The main support for the entire cryptocurrency sector was provided by monetary factors. After the release on Thursday of the December data on US consumer inflation, which recorded a new slowdown in its growth rate from 7.1% to 6.5% on an annualized basis, investors became stronger in the opinion that the US Fed will also adjust the rate of interest rate hike to 25.0 percentage points, putting pressure on the quotes of the national currency. As a result, the positions of alternative assets, including digital ones, have strengthened. It should be noted that the current trend is in line with the forecasts of the well-known crypto enthusiast, the head of Galaxy Digital, Michael Novogratz, who at the beginning of last year said that the digital asset market would restore positive dynamics after the American regulator retreats from the policy of sharp monetary tightening. Further positive for the sector was the news that the FTX bankruptcy team was able to restore access to the company's assets of about 5.0B dollars, which could provide investors with a significant part of the losses.

However, despite a number of positive factors, the further recovery of BTC positions does not look sustainable, as the position of the cryptocurrency industry as a whole remains difficult. The decline in trading volumes on the leading centralized exchanges continues, in December alone, the number of spot trading decreased by 42.8% at once, and of futures – by 47.6% compared to November. The difficult financial situation caused by a protracted fall in prices last year is forcing companies to optimize costs and reduce staff. Thus, the Coinbase platform announced plans to lay off 950 employees, which is about 20.0% of the staff. Cryptocurrency company ConsenSys intends to lay off about 100 employees, and cryptocurrency wallet operator Blockchain.com – 110. In addition, additional problems for the industry may be created by a new lawsuit by the US Securities and Exchange Commission (SEC) against the Gemini site and the Genesis credit service, which, according to the regulator, are guilty of unregistered sale of securities to investors.

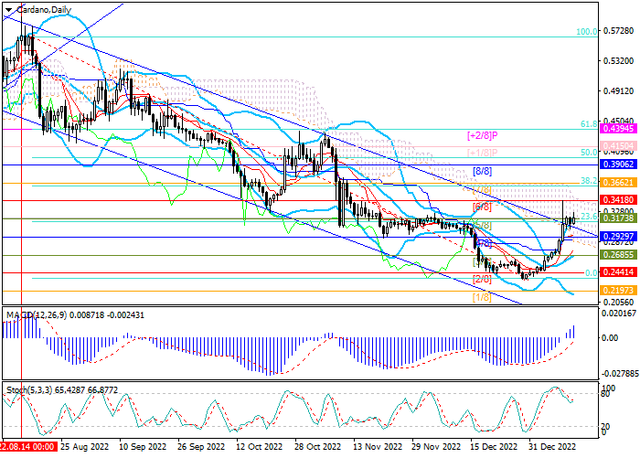

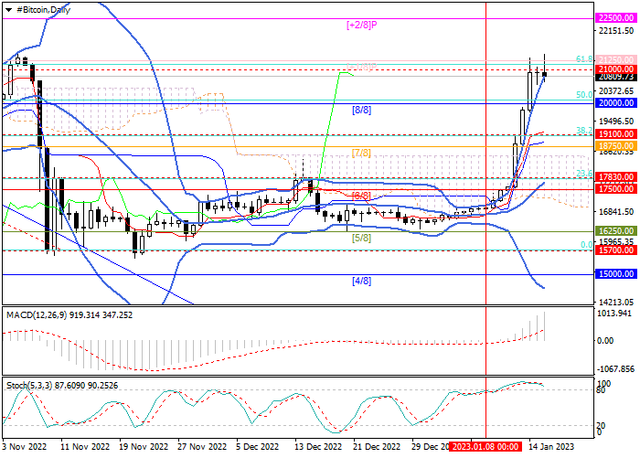

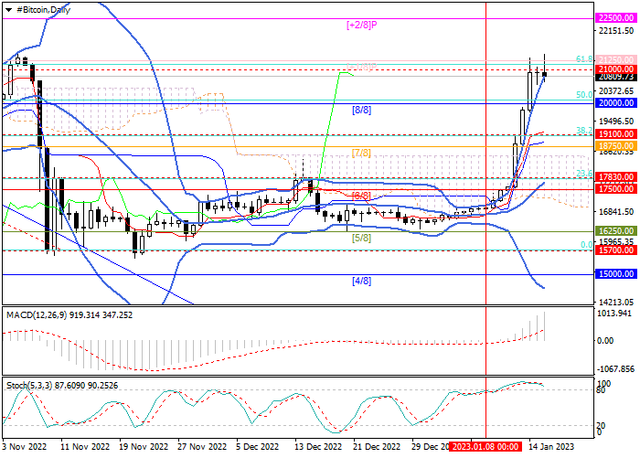

Technically, the price is testing the resistance zone of 21000 - 21250 (Murray level [+1/8], Fibo retracement 61.8%), consolidation above it will give the prospect of further growth to the levels of 22500 (Murray level [+2/8]) and 25000 (Murray level [0/8] for W1). If the level of 20000 (Murray level [8/8], Fibo retracement 50.0%) is broken down, the decline will be able to resume to the area of 19100 (Fibo retracement 38.2%) and 17830 (Fibo retracement 23.6%).

Resistance levels: 21250, 22500, 25000 |

Support levels: 20000, 19100, 17830