Tifia FX

TifiaFx Representative

- Messages

- 30

USD/CAD: on the eve of the NFP publication

07/02/2020

Current Dynamics

Today, the attention of market participants will be riveted to the publication at 13:30 (GMT) of data from the US labor market. Strong data expected. According to a report by the US Department of Labor, in January, 160,000 new jobs were created, salaries increased by 0.3%, and unemployment remained at the level of multi-year lows of 3.5%.

If the data is confirmed or is better than the forecast, then the dollar is likely to strengthen and US stock indices will rise. At the same time, you must be prepared for unexpected data that can cause increased volatility in the financial market. If the data on the labor market published today turn out to be weaker than the forecast, and previous reports will be revised downward, then the dollar may drop sharply.

Also at the same time (at 13:30 GMT) Statistics Canada will present its monthly report on the labor market in the country. Unemployment is expected to be 5.6% in January, the same as in December, and the number of employed increased by 15,000 (against 27,300 in December). If the data turn out to be better than the previous values or forecast, then the Canadian dollar is likely to strengthen, including with respect to the USD.

In any case, when data from the US and Canada labor markets are published, a surge in volatility is expected across the entire financial market. This will especially affect the USD / CAD pair, which grew in the first half of today's trading day, primarily due to the strengthening of the US dollar.

Futures on the DXY dollar index, which reflects the value of the dollar against a basket of 6 major world currencies, is growing today for the 5th day in a row and is trading at the beginning of today's European session near 98.46, 125 points higher than the closing price at the end of last week.

The dollar is strengthened by strong macro statistics coming from the United States, as well as the demand for it as a protective asset amid the spread of coronavirus in China.

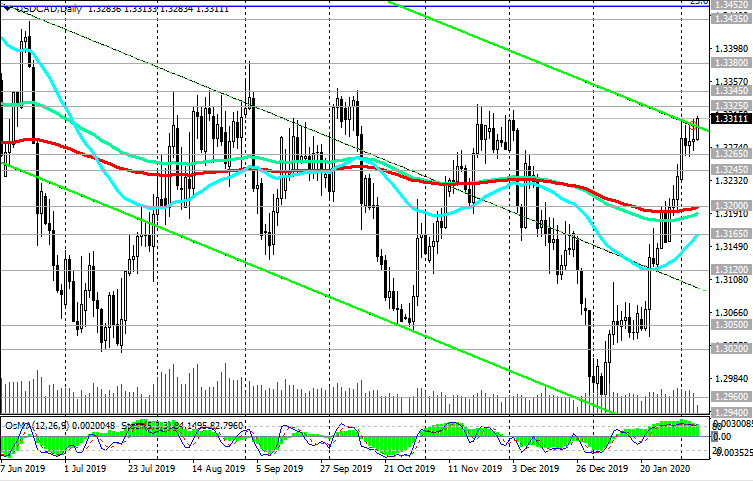

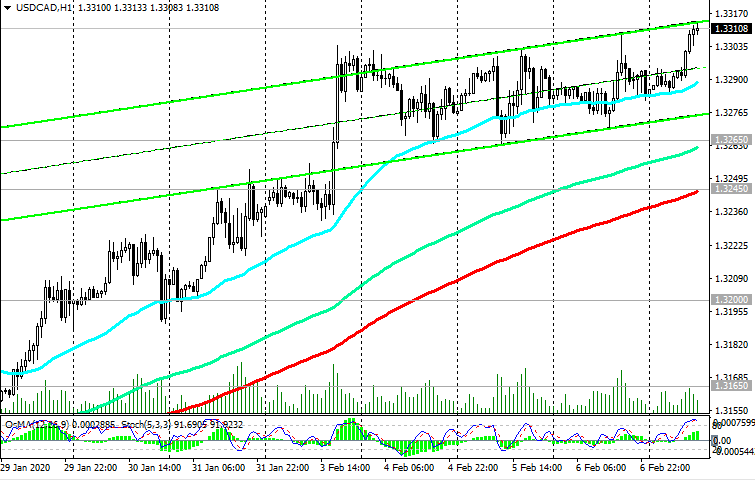

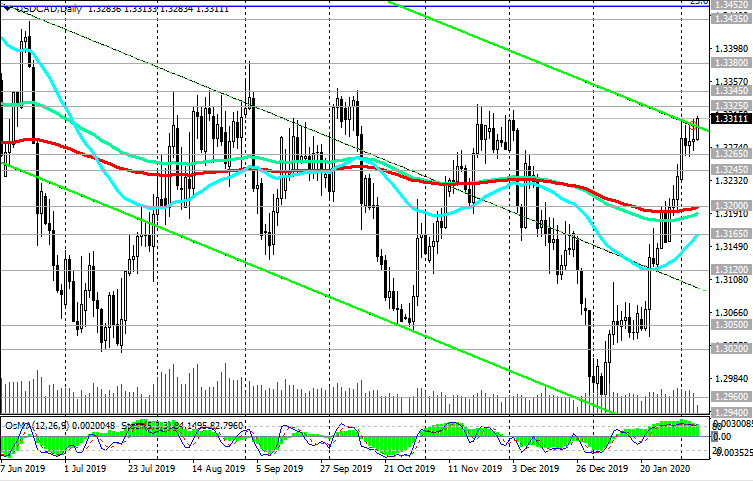

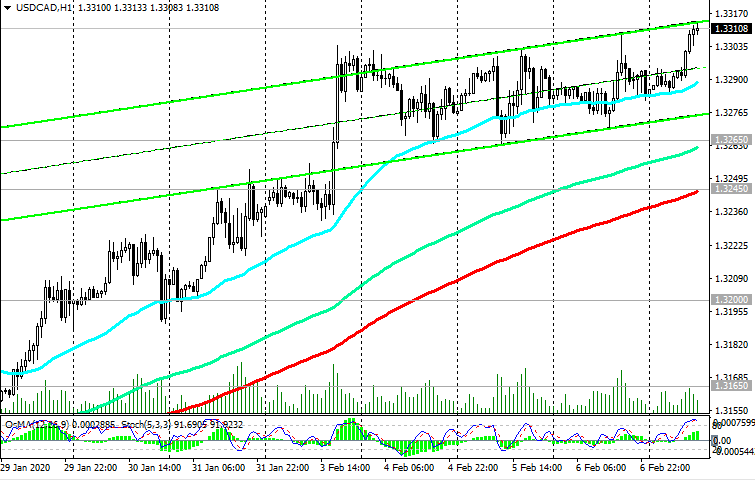

At the beginning of today's European session, USD / CAD is trading near 1.3310, 85 pips above its opening price earlier this week.

So far, everything speaks in favor of further growth of USD / CAD. Nevertheless, it should be noted that the pair has reached the upper limit of the range located between the levels of 1.3345 (1.3380) and 1.3020 (1.3050). Near these resistance levels, if not a reversal, then rebound with a subsequent decrease is possible. A signal for sales may be a breakdown of the local support level 1.3265 and the short-term support level 1.3245 (ЕМА200 on the 1-hour chart).

Nevertheless, while USD / CAD is trading above the key support level of 1.3200 (ЕМА200 on the daily chart), long positions should be preferred.

Support Levels: 1.3265, 1.3245, 1.3200, 1.3165, 1.3120, 1.3050, 1.3020

Resistance Levels: 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

Trading Scenarios

Sell Stop 1.3025. Stop-Loss 1.3100. Take-Profit 1.3000, 1.2960, 1.2930

Buy Stop 1.3105. Stop-Loss 1.3025. Take-Profit 1.3120, 1.3190, 1.3300, 1.3325, 1.3345, 1.3380, 1.3400

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

07/02/2020

Current Dynamics

Today, the attention of market participants will be riveted to the publication at 13:30 (GMT) of data from the US labor market. Strong data expected. According to a report by the US Department of Labor, in January, 160,000 new jobs were created, salaries increased by 0.3%, and unemployment remained at the level of multi-year lows of 3.5%.

If the data is confirmed or is better than the forecast, then the dollar is likely to strengthen and US stock indices will rise. At the same time, you must be prepared for unexpected data that can cause increased volatility in the financial market. If the data on the labor market published today turn out to be weaker than the forecast, and previous reports will be revised downward, then the dollar may drop sharply.

Also at the same time (at 13:30 GMT) Statistics Canada will present its monthly report on the labor market in the country. Unemployment is expected to be 5.6% in January, the same as in December, and the number of employed increased by 15,000 (against 27,300 in December). If the data turn out to be better than the previous values or forecast, then the Canadian dollar is likely to strengthen, including with respect to the USD.

In any case, when data from the US and Canada labor markets are published, a surge in volatility is expected across the entire financial market. This will especially affect the USD / CAD pair, which grew in the first half of today's trading day, primarily due to the strengthening of the US dollar.

Futures on the DXY dollar index, which reflects the value of the dollar against a basket of 6 major world currencies, is growing today for the 5th day in a row and is trading at the beginning of today's European session near 98.46, 125 points higher than the closing price at the end of last week.

The dollar is strengthened by strong macro statistics coming from the United States, as well as the demand for it as a protective asset amid the spread of coronavirus in China.

At the beginning of today's European session, USD / CAD is trading near 1.3310, 85 pips above its opening price earlier this week.

So far, everything speaks in favor of further growth of USD / CAD. Nevertheless, it should be noted that the pair has reached the upper limit of the range located between the levels of 1.3345 (1.3380) and 1.3020 (1.3050). Near these resistance levels, if not a reversal, then rebound with a subsequent decrease is possible. A signal for sales may be a breakdown of the local support level 1.3265 and the short-term support level 1.3245 (ЕМА200 on the 1-hour chart).

Nevertheless, while USD / CAD is trading above the key support level of 1.3200 (ЕМА200 on the daily chart), long positions should be preferred.

Support Levels: 1.3265, 1.3245, 1.3200, 1.3165, 1.3120, 1.3050, 1.3020

Resistance Levels: 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

Trading Scenarios

Sell Stop 1.3025. Stop-Loss 1.3100. Take-Profit 1.3000, 1.2960, 1.2930

Buy Stop 1.3105. Stop-Loss 1.3025. Take-Profit 1.3120, 1.3190, 1.3300, 1.3325, 1.3345, 1.3380, 1.3400

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com