SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

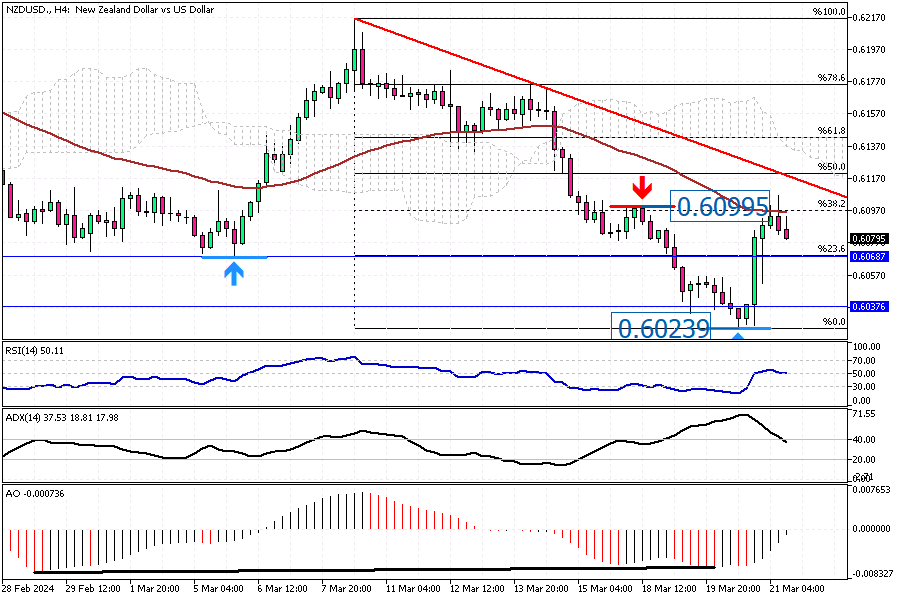

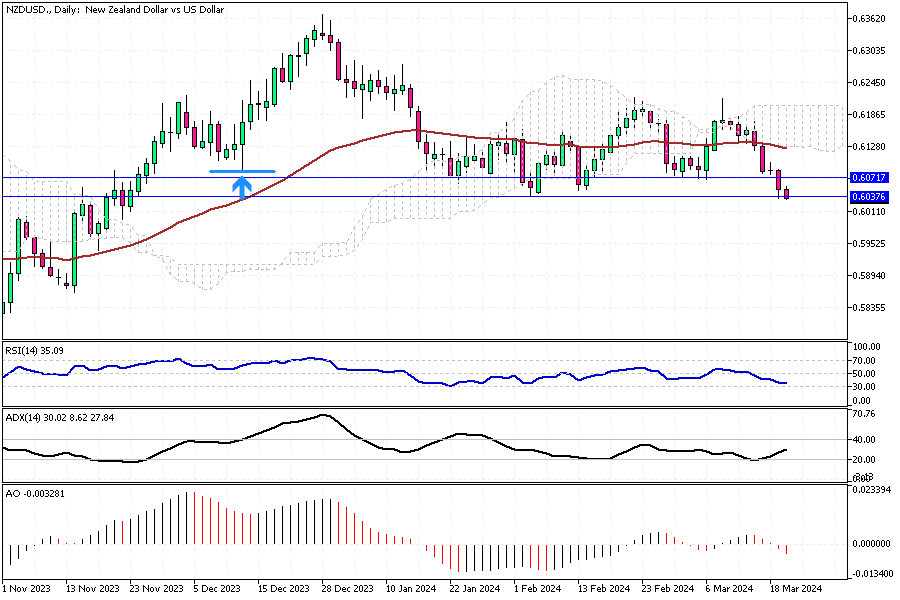

Recent Trends in NZDUSD

Solid ECN – The New Zealand dollar fell below $0.605, reaching close to its four-month low following the Australian dollar's downturn. This happened after the Reserve Bank of Australia decided not to change interest rates, a decision many anticipated. They also removed their previous caution against ruling out future rate hikes. Meanwhile, the Kiwi dollar faced additional pressure due to the upcoming policy meeting of the US Federal Reserve. There's the worry that persistently high inflation in the US might postpone any cuts in Fed rates.

Furthermore, within New Zealand, the expectation is growing that the Reserve Bank of New Zealand may reduce its policy rates starting in August as the rise in prices begins to slow down. As investors wait, they are particularly interested in the upcoming report on the country's economic growth, hoping it will offer more clarity.

Furthermore, within New Zealand, the expectation is growing that the Reserve Bank of New Zealand may reduce its policy rates starting in August as the rise in prices begins to slow down. As investors wait, they are particularly interested in the upcoming report on the country's economic growth, hoping it will offer more clarity.