be taking lead in the global recovery, driving capital inflows

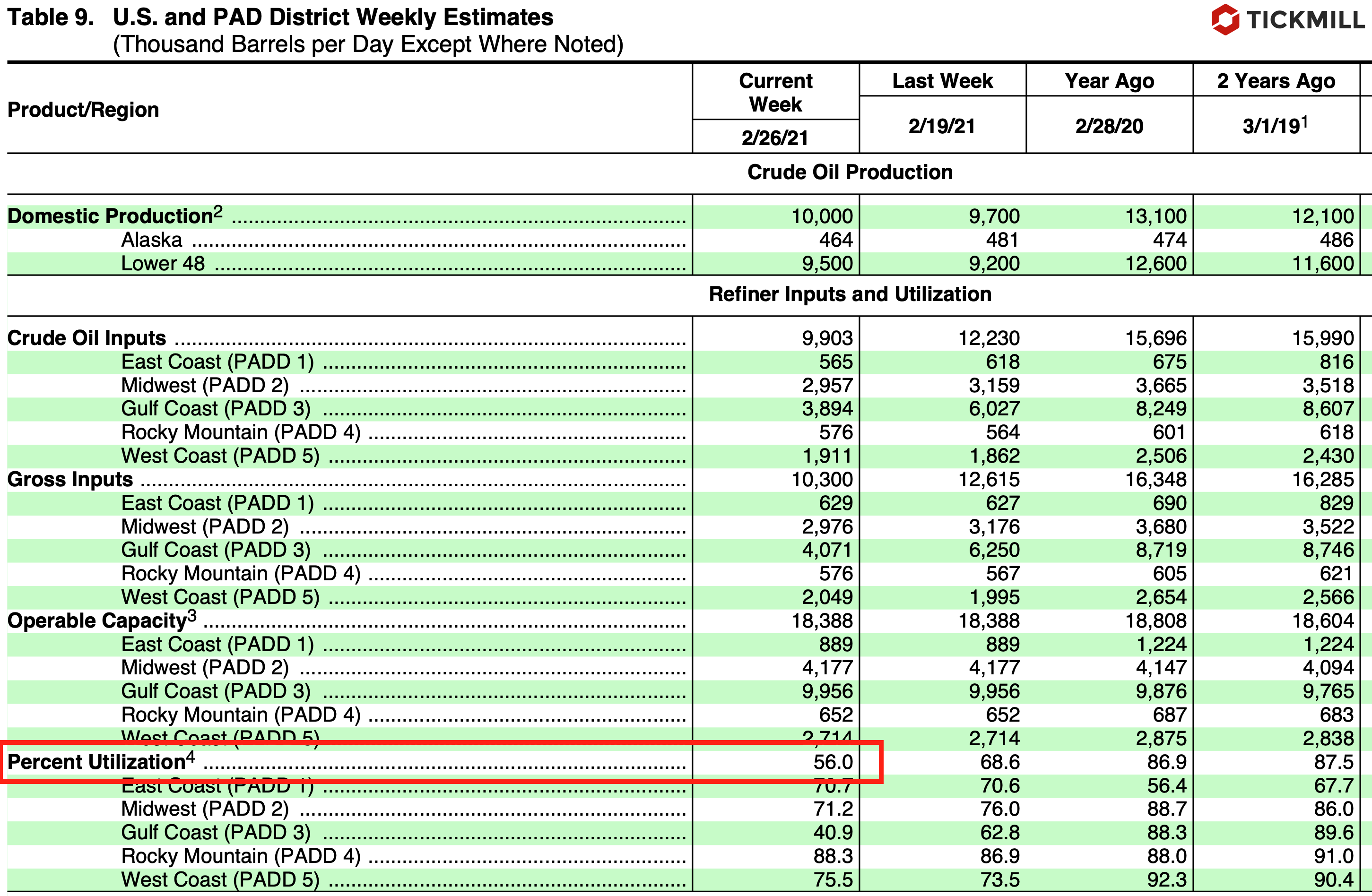

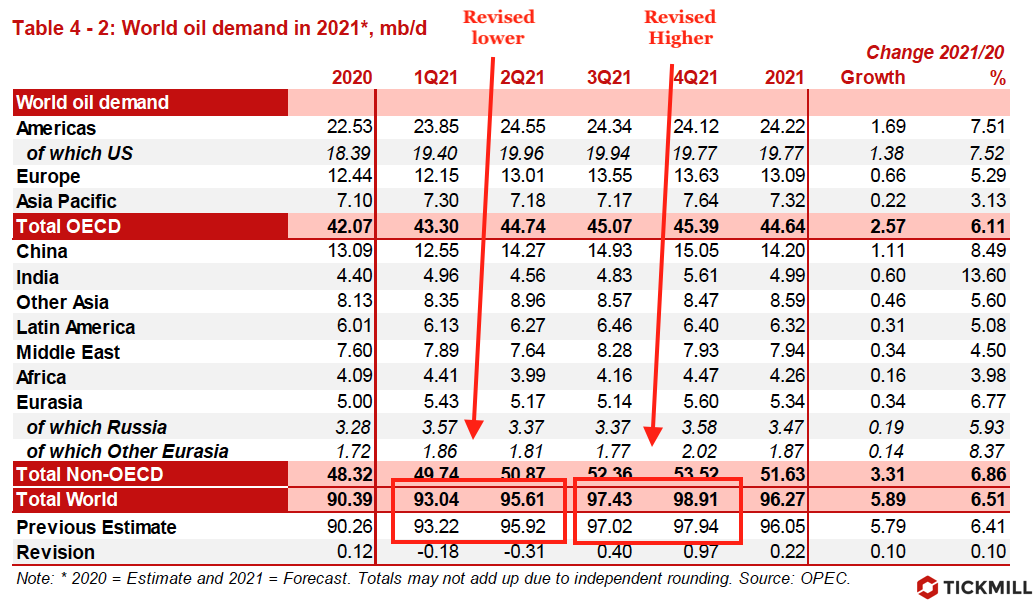

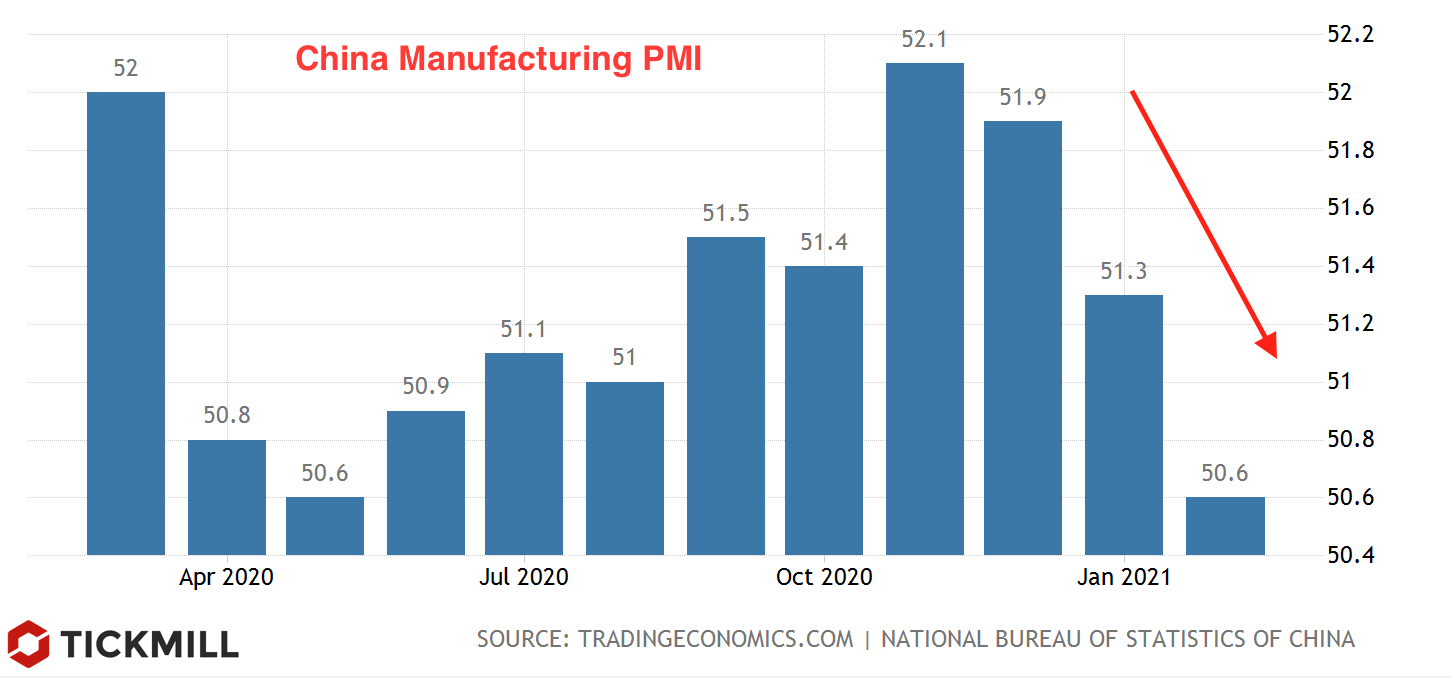

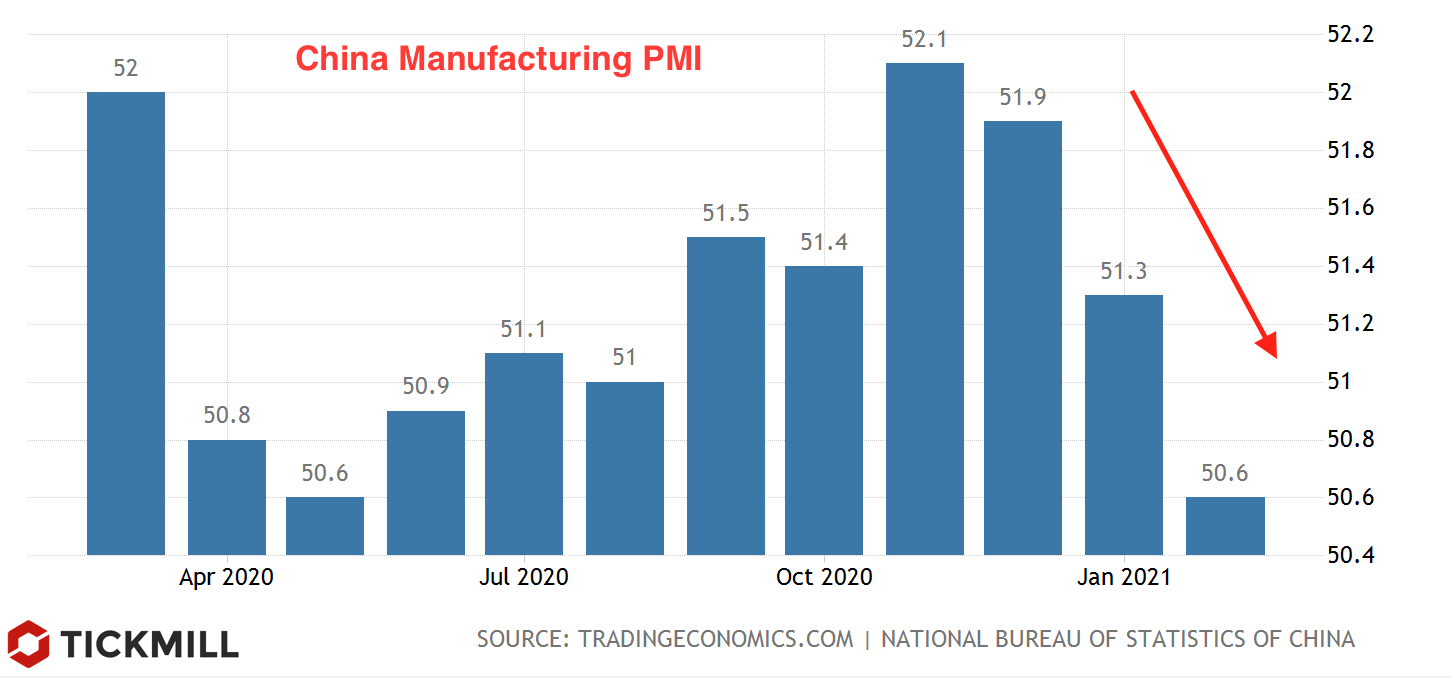

Oil quotes struggle to retain elevated mood ahead of OPEC+ meeting. Monday rally in equities, Monday rally in equities, which led to the surge of US stock indices by 2.3% on average, failed to underpin commodity prices. On Tuesday, prices stay in a downtrend thanks to strengthening USD and bearish motives in commodity markets in general. While optimism still prevails in the oil market, there are signs that demand growth has begun to weaken with downside risks growing on the demand side. For example, recovery momentum in the manufacturing sector of China, the largest consumer of oil in Asia, continued to fade in January, indicated the data on Sunday:

The latest trade data shows that China is starting to buy less oil, both due to a slowdown in domestic demand growth and as the time of cheap prices has apparently gone. In general, it is reasonable to expect that Chinese demand will move to a plateau, since China stocked up storage facilities in the 3-4th quarter of last year, taking advantage of low prices. The season for refinery maintenance in China begins in the second quarter, which will also hit purchases.

According to Reuters estimates, OPEC oil output, despite signs of strengthening demand, declined in February. Saudi Arabia's voluntary production cuts drove OPEC's average production down by 870K in February to 24.89 million barrels per day. The consensus now is that the Saudis won’t extend the gift to the market after the upcoming OPEC + ministerial meeting. In addition, there are expectations that the output quota will be lifted by 500K barrels. Clearly, negative news background builds up for the oil market.

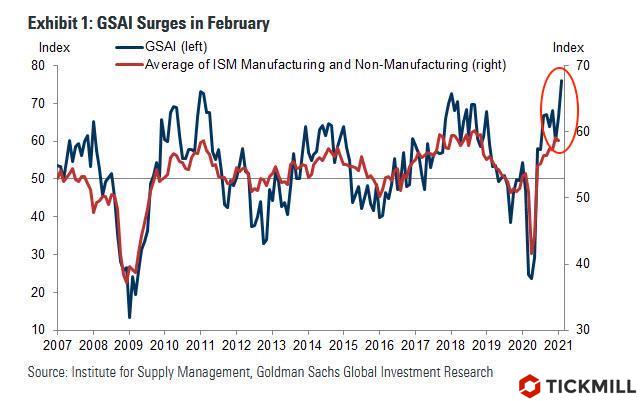

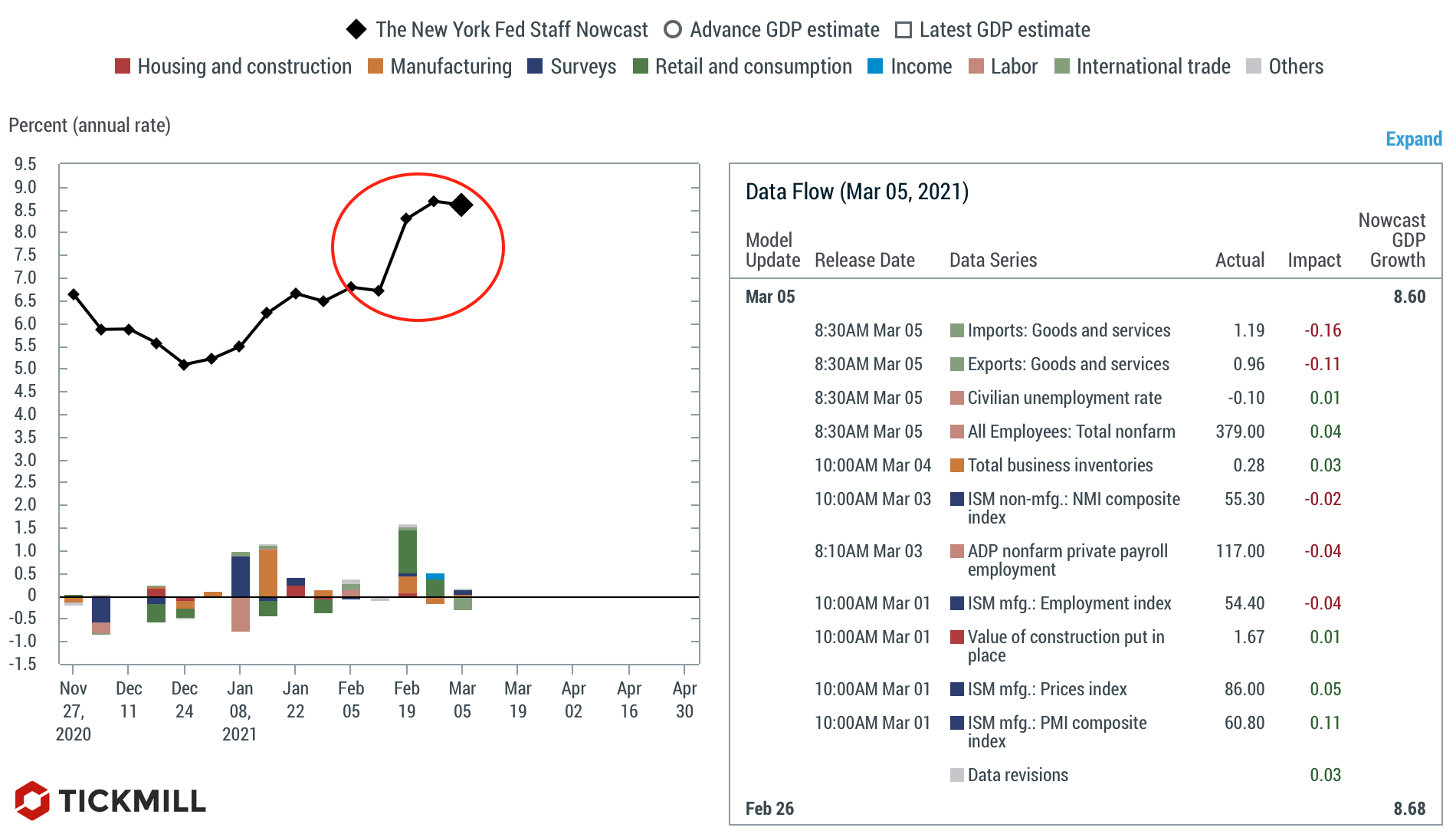

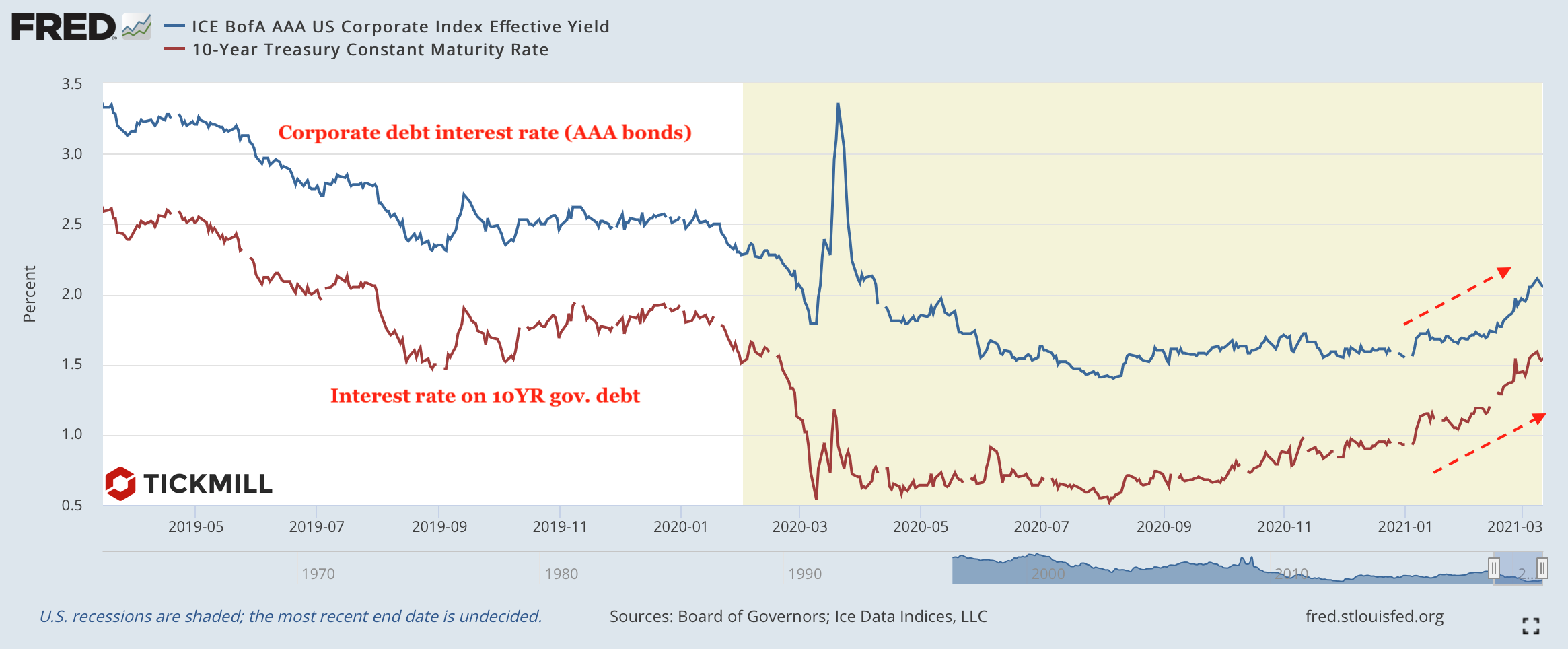

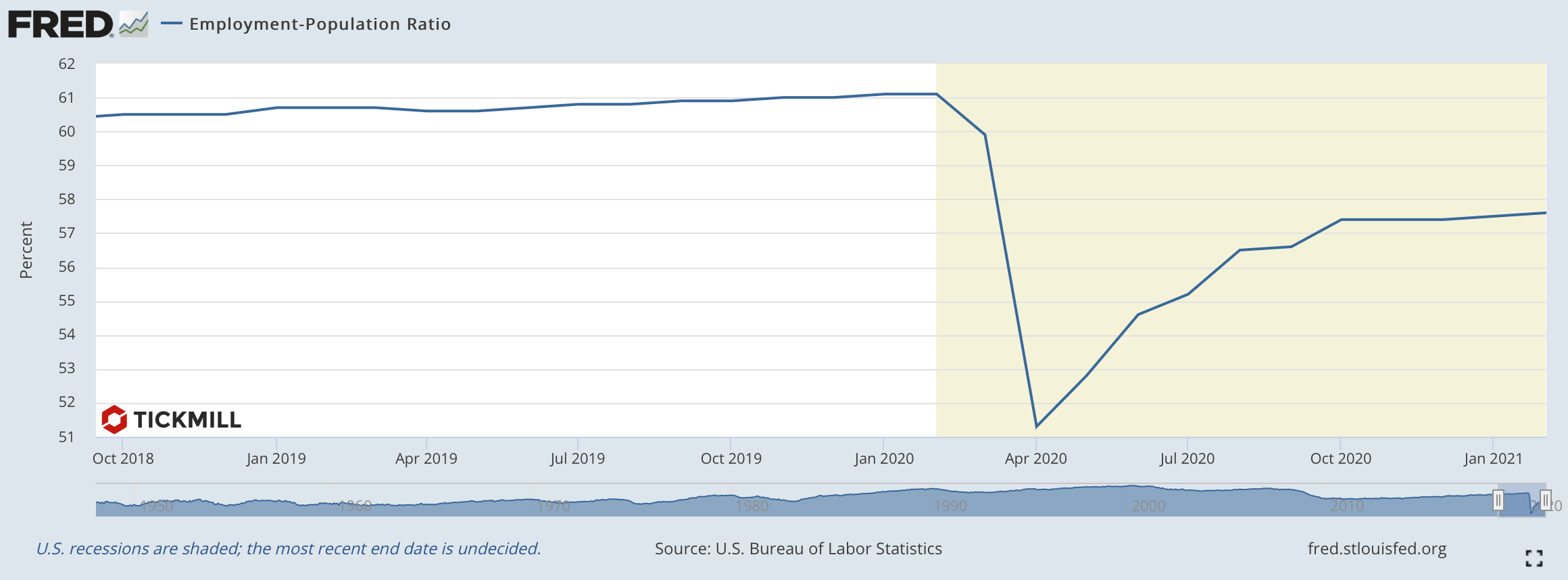

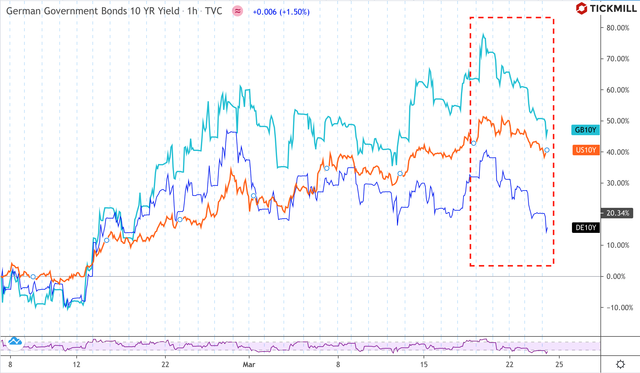

Greenback rally gains traction as the US economy appears to be taking lead in the pace of recovery among developed economies. If in January-early February we had a mix of a relatively weak US economy + expectations of US fiscal incentives + risk-on, now the first component seems to be replaced by a “strong US economy”, which started to draw foreign capital flows into the US assets. Previous risk-on setup contributed to investment outflows from the US in the search for yield abroad, which pressured USD. Now this trend seems to be changing sign. ISM manufacturing PMI for February released on Monday cemented idea of US economic acceleration as it surprised substantially to the upside. The index rose to 60.8 points (forecast 58.8), positive expectations about the labor market were also set by employment component (54.4 points, forecast 53). Apparently, the data release triggered a move in FX:

This week, the dollar is likely to develop corrective momentum upwards. The focus is on the release of PMI in the non-manufacturing sector, the ADP data (due on Wednesday) and the US unemployment report on Friday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Oil quotes struggle to retain elevated mood ahead of OPEC+ meeting. Monday rally in equities, Monday rally in equities, which led to the surge of US stock indices by 2.3% on average, failed to underpin commodity prices. On Tuesday, prices stay in a downtrend thanks to strengthening USD and bearish motives in commodity markets in general. While optimism still prevails in the oil market, there are signs that demand growth has begun to weaken with downside risks growing on the demand side. For example, recovery momentum in the manufacturing sector of China, the largest consumer of oil in Asia, continued to fade in January, indicated the data on Sunday:

The latest trade data shows that China is starting to buy less oil, both due to a slowdown in domestic demand growth and as the time of cheap prices has apparently gone. In general, it is reasonable to expect that Chinese demand will move to a plateau, since China stocked up storage facilities in the 3-4th quarter of last year, taking advantage of low prices. The season for refinery maintenance in China begins in the second quarter, which will also hit purchases.

According to Reuters estimates, OPEC oil output, despite signs of strengthening demand, declined in February. Saudi Arabia's voluntary production cuts drove OPEC's average production down by 870K in February to 24.89 million barrels per day. The consensus now is that the Saudis won’t extend the gift to the market after the upcoming OPEC + ministerial meeting. In addition, there are expectations that the output quota will be lifted by 500K barrels. Clearly, negative news background builds up for the oil market.

Greenback rally gains traction as the US economy appears to be taking lead in the pace of recovery among developed economies. If in January-early February we had a mix of a relatively weak US economy + expectations of US fiscal incentives + risk-on, now the first component seems to be replaced by a “strong US economy”, which started to draw foreign capital flows into the US assets. Previous risk-on setup contributed to investment outflows from the US in the search for yield abroad, which pressured USD. Now this trend seems to be changing sign. ISM manufacturing PMI for February released on Monday cemented idea of US economic acceleration as it surprised substantially to the upside. The index rose to 60.8 points (forecast 58.8), positive expectations about the labor market were also set by employment component (54.4 points, forecast 53). Apparently, the data release triggered a move in FX:

This week, the dollar is likely to develop corrective momentum upwards. The focus is on the release of PMI in the non-manufacturing sector, the ADP data (due on Wednesday) and the US unemployment report on Friday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.