SOLID ECN LLC

Solid ECN Representative

- Messages

- 513

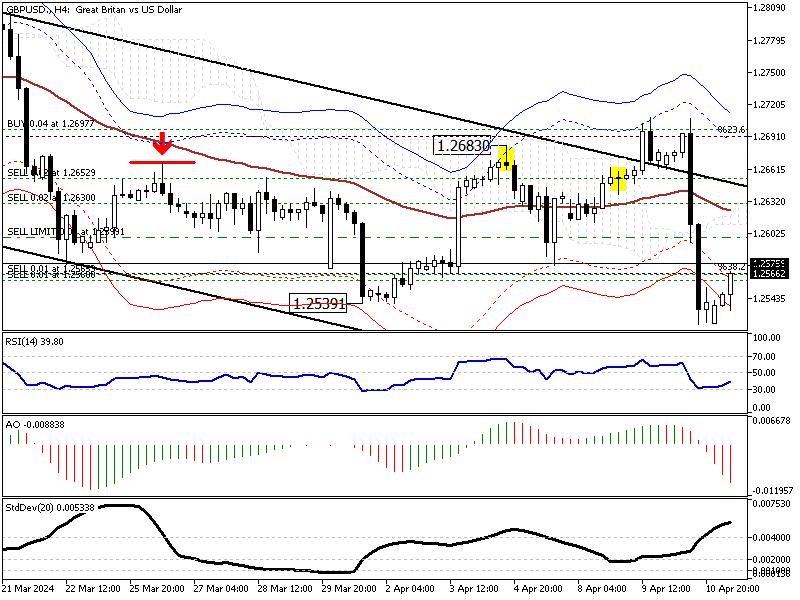

GBPUSD's Pullback: An Opportunity?

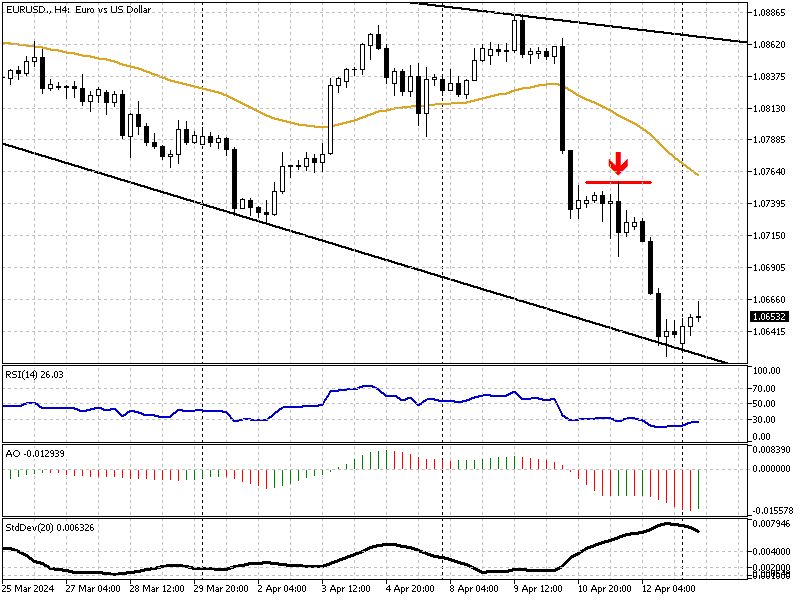

Solid ECN—In yesterday's trading session, The GBPUSD pair dipped below 1.2593, April's lowest point against the U.S. dollar. As of writing, the pair is experiencing a pullback toward the broken support at 1.2575. This pullback was expected because the price exceeded the envelope indicator's lines, interpreted as an oversold market.

From a technical perspective, the market is bearish as long as the GBPUSD price hovers below the Ichimoku Cloud and the EMA 50. The pullback can provide opportunities to join the bear market if it stops at the 1.2575 resistance, followed by 1.2613. Therefore, monitoring these levels and looking for bearish candlestick patterns, such as a doji or a bearish engulfing pattern, can signal investors to join the sellers.

If this scenario comes into play, the next target for the bears will likely be the 50% Fibonacci level, the 1.247 mark, followed by the lower band of the bearish flag.

Conversely, if the GBPUSD closes and stabilizes itself above the cloud and the upper band of the flag, the bear market should be considered invalid.

From a technical perspective, the market is bearish as long as the GBPUSD price hovers below the Ichimoku Cloud and the EMA 50. The pullback can provide opportunities to join the bear market if it stops at the 1.2575 resistance, followed by 1.2613. Therefore, monitoring these levels and looking for bearish candlestick patterns, such as a doji or a bearish engulfing pattern, can signal investors to join the sellers.

If this scenario comes into play, the next target for the bears will likely be the 50% Fibonacci level, the 1.247 mark, followed by the lower band of the bearish flag.

Conversely, if the GBPUSD closes and stabilizes itself above the cloud and the upper band of the flag, the bear market should be considered invalid.