Gold Price and Crude Oil Price Aim Fresh Increase

Gold price started a major decline below the $1,725 support zone. Crude oil price is attempting a fresh increase from the $88.80 support zone.

Important Takeaways for Gold and Oil

- Gold price struggled above $1,740 and declined against the US Dollar.

- Recently, there was a break above a key bearish trend line with resistance near $1,705 on the hourly chart of gold.

- Crude oil price started a downside correction from the $100 and $101 resistance levels.

- There was a break below a major bullish trend line with support near $98.95 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price struggled to gain pace above the $1,750 resistance zone against the US Dollar. The price started a fresh decline and traded below the $1,725 pivot level.

There was a clear move below the $1,712 support zone and the 50 hourly simple moving average. The price even traded below the $1,700 level and formed a low near $1,680 on FXOpen. It is now correcting losses above the $1,695 level.

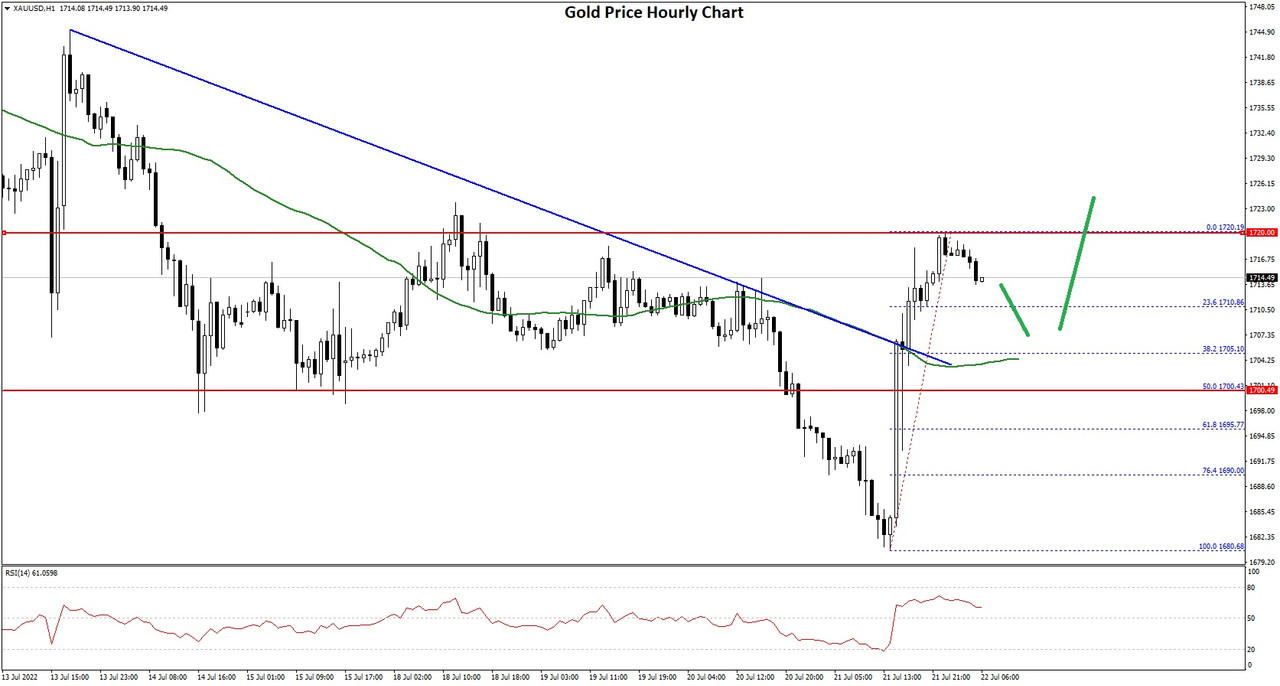

Gold Price Hourly Chart

There was a break above a key bearish trend line with resistance near $1,705 on the hourly chart of gold. The price even climbed above the $1,712 level but struggled to clear $1,720.

A high is formed near $1,720 and the price is now consolidating gains. On the downside, an initial support is near the $1,710 level. It is near the 23.6% Fib retracement level of the upward move from the $1,680 swing low to $1,720 high.

The next major support is near the $1,700 level or the 50% Fib retracement level of the upward move from the $1,680 swing low to $1,720 high, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,680 support zone.

On the upside, the price is facing resistance near the $1,720 level. A clear upside break above the $1,720 resistance could send the price towards $1,735. The main resistance is now forming near the $1,750 level. A close above the $1,750 level could open the doors for a steady increase towards $1,780.

Read Full on FXOpen Company Blog...