SOLID ECN LLC

Solid ECN Representative

- Messages

- 515

Gold market analysis by Solid ECN Securities

Trading participants reduce positions in gold

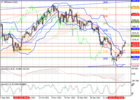

The development of the global sideways range of 1850–1730 in the gold continues, and the quotes are once again holding slightly above the key level of $1,800 per ounce.

There are no serious prerequisites for the growth of the asset yet, but there are not so many pressure factors either. The situation may change only in March during the meeting of the US Federal Reserve when the regulator's decision to raise the interest rate will be announced. To this point, traders should focus on the US dollar index and investment demand. Currently, the USD Index consolidates at the level of 95.5 after one of the most dynamic falls in recent years, which led to the current upward correction in gold. However, the observed dynamics have little prospects for further development in light of Friday's positive employment report in the US.

Support and resistance

On the daily chart, the price moves within the global sideways channel, correcting towards the resistance line. Technical indicators maintain a sell signal.

Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram has moved into the sell zone and is forming local rising bars.

Resistance levels: 1830, 1870.

Support levels: 1790, 1720.

Trading participants reduce positions in gold

The development of the global sideways range of 1850–1730 in the gold continues, and the quotes are once again holding slightly above the key level of $1,800 per ounce.

There are no serious prerequisites for the growth of the asset yet, but there are not so many pressure factors either. The situation may change only in March during the meeting of the US Federal Reserve when the regulator's decision to raise the interest rate will be announced. To this point, traders should focus on the US dollar index and investment demand. Currently, the USD Index consolidates at the level of 95.5 after one of the most dynamic falls in recent years, which led to the current upward correction in gold. However, the observed dynamics have little prospects for further development in light of Friday's positive employment report in the US.

Support and resistance

On the daily chart, the price moves within the global sideways channel, correcting towards the resistance line. Technical indicators maintain a sell signal.

Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram has moved into the sell zone and is forming local rising bars.

Resistance levels: 1830, 1870.

Support levels: 1790, 1720.