dkami

Sergeant

- Messages

- 757

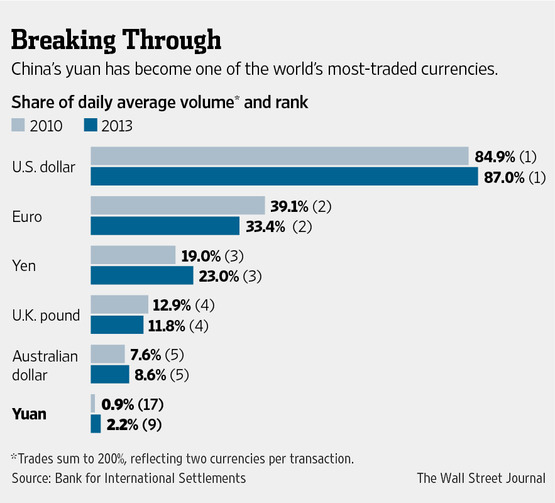

Is USD as the reserve currency coming to an end?

It's becoming clearer that most of the largest economies in the world are bypassing the USD in international trade, instead using their own currency's and it seems China is leading the way international trade is done following closely by Russia

China is said to become the largest economy by 2016 and with China leading the way international trade is done even with smaller economies like Australia the ramifications for the USD could be huge with China selling their U.S. Bonds and Treasuries causing high inflation across the USA

With the USA in such a bad state of affairs, confidence in the dollar at its lowest level and Americans among the most hated people on the planet even amongst its allies in my opinion USD isn't to big to fail its just a matter of time!

It's becoming clearer that most of the largest economies in the world are bypassing the USD in international trade, instead using their own currency's and it seems China is leading the way international trade is done following closely by Russia

China is said to become the largest economy by 2016 and with China leading the way international trade is done even with smaller economies like Australia the ramifications for the USD could be huge with China selling their U.S. Bonds and Treasuries causing high inflation across the USA

With the USA in such a bad state of affairs, confidence in the dollar at its lowest level and Americans among the most hated people on the planet even amongst its allies in my opinion USD isn't to big to fail its just a matter of time!