Trading on Forex – A Primary Source of Income

Author: Dmitriy Gurkovskiy

Dear Clients and Partners,

There are a lot of discussions about trading within the boundlessness of the Internet, both in conventional businesses and state-financed organizations. People say and write a lot of different things. More often than not, they are sure that trading can’t be regarded as a primary source of income. Arguments in these judgment call are as follows: “No matter how professional, cold-blooded, or wise you are, all these personal qualities won’t help you if markets don’t give you a chance to earn money, because markets offer such chances only at some particular periods of time. And if you trade every day, you are doomed to failure.”

Forex stereotypes

Many people have similar views on the matter and say that trading may be considered only as some kind of a part-time activity in addition to one’s main day job, occupation or business, because like we’ve said before, markets offer chances to earn money only at some particular short periods of time, while the rest of the time is simply wasted. According to these discussions, to avoid wasting time one should think of trading as a secondary activity (income, earnings) or get a job at brokers, investments/asset management, etc. Independent, so called home-made, traders and investors are foretold only falling into a decline or losing all their money and going broke.

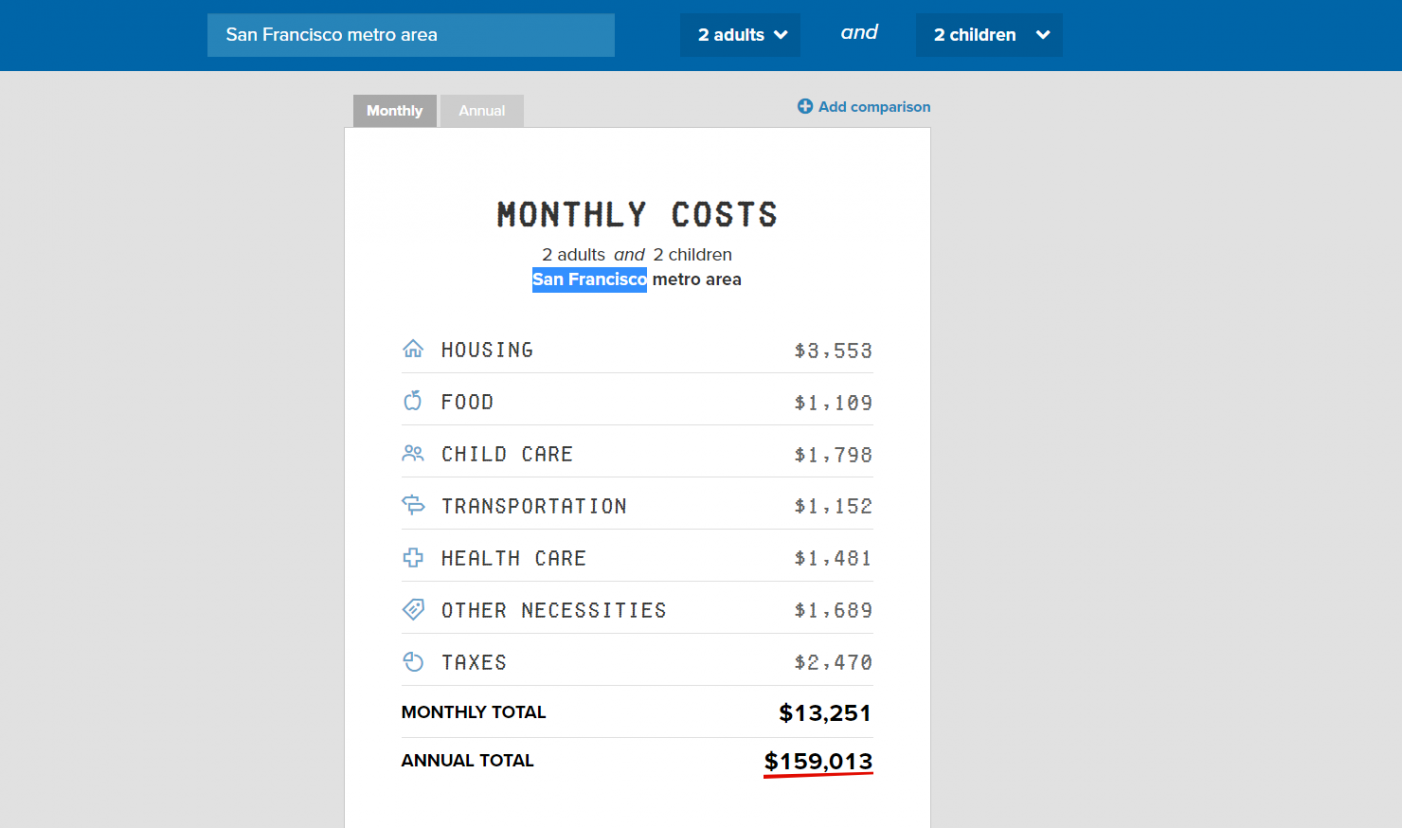

Of course, you can agree or disagree with this opinion, it’s your private stance. However, no one prohibits you to think of about a possibility of turning your personal trading activities on global financial market into something more than just a leisure, an opportunity to earn 100 extra bucks into a real business or a job that earns you considerable money. That’s why, I suggest you to decide on your approach to trading, its daily schedule, and the level of income you want to get from it to cover all your subsistence needs, because these are the criteria that you usually follow when starting your own business or applying for a job.

And of course, you have to make up your mind about an average weekly/monthly income. Probably, the income level issue may be the most essential for many of people, but it shouldn’t become a “stumbling block”, because trading is a complex matter, not a complexing one. Also, this issue may bring down to earth some beginners, who want to start trading with 100 USD and expecting to see 1,000 USD on their account balance at the end of the month. Yes, the reality is that stability and longevity on the market are controlled by modesty and common sense.

Trading system

Well, first things come first. If you plan a steady monthly income of 1,000-2,000 USD, you must have 10,000-20,000 USD on your account balance on the first day of trading. Of course, this level of income is possible if you trade very carefully and in a risk averse way. If you’re more advanced in risk management, you can start trading with 5,000 USD and hope for 1,000-1,500 USD a month. In other words, this is a basis for “home/couch” trading. Still, you must always remember that your entire work should be based directly on your trading system! It means that your trading system should adapt to all periods of market activity and earn 40-50 pips every day. Given this, we can assume that a daytrader’s standard trading volume is 0.2-0.4 lots.

Yes, it can! Your task reduces to find and track a trading instrument that can match this speed and distance and then just copy successful trades/deals. At the same time, you should realize that not all deals will be profitable, that’s why think of increasing profitable periods to cover losses suffered during drawdowns. If you survive this rhythm/schedule for at least 6 months, you can count on a glittering future and start your career as an asset management company in CopyFX and RAMM. You can create trader communities to attract investors and manage big money. This scaling, if not to say socializing, method, will help you to avoid risks of asocial burnout due to lack of social communication, which is a very common thing for retail traders and investors.

Conclusion

To put it shortly, one can draw the following conclusion: it is possible to turn trading into a primary source of income if you create your own strategy and abide by its rules. However, if you don’t have what it takes yet, I mean strategy, knowledge, skills, money, don’t rush to quit your job. Just continue practicing, accumulate experience and money.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team