"

......I'm curious about your swap rate method......."

Hi buddy! Hope the forex market has been kind to you!

Ok, as I have mentioned, I have been and is still being kept busy with my bread-and-butter project works right until at least April 2013.

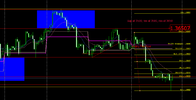

Last month I hurriedly set-up a "Carry Trade" on a Demo account with IC Markets (as in attachment) just to demonstrate to you what I am on about.

Of course.....

...the account need not be AUD1m, but, like I said, I set that up in a hurry and the actual amount was supposed to be USD100k, but somehow it became AUD1m

....and also, the currency is supposed to be in USD.

The way the positive swaps are accumulating on a daily basis, in just under one year's time the positive swaps will pay just over AUD1.2m which will be more than initial investment of AUD1m.

And....this is the best part.......I absolutely don't have to do anymore trading on that account but just to check and maintain the account once in a while....and the chances of the account going into margin call & stop out is extremely remote.

Ok buddy, all the best and, please, any comments & views would be highly appreciated.

=============================

Additional comments:

The beauty of this "Carry trade" is that I can choose to close all opened positions when the balance is at whatever percentage profits that I am satisfied with without having to wait for one year and start the process all over again with a much higher account balance and, of course, bigger daily positive swaps.

=============================

P/S: I am not sure whether the "Detail Statement" have been downloaded properly as I kept getting an "Invalid file" pop-up message and I finally simply drag and drop the file into the "Attachment" box.

=========================

Ok, so Detailed Statement didn't or couldn't be downloaded as an attachment.

I am attaching three (ignore the first one as I do not know how to delete it) screenshots of the account.