Tifia FX

TifiaFx Representative

- Messages

- 30

AUD/USD: RBA is ready to lower rates

12/17/2019

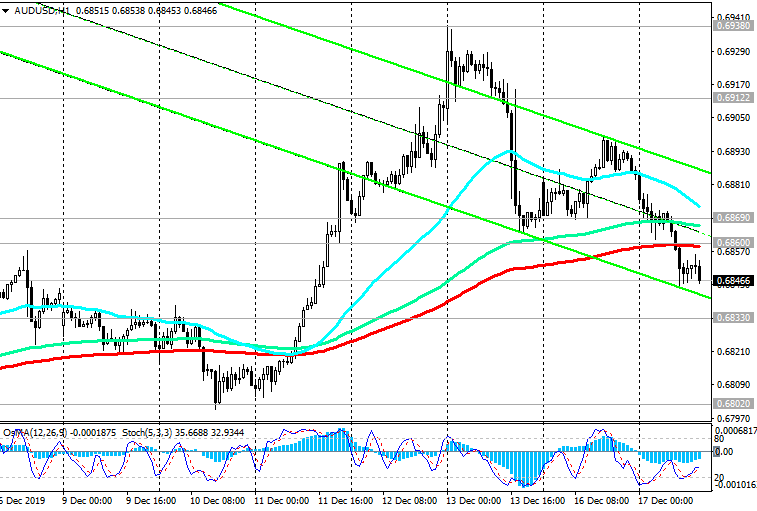

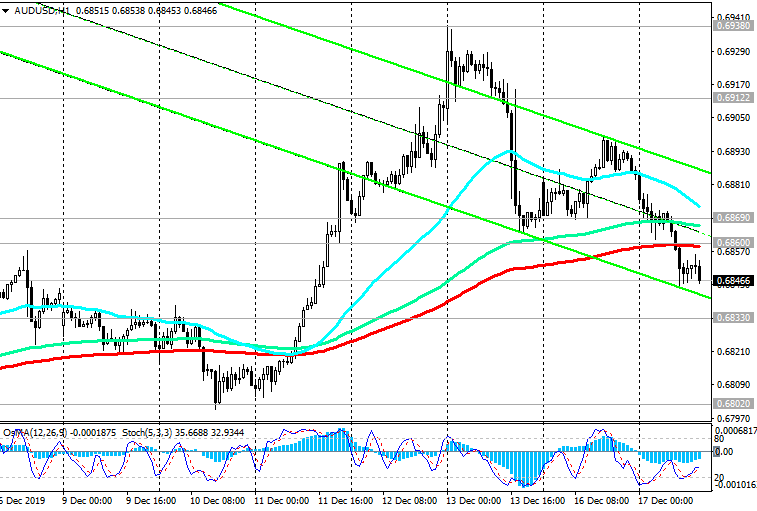

The AUD / USD pair broke on Tuesday an important short-term support level of 0.6860 (ЕМА200 on the 1-hour chart) and is developing a downward movement, returning to the global down-trend.

Following a meeting in December, the RBA left the key interest rate unchanged, at a record low of 0.75%.

Concerns about a sharp slowdown in global economic growth have become one of the main reasons that prompted the RBA to lower interest rates this year. According to the text of the minutes of the meeting of the RBA held on December 3, which were published earlier on Tuesday, the bank's management in February intends to reassess the prospects of monetary policy.

RBA Governor Philip Lowe spoke about the "emerging turning point" in the economy. However, the published RBA protocols indicated that the bank was ready to lower rates again if necessary.

Weak GDP growth in the 3rd and 4th quarters, remaining low personal consumption and weak retail sales reinforce expectations of a further reduction in interest rates at a meeting of the Reserve Bank of Australia on February 4. This will put downward pressure on AUD.

AUD / USD is trading below important resistance levels 0.6912 (ЕМА200 on the daily chart), 0.6869 (ЕМА144 on the daily chart).

In the event of a breakdown of the local support level of 0.6802 and a further decrease, the targets will be the support levels of 0.6670 (2019 lows), 0.6600.

Below resistance level 0.6860, short positions are preferred.

Support Levels: 0.6833, 0.6802, 0.6745, 0.6700, 0.6670, 0.6600, 0.6300

Resistance Levels: 0.6860, 0.6869, 0.6912, 0.6938

Trading Recommendations

Sell by market. Stop-Loss 0.6870. Take-Profit 0.6833, 0.6802, 0.6745, 0.6700, 0.6670, 0.6600, 0.6300

Buy Stop 0.6870. Stop-Loss 0.6810. Take-Profit 0.6900, 0.6910

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

12/17/2019

The AUD / USD pair broke on Tuesday an important short-term support level of 0.6860 (ЕМА200 on the 1-hour chart) and is developing a downward movement, returning to the global down-trend.

Following a meeting in December, the RBA left the key interest rate unchanged, at a record low of 0.75%.

Concerns about a sharp slowdown in global economic growth have become one of the main reasons that prompted the RBA to lower interest rates this year. According to the text of the minutes of the meeting of the RBA held on December 3, which were published earlier on Tuesday, the bank's management in February intends to reassess the prospects of monetary policy.

RBA Governor Philip Lowe spoke about the "emerging turning point" in the economy. However, the published RBA protocols indicated that the bank was ready to lower rates again if necessary.

Weak GDP growth in the 3rd and 4th quarters, remaining low personal consumption and weak retail sales reinforce expectations of a further reduction in interest rates at a meeting of the Reserve Bank of Australia on February 4. This will put downward pressure on AUD.

AUD / USD is trading below important resistance levels 0.6912 (ЕМА200 on the daily chart), 0.6869 (ЕМА144 on the daily chart).

In the event of a breakdown of the local support level of 0.6802 and a further decrease, the targets will be the support levels of 0.6670 (2019 lows), 0.6600.

Below resistance level 0.6860, short positions are preferred.

Support Levels: 0.6833, 0.6802, 0.6745, 0.6700, 0.6670, 0.6600, 0.6300

Resistance Levels: 0.6860, 0.6869, 0.6912, 0.6938

Trading Recommendations

Sell by market. Stop-Loss 0.6870. Take-Profit 0.6833, 0.6802, 0.6745, 0.6700, 0.6670, 0.6600, 0.6300

Buy Stop 0.6870. Stop-Loss 0.6810. Take-Profit 0.6900, 0.6910

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com