AUD/USD was in a strong and consistent downtrend during the recent weeks that Sellers were successful in obtaining the lowest price of 0.76248. As it is drawn in the picture below, according to the type of price movement, price is in a Down Channel that Sellers use the supportive edge of that to leave their trades.According to the previous week changes, previous week candle was closed as Spinning Top candlestick pattern which shows vulnerability of descending trend and potential for formation of a bottom price in this range.

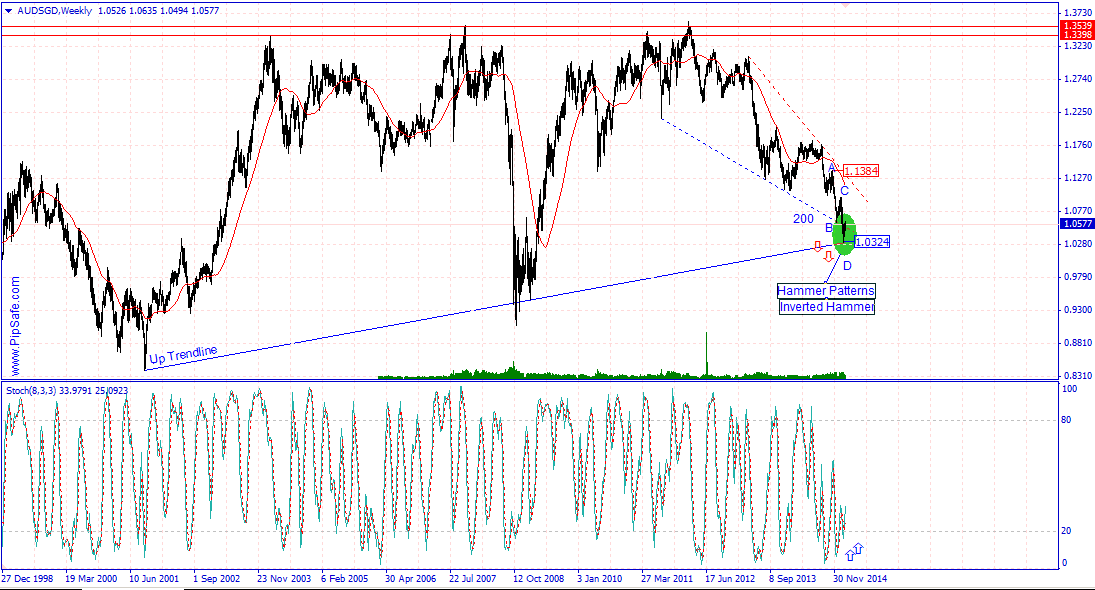

As it is obvious in the picture below, between the top price of 1.05769 and bottom price of 0.76248 there is AB=CD harmonic pattern with ratios of 38.2 and 2.24 that warns the potential of ascending from the D point of this pattern. RSI indicator is in saturation Sell area and confirms the current bottom price, also wars about formation of a Bottom price. Generally until the Bottom price of 0.76248 is preserved, price has the potential of ascending.

As it is obvious in the picture below, between the top price of 1.05769 and bottom price of 0.76248 there is AB=CD harmonic pattern with ratios of 38.2 and 2.24 that warns the potential of ascending from the D point of this pattern. RSI indicator is in saturation Sell area and confirms the current bottom price, also wars about formation of a Bottom price. Generally until the Bottom price of 0.76248 is preserved, price has the potential of ascending.