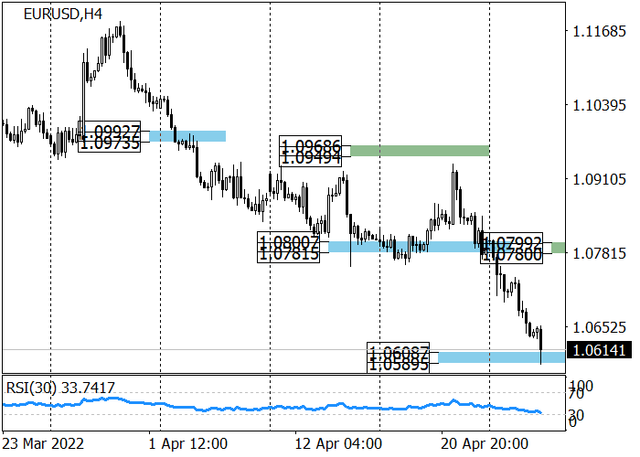

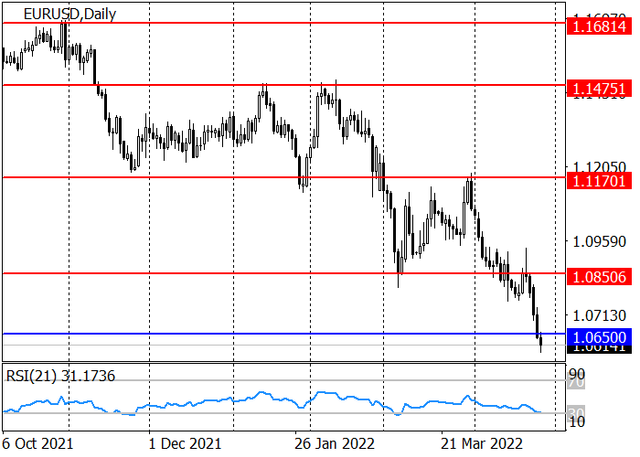

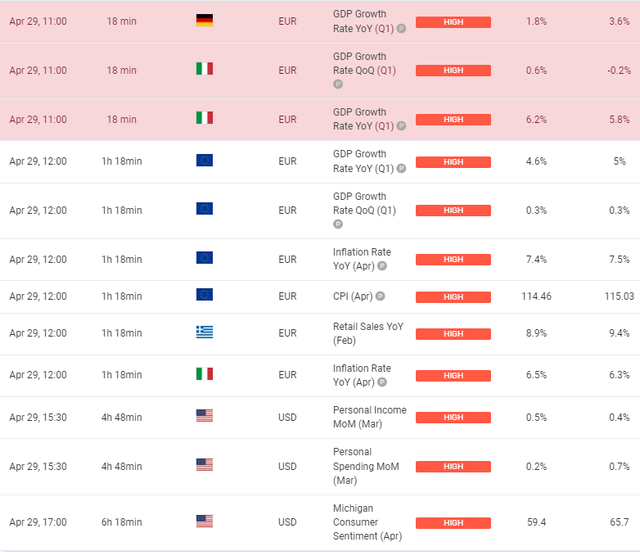

EURUSD

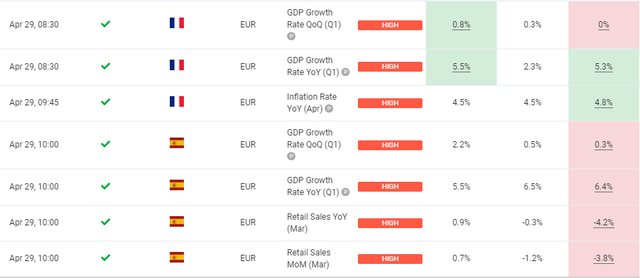

The European currency is showing multidirectional dynamics of trading in a pair with the US dollar during the Asian session, consolidating around 1.0500. Market activity remains subdued as traders await today's release of the US Federal Reserve's interest rate decision. Recall that the consolidated forecast assumes an increase in the indicator by 50 basis points at once, in addition, it is expected to announce the launch of a program to reduce the department's balance sheet by 9 trillion dollars. In turn, the European Central Bank (ECB) is still taking a wait-and-see position, despite the rapid growth of inflation in the region, although "hawkish" rhetoric is observed in the speeches of officials of this regulator as well. Earlier, the ECB executive board member, Isabel Schnabel, spoke in favor of the possibility of raising the rate in July, given that fuel and food prices will continue to increase. The macroeconomic statistics from Europe, published the day before, did not affect the dynamics of the instrument too much. Meanwhile, the Unemployment Rate in the euro area in March fell from 6.9% to 6.8%, which was only 0.1% worse than market expectations. The Producer Price Index confirmed the further acceleration of manufacturing inflation: in March, the indicator rose from 1.1% to 5.3%, and accelerated from 31.5% to 36.8% in annual terms.

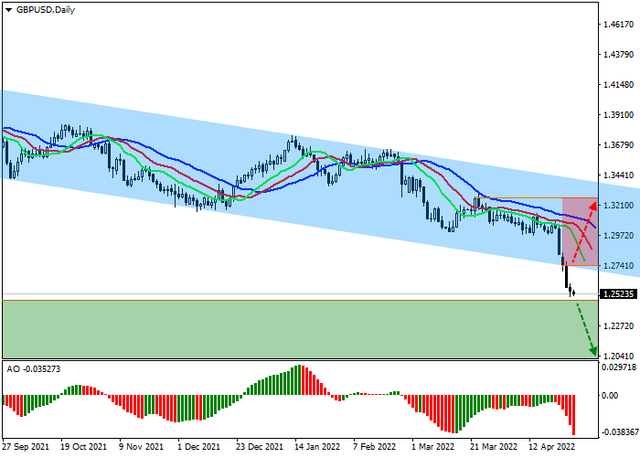

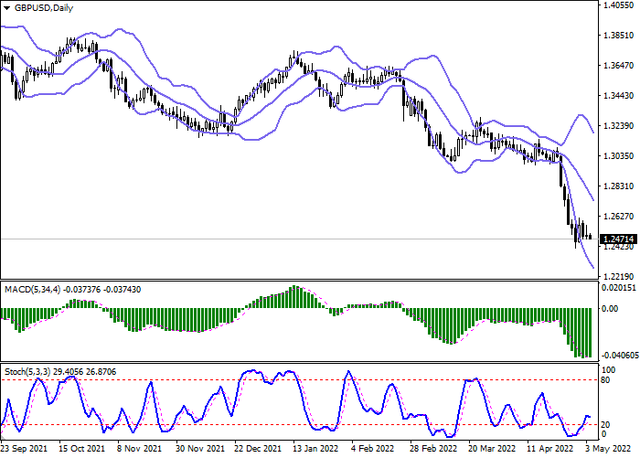

GBPUSD

The pound shows flat trading dynamics against the US currency during the morning session on May 4, consolidating near the level of 1.2500. Traders are in no hurry to open new trading positions, preferring to wait for the publication of the US Fed Meeting Minutes. Analysts have little doubt that the key interest rate will be raised by 50 basis points at once; however, some of them allow for a correction by 75 basis points, citing record inflation over 40 years, as well as fairly stable trends in the labor market as arguments. Macroeconomic statistics from the UK released yesterday provided additional support to GBP. The Manufacturing PMI from Markit in April rose from 55.3 to 55.8 points, which turned out to be better than the neutral forecasts of analysts, and the BRC Shop Price Index released today showed an acceleration year-on-year from 2.1% to 2.7% in March, which coincided with analysts' estimates.

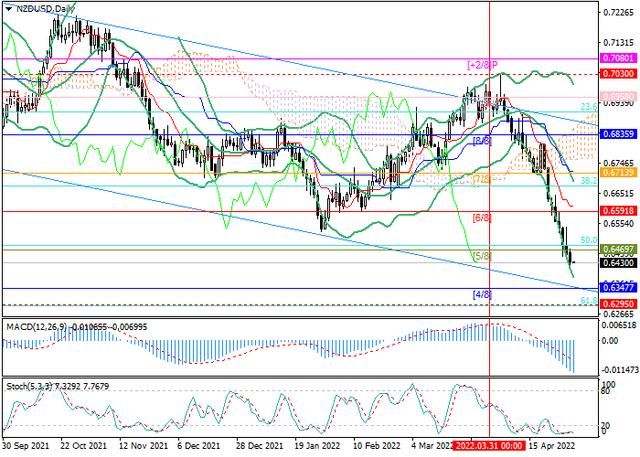

NZDUSD

The New Zealand dollar is slightly strengthening its position, recovering from the "bearish" start of the trading week, which led to the renewal of record lows since June 2020. Investors are cautious and do not rush to open new trading positions in anticipation of the publication during the day of the final minutes of the two-day meeting of the US Federal Reserve, at which the key interest rate is expected to be increased immediately by 50 basis points. As for the New Zealand macroeconomic statistics, it failed to provide significant support for the instrument quotes. The Unemployment Rate remained at the level of 3.2%, while the Participation Rate decreased from 71.1% to 70.9%, and the Employment Change increased by only 0.1% in the quarterly terms.

USDJPY

The trading instrument shows mixed dynamics, remaining close to the record highs updated at the end of last week. Now the USD/JPY pair is testing 130.00 for a breakout; however, the "bulls" prefer to wait for the US Federal Reserve meeting, at which the rate can be raised immediately by 50 basis points. The markets have already included such an outcome in the current quotes of the instrument, and therefore a noticeable increase in the US currency may not follow. However, officials' comments will continue to be extremely important for assessing the situation in the near future. In addition, the possibility of a rate increase by 75 basis points is not ruled out, although this scenario remains unlikely. Japanese markets are closed on Wednesday due to the national holidays, and therefore new drivers for the movement of the trading instrument will appear only at the end of the week, when the April statistics on consumer price dynamics in the Tokyo region will be published.

XAUUSD

Gold prices are consolidating near the level of 1865.00 after an attempt at corrective growth the day before, which did not allow XAU/USD to consolidate on new local lows from February 16. The pressure on quotes is exerted by the growth in the yield of US Treasury bonds: the indicator for 10-year bonds last Monday exceeded 3% for the first time since December 2018 and remains in this area at the present time. The investment attractiveness of the precious metal is decreasing before the start of the US Federal Reserve's meeting on monetary policy, which will be held today at 20:00 (GMT+2). US officials are expected to raise interest rates by 50 basis points at once, and also announce the launch of a quantitative tightening program, which should help to reduce the almost 9 trillion dollars balance sheet. Higher short-term interest rates and US bond yields tend to increase the opportunity cost of holding zero-yield bullion.