WEEKLY SNAPSHOT

MANUFACTURING PRODUCTION (MOM) (NOV), U.K.

WHEN: WHAT IT HAD INFLUENCED:

11th JANUARY 2022 GBP and its subsequent pairs

WHAT HAPPENED: Manufacturing Production measures the change in the total inflation-adjusted value of output produced by manufacturers. Manufacturing accounts for approximately 80% of overall Industrial Production.

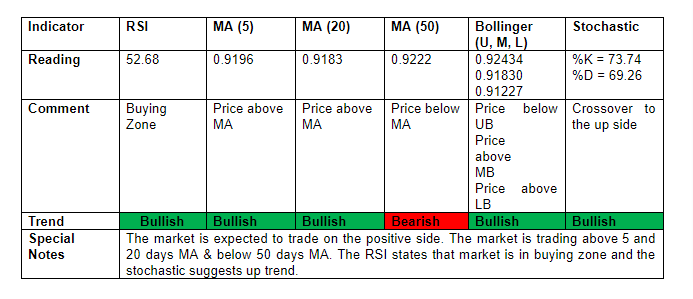

GBPNZD is trading in the up channel. Further upside can be seen in the coming week.

Core CPI (MoM) (Dec), U.S.

WHEN: WHAT IT HAD INFLUENCED:

12th JANUARY 2022 USD and its subsequent pairs

WHAT HAPPENED: The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

USDNOK is currently in the downward channel. Further downside can be seen in the coming week.

RETAIL SALES (MOM) (NOV), AUSTRALIA

WHEN: WHAT IT HAD INFLUENCED:

10th JANUARY 2022 AUD and its subsequent pairs

WHAT HAPPENED: Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

AUDJPY is currently in the downward channel. Further downside can be seen in the coming week.

GOLD FUTURES FALL FOR THE SESSION, GAIN FOR THE WEEK

WHAT IT HAD INFLUENCED:

GOLD

WHAT HAPPENED: Gold futures declined on Friday, giving up earlier gains, but holding onto a climb for the week. Colin Cieszynski, chief market strategist at SIA Wealth Management, attributed the day’s pullback in prices partly to profit-taking ahead of the long weekend, with regular trading closed Monday for the Martin Luther King Jr. holiday. However, a decline in the U.S. dollar for the week and gold’s long-term role as an inflation hedge are among the reasons behind the precious metal’s rise this week, he said. February gold fell $4.90, or 0.3%, to settle at $1,816.50 an ounce. Prices based on the most-active contract rose 1.1% from last Friday’s settlement to mark their fifth weekly rise in six weeks

GOLD is trading in the upward channel. Further upside can be seen in the coming week.

OIL PRICES IN 4TH WEEKLY GAIN ON SIGNS OF TIGHTER SUPPLIES, FIRMER DEMAND

WHAT IT HAD INFLUENCED:

CRUDE OIL

WHAT HAPPENED:

Crude settled higher on Friday, notching a fourth positive week, supported by bets the Omicron-fueled drag on demand will be short-lived at a time when global supplies are expected to tighten.

On the New York Mercantile Exchange crude futures gained 2.1% to settle at $84.82 a barrel, while on London’s Intercontinental Exchange (NYSE:ICE), Brent added 2.0% to trade at $86.14 a barrel.

The fourth week of gains in oil prices has been supported by easing fears about the Omicron variant’s impact on demand.

The International Energy Agency said earlier this week that demand was proving stronger “than many of the market observers had thought, mainly due to the milder Omicron expectations.”

As well as positive demand, supply disruptions from key producers including Nigeria and Libya have propped up bets of tightening global supplies and underpinned a climb in oil prices.

Oil prices were also underpinned by a weaker dollar, which despite a gain on Friday, is on course for a weekly slump.

WTI CRUDE OIL is trading in the up channel. Further upside can be seen in the coming week.

JPMORGAN CLIENT SURVEY: MAJORITY EXPECT BITCOIN PRICE TO REACH $60K OR MORE THIS YEAR

WHAT IT HAD INFLUENCED:

BITCOIN

WHAT HAPPENED:

JPMorgan has conducted a survey of its clients about what they expect the price of bitcoin to be by year-end. The global investment bank released the results earlier this week. The survey was conducted between Dec. 13 and Jan. 7 as part of a broader macroeconomic outlook for 2022. Forty-seven of JPMorgan’s clients participated in the survey.

About 41% of the bank’s clients who responded expect bitcoin to end the year at around $60,000. 23% expect the price to be $20,000 while 20% expect it to be $40,000.

In addition, 9% believe that the price of BTC will reach $80,000, 5% think that it could be $100,000 or more, while 2% expect it to fall to $10,000 or lower.

BTCUSD is trading in the down channel; downside will be seen in the coming days.

5 KEY EVENTS TO WATCH OUT

CLAIMANT COUNT CHANGE (DEC), U.K.

WHEN: WHAT IT INFLUENCES:

18th JANUARY 2022 GBP and its subsequent

Pairs

WHAT’S HAPPENING: Claimant Count Change measures the change in the number of unemployed people in the U.K. during the reported month. A rising trend indicates weakness in the labor market, which has a trickle-down effect on consumer spending and economic growth.

A higher-than-expected reading ought to be taken as negative/bearish for the GBP, whereas a lower-than-expected reading should be taken as positive/bullish for the GBP.

BUILDING PERMITS (DEC), U.S.

WHEN: WHAT IT INFLUENCES:

19th JANUARY 2022 USD and its subsequent

Pairs

WHAT’S HAPPENING: Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

A higher-than-expected reading ought to be taken as positive/bullish for the USD, whereas a lower-than-expected reading should be taken as negative/bearish for the USD.

EMPLOYMENT CHANGE (DEC), AUSTRALIA

WHEN: WHAT IT INFLUENCES:

19th JANUARY 2022 AUD and its subsequent

Pairs

WHAT’S HAPPENING: Employment Change measures the change in the number of people employed. Job creation is an important indicator of consumer spending.

A higher-than-expected reading ought to be taken as positive/bullish for the AUD, whereas a lower-than-expected reading should be taken as negative/bearish for the AUD.

NATIONAL CORE CPI (YOY) (DEC), JAPAN

WHEN: WHAT IT INFLUENCES:

20th JANUARY 2022 JPY and its subsequent

Pairs

WHAT’S HAPPENING: The National Core Consumer Price Index (CPI) measures the change in the price of goods and services purchased by consumers, excluding fresh food.

A higher-than-expected reading ought to be taken as positive/bullish for the JPY, whereas a lower-than-expected reading should be taken as negative/bearish for the JPY.

CORE RETAIL SALES (MOM) (NOV), CANADA

WHEN: WHAT IT INFLUENCES:

21st JANUARY 2022 CAD and it’s subsequent

pairs

WHAT’S HAPPENING: Core Retail Sales measures the change in the total value of sales at the retail level in Canada, excluding automobiles. It is an important indicator of consumer spending and is also considered a pace indicator for the Canadian economy.

A higher-than-expected reading ought to be taken as positive/bullish for the CAD, whereas a lower-than-expected reading should be taken as negative/bearish for the CAD.

EQUITIES IN THE COMING WEEK

1.

Bank of America (BAC) to announce its Quarterly Results on 18th JANUARY 2022, EPS estimated to 0.7709 per share while revenue estimated 22.17B.

2.

Goldman Sachs (GS) to announce its Quarterly Results on 18th JANUARY 2022, EPS estimated to 11.75 per share while revenue estimated 12.00B.

3

. Morgan Stanley (MS) to announce its Quarterly Results on 19th JANUARY 2022, EPS estimated to 1.94 per share while revenue estimated 14.57B.

4.

Netflix (NFLX) to announce its Quarterly Results on 20th JANUARY 2022, EPS estimated to 0.8454 per share while revenue estimated 7.72B.

5.

IHS Markit Ltd (INFO) to announce its Quarterly Results on 21st JANUARY 2022, EPS estimated to 0.8317 per share while revenue estimated 1.15B.

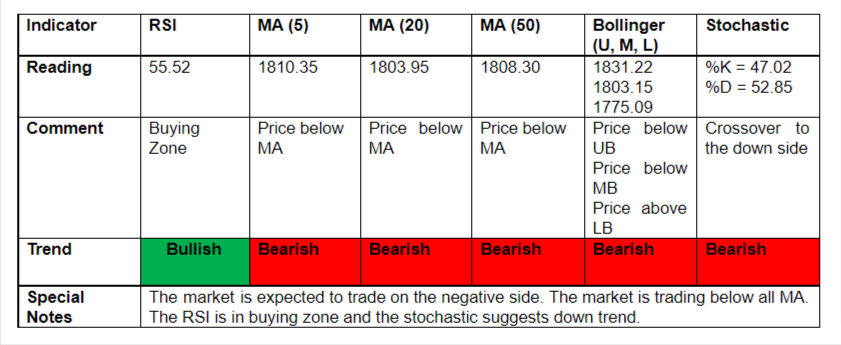

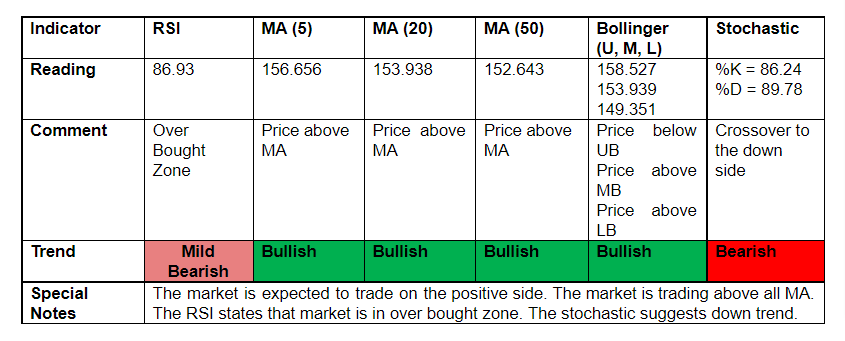

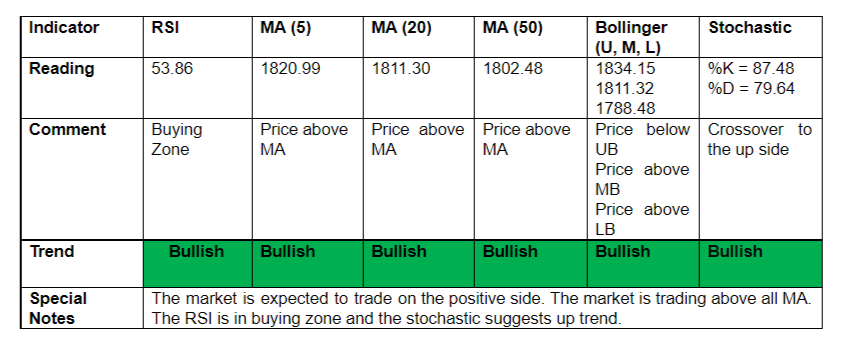

TOP COMMODITIES IN THE COMING WEEK

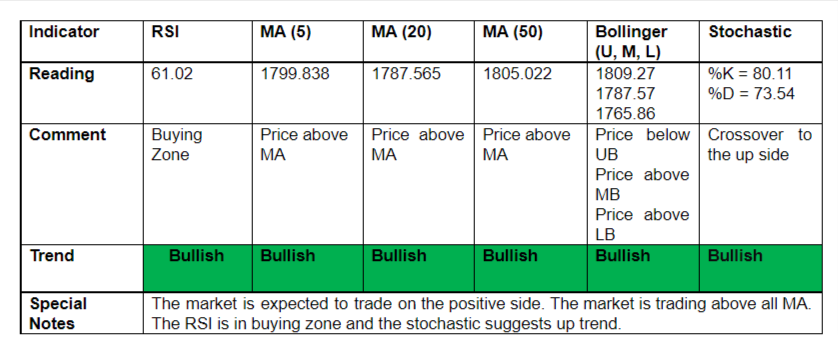

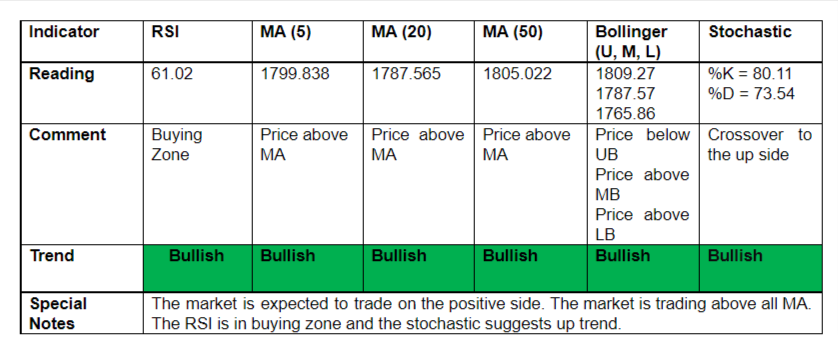

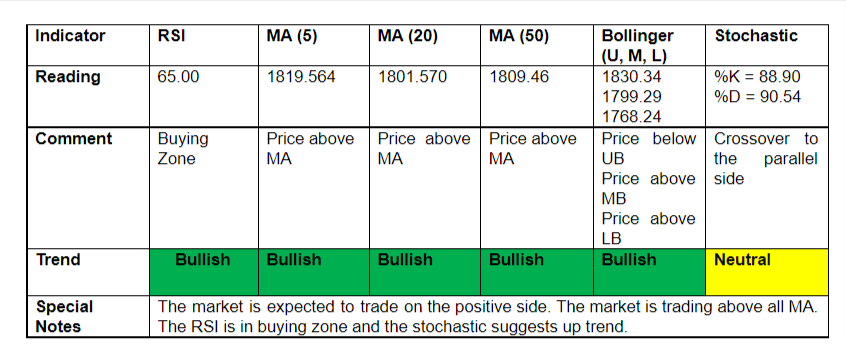

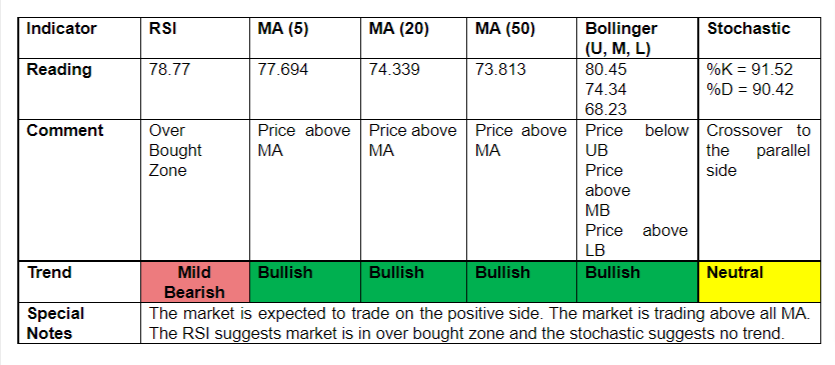

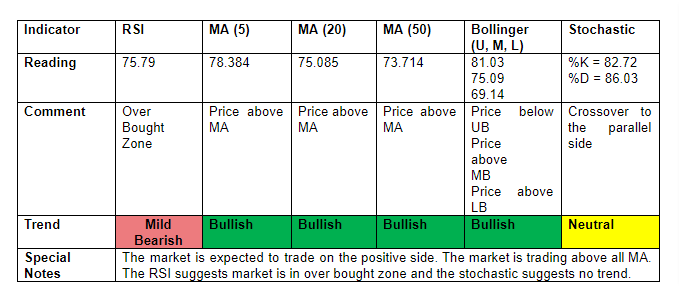

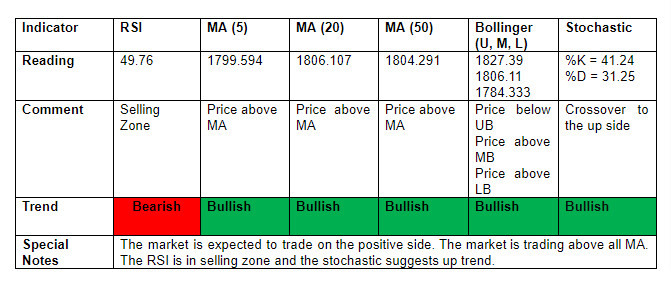

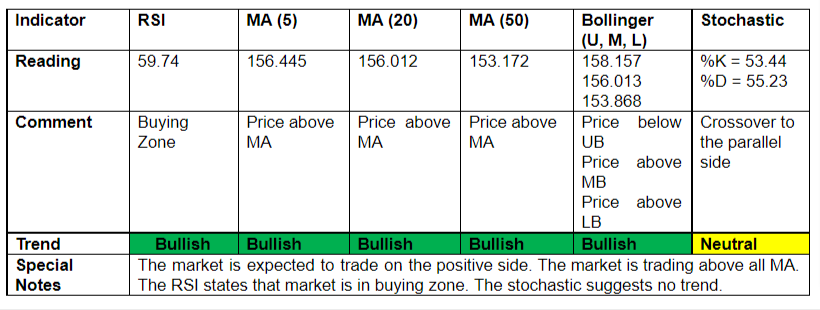

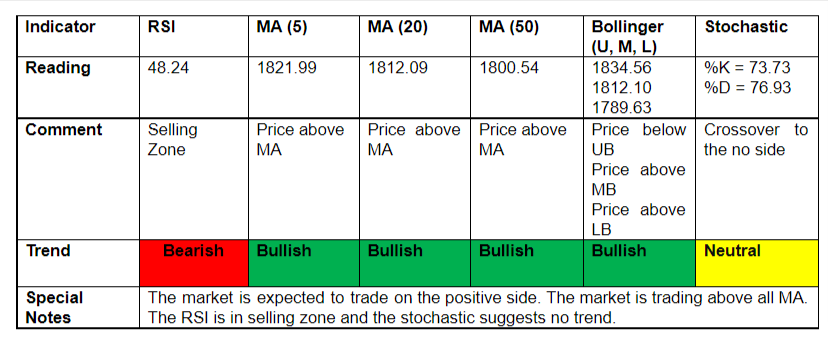

GOLD

GOLD is currently in the upward channel. Further upside can be seen in the coming week.

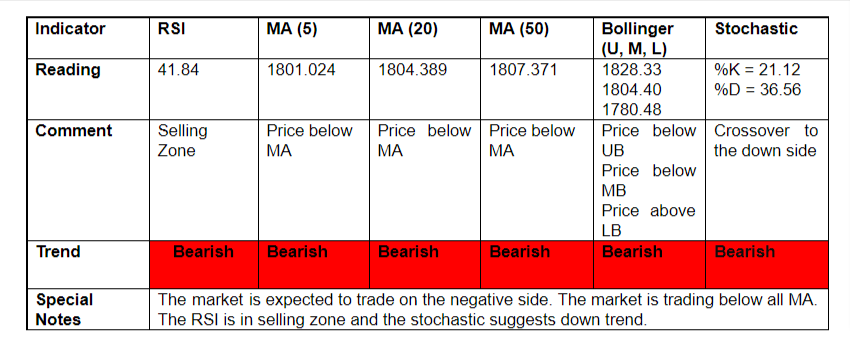

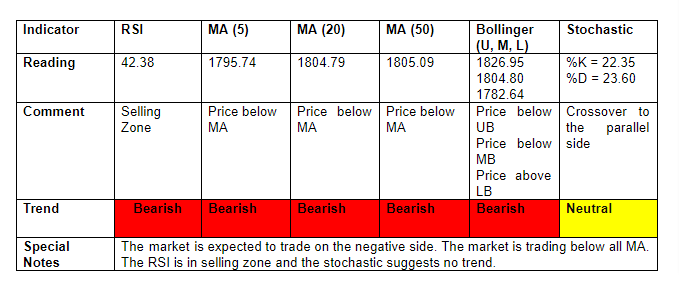

SILVER

SILVER is trading in the upward channel. Further upside can be seen in the coming week.

WTI CRUDE OIL

WTI CRUDE OIL is trading in the up channel. Further upside can be seen in the coming week.

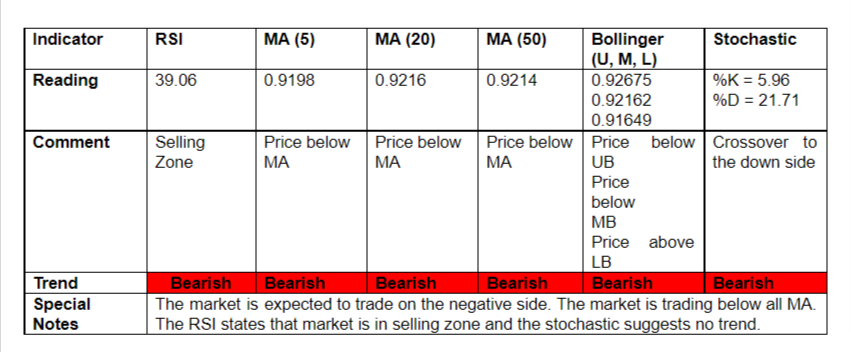

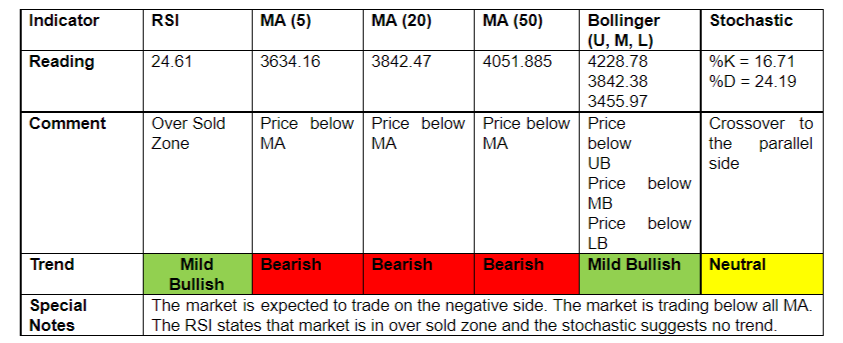

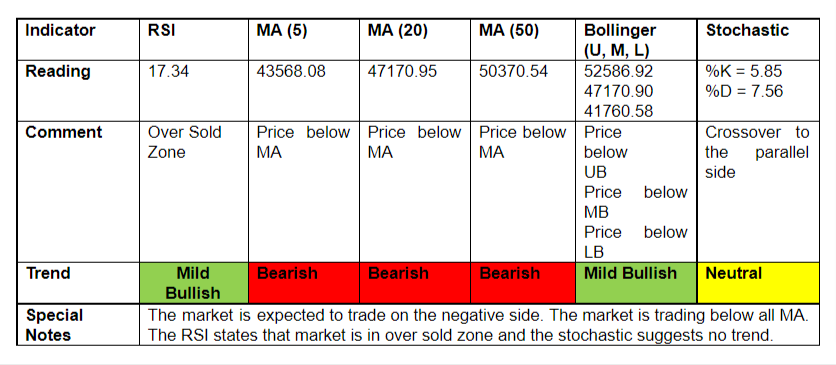

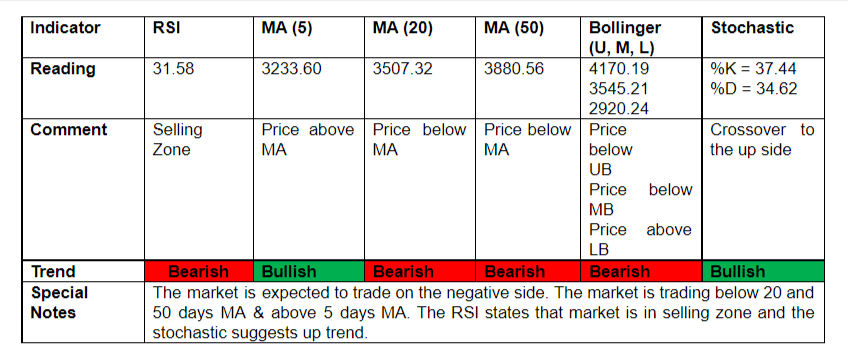

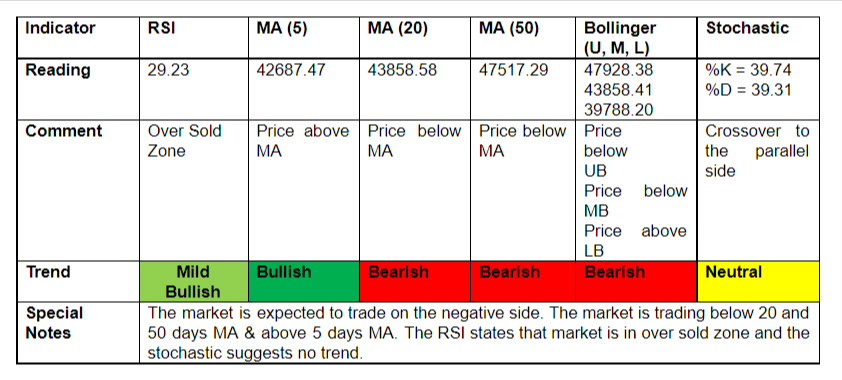

TOP CRYPTO IN THE COMING WEEK

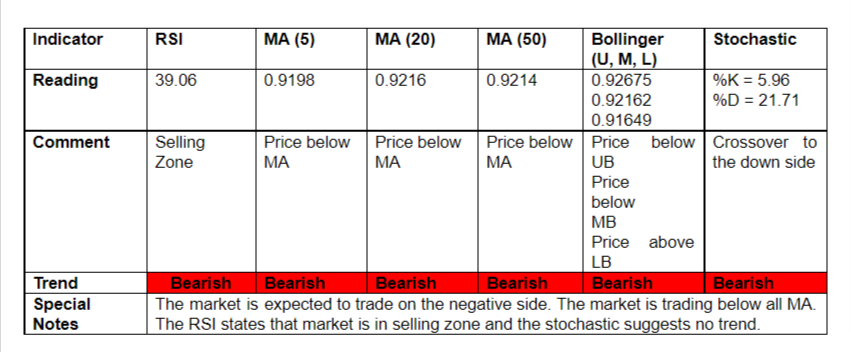

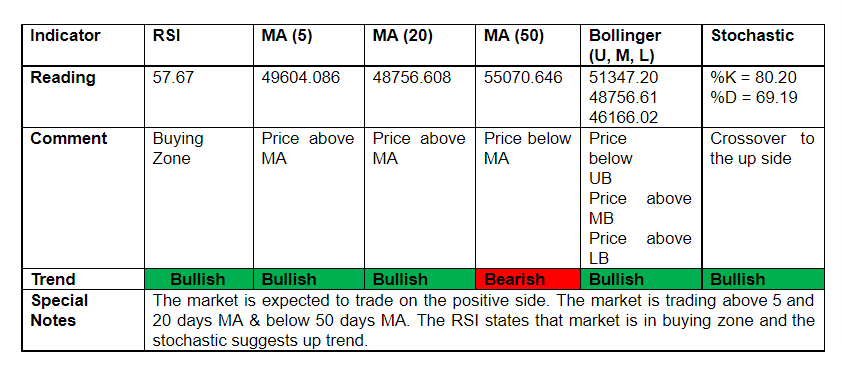

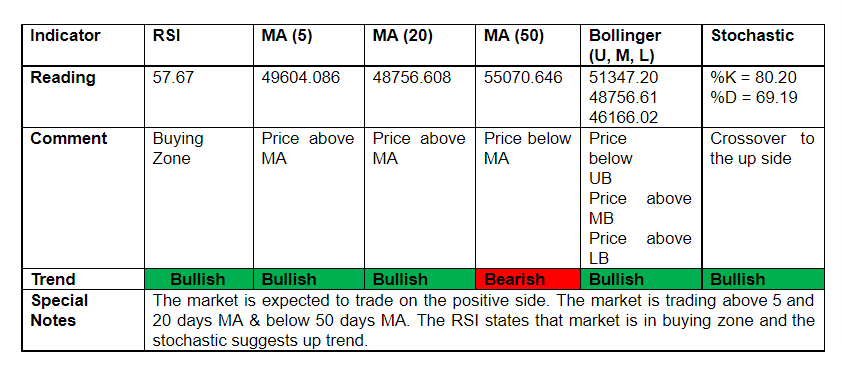

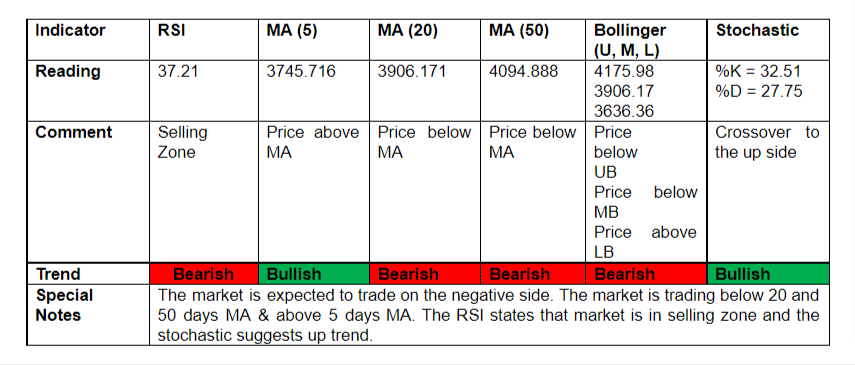

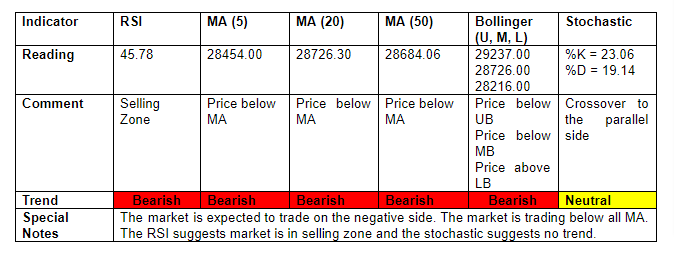

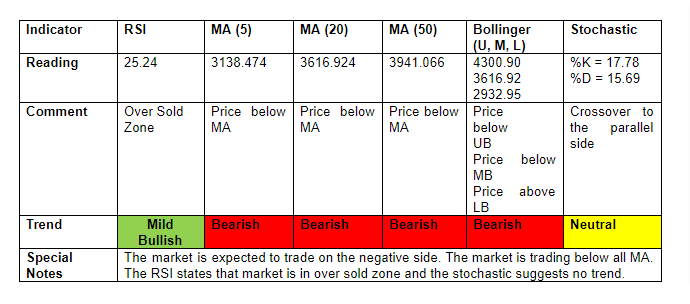

BTCUSD

BTCUSD is trading in the down channel; downside will be seen in the coming days.

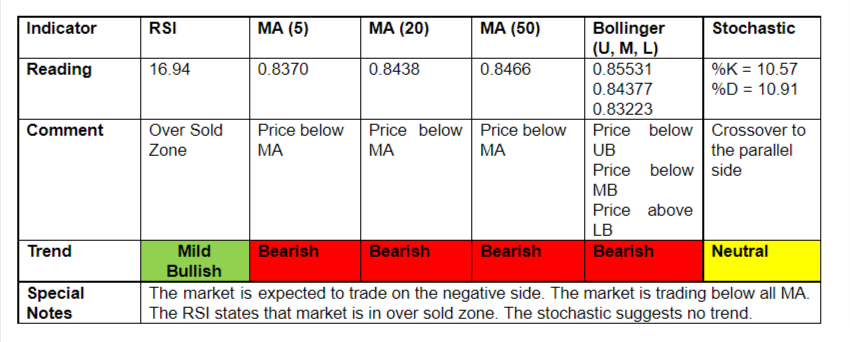

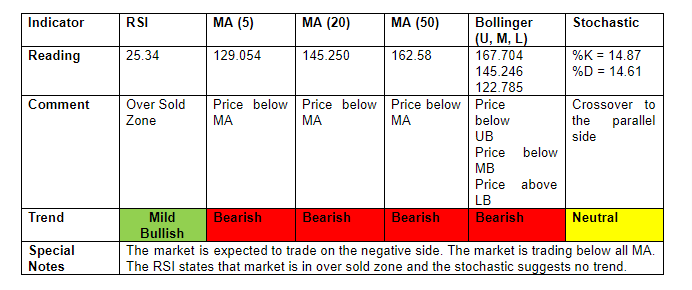

ETHEREUM

ETHEREUM is currently in the downward channel. Further downside can be seen in the coming week.

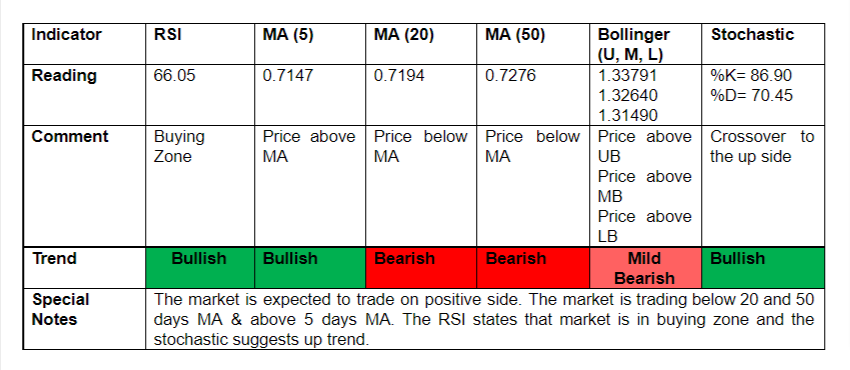

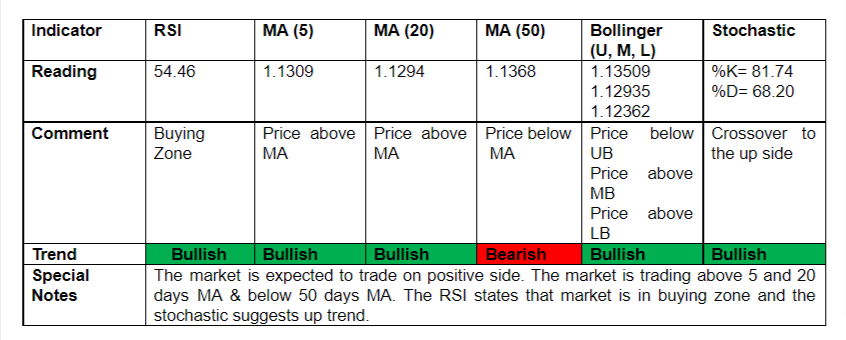

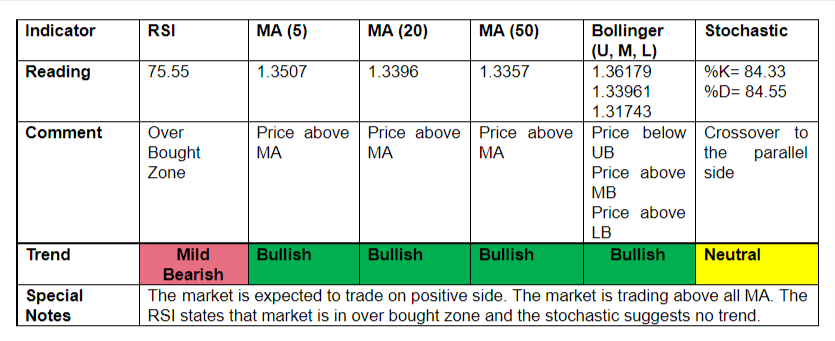

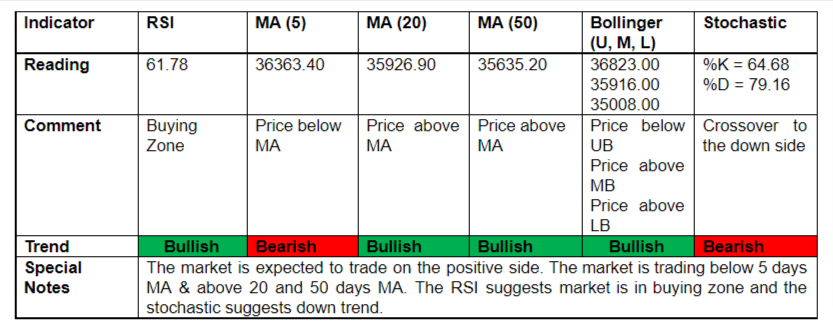

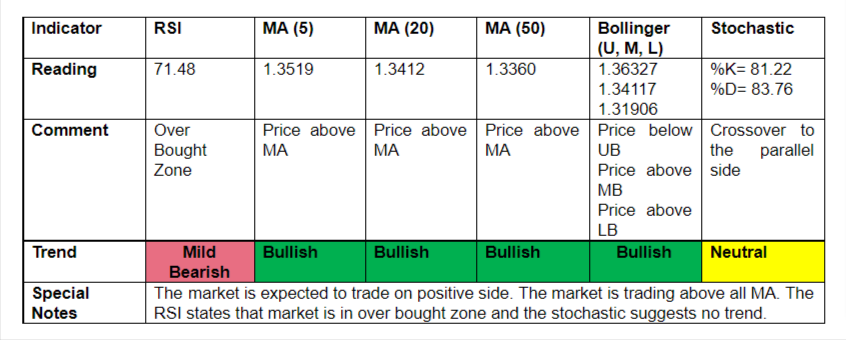

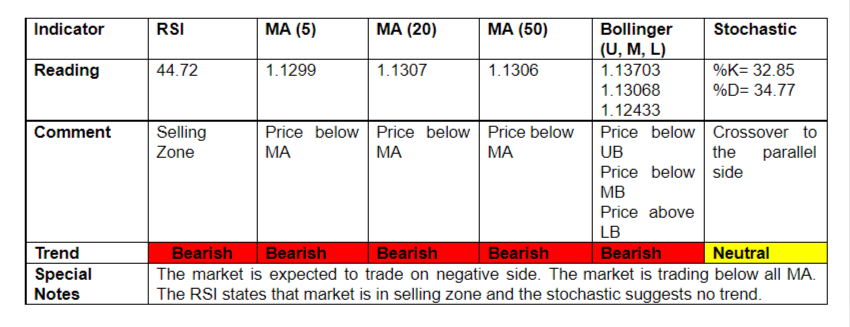

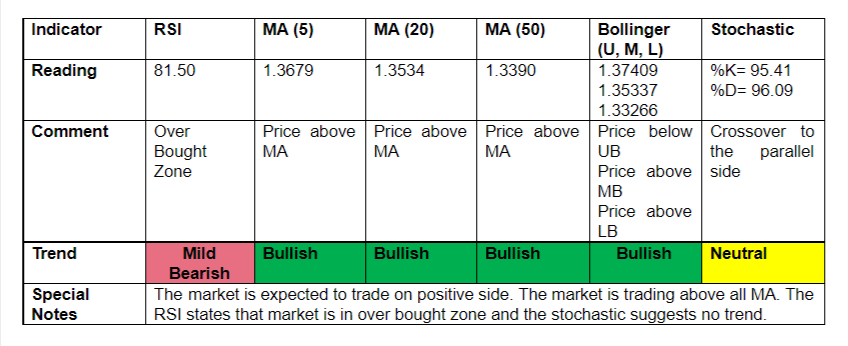

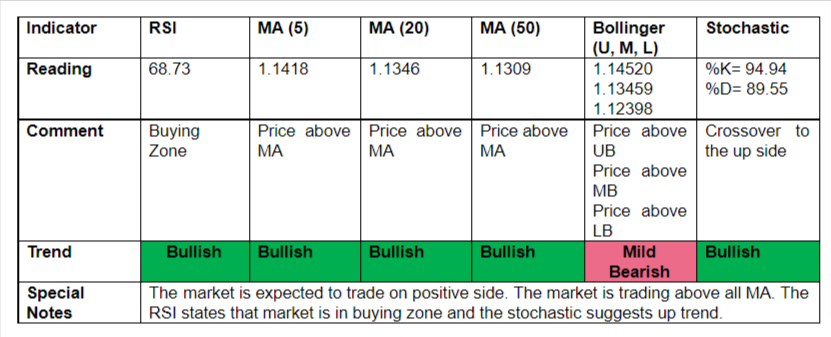

TOP CURRENCY IN THE COMING WEEK

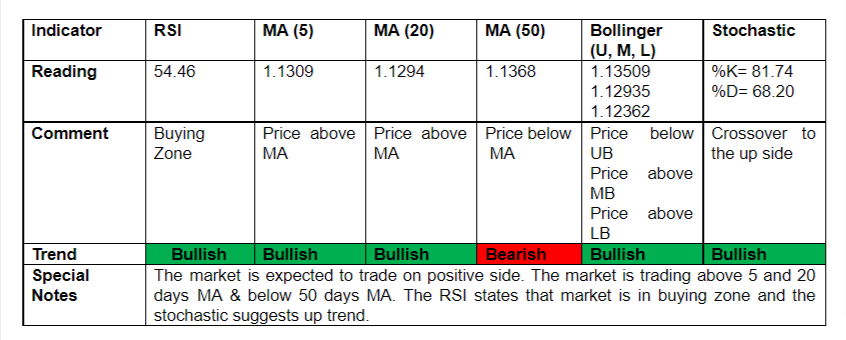

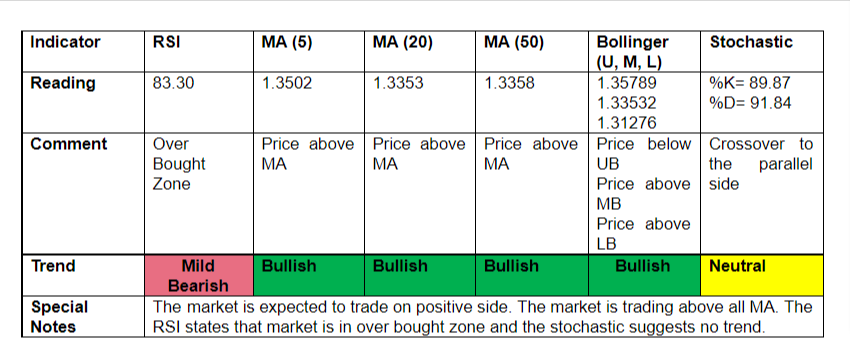

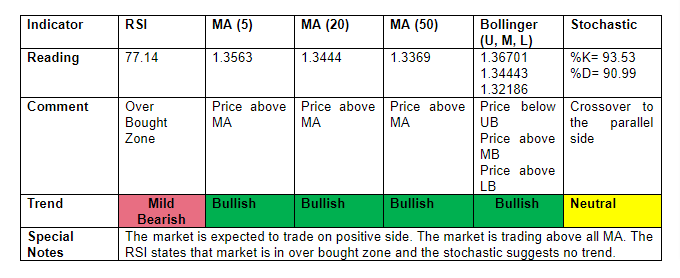

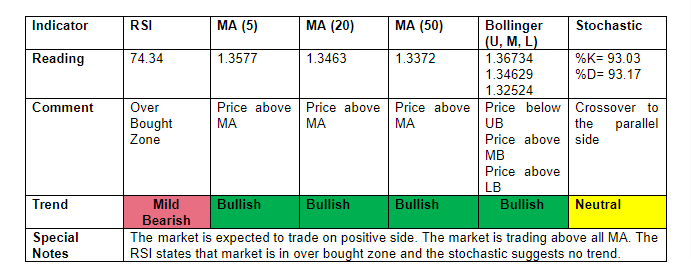

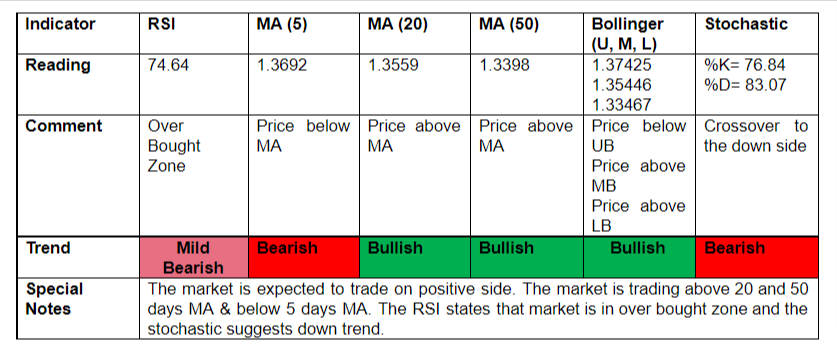

EURUSD

EURUSD is trading in the up channel; further upside can be seen in the coming days.

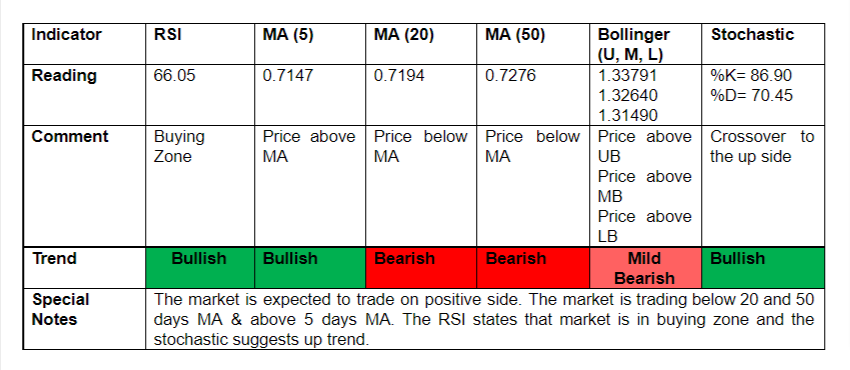

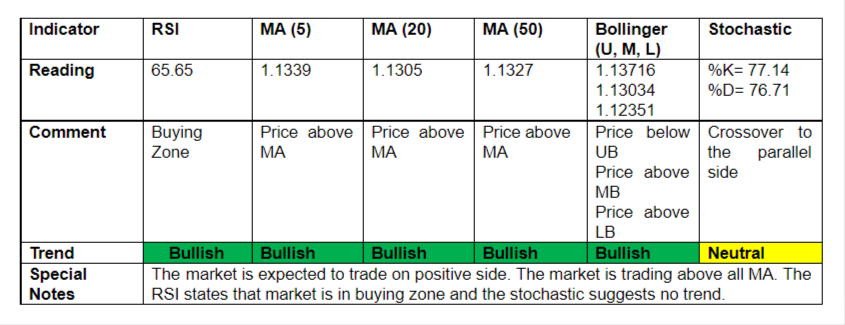

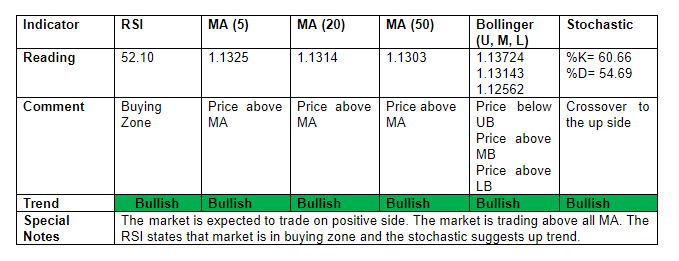

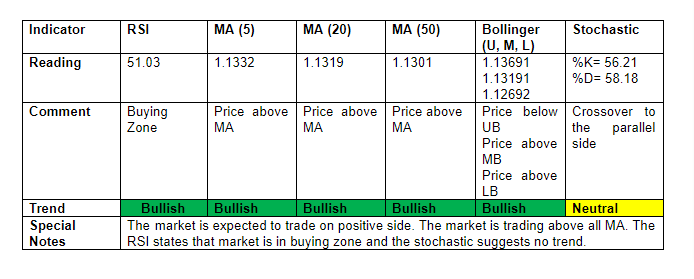

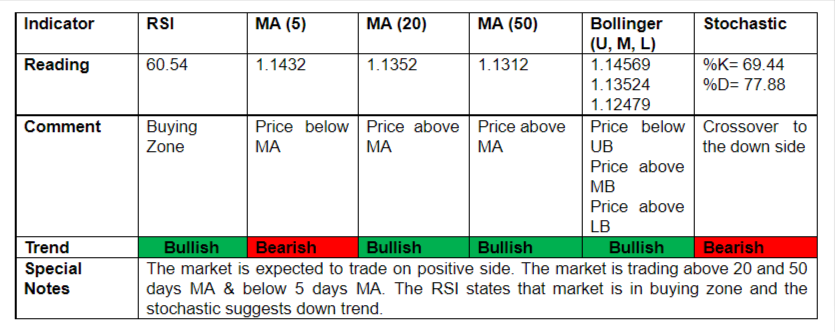

GBPUSD

GBPUSD is trading in the up channel; further upside can be seen in the coming days.

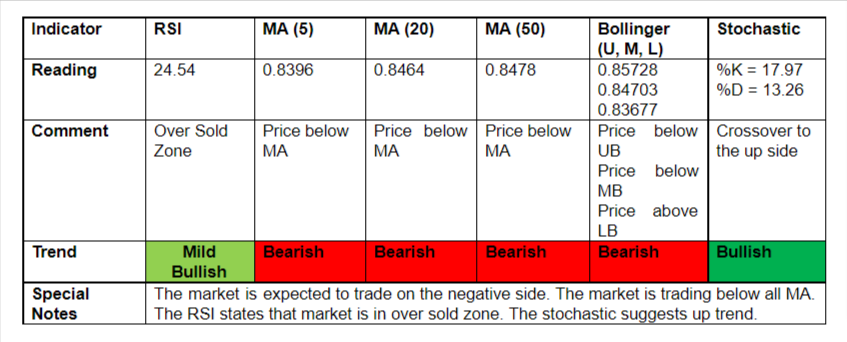

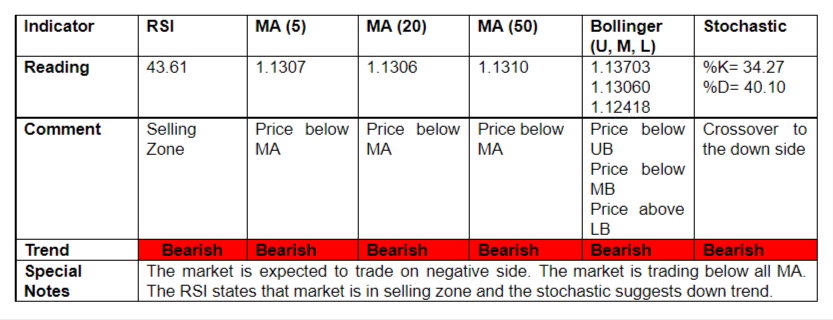

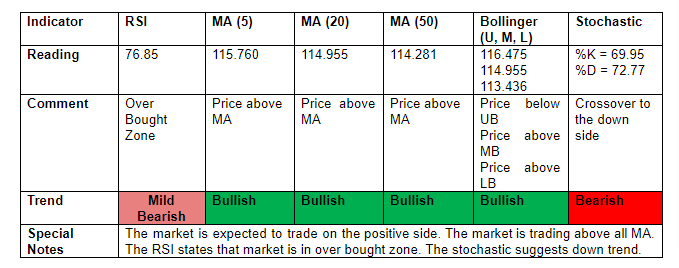

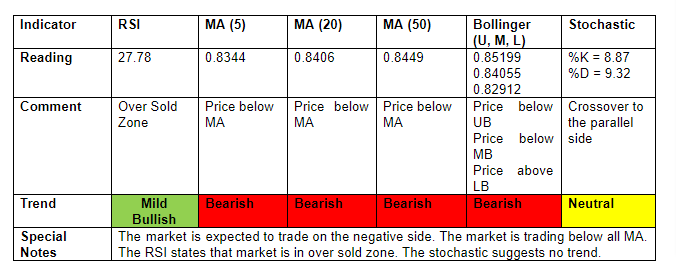

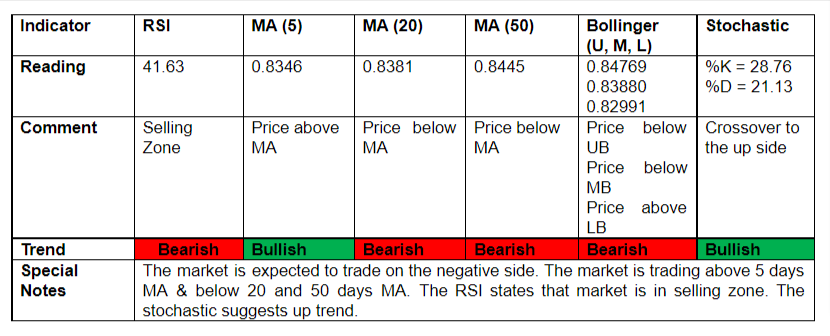

EURGBP

EURGBP is currently in the downward channel. The further downside can be seen in the coming week.

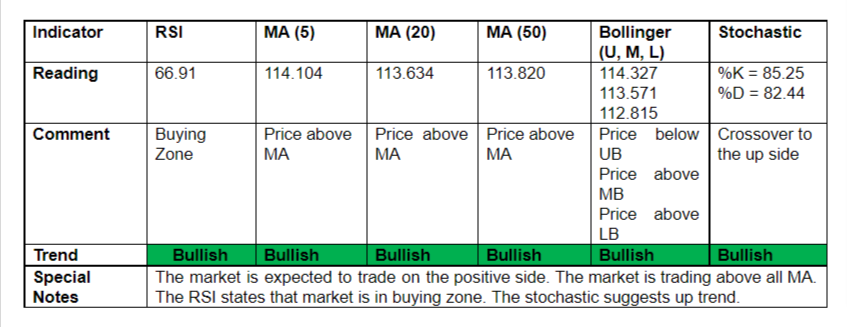

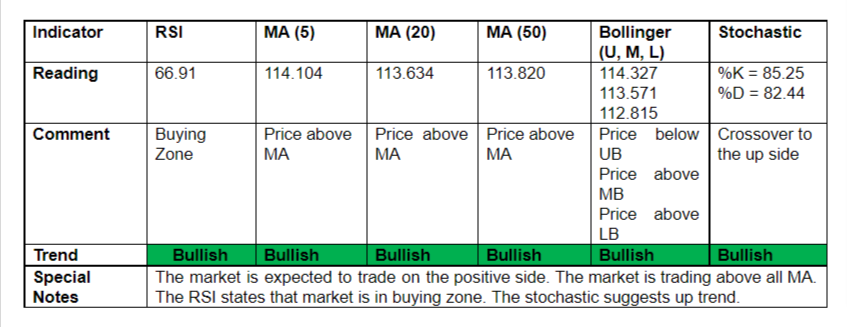

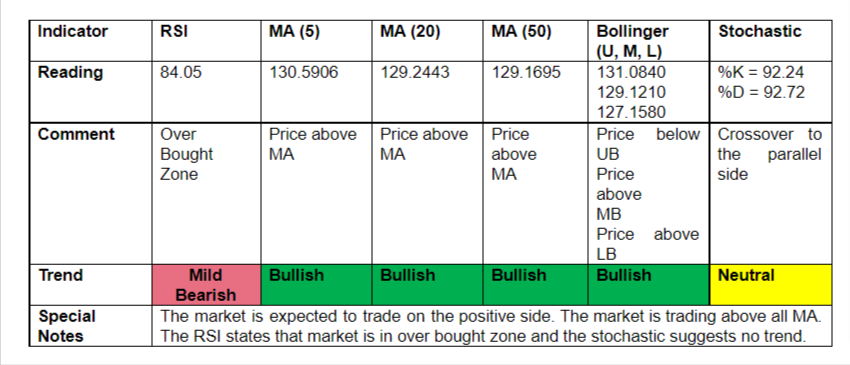

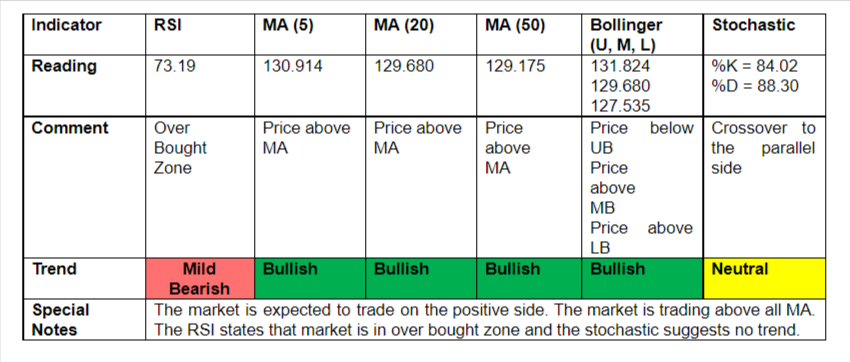

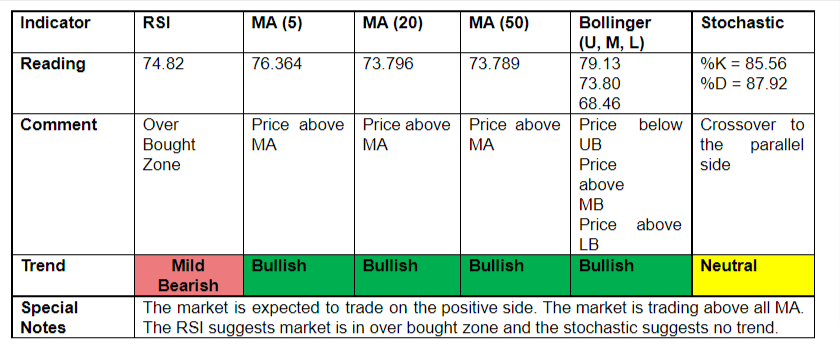

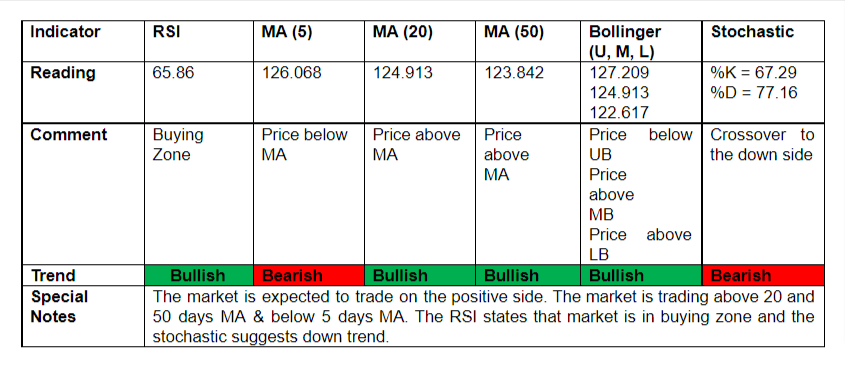

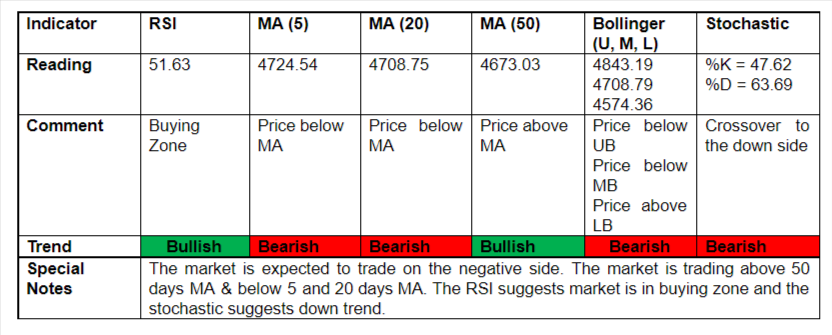

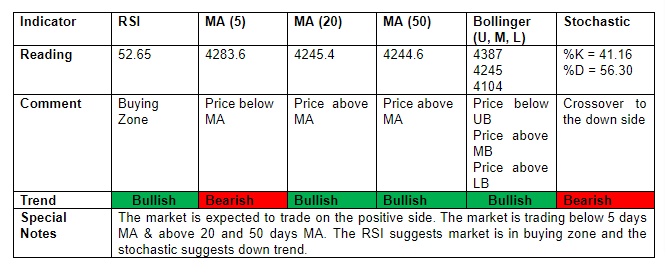

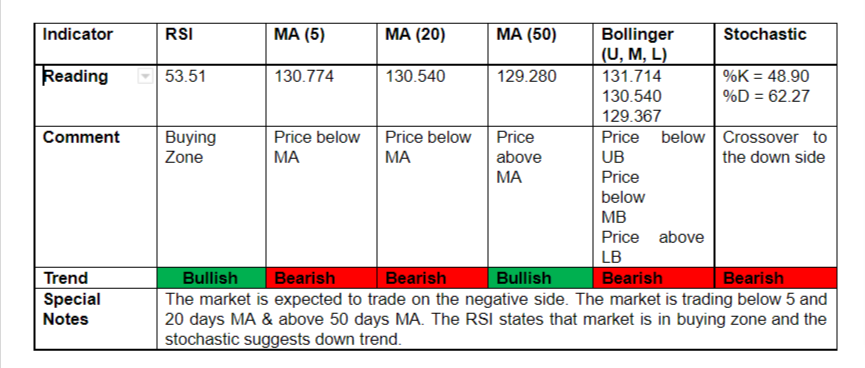

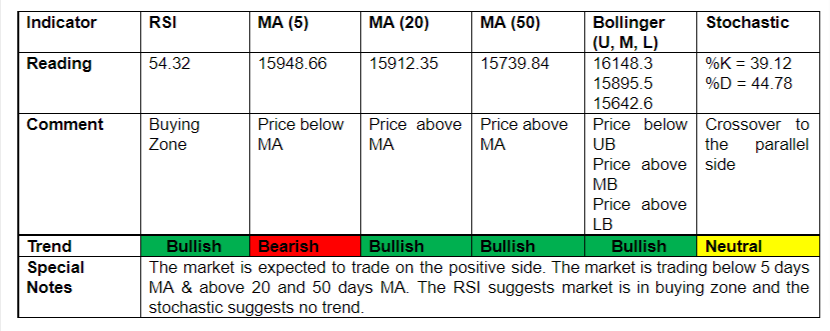

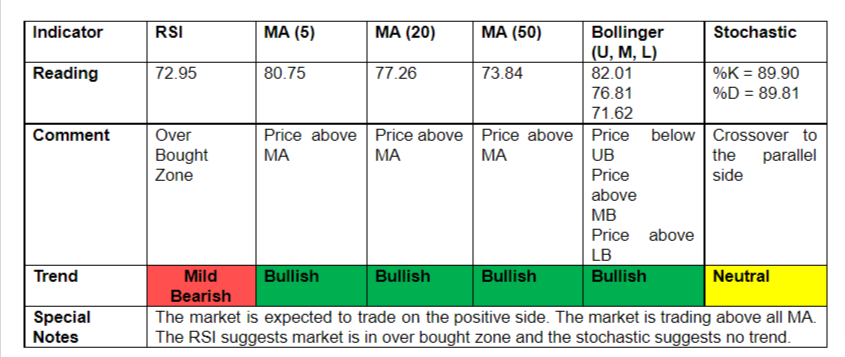

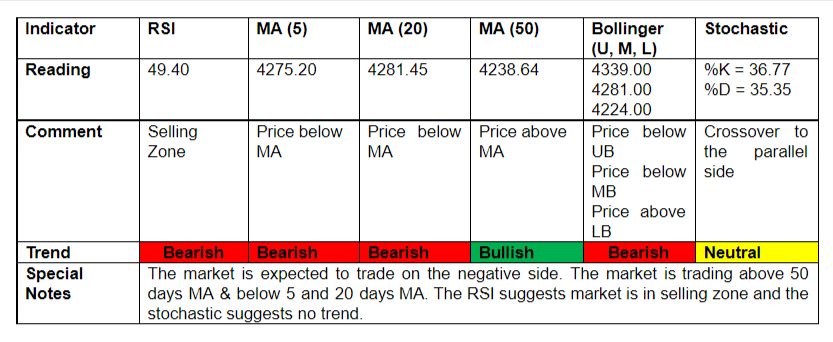

TOP INDEX IN THE COMING WEEK

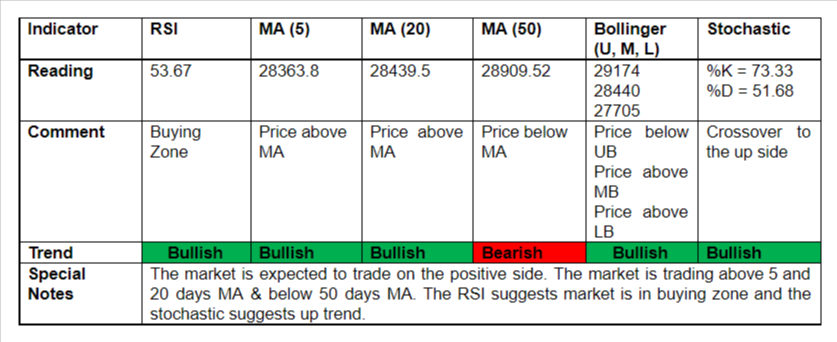

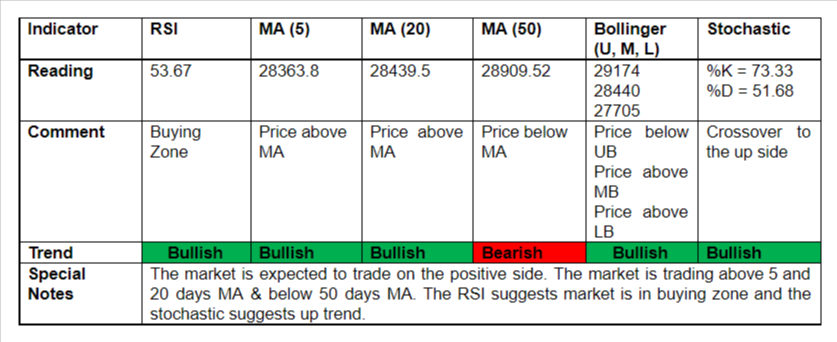

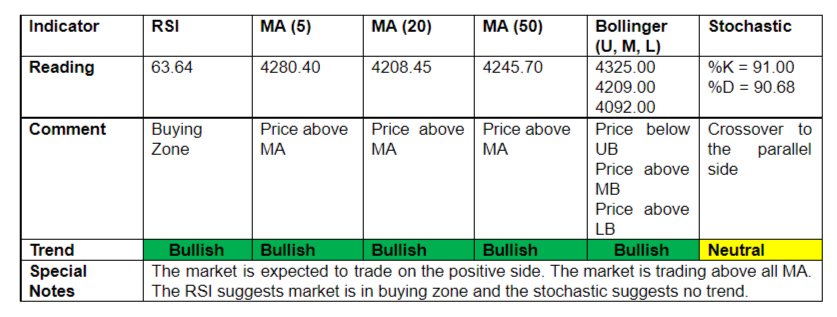

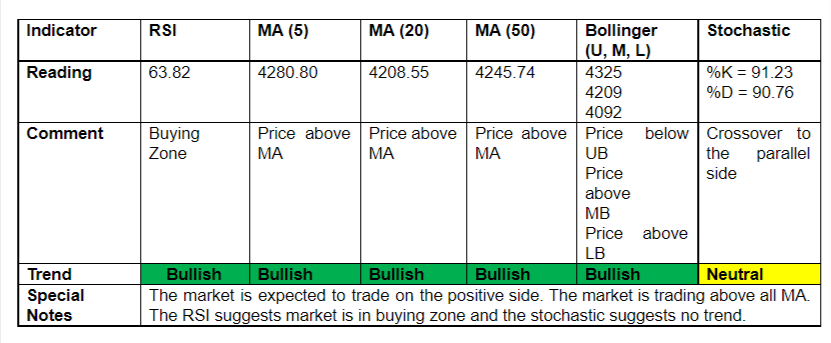

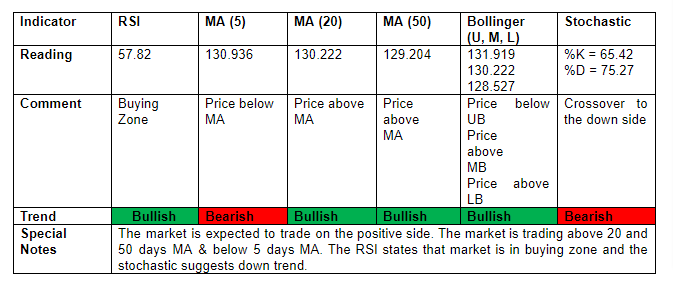

S&P 500

S&P 500 is trading in the up channel; further upside will be seen in the coming days.

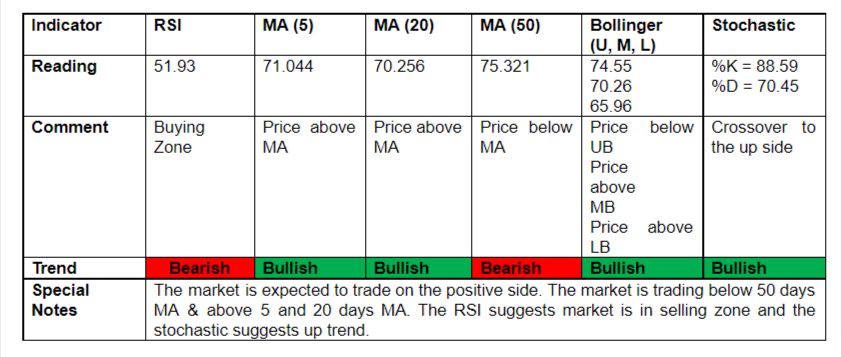

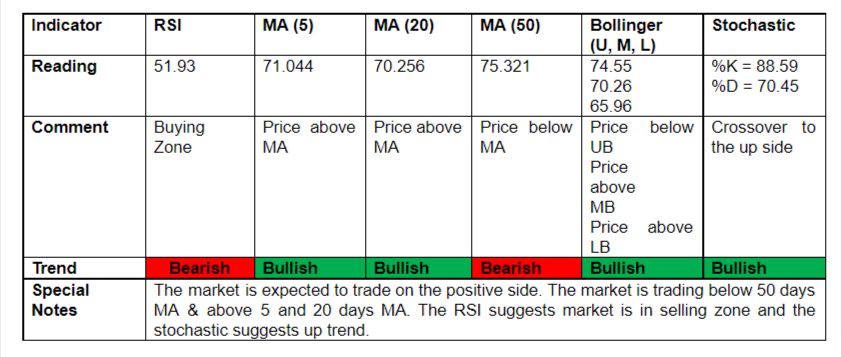

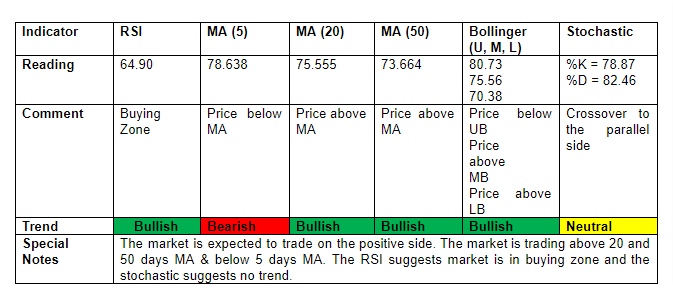

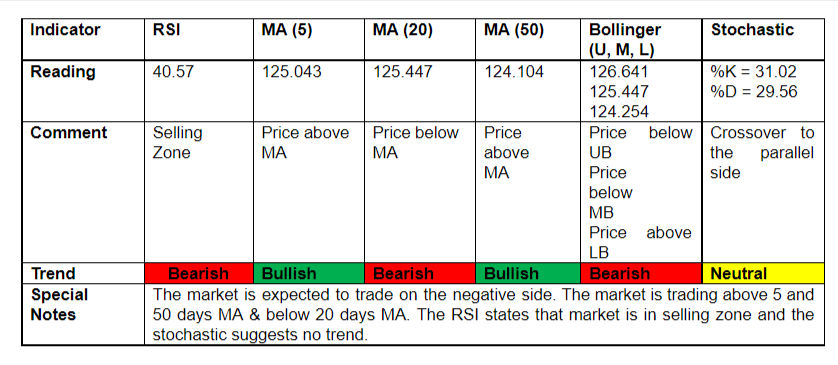

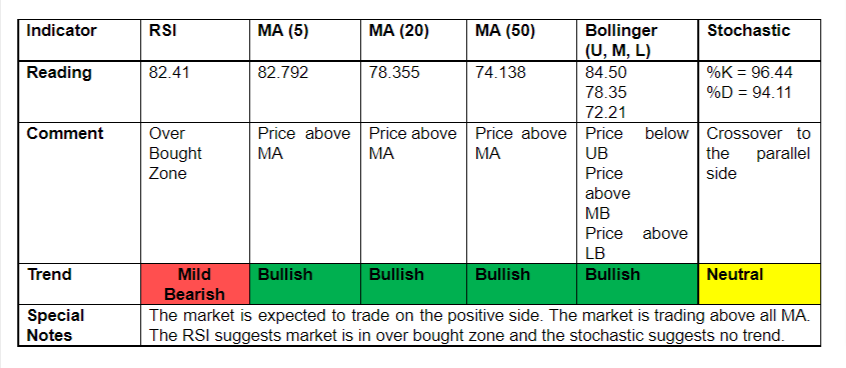

FTSE 100

FTSE 100 is trading in the up channel; further upside will be seen in the coming days.

DATA WATCH

CHECK DAILY REPORT CLICK HERE