You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WaveRider

Master Sergeant

- Messages

- 350

I was able to get long in GBPJPY. I'll keep monitoring this trade but the trend is up and GBP has good fundamentals. Pretty sure we made the low of the week during the asian session last night.I was able to close this trade out at break even. The price is still sitting inside the previous ranging channels 133 pip box but I thought it was going to go up and down, not down. The area but broke lower than I thought. The context is valid but my entry was not so hot. Glad to have closed out at BE while being wrong. I'm not sure if I'll trade this pair again this week. The K entry would be 154.64-69. That's the 61.8 % retracement of the swing up and the 161.8 FE of the swing down making a 222 buy. I'd consider this a safe low risk entry but we'll see how the week progresses.

View attachment 65483

WaveRider

Master Sergeant

- Messages

- 350

I just went flat on all positions in anticipation of NFP tomorrow. The only remaining trades this week would be a London close today or tomorrow for 20ish pips. I closed out the GBPJPY and AUDUSD positions with 1.5 percent or so each.

Woke up to the TP hit on this this morning. This isn't behaving like I'd hoped and I wanted to get out before NFP anyway so I'm glad to be flat on this the rest of the week. This was 43 pips.

Was short AUDUSD and happy to bank a candle. Total on this trade was about 1.5%. I just collapsed this here in profit because I don't want to be exposed during the news. As I'm writing this, this trade has continued to go my way but I was at the ADR anyhow.

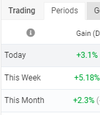

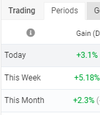

Thee myfxbook is smoking crack. This wasn't 5% this week and 2% this month. We're three days into both the month and week. I'm up about 3% for the week. 6% monthly on this account is the goal. Let's see if we can hang on to the gains. I closed out a floating loss by accident for a percent earlier too and took a scalp Monday lost a percent, a trade that went my way but my SL was too close. Stupidity cost me 2% this week.

Woke up to the TP hit on this this morning. This isn't behaving like I'd hoped and I wanted to get out before NFP anyway so I'm glad to be flat on this the rest of the week. This was 43 pips.

Was short AUDUSD and happy to bank a candle. Total on this trade was about 1.5%. I just collapsed this here in profit because I don't want to be exposed during the news. As I'm writing this, this trade has continued to go my way but I was at the ADR anyhow.

Thee myfxbook is smoking crack. This wasn't 5% this week and 2% this month. We're three days into both the month and week. I'm up about 3% for the week. 6% monthly on this account is the goal. Let's see if we can hang on to the gains. I closed out a floating loss by accident for a percent earlier too and took a scalp Monday lost a percent, a trade that went my way but my SL was too close. Stupidity cost me 2% this week.

Last edited:

WaveRider

Master Sergeant

- Messages

- 350

Maybe I’m the one smoking crack. Monday was the 31st so it is 5% for the week total. Lol.Thee myfxbook is smoking crack. This wasn't 5% this week and 2% this month. We're three days into both the month and week. I'm up about 3% for week.

View attachment 65575

Still 6% for the month is the goal so I’m not going to sweat having some losing trades. I’ll pull apart some losses and partial wins to troubleshoot where I went wrong. If I’d been more careful, I could be closer to 8-9% for the week only risking 1-1.5% each trade.

WaveRider

Master Sergeant

- Messages

- 350

I'll post about this more later. Glad I got out of this with a profit this week. I'm out until after NFP because the Federal Reserve Bank is private for profit bank that needs to make money too so I don't trust them to release correct numbers. I don't trade any news yet but I'd like to learn later on.

I may be completely wrong.....

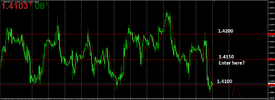

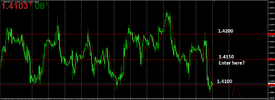

GBPUSD is in this decision area in between 1.4200 and 1.4100. We have bullish seasonal tendencies this week and a strong uptrend so we were bulls. June 6-18, the GBP seasonal tendency is bearish for the last 5 years (but bullish for the last 15 years so there's that). So we wait until the market tells us where the big money is going. I have my eye on bonds and interest rates too but not going to talk about them here. 1.4200 was historically a strong resistance level and it's been rejected (it looks like). Nice bearish engulfing bar showing large sell orders. Here's the daily.

Here's the 4h showing a strong rejection and weak retracement of 1.4200. Breaking down out of this channel and pulling back up to retest the line is the classic way to enter this but I'm probably not going to trade it that way.

This may zip away or it may run back up during NFP and run the stops at the top at 1.4200. That would be the absolute best case scenario. If I'm wrong, I risk a tiny tiny amount selling up there. If I'm right it'll enter me into a mega trade worth hundreds of pips, the top daily chart had that low that's 500 pips away from April 2021 and I'd be expecting a reach for this. Good math on this. Wrong = 1%, right = 4% or whatever after scaling out.

1.4150 is also a decent entry as it's shown to be of interest to larger traders. I'd enter a small amount with a wide stop, like 70 or 80 pips. Let the market just scramble around and clear stops out. The previous stop run from February of 2021 was 1.4238, so a 38 pip stop run. There are a lot of pending orders up there but it's possible the institutions have been in this range long enough to fill their positions. Daily candle traders and some trend traders who went short at 1.4100 have possibly put stops at 1.4205 at the top of that big candle on the 1h. The hourly chart does show a slight dip below the low from May 27 2021 by 6pips and I'm sure the institutions would like to drop all those shorts off before the drop so they may run it up. This looks like big money in the market making waves. NFP is a casino so I'm flat until after. The FED (I've seen this first hand) will release fake numbers to catch traders and then revise the numbers later so you wouldn't be able to tell the market did something crazy.

I'm probably going to be looking for a London or NY close tomorrow and that'll be my week.

I may be completely wrong.....

GBPUSD is in this decision area in between 1.4200 and 1.4100. We have bullish seasonal tendencies this week and a strong uptrend so we were bulls. June 6-18, the GBP seasonal tendency is bearish for the last 5 years (but bullish for the last 15 years so there's that). So we wait until the market tells us where the big money is going. I have my eye on bonds and interest rates too but not going to talk about them here. 1.4200 was historically a strong resistance level and it's been rejected (it looks like). Nice bearish engulfing bar showing large sell orders. Here's the daily.

Here's the 4h showing a strong rejection and weak retracement of 1.4200. Breaking down out of this channel and pulling back up to retest the line is the classic way to enter this but I'm probably not going to trade it that way.

This may zip away or it may run back up during NFP and run the stops at the top at 1.4200. That would be the absolute best case scenario. If I'm wrong, I risk a tiny tiny amount selling up there. If I'm right it'll enter me into a mega trade worth hundreds of pips, the top daily chart had that low that's 500 pips away from April 2021 and I'd be expecting a reach for this. Good math on this. Wrong = 1%, right = 4% or whatever after scaling out.

1.4150 is also a decent entry as it's shown to be of interest to larger traders. I'd enter a small amount with a wide stop, like 70 or 80 pips. Let the market just scramble around and clear stops out. The previous stop run from February of 2021 was 1.4238, so a 38 pip stop run. There are a lot of pending orders up there but it's possible the institutions have been in this range long enough to fill their positions. Daily candle traders and some trend traders who went short at 1.4100 have possibly put stops at 1.4205 at the top of that big candle on the 1h. The hourly chart does show a slight dip below the low from May 27 2021 by 6pips and I'm sure the institutions would like to drop all those shorts off before the drop so they may run it up. This looks like big money in the market making waves. NFP is a casino so I'm flat until after. The FED (I've seen this first hand) will release fake numbers to catch traders and then revise the numbers later so you wouldn't be able to tell the market did something crazy.

I'm probably going to be looking for a London or NY close tomorrow and that'll be my week.

WaveRider

Master Sergeant

- Messages

- 350

For Monday 6-7-21

I'm bearish this week on GBPUSD and EURUSD. I've checked the weekly and daily charts and there's no update. We're in a decision making area still.

EURUSD: Friday broke market structure down on the 4h, from low 1 to low 2. We thought low 1 was the low since the rejection was so strong but Friday the market shows weakness so we'll adapt. Totally possible to run up to 1.200 for a good safe entry if you're just trading 4h candles and would be a great place to get the weekly range.

If Monday ranges or drops a little and reverses back up, we can use the old low from Wednesday last week as a way to get in. I'd wait to see price action and I'd take some early profit and not hold on for the weekly candle. Same if, the price drops sharply and reverses up, I'd just sell at one of these levels.

GBPUSD:

This is what I'm hoping the week will look like. I took at tiny scalp Friday at 1.4200 for about 10 pips but it would have made a ton if I'd left it in. It was a very good entry and a very good time of day but I'm still finding my comfort levels. I did sell at 1.4145 or so like I'd said with a very wide stop. Risk is 1% beyond the peak and I'll hold this position probably all week. I want to see how far it'll go. If it hits the objectives it'll be 2% by itself which is all I need for the week anyway.

I'm bearish this week on GBPUSD and EURUSD. I've checked the weekly and daily charts and there's no update. We're in a decision making area still.

EURUSD: Friday broke market structure down on the 4h, from low 1 to low 2. We thought low 1 was the low since the rejection was so strong but Friday the market shows weakness so we'll adapt. Totally possible to run up to 1.200 for a good safe entry if you're just trading 4h candles and would be a great place to get the weekly range.

If Monday ranges or drops a little and reverses back up, we can use the old low from Wednesday last week as a way to get in. I'd wait to see price action and I'd take some early profit and not hold on for the weekly candle. Same if, the price drops sharply and reverses up, I'd just sell at one of these levels.

GBPUSD:

This is what I'm hoping the week will look like. I took at tiny scalp Friday at 1.4200 for about 10 pips but it would have made a ton if I'd left it in. It was a very good entry and a very good time of day but I'm still finding my comfort levels. I did sell at 1.4145 or so like I'd said with a very wide stop. Risk is 1% beyond the peak and I'll hold this position probably all week. I want to see how far it'll go. If it hits the objectives it'll be 2% by itself which is all I need for the week anyway.

WaveRider

Master Sergeant

- Messages

- 350

Week 6/7/21 part 2.

I'm going to be short AUDUSD this week. The 4h looks like a great entry to sell. Friday was a strong thrust up well above the 61.8 retracement level. Seasonal tendencies put AUD at a sell or range this coming week. The USDX we'll be expecting a range right now or soon. We're breaking out of this channel. I want to see price action Monday but this is currently in a very safe sell. If this becomes a buy it'll launch away up and I'll take the loss. But I'll leave a wide stop for the stop runs since I don't always find a great entry.

This next one shows the shorts I took last week. I got nervous after two days and collapsed the trade but it went my way. I could have taken a lot more from the position if I'd let it run according to the original plan. I did take partial profit. I'm happy about the win but I could have gotten more from it.

Having positions open for two or three days is stressful and closing them is relieving. I can sleep because the stops are placed and my risk is small but still. Been trading crypto and stocks for a few months and now I'm back to actively trading Forex for about a week. We did 5.7% positive this week. I'm not mad about being positive but I think I could have done a little better keeping risk low.

I'm going to be short AUDUSD this week. The 4h looks like a great entry to sell. Friday was a strong thrust up well above the 61.8 retracement level. Seasonal tendencies put AUD at a sell or range this coming week. The USDX we'll be expecting a range right now or soon. We're breaking out of this channel. I want to see price action Monday but this is currently in a very safe sell. If this becomes a buy it'll launch away up and I'll take the loss. But I'll leave a wide stop for the stop runs since I don't always find a great entry.

This next one shows the shorts I took last week. I got nervous after two days and collapsed the trade but it went my way. I could have taken a lot more from the position if I'd let it run according to the original plan. I did take partial profit. I'm happy about the win but I could have gotten more from it.

Having positions open for two or three days is stressful and closing them is relieving. I can sleep because the stops are placed and my risk is small but still. Been trading crypto and stocks for a few months and now I'm back to actively trading Forex for about a week. We did 5.7% positive this week. I'm not mad about being positive but I think I could have done a little better keeping risk low.

WaveRider

Master Sergeant

- Messages

- 350

I got chopped a little last week. Down a percent. I had several trades in profit and I didn't close them out or take partial profits like I should have.

We are entering the summer chop on seasonal tendencies for all the currencies I'm listing so I'm expecting some smaller ranges and less sharp moves. Just means to take partial profits and move stops to BE. More scalping and smaller moves.

EURUSD:

Sive likes 1.2050 for buys. There's also a bullish order block about 1.2080. WPS1 is 1.2060. If we spike to the 50% of Friday's 4h candle at 1.2142, also the WPP, I'll be a bear this week. The market likes to erase these large candles. I would expect maybe 4-8 4h candles and then the market would erase about half the Friday candle. If it runs down initially toe 1.2050 area, I'll be a buyer.

EURGBP is still in this 70 pip range and I'm going to expect it to stay in the range. It's at the bottom of the range now, I'll expect the market to bounce between 0.8620 and 0.8565 or so. A 20 pip stop run above and below the range would be totally in character so 0.8660 to 0.8540. I'll be trading back into this range this week.

GBPUSD:

I'm still bearish on this. We chopped all over last week. I really want to see stops hit someplace, especially on the peaks around 1.4200. Lot's of break out stops in both directions. The market maker would love to take the breakout stops for a ride and run the market the other way. If we're really going down, I'd like to see a stop run.

AUDUSD looks a lot like GBP. I'd favor a buy off the WPS1 area or if we've run stop to the upside I'd favor a target below last weeks low at 0.7645 .The daily candles have had lots of overlap and lots of wicks for weeks.

Got my eye a a couple other pairs but these will be may preferred trades this week.

We are entering the summer chop on seasonal tendencies for all the currencies I'm listing so I'm expecting some smaller ranges and less sharp moves. Just means to take partial profits and move stops to BE. More scalping and smaller moves.

EURUSD:

Sive likes 1.2050 for buys. There's also a bullish order block about 1.2080. WPS1 is 1.2060. If we spike to the 50% of Friday's 4h candle at 1.2142, also the WPP, I'll be a bear this week. The market likes to erase these large candles. I would expect maybe 4-8 4h candles and then the market would erase about half the Friday candle. If it runs down initially toe 1.2050 area, I'll be a buyer.

EURGBP is still in this 70 pip range and I'm going to expect it to stay in the range. It's at the bottom of the range now, I'll expect the market to bounce between 0.8620 and 0.8565 or so. A 20 pip stop run above and below the range would be totally in character so 0.8660 to 0.8540. I'll be trading back into this range this week.

GBPUSD:

I'm still bearish on this. We chopped all over last week. I really want to see stops hit someplace, especially on the peaks around 1.4200. Lot's of break out stops in both directions. The market maker would love to take the breakout stops for a ride and run the market the other way. If we're really going down, I'd like to see a stop run.

AUDUSD looks a lot like GBP. I'd favor a buy off the WPS1 area or if we've run stop to the upside I'd favor a target below last weeks low at 0.7645 .The daily candles have had lots of overlap and lots of wicks for weeks.

Got my eye a a couple other pairs but these will be may preferred trades this week.

Similar threads

- Replies

- 5

- Views

- 7K

- Replies

- 5

- Views

- 671

- Replies

- 9

- Views

- 12K

- Replies

- 12

- Views

- 314

- Replies

- 11

- Views

- 271