You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Daily Technical Analysis by PipSafe

- Thread starter Pip.Safe

- Start date

Technical analysis of Gold dated 29.12.2014

Price since the end of 2011 till now was in strong and consistent downtrend with a little price reformation and sellers were successful in achieving the lowest price of 1131.335.Price has formed a bottom price(Spinning Top Pattern) with reaching to the specified supportive levels(Up Trendline and d point of harmonic pattern) in the picture below and it has stopped from more descend and has started a little ascend with shows exit of some sellers from their trades.

As it is obvious in the picture below, there is a harmonic butterfly pattern between the bottom price of 1131.335 and the top price of 1389.947 that there is a potential for changing price direction from D point of this pattern.Stoch indicator in Monthly time frame (also in daily time frame) is in saturation sell area and with the next cycle warns about ascending of price during the next candles.Generally until the third point of Up Trendline is preserved, the price has the potential for ascend and reformation in this Metal.

Price since the end of 2011 till now was in strong and consistent downtrend with a little price reformation and sellers were successful in achieving the lowest price of 1131.335.Price has formed a bottom price(Spinning Top Pattern) with reaching to the specified supportive levels(Up Trendline and d point of harmonic pattern) in the picture below and it has stopped from more descend and has started a little ascend with shows exit of some sellers from their trades.

As it is obvious in the picture below, there is a harmonic butterfly pattern between the bottom price of 1131.335 and the top price of 1389.947 that there is a potential for changing price direction from D point of this pattern.Stoch indicator in Monthly time frame (also in daily time frame) is in saturation sell area and with the next cycle warns about ascending of price during the next candles.Generally until the third point of Up Trendline is preserved, the price has the potential for ascend and reformation in this Metal.

Forex Market Analysis

GBP/AUD during the recent weeks could ascend without reformation and record the top price of 1.93055.Formation of Shooting Star and Hanging Man and Spinning Top candlestick patterns with thin body in red area shows indecision market and vulnerability of ascending trend.As it is obvious in the picture below, according to the formed movements , the AB=CD harmonic pattern with the ratios of 50 and 161.8 is formed and by completing the D point of this pattern, there is a warning for descending in this currency pair.RSI indicator in weekly time frame is in saturation Buy area and warns the possibility of stopping of the ascending trend by the next cycle.Generally until the top price of 1.93055 is preserved, the price has the potential for descending and reformation.

GBP/AUD during the recent weeks could ascend without reformation and record the top price of 1.93055.Formation of Shooting Star and Hanging Man and Spinning Top candlestick patterns with thin body in red area shows indecision market and vulnerability of ascending trend.As it is obvious in the picture below, according to the formed movements , the AB=CD harmonic pattern with the ratios of 50 and 161.8 is formed and by completing the D point of this pattern, there is a warning for descending in this currency pair.RSI indicator in weekly time frame is in saturation Buy area and warns the possibility of stopping of the ascending trend by the next cycle.Generally until the top price of 1.93055 is preserved, the price has the potential for descending and reformation.

Technical analysis of USD/CAD dated 2015.01.06

USD/CAD was in a strong and consistent uptrend during the recent weeks that buyers were successful in achieving the highest price of 1.18355.Price by reaching to the round resistance level of 1.18000 and the resistance edge of up channel has stopped from more ascend that shows buyers used this price level to exit their trades.There are Shooting Star candlestick pattern and also Harami Pattern in top price of 1.18355 that warns the potential for formation of a successful top price and Vulnerability of ascending trend for buyers.With close of the next bearish candle, this signal will be fix.

As it is obvious in the picture below, there is AB=CD harmonic pattern with ratios of 61.8 and 161.8 between the bottom price of 1.01841 and the top price of 1.18355 that warns changing price direction from D point.RSI indicator in Daily time frame is in saturation buy area and warns about descending of price according to the next cycle during the next days.(and confirms the harmonic D point)Generally until the Top price of 1.18355 is preserved, there is the possibility of decrease and descend of price in this currency pair.

USD/CAD was in a strong and consistent uptrend during the recent weeks that buyers were successful in achieving the highest price of 1.18355.Price by reaching to the round resistance level of 1.18000 and the resistance edge of up channel has stopped from more ascend that shows buyers used this price level to exit their trades.There are Shooting Star candlestick pattern and also Harami Pattern in top price of 1.18355 that warns the potential for formation of a successful top price and Vulnerability of ascending trend for buyers.With close of the next bearish candle, this signal will be fix.

As it is obvious in the picture below, there is AB=CD harmonic pattern with ratios of 61.8 and 161.8 between the bottom price of 1.01841 and the top price of 1.18355 that warns changing price direction from D point.RSI indicator in Daily time frame is in saturation buy area and warns about descending of price according to the next cycle during the next days.(and confirms the harmonic D point)Generally until the Top price of 1.18355 is preserved, there is the possibility of decrease and descend of price in this currency pair.

Technical analysis of USD/SGD dated 2015.01.07

USD/SGD during the recent months was in a strong uptrend that Buyers were successful in achieving the highest price of 1.35056.Right now price is above 5-day moving average in long term time frames such as monthly and weekly that shows a consistent uptrend in this currency pair.

As it is obvious in the picture below, Price has passed the Resistance Level(1.31950) and with being above 5-day moving average warns about more ascending.According to the current situation there is not any clear reason about descending of price in long term time frames and The least sign for descending of price is formation of a top price and recording of it in daily time frame.

………………………………………………………………………………..

Resistance 3 : 1.35858

Resistance 2: 1.34247

Resistance 1: 1.33360

Pivot Point (MN): 1.31683

Support 1: 1.30762

Support 2: 1.29118

Support 3: 1.28231

USD/SGD during the recent months was in a strong uptrend that Buyers were successful in achieving the highest price of 1.35056.Right now price is above 5-day moving average in long term time frames such as monthly and weekly that shows a consistent uptrend in this currency pair.

As it is obvious in the picture below, Price has passed the Resistance Level(1.31950) and with being above 5-day moving average warns about more ascending.According to the current situation there is not any clear reason about descending of price in long term time frames and The least sign for descending of price is formation of a top price and recording of it in daily time frame.

………………………………………………………………………………..

Resistance 3 : 1.35858

Resistance 2: 1.34247

Resistance 1: 1.33360

Pivot Point (MN): 1.31683

Support 1: 1.30762

Support 2: 1.29118

Support 3: 1.28231

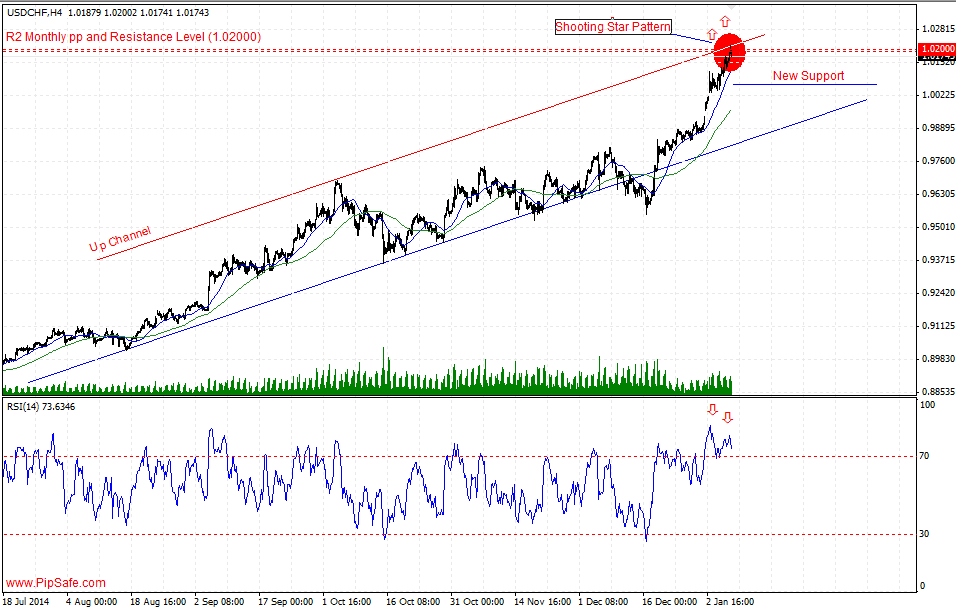

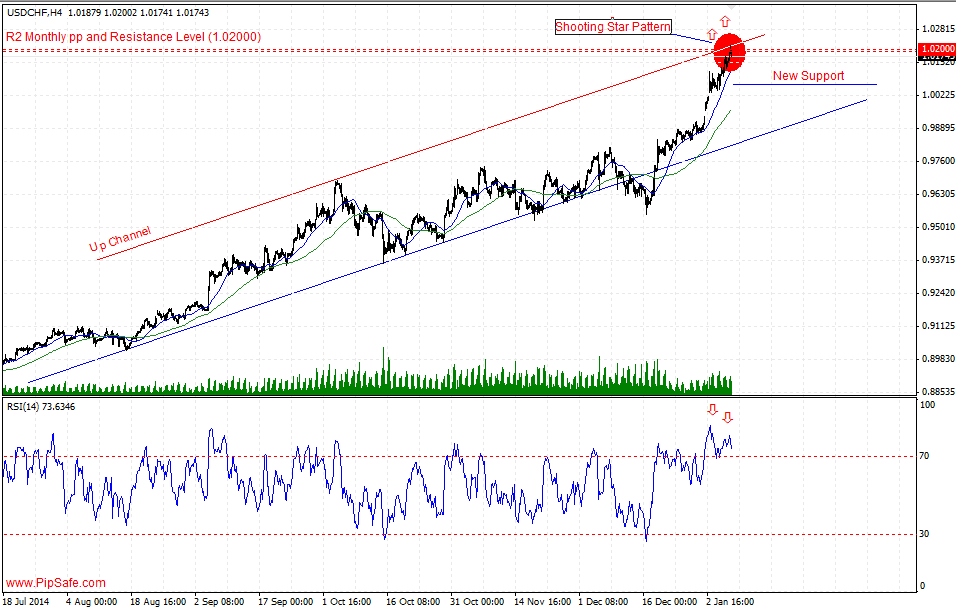

Technical analysis of USD/CHF dated 2014.01.08

USD/CHF chart has experienced a strong ascending trend during the recent days that could record the top price of 1.02117.One of the buyers’ targets was the round level of 1.02000 that they were successful in reaching to it and the price was not able to ascend more by reaching to this level.Right now the price has reached to the resistance level of Monthly Pivot 2 and with forming Shooting Star candlestick pattern warns about formation of a top price (need to be confirmed by a bearish candle).

According to the recent strong ascending, price is in saturation buy area and there is the potential for descending and price reformation.RSI indicator is in saturation buy area and in divergence mode with the price chart in h4 time frame that confirms the current top price and warns changing price direction during the next candles.The first warning in this currency pair for ascending of price (in the same direction of long term time frames) is breaking of the resistance level of 1.02117.

USD/CHF chart has experienced a strong ascending trend during the recent days that could record the top price of 1.02117.One of the buyers’ targets was the round level of 1.02000 that they were successful in reaching to it and the price was not able to ascend more by reaching to this level.Right now the price has reached to the resistance level of Monthly Pivot 2 and with forming Shooting Star candlestick pattern warns about formation of a top price (need to be confirmed by a bearish candle).

According to the recent strong ascending, price is in saturation buy area and there is the potential for descending and price reformation.RSI indicator is in saturation buy area and in divergence mode with the price chart in h4 time frame that confirms the current top price and warns changing price direction during the next candles.The first warning in this currency pair for ascending of price (in the same direction of long term time frames) is breaking of the resistance level of 1.02117.

Technical analysis of EUR/NZD dated 2015.01.12

Right now EUR/NZD pair in its descending trend from 2009 year is in the lowest (around)fixed prices during its recent 15 years and Sellers have the price close to the supportive levels’ range of 2012 and 2013.Price has been stopped from more descending with reaching to the supportive edge of Down Channel pattern and also the round supportive level of 1.50500(sellers use this levels to exit their trades) and starts to ascend.

As it is obvious in the picture below, there is an ideal butterfly pattern between the top price of 1.64450 and the bottom price of 1.50500 that there is a potential for ceasing of price from D point of this pattern.RSI indicator is in saturation sell area in daily time frame and according to the next cycle confirms the mentioned bottom price(D) and warns about ascending during the next candles.Generally until the Support Level of 1.50500 on Down Channel is preserved, the price has the potential for reformation and ascends in this currency pair.

Right now EUR/NZD pair in its descending trend from 2009 year is in the lowest (around)fixed prices during its recent 15 years and Sellers have the price close to the supportive levels’ range of 2012 and 2013.Price has been stopped from more descending with reaching to the supportive edge of Down Channel pattern and also the round supportive level of 1.50500(sellers use this levels to exit their trades) and starts to ascend.

As it is obvious in the picture below, there is an ideal butterfly pattern between the top price of 1.64450 and the bottom price of 1.50500 that there is a potential for ceasing of price from D point of this pattern.RSI indicator is in saturation sell area in daily time frame and according to the next cycle confirms the mentioned bottom price(D) and warns about ascending during the next candles.Generally until the Support Level of 1.50500 on Down Channel is preserved, the price has the potential for reformation and ascends in this currency pair.

Technical Analysis of Silver dated 2015.01.13

Price since the end of 2011 till now was in strong and consistent downtrend with a little price reformation and Sellers were successful in achieving the lowest price of 14.401 .Price has formed a bottom price with reaching to the specified supportive levels in the picture below and it has stopped from more descend and has started a little ascend with shows exit of some sellers from their trades.

In Monthly time frame with formation of Spinning Top candlestick pattern in previous candle, there is a warning for formation of a bottom price (need to be recorded) and vulnerability of downtrend. As it is obvious in the picture below, there is AB=CD harmonic pattern with ideal ratios of 0.382 and 2.42 between the bottom price of 14.401 and the top price of 49.689 that warns changing price direction from D point.

Stoch indicator is in saturation Sell area and confirms the harmonic D point and potential for ascending of the price. In case of ascending of the price, one of the buyers target will be the Down Trendline(made of 4 top prices). Generally according to the formed signs in this price chart, until the bottom price of 14.401 is preserved, there will be the potential for ascending and price reformation in this Metal.

Price since the end of 2011 till now was in strong and consistent downtrend with a little price reformation and Sellers were successful in achieving the lowest price of 14.401 .Price has formed a bottom price with reaching to the specified supportive levels in the picture below and it has stopped from more descend and has started a little ascend with shows exit of some sellers from their trades.

In Monthly time frame with formation of Spinning Top candlestick pattern in previous candle, there is a warning for formation of a bottom price (need to be recorded) and vulnerability of downtrend. As it is obvious in the picture below, there is AB=CD harmonic pattern with ideal ratios of 0.382 and 2.42 between the bottom price of 14.401 and the top price of 49.689 that warns changing price direction from D point.

Stoch indicator is in saturation Sell area and confirms the harmonic D point and potential for ascending of the price. In case of ascending of the price, one of the buyers target will be the Down Trendline(made of 4 top prices). Generally according to the formed signs in this price chart, until the bottom price of 14.401 is preserved, there will be the potential for ascending and price reformation in this Metal.

Technical Analysis of EUR/SGD dated 2015.01.14

EUR/SGD was in a strong and consistent downtrend during the recent months that sellers were successful in obtaining the lowest price of 1.56611 .Price during the downtrend by reaching to the support level of number 1 weekly pivot point and touching the Fibonacci resistance level of 78.6( from the bottom price of 1.51710 to top price of 1.76662) has been stopped from more descends by creating a bottom price. (need to be confirmed by a bullish candle)

As it is obvious in the picture below, between the top price of 1.64375 and bottom price of 1.56611 there is Bullish Deep Crab harmonic pattern that warns the potential of ascending from the D point of this pattern.RSI indicator is in saturation sell area in h4 time frame and in divergence mode with the price chart that warns about changing price direction during the next days.The first important warning for ascending of price is breaking of the 1.57675 resistance level(the highest level of price changes in previous candle).

EUR/SGD was in a strong and consistent downtrend during the recent months that sellers were successful in obtaining the lowest price of 1.56611 .Price during the downtrend by reaching to the support level of number 1 weekly pivot point and touching the Fibonacci resistance level of 78.6( from the bottom price of 1.51710 to top price of 1.76662) has been stopped from more descends by creating a bottom price. (need to be confirmed by a bullish candle)

As it is obvious in the picture below, between the top price of 1.64375 and bottom price of 1.56611 there is Bullish Deep Crab harmonic pattern that warns the potential of ascending from the D point of this pattern.RSI indicator is in saturation sell area in h4 time frame and in divergence mode with the price chart that warns about changing price direction during the next days.The first important warning for ascending of price is breaking of the 1.57675 resistance level(the highest level of price changes in previous candle).

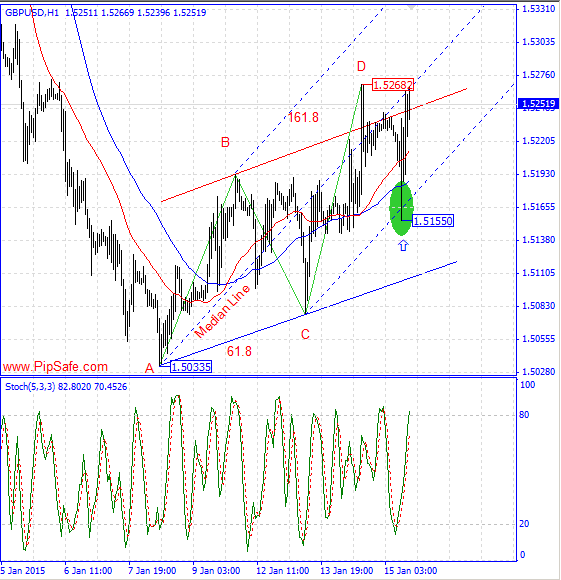

Technical Analysis of GBP/USD dated 2015.01.15

GBP/USD from 2014.07.04 is in a strong and without reformation descending trend that could experience a good price reduction could record the bottom price of 1.50335.Right now this bottom price is fixed(Daily TF) by an ascending candle which there are hammer candlestick patterns in this bottom price that shows the possibility of formation of a bottom price and then ascending of the price.With closing of the yesterday bullish candle, there is the potential for more ascending from the bottom price of 1.50335.

Stoch indicator in 1 H time frame is in saturation sell area that confirms the bottom price of 1.51550 and warns about the possible uptrend during the next candles.Generally according to the current situation and also price is in a saturation sell area , until the bottom price of 1.50335 is preserved, there is the potential for ascending of price and reformation of descending trend.

Similar threads

- Replies

- 5

- Views

- 41

- Replies

- 24

- Views

- 237

- Replies

- 25

- Views

- 240

- Replies

- 0

- Views

- 332