SOLID ECN LLC

Solid ECN Representative

- Messages

- 515

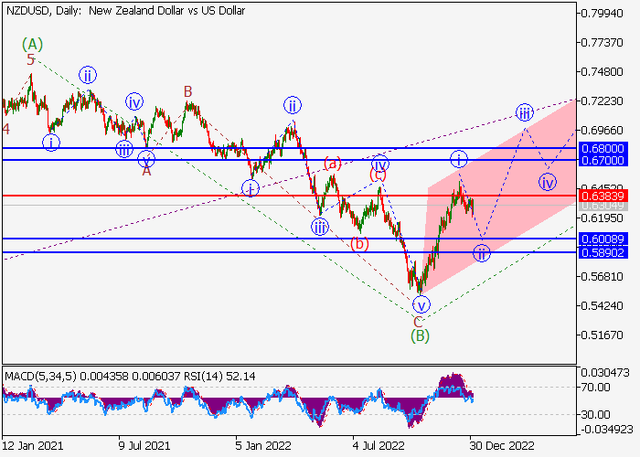

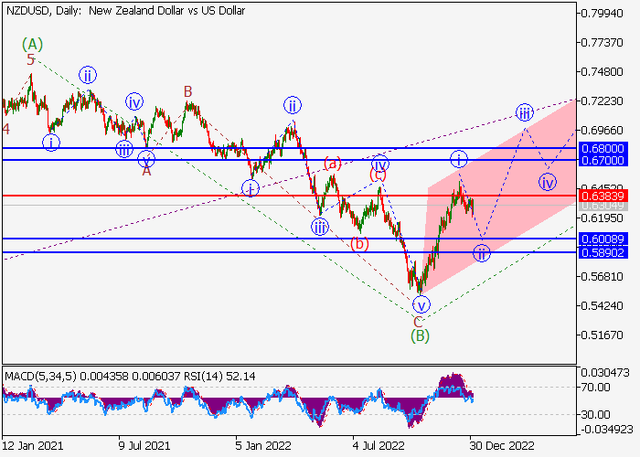

NZDUSD - The price is in a correction, a fall is possible.

On the daily chart, the upward wave of the higher level (А) formed, a downward correction ended as the wave (B), and the development of the wave (C) started. Now, the first entry wave of the lower level i of 1 of (C) has formed, and a local correction is developing as the second wave ii of 1 of (C), within which the wave (c) of ii is forming.

If the assumption is correct, the NZDUSD pair will fall to the area of 0.6008 – 0.5890. In this scenario, critical stop loss level is 0.6383.

If the assumption is correct, the NZDUSD pair will fall to the area of 0.6008 – 0.5890. In this scenario, critical stop loss level is 0.6383.