SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

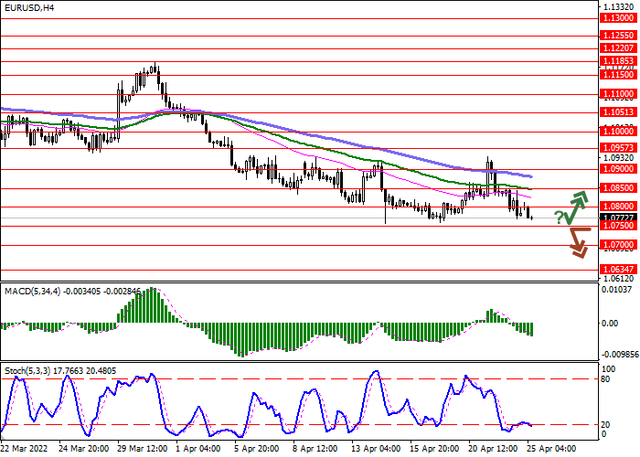

European currency shows moderate growth against the US dollar in the Asian session, recovering after the "bearish" start of the week and retreating from the local lows of April 14, updated the day before. The growth of the instrument is primarily driven by technical factors, while the news background changes slightly and still does not contribute to an increase in demand for risky assets.

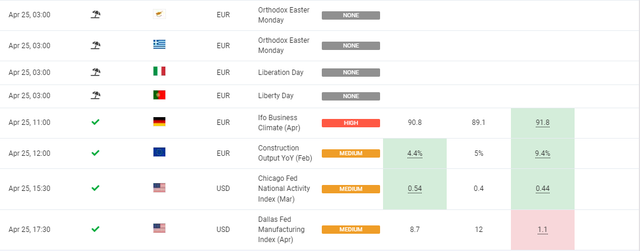

Moreover, since the beginning of the week, no significant macroeconomic statistics have been received from Europe, while US Federal Reserve officials continue to stir up investor interest in the May meeting of the Fed. In particular, on Monday, the Chair of the St. Louis Fed, James Bullard, admitted the possibility of raising the interest rate immediately by 75 basis points in the near future, but noted that this is not a "baseline scenario". In addition to adjusting the rate, the regulator is also expected to launch a program of quantitative tightening.

Today, investors will pay attention to the statistics on the dynamics of Industrial Production and Trade Balance in the euro area in February. It is assumed that the pace of production will increase by 0.7% after the zero dynamics of the previous month, and in annual terms, the figure may rise by 1.5% after falling by 1.3%. However, given the sharp deterioration in the geopolitical situation in Eastern Europe at the end of February, it is likely that the relevance of these data will be in question.

Bollinger Bands on the daily chart show a moderate decline. The price range is narrowing, reflecting the emergence of mixed trading dynamics in the ultra-short term. MACD indicator is reversing upwards forming a new buy signal (the histogram is trying to consolidate above the signal line). Stochastic is showing similar dynamics, again trying to rebound upwards from the level of "20".

Resistance levels: 1.085, 1.09, 1.0957, 1.1 | Support levels: 1.0800, 1.0767, 1.0726, 1.069