SOLID ECN LLC

Solid ECN Representative

- Messages

- 516

Euro Area Q4 GDP Beats Estimates

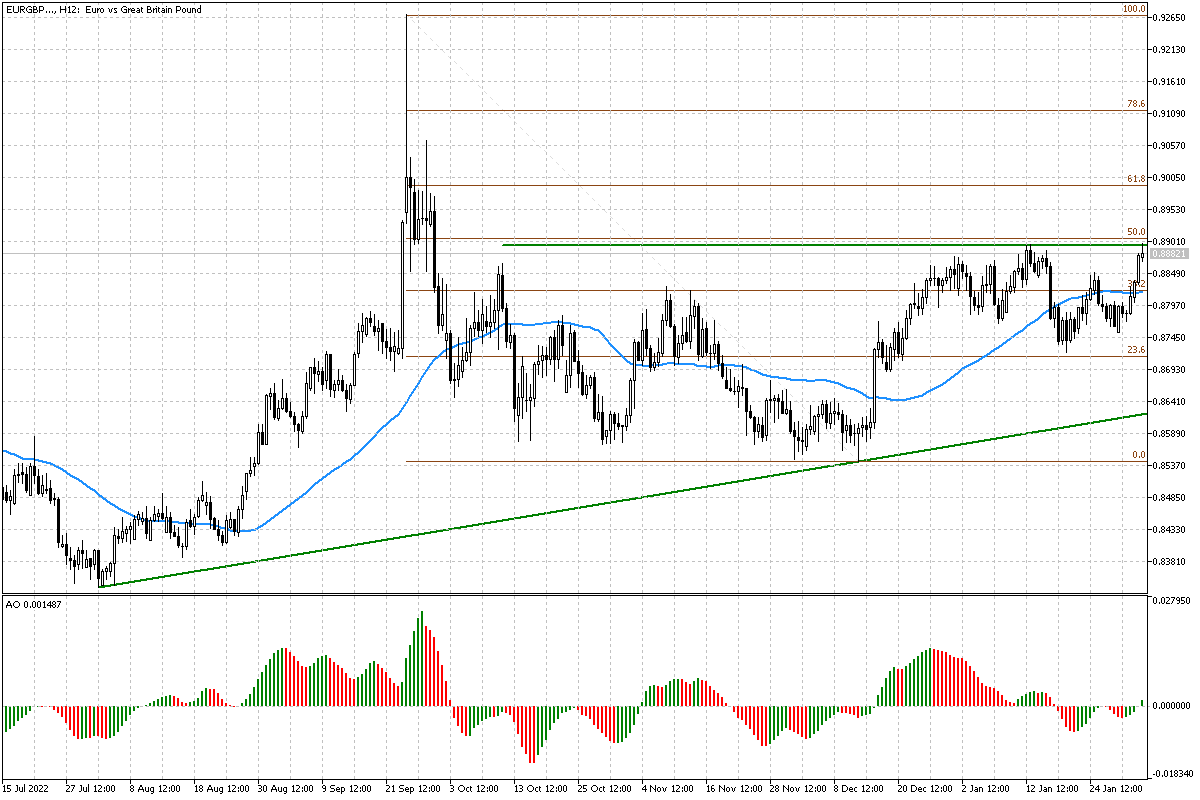

Q4 GDP report from euro area just came out and turned out to be a positive surprise. Growth reached 0.1% QoQ while market expected a 0.1% QoQ drop. On annual basis, GDP growth reached 1.9% YoY (exp. 1.8% YoY), slightly slower than 2.1% YoY reported in Q3 2022. Simultaneously, Q4 GDP report from Italy was released and it also turned out to be better-than-expected. Italian GDP declined 0.1% QoQ in Q4 2022, but the market expected a 0.2% QoQ drop. On an annual basis growth reached 1.7% YoY (exp. 1.6% YoY).

However, in spite of being a positive surprise, reports did not have much of an impact. EURUSD barely moved while DE30 ticked lower.

Q4 GDP report from euro area just came out and turned out to be a positive surprise. Growth reached 0.1% QoQ while market expected a 0.1% QoQ drop. On annual basis, GDP growth reached 1.9% YoY (exp. 1.8% YoY), slightly slower than 2.1% YoY reported in Q3 2022. Simultaneously, Q4 GDP report from Italy was released and it also turned out to be better-than-expected. Italian GDP declined 0.1% QoQ in Q4 2022, but the market expected a 0.2% QoQ drop. On an annual basis growth reached 1.7% YoY (exp. 1.6% YoY).

However, in spite of being a positive surprise, reports did not have much of an impact. EURUSD barely moved while DE30 ticked lower.