SOLID ECN LLC

Solid ECN Representative

- Messages

- 512

Crude Oil, decline on expectations of the "hawkish" rhetoric of the US Federal Reserve

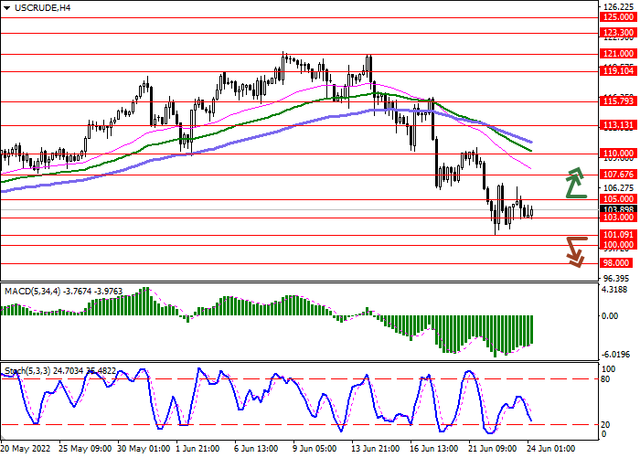

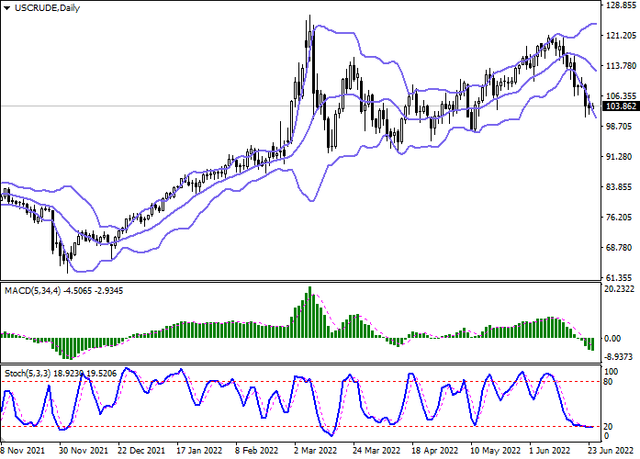

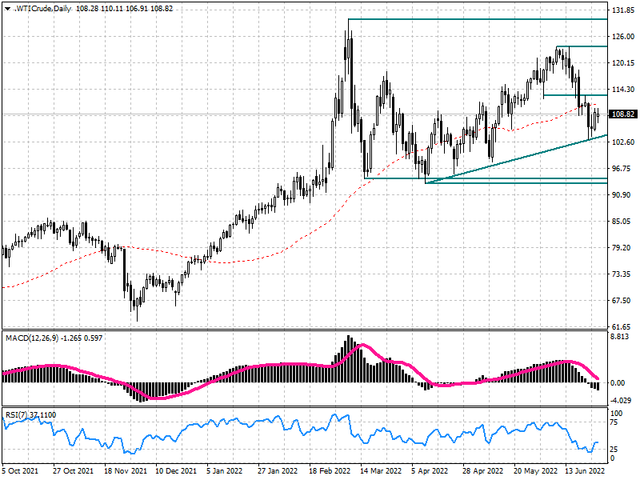

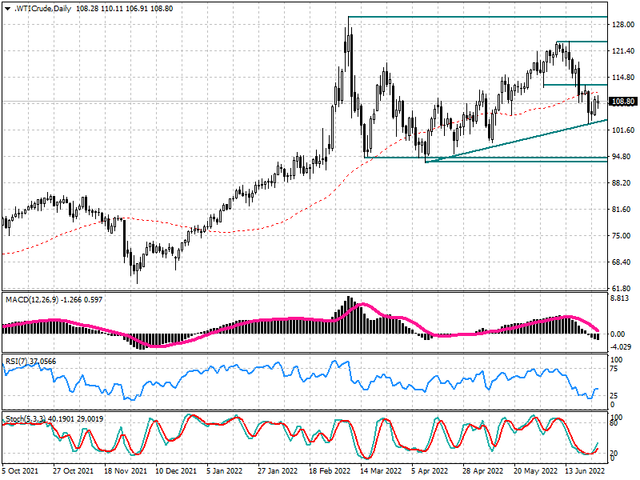

Previously, experts predicted that the US regulator would raise rates by 50 basis points at a meeting on Wednesday, but after the release of strong data on the consumer price index for May last Friday, more investors expect a change of 75 basis points, which puts pressure on stock positions and oil. Last month, the inflation in the US accelerated from 0.3% to 1.0%, which exceeded the average market forecasts of 0.7%. The value has renewed 40-year highs, reaching a new peak at 8.6% YoY, while in April, the growth was 8.3%.

Additional pressure on the oil quotes is exerted by reports that the chairman of the US Senate Finance Committee, Ron Wyden, plans to pass a law establishing a 21% income tax on excess profits of oil and gas companies with an annual income of more than 1B dollars, which analysts perceive as excessive in these conditions.

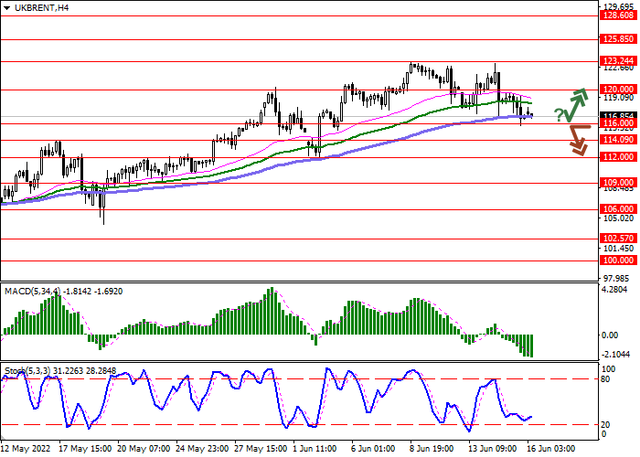

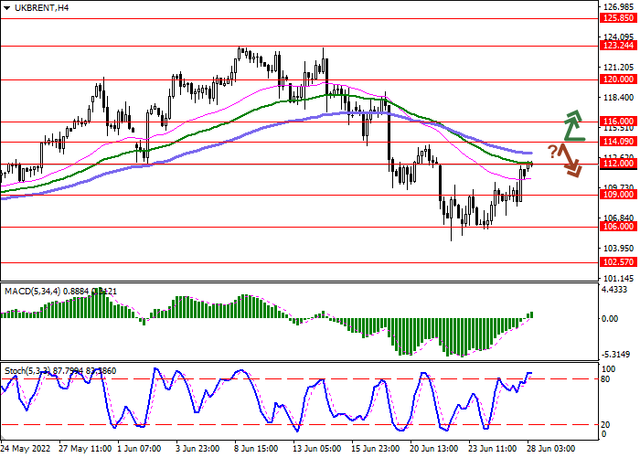

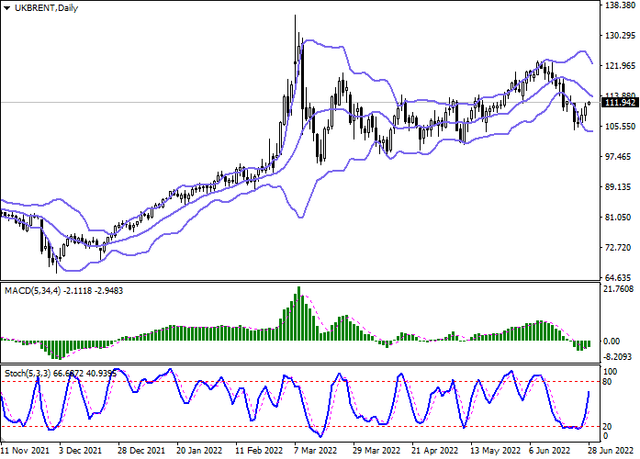

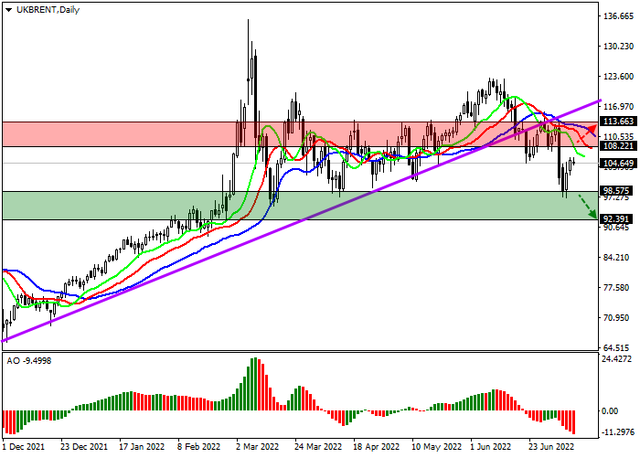

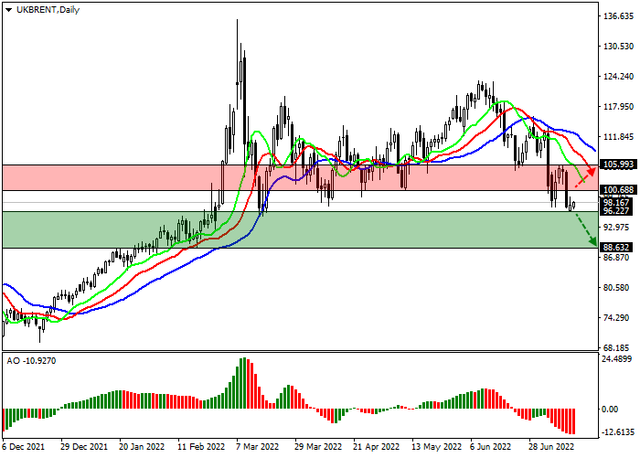

From an even stronger fall, the trading instrument is kept by reports that Libya has almost completely stopped oil production due to the political crisis in the east of the country. Market losses are estimated at 1.1M barrels per day, although last month's production averaged 1.2M barrels per day. Libyan Oil Minister Mohammed Aoun said that almost all fields are currently closed. In turn, the limitation of oil production leads to a lack of supply, which, against the backdrop of high demand, does not allow prices for Brent Crude Oil to fall below 120.

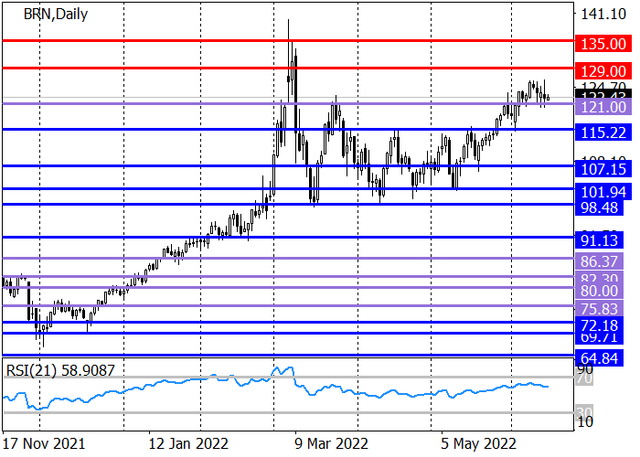

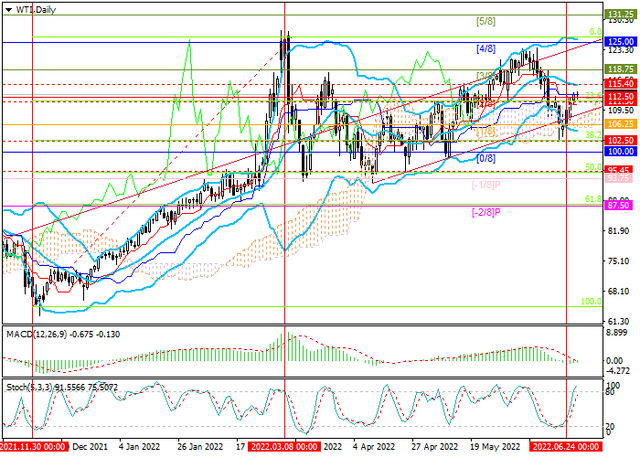

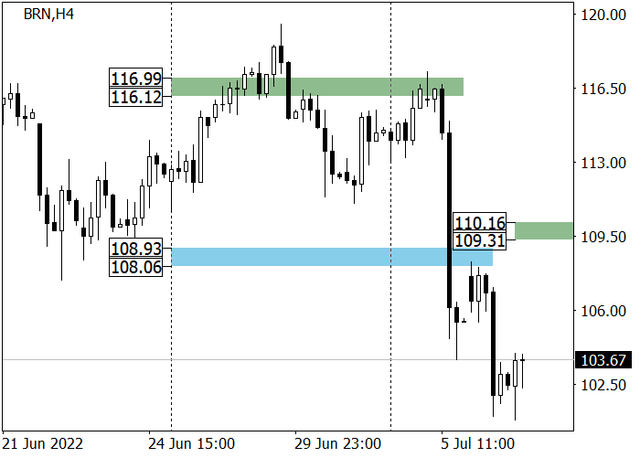

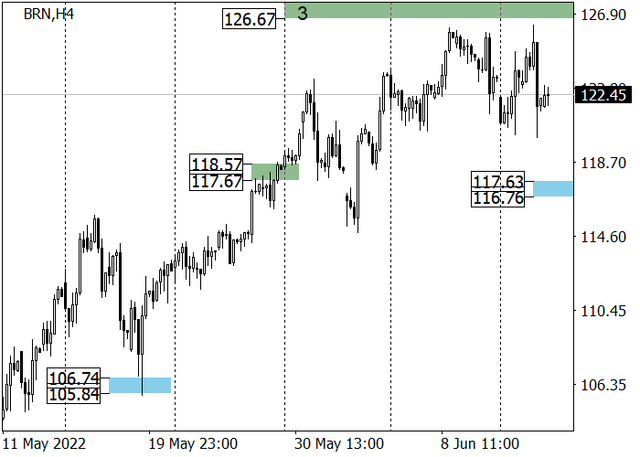

The long-term trend is upwards. In early June, the support level of 120 was broken, around which the price is now correcting, and long positions with the target of around 129 may be opened here. The medium-term trend is with the target in zone 3 (127.57–126.67). Now the price is heading for a correction towards the area of the trend's key support at 117.63–116.76, after reaching which, long positions with the first target at the current week's high at 126.20 may be opened.

Resistance levels: 129, 135 | Support levels: 121, 115.2, 107.15