Jason Aleksei

Failed ALL tests of his claimed psychic abilities.

- Messages

- 19

Background:

I kind of feel that spot FX is the wild wild west with brokers clipping stops when they get close at every opportunity hence I have moved away from $EURUSD in favor of M6E which is the CME Group's Micro FX contract (roughly equivalent to a 10k spot contract). Not too liquid but observation over a 6 month period of bid-ask spreads showed very good behavior and none of the spikes you would see in the spot market like USD/JPY.

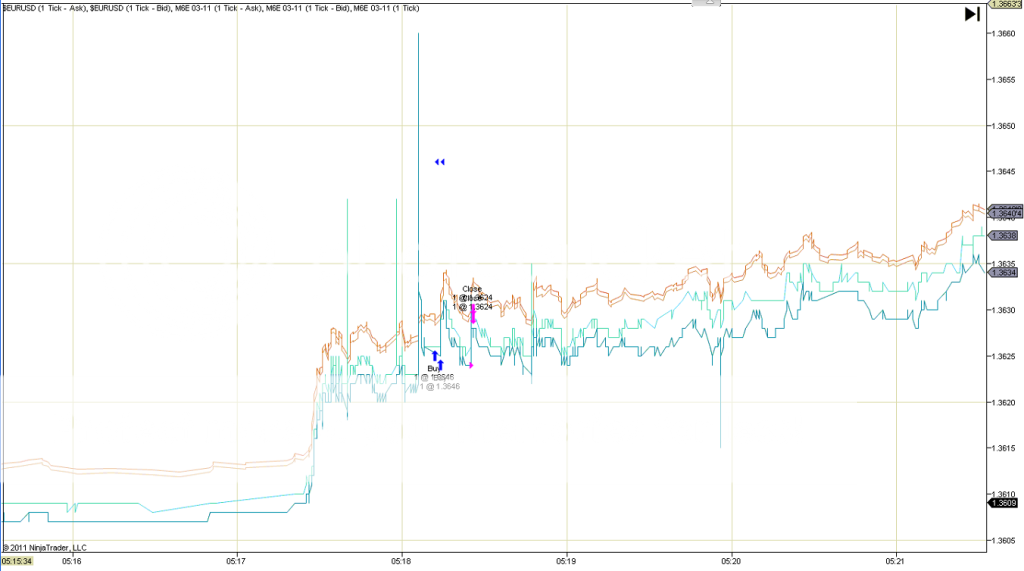

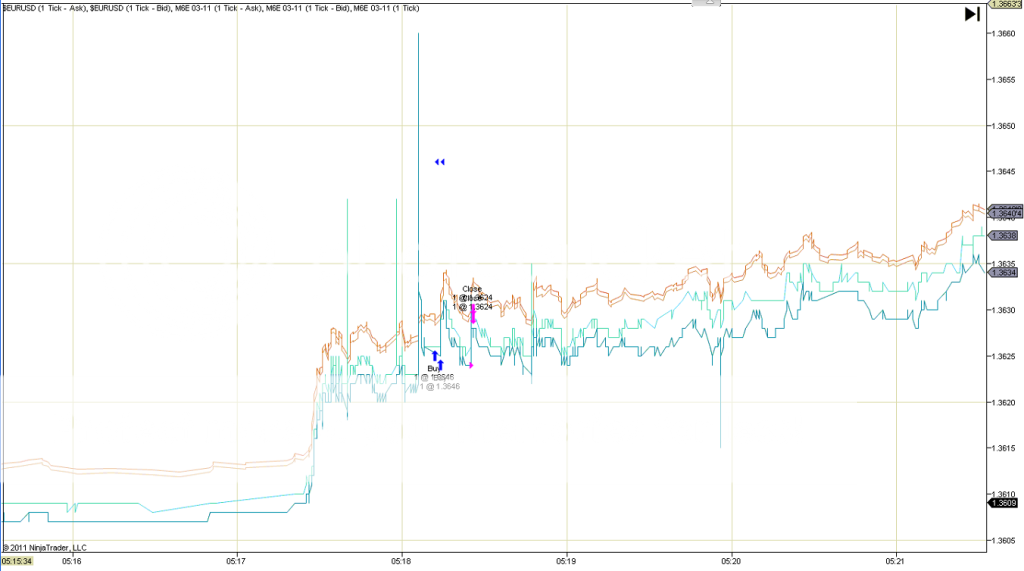

Well hold your hat because it seems the CME's attempt to scoop up some smaller traders over to the "safer" and "more stable" M6E is showing some big problems. On the morning of 2/08/2011 (4:18:06AM CST to be precise) There was a huge 30 pip spike that lasted less mainly about a second on the M6E EUR/USD micro contract. I happened to have a chart with both the $EURUSD bid/ask and M6E bid/ask going at the exact time of the aberrant behavior. (see below).

Next I thought maybe it was something bigger and specific to the CME futures products and carried over to 6E and E7. So I pulled up those charts in parallel to M6E. (seen below)

Not the slightest hint of an effen spike on either of them. My first thought was my broker sent bad data (PFG). I called them, and they called the exchange and supposedly it was a good fill. They refused to provide documented proof that the trade was valid, but no biggie, CME Group posts all Time & Sales data on their website the next day. So sure enough the spike shows up on M6E but not 6E and E7 time and sales reports (you probably have another 3 hours to download it for yourself

I contacted CME Group and they are "looking into it" but I would like to know if there is an established process to file a complaint with the CFTC or NFA about manipulation? Any suggestions on how to proceed?

I kind of feel that spot FX is the wild wild west with brokers clipping stops when they get close at every opportunity hence I have moved away from $EURUSD in favor of M6E which is the CME Group's Micro FX contract (roughly equivalent to a 10k spot contract). Not too liquid but observation over a 6 month period of bid-ask spreads showed very good behavior and none of the spikes you would see in the spot market like USD/JPY.

Well hold your hat because it seems the CME's attempt to scoop up some smaller traders over to the "safer" and "more stable" M6E is showing some big problems. On the morning of 2/08/2011 (4:18:06AM CST to be precise) There was a huge 30 pip spike that lasted less mainly about a second on the M6E EUR/USD micro contract. I happened to have a chart with both the $EURUSD bid/ask and M6E bid/ask going at the exact time of the aberrant behavior. (see below).

Next I thought maybe it was something bigger and specific to the CME futures products and carried over to 6E and E7. So I pulled up those charts in parallel to M6E. (seen below)

Not the slightest hint of an effen spike on either of them. My first thought was my broker sent bad data (PFG). I called them, and they called the exchange and supposedly it was a good fill. They refused to provide documented proof that the trade was valid, but no biggie, CME Group posts all Time & Sales data on their website the next day. So sure enough the spike shows up on M6E but not 6E and E7 time and sales reports (you probably have another 3 hours to download it for yourself

I contacted CME Group and they are "looking into it" but I would like to know if there is an established process to file a complaint with the CFTC or NFA about manipulation? Any suggestions on how to proceed?

Last edited: