tickmill-news

Tickmill Representative

- Messages

- 79

Continuing US bond rout may offer some support to USD next week

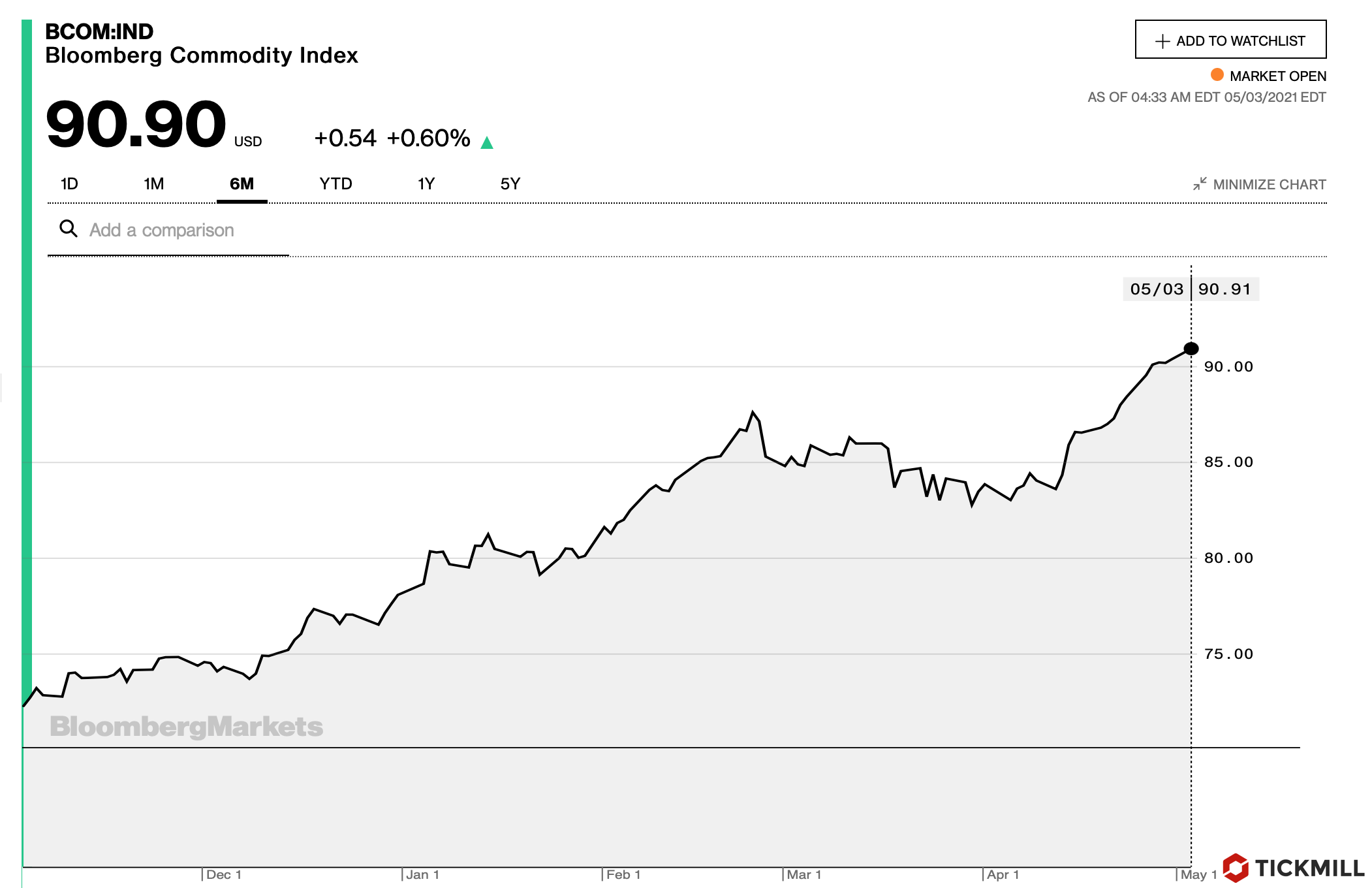

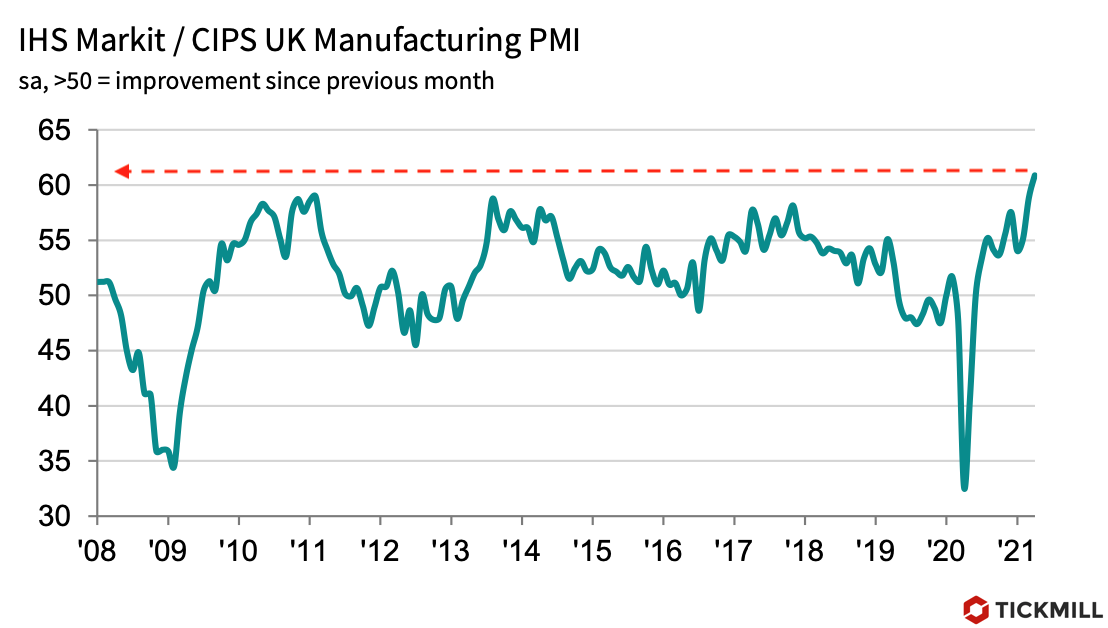

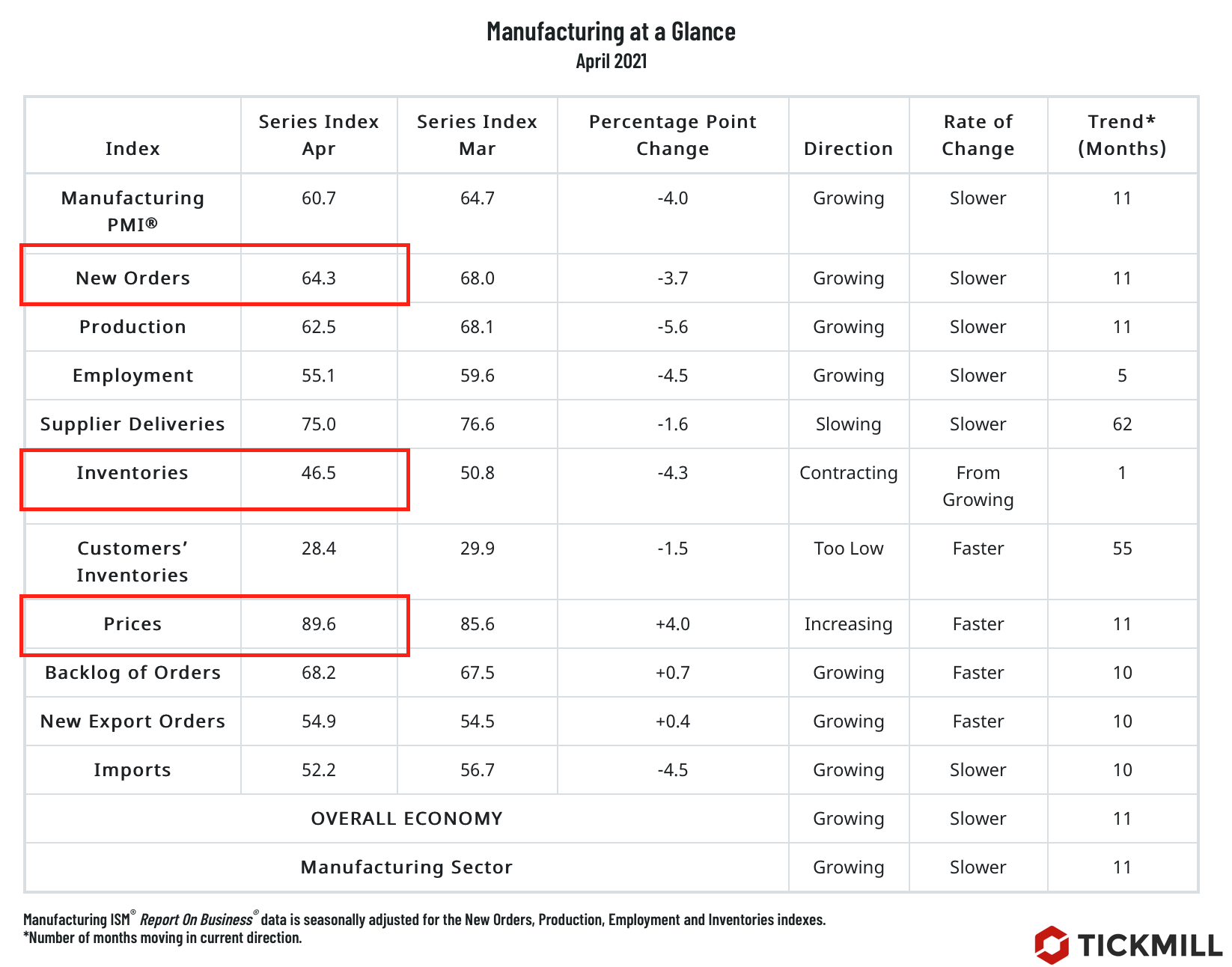

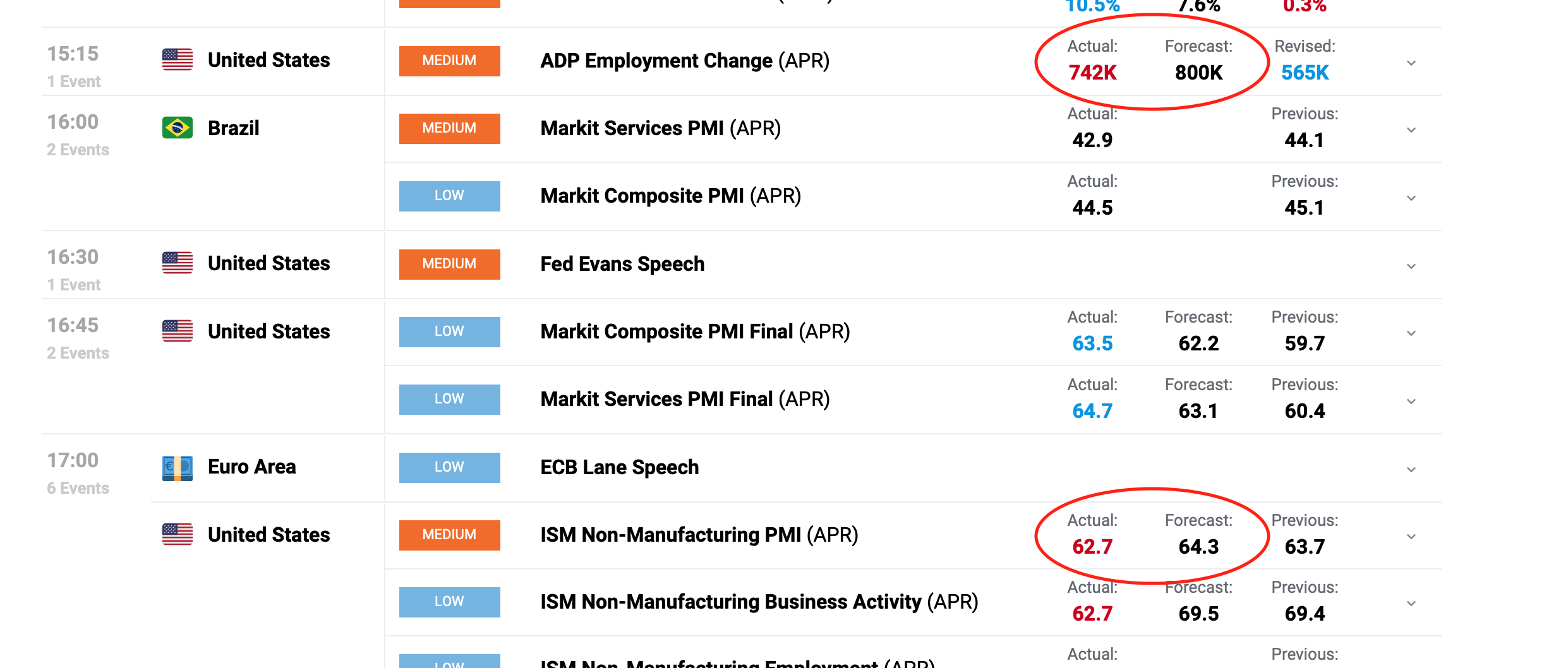

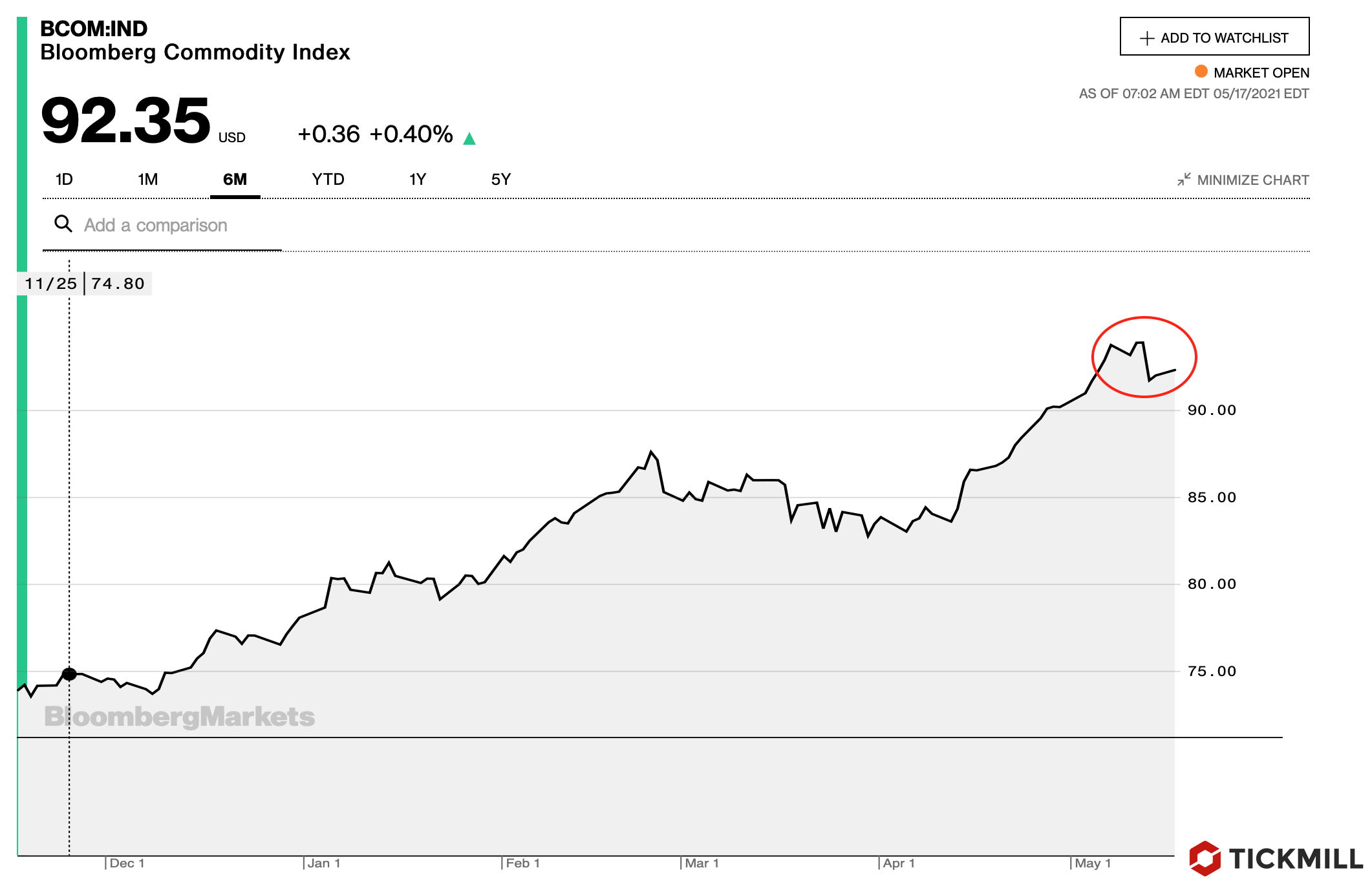

Incoming economic data of developed economies in the second half of the week, dynamics of commodity prices (record price of steel futures) added fuel to the flight from long-dated bonds:

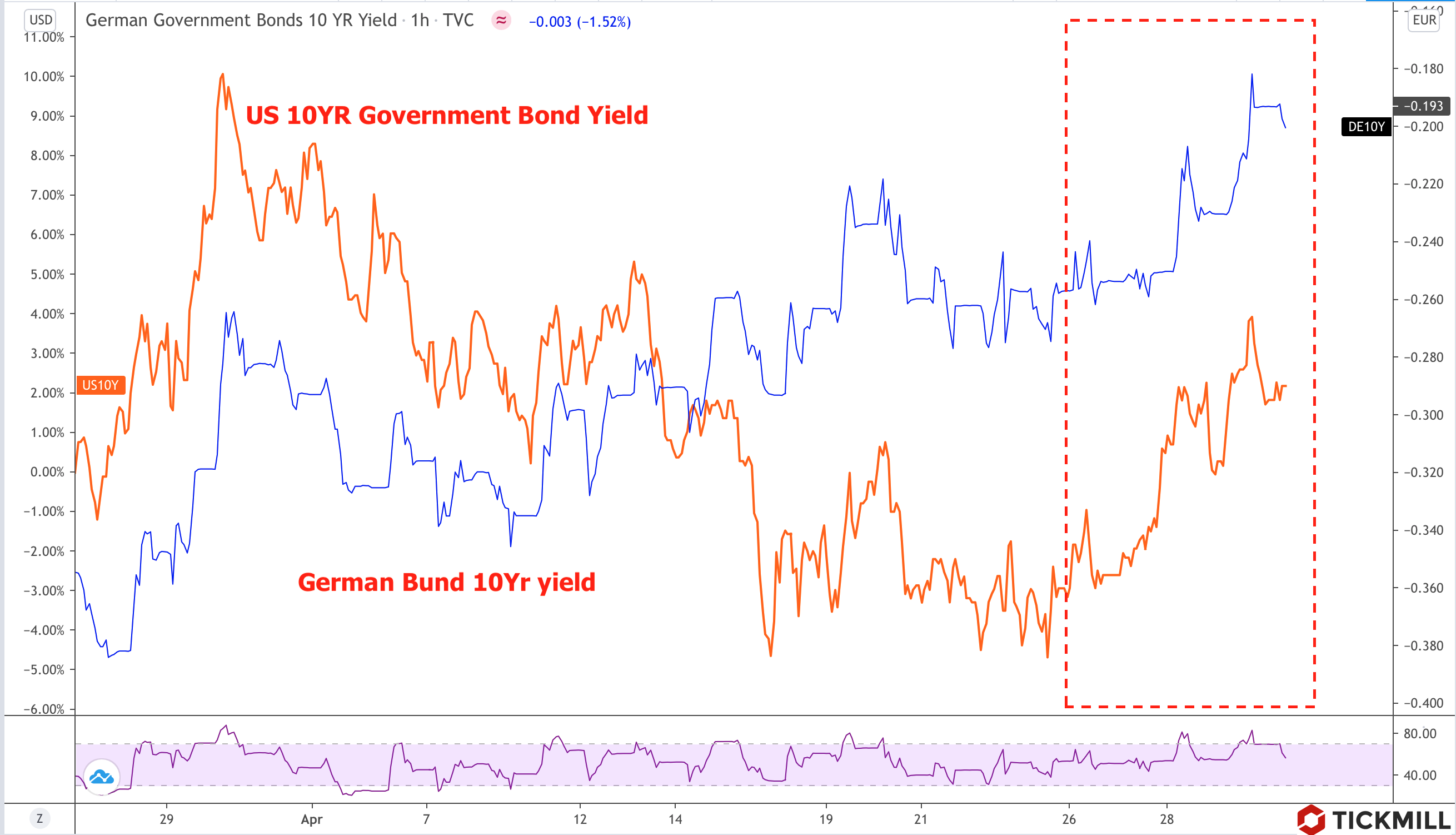

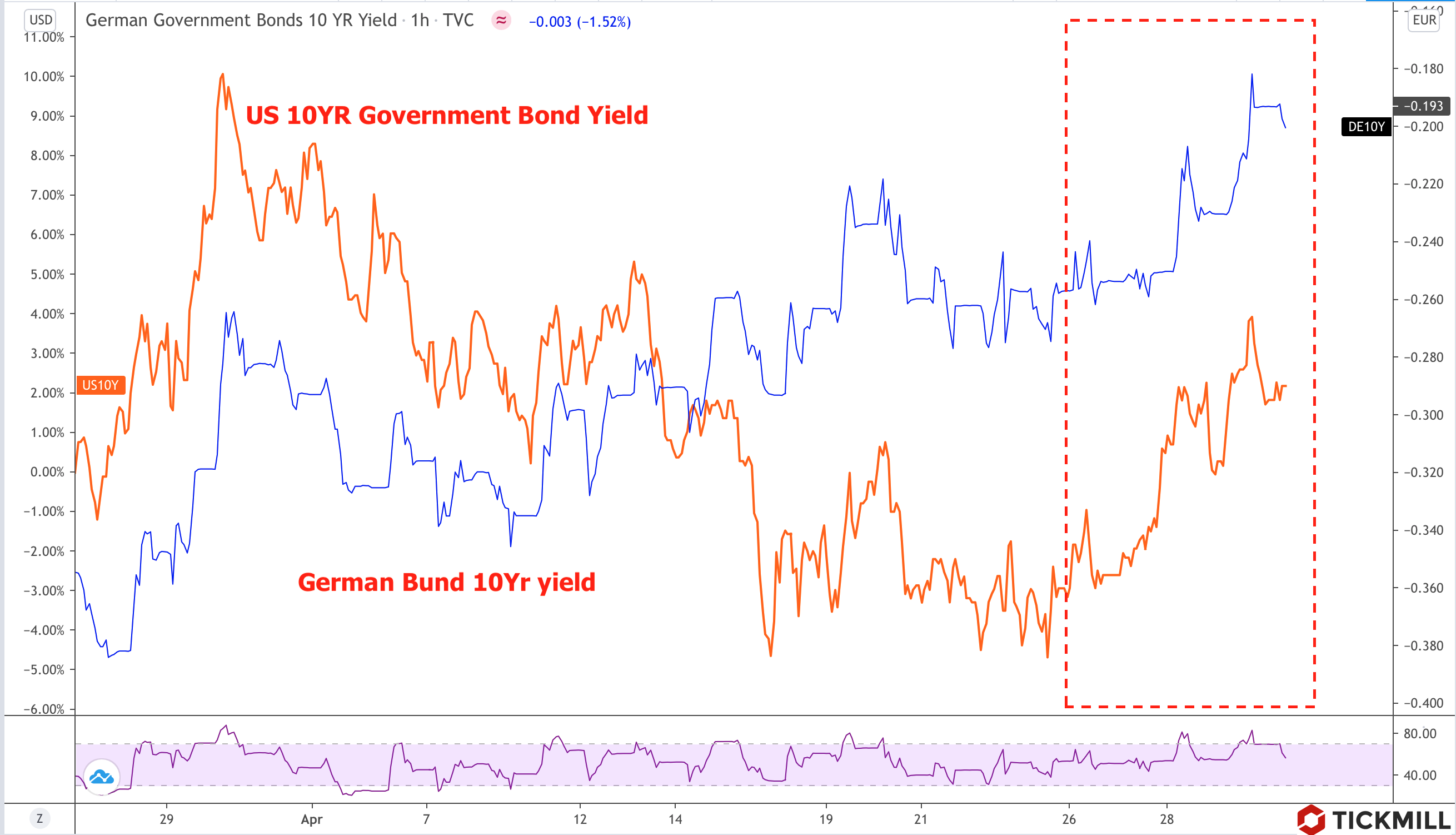

US GDP growth beat forecast in the first quarter of 2021, averaging to 6.4%, while quarterly inflation measured through GDP growth accelerated to 4.1% against expectations of 2.5%. Despite weak output in Germany and threat of technical recession in the first quarter, price growth there also accelerated above expectations in April.

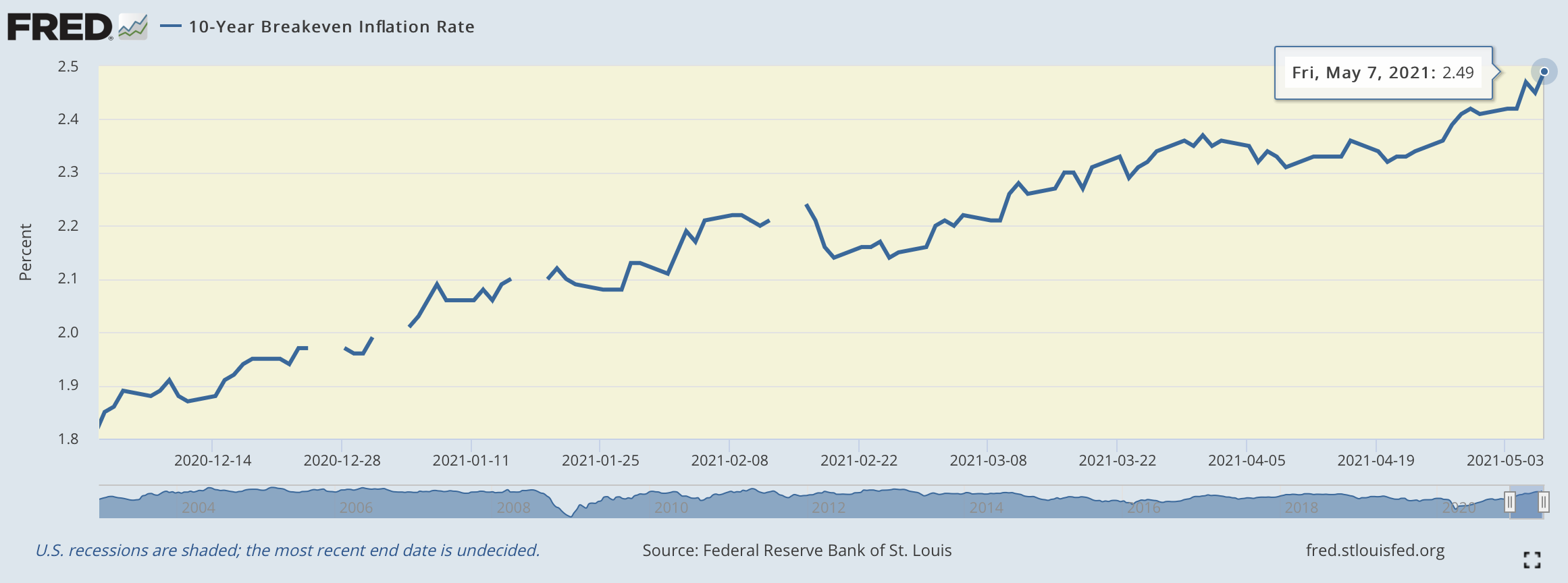

US unemployment claims that came on Thursday were slightly weaker than the forecast - both initial and continuing claims gained more than expected, nevertheless, the markets are bracing for a very strong increase in the April NFP of 925K. The report is due for release on next Friday. If job growth meets expectations or even beats forecast, rumors that the Fed will move to tapering earlier than previously expected should increase, as according to the Fed, substantial progress in employment is the key goal of ultra-easy credit policy. Inflation expectations are also set to accelerate in this case, fueling more upside in yields which in case of rapid movements may offer support for USD.

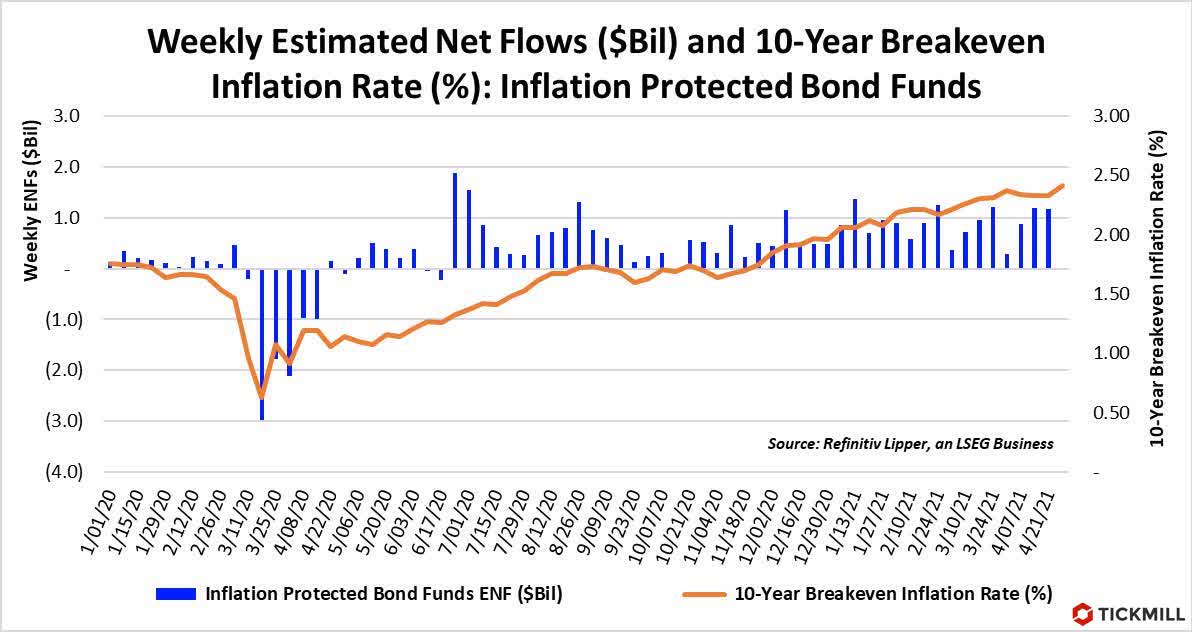

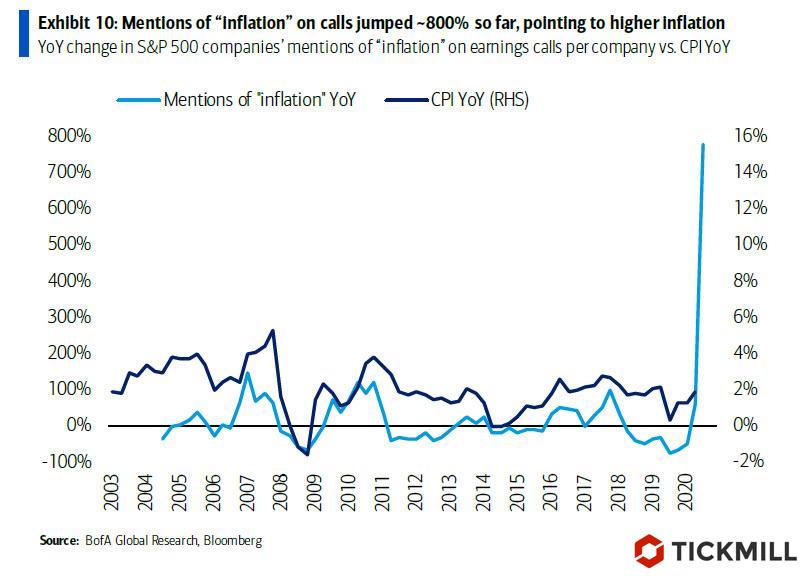

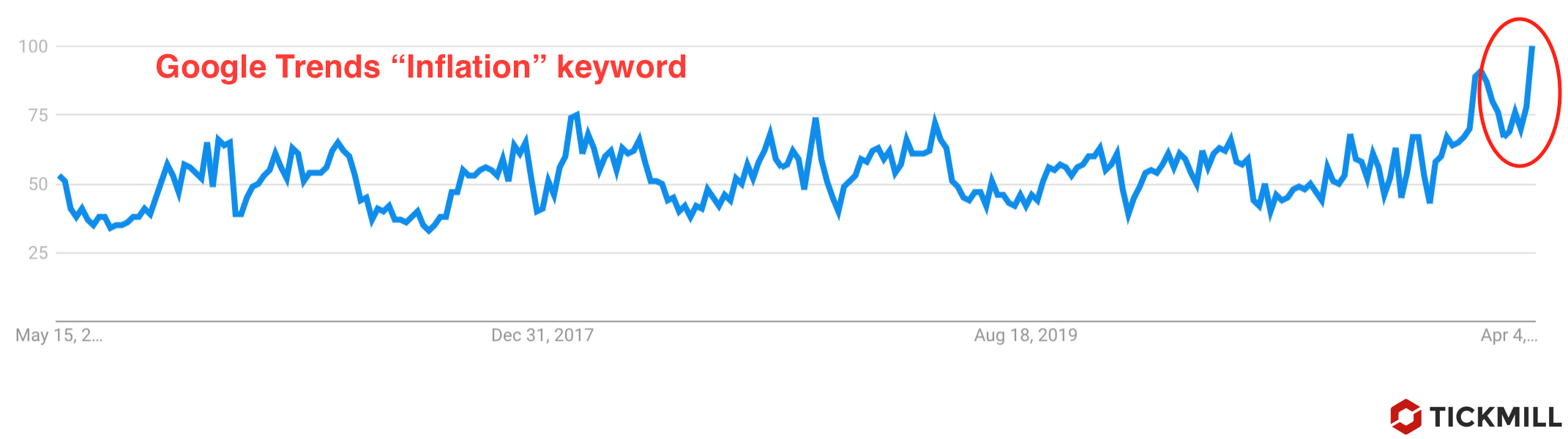

It is clear that US debt market became more concerned about the threat of inflation this week. However, in the current environment, inflation is a synonym of expansion, which means demand for risk is likely to stay here as the dominant market theme. At the very least, it is difficult to expect that there will be a reason for a collapse and even a correction. The Fed added fuel to the fire on Wednesday, once again declaring that "it is not time to even discuss the changes in QE purchases". Cheap credit policy, coupled with economic pickup will likely continue to push prices up and the risk that inflation will accelerate haunts bonds. The Fed stubbornly denies that inflation will be here for a long time and is trying to convince market participants of this. As you can see, it doesn't work out very well.

The dollar sank after the Fed meeting, but is trying to recover for the second day in a row. Yesterday, consolidation above the upper border of the descending channel failed, but on Friday the chances of this are much higher:

Next week we may see a slight strengthening of the dollar towards 91.00-91.20 amid bond pressure ahead of a possible NFP surprise. The bar to surprise is very high and if the report fails to meet expectations, USD will likely start to drift lower from those levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Incoming economic data of developed economies in the second half of the week, dynamics of commodity prices (record price of steel futures) added fuel to the flight from long-dated bonds:

US GDP growth beat forecast in the first quarter of 2021, averaging to 6.4%, while quarterly inflation measured through GDP growth accelerated to 4.1% against expectations of 2.5%. Despite weak output in Germany and threat of technical recession in the first quarter, price growth there also accelerated above expectations in April.

US unemployment claims that came on Thursday were slightly weaker than the forecast - both initial and continuing claims gained more than expected, nevertheless, the markets are bracing for a very strong increase in the April NFP of 925K. The report is due for release on next Friday. If job growth meets expectations or even beats forecast, rumors that the Fed will move to tapering earlier than previously expected should increase, as according to the Fed, substantial progress in employment is the key goal of ultra-easy credit policy. Inflation expectations are also set to accelerate in this case, fueling more upside in yields which in case of rapid movements may offer support for USD.

It is clear that US debt market became more concerned about the threat of inflation this week. However, in the current environment, inflation is a synonym of expansion, which means demand for risk is likely to stay here as the dominant market theme. At the very least, it is difficult to expect that there will be a reason for a collapse and even a correction. The Fed added fuel to the fire on Wednesday, once again declaring that "it is not time to even discuss the changes in QE purchases". Cheap credit policy, coupled with economic pickup will likely continue to push prices up and the risk that inflation will accelerate haunts bonds. The Fed stubbornly denies that inflation will be here for a long time and is trying to convince market participants of this. As you can see, it doesn't work out very well.

The dollar sank after the Fed meeting, but is trying to recover for the second day in a row. Yesterday, consolidation above the upper border of the descending channel failed, but on Friday the chances of this are much higher:

Next week we may see a slight strengthening of the dollar towards 91.00-91.20 amid bond pressure ahead of a possible NFP surprise. The bar to surprise is very high and if the report fails to meet expectations, USD will likely start to drift lower from those levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.