Tusharcsfx

Recruit

- Messages

- 0

Daily Crypto Analysis – Bitcoin hits $52K, Ethereum eyes $3K.

Introduction

Bitcoin marks a new range high, surpassing $50,000 and reaching $52,043, while SEC Chair Gary Gensler emphasizes the economic distinctions between BTC and the US Dollar. BTC’s upward momentum may lead to a 5% climb to $55,000, with bulls dominating the market. Ethereum (ETH) eyes a 7% surge to $3,000 if it maintains bullish momentum. XRP hits $0.5590 amid Bitcoin’s rally, with increased trade volume and a pro-Ripple response to Gensler’s comments. Dogecoin (DOGE) experiences a 7.5% surge, reclaiming its top 10 position, and surpassing Chainlink in market capitalization.Markets In Focus Today – BITCOIN

Bitcoin Price Posts A New Range High As Gensler Details The Economic Difference Between BTC And The US Dollar.

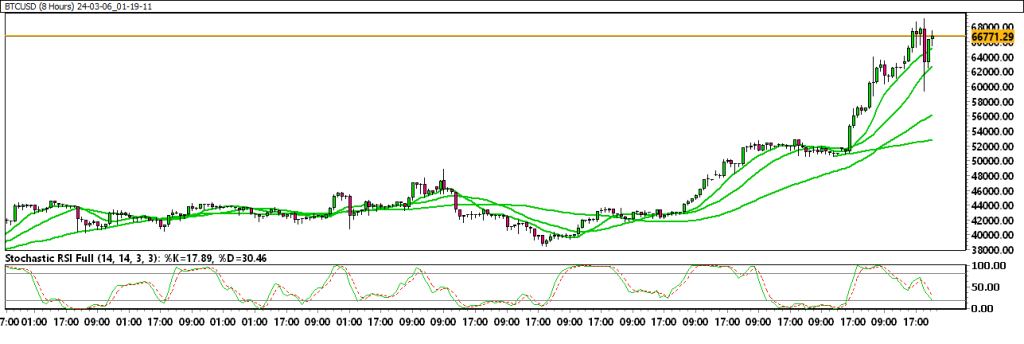

Bitcoin price put the $50,000 milestone behind it after recording an intraday high of $52,043 on Wednesday.BTC could extend the climb by 5% to $55,000 amid rising momentum and a strong presence of bulls in the BTC market. The bullish thesis will be invalidated if the apex crypto breaks and closes below $45,554.Appearing on CNBC, SEC Chair Gary Gensler said Bitcoin is not decentralized, calling it a token of choice for ransomware. Bitcoin’s (BTC) price remains northbound, pushing to higher highs as holders keep their profit appetite in check. Meanwhile, Gary Gensler has drawn a line separating BTC from other currencies.Technical Overview With Chart :

Moving Averages :

Exponential :

- MA 10 : 48578.2931 | Positive Crossover | Bullish

- MA 20 : 46458.6635 | Positive Crossover | Bullish

- MA 50 : 44159.2752 | Positive Crossover | Bullish

Simple :

- MA 10 : 47943.0210 | Positive Crossover | Bullish

- MA 20 : 45361.2990 | Positive Crossover | Bullish

- MA 50 : 43923.6724 | Positive Crossover | Bullish

Stochastic Oscillator : 96.4489 | Buy Zone | Positive

Resistance And Support Levels :

- R1 : 47387.2295 R2 : 49860.6039

- S1 : 39380.2039 S2 : 36906.8295