Are we forming another area of consolidation?

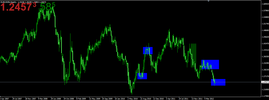

First is the weekly. These consolidation areas are about 350-550 pips on this pair, EURUSD. The regions in blue are other consolidation areas. Are we about to form another area? If you zoom in, you can see why they bounce around often. The second is the daily. See the first top created a price pivot zone full of fresh supply so the next time the price tesed it, it wasn't able to pass. The third top reacted the same way. It means if price returns here we're likey to get a really good bounce off this ceiling, the whole zone has a black rectangle. Even if that celing were penetrated, there are two more areas of down pressure on top to protect the stops. A new trader will see that third top and think if price breaks it, the market should continue up but that's really unlikely. That's how new traders buy boats and summer homes for pro traders.

In these area, especially on the daily chart, you could pretty well use the MACD and trade it exactly as the indicator calls it. That's PA sacriledge! That zone lasted for three months and was a product of two strong areas of supply and demand that caught the price and the resulting bear/bulls struggle.

BTW, I'm removing the 200EMA from my charts. I will continue to use PA in conjuntion with confluence of fibs, and weekly and monthly pivots, the way Sive does. For now, that is how big bankers are making their decisions so it's useful to know who's moving the market.

Indicators: None for now. Not even the MACD until I think we are in a consolidation area, though I have no reason the think that yet.

Just weekly and monthly pivot points with no PP1 and PP2 business, fib retr and exp. Trendlines and channels.

Want to explore more on harmonics for setting SL's and getting in. Want to practice scaling in. Scaling in was my big Ah-ha this week. Thanks Sive Morten!

Forex is about 1) Which way is it going 2) How far will it go 3) When will I know I'm wrong 4) What position method can I use to maximize the profit if I'm right or mostly right 5) How much will I risk on being right and is it worth it?

If you have a trading plan, there is no need to be afraid of losing. You will be comfortable that the risk you took is worth the potential reward. Proper trade management will help from turning winners into losers. I caught this big down movement off the weekly chart and bailed early with only a little profit because I was afraid of it reversing on me. With proper trade management, I could have locked in profits and kept some smaller portion of the overall position open for the 800 pip move that resulted and let the price stop me out. I got 100 pips of an 800 pip move, risked 300 pips. Proper managment would have let me stay in risk free for the entire thrust. Hard to lose when you're in risk free. I got stopped out of two trades this week but they were both positive because I took some profit and moved my stops. Nice to see a red box in the MT4 trade history but still have the trade positive!

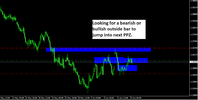

Didn't trade today because I don't have any idea what the market will do. Price broke the channel to return to the center of the over bought oversold region just like Sive predicted. Up? Down? No idea. For anyone new to trading who may be reading this, watch about 50 of Sive's videos this weekend and take notes. He keeps spouting little tidbits of typical market behavior that would take years of reading and trial and error to learn. Maybe I'll do the same.

Had a great week in Forex. Hopefully many more. Going on 9 months consecutive positive. (Had draw down in the demo because of trying new strats but live is positive). Thinking about funding the account more....Good weekend everybody.