Tifia FX

TifiaFx Representative

- Messages

- 30

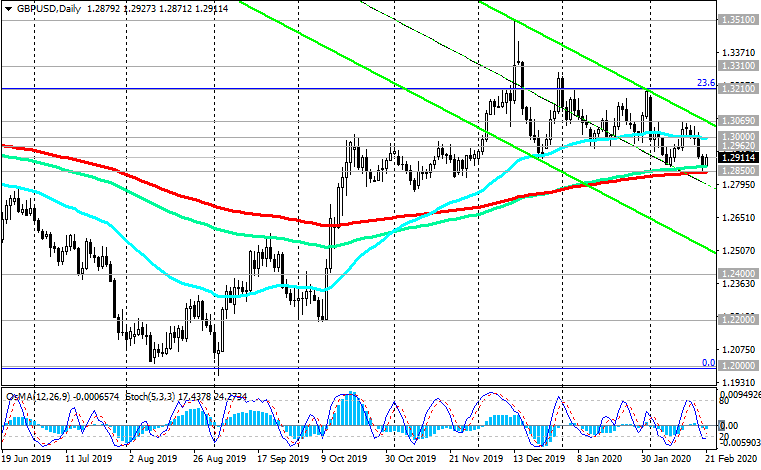

GBP/USD: downtrend risk increased

21/02/2020

According to Markit Economics, the Purchasing Managers Index (PMI) in the UK manufacturing sector rose in February (51.9 against the forecast of 49.7 and 50.0 in January), reaching a 10-month high. The preliminary PMI for the UK services sector was forecast at 53.4 in February, but came out with a value slightly lower (53.3 against 53.9 in January).

Having received support from positive macro statistics, the pound strengthened, while the GBP / USD pair rose during the European session to an intraday high of 1.2951.

However, further growth of GBP / USD above the intraday high of 1.2951 did not follow. Investors are still cautious about positive macro data against the backdrop of Brexit and the spread of coronavirus in Asia.

The theme of coronavirus today again came to the fore. The growth in the number of new infected people in China and South Korea again raises concerns among investors, including the slowdown in global economic growth.

Economists also believe that the UK draft budget expected on March 11 will not contain plans for a significant fiscal stimulus to the economy, and the yield on UK 10-year government bonds by the 3rd quarter will fall by 40 basis points.

At the same time, the dollar continues to be in demand both as a defensive asset, and against the backdrop of positive macro statistics coming from the United States. Most likely, the DXY dollar index will finish in positive territory for the third week in a row.

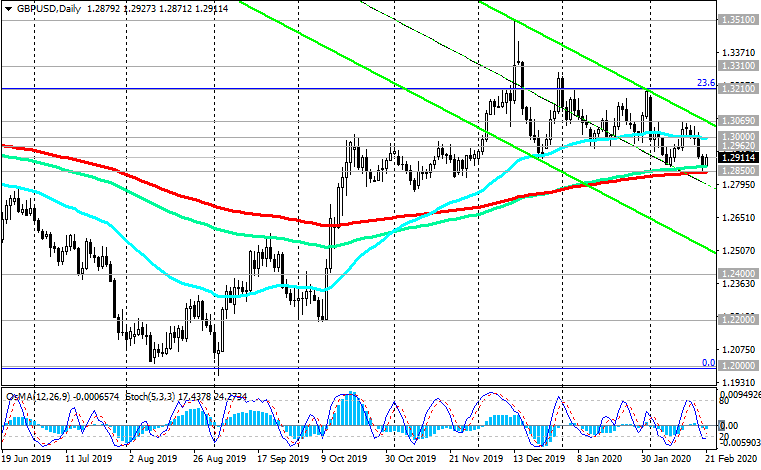

Despite the current growth of the GBP / USD pair, the OsMA and Stochastic indicators on the daily and weekly charts switched to the side of the sellers, signaling the likelihood of a breakdown of the key support level of 1.2850 (EMA200 on the daily chart) and the resumption of the global GBP / USD downtrend.

GBP / USD has already broken through important short-term support levels of 1.3000 and 1.2962, which speaks in favor of short short-term positions with an immediate goal at the support level of 1.2850.

In an alternative scenario, and after the breakdown of resistance levels 1.2962 (ЕМА200 on the 1-hour chart), 1.3000 (ЕМА200 on the 4-hour chart) GBP / USD will resume upward trend and head towards the local resistance level 1.3069. Further growth of GBP / USD in the current situation is unlikely.

Support Levels: 1.2850, 1.2400, 1.2200, 1.2000

Resistance Levels: 1.2962, 1.3000, 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

Trading Scenarios

Sell Stop 1.2890. Stop-Loss 1.2970. Take-Profit 1.2850, 1.2400, 1.2200, 1.2000

Buy Stop 1.2970. Stop-Loss 1.2890. Take-Profit 1.3000, 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

21/02/2020

According to Markit Economics, the Purchasing Managers Index (PMI) in the UK manufacturing sector rose in February (51.9 against the forecast of 49.7 and 50.0 in January), reaching a 10-month high. The preliminary PMI for the UK services sector was forecast at 53.4 in February, but came out with a value slightly lower (53.3 against 53.9 in January).

Having received support from positive macro statistics, the pound strengthened, while the GBP / USD pair rose during the European session to an intraday high of 1.2951.

However, further growth of GBP / USD above the intraday high of 1.2951 did not follow. Investors are still cautious about positive macro data against the backdrop of Brexit and the spread of coronavirus in Asia.

The theme of coronavirus today again came to the fore. The growth in the number of new infected people in China and South Korea again raises concerns among investors, including the slowdown in global economic growth.

Economists also believe that the UK draft budget expected on March 11 will not contain plans for a significant fiscal stimulus to the economy, and the yield on UK 10-year government bonds by the 3rd quarter will fall by 40 basis points.

At the same time, the dollar continues to be in demand both as a defensive asset, and against the backdrop of positive macro statistics coming from the United States. Most likely, the DXY dollar index will finish in positive territory for the third week in a row.

Despite the current growth of the GBP / USD pair, the OsMA and Stochastic indicators on the daily and weekly charts switched to the side of the sellers, signaling the likelihood of a breakdown of the key support level of 1.2850 (EMA200 on the daily chart) and the resumption of the global GBP / USD downtrend.

GBP / USD has already broken through important short-term support levels of 1.3000 and 1.2962, which speaks in favor of short short-term positions with an immediate goal at the support level of 1.2850.

In an alternative scenario, and after the breakdown of resistance levels 1.2962 (ЕМА200 on the 1-hour chart), 1.3000 (ЕМА200 on the 4-hour chart) GBP / USD will resume upward trend and head towards the local resistance level 1.3069. Further growth of GBP / USD in the current situation is unlikely.

Support Levels: 1.2850, 1.2400, 1.2200, 1.2000

Resistance Levels: 1.2962, 1.3000, 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

Trading Scenarios

Sell Stop 1.2890. Stop-Loss 1.2970. Take-Profit 1.2850, 1.2400, 1.2200, 1.2000

Buy Stop 1.2970. Stop-Loss 1.2890. Take-Profit 1.3000, 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com