Yordan Kuzmanov

Private, 1st Class

- Messages

- 267

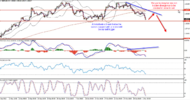

Short term buy opportunity for EURUSD from a critical support

Long term outlook is still bearish but in the short term we should be looking for buy opportunities.

Price is sitting on the D1 20 MA and is in front of stiff support levels. We are looking for the pair to

push down, create bullish divergence + candle pattern to enter long.

TP1: H4 20 MA

TP2: 1.3770

SL: Daily close below 20 MA

Long term outlook is still bearish but in the short term we should be looking for buy opportunities.

Price is sitting on the D1 20 MA and is in front of stiff support levels. We are looking for the pair to

push down, create bullish divergence + candle pattern to enter long.

TP1: H4 20 MA

TP2: 1.3770

SL: Daily close below 20 MA