SOLID ECN LLC

Solid ECN Representative

- Messages

- 516

USDJPY insights by Solid ECN Securities

The pair is aiming for the January high

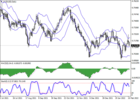

Due to the difference in approaches to regulating monetary processes by the Bank of Japan and the US Federal Reserve, the USDJPY pair is strengthening its position and has now reached the level of 115.4, preparing to continue its upward trend towards 116.10.

The long-term trend is upwards. Yesterday, the price broke through the resistance level of 115.40, and the next growth target was 116.1, which breakout allows the quotes to rise to the 117 area.

The medium-term trend is upwards. Last week, the price reversed at the support level of 114.45. It renewed the local high at 115.60, which breakout will allow the rate to rise to the 116.25 area.

Resistance levels: 116.1, 117.

Support levels: 114.3, 113.5, 112.7.

The pair is aiming for the January high

Due to the difference in approaches to regulating monetary processes by the Bank of Japan and the US Federal Reserve, the USDJPY pair is strengthening its position and has now reached the level of 115.4, preparing to continue its upward trend towards 116.10.

The long-term trend is upwards. Yesterday, the price broke through the resistance level of 115.40, and the next growth target was 116.1, which breakout allows the quotes to rise to the 117 area.

The medium-term trend is upwards. Last week, the price reversed at the support level of 114.45. It renewed the local high at 115.60, which breakout will allow the rate to rise to the 116.25 area.

Resistance levels: 116.1, 117.

Support levels: 114.3, 113.5, 112.7.