SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

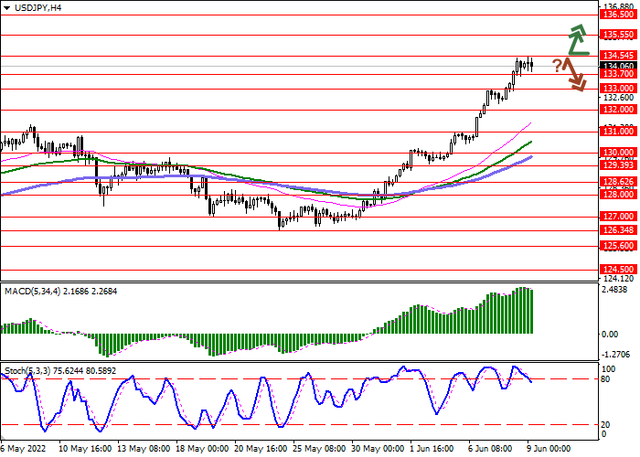

Consolidation near record highs

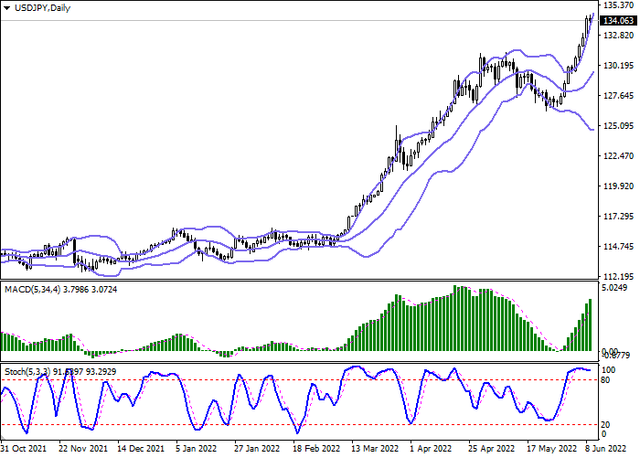

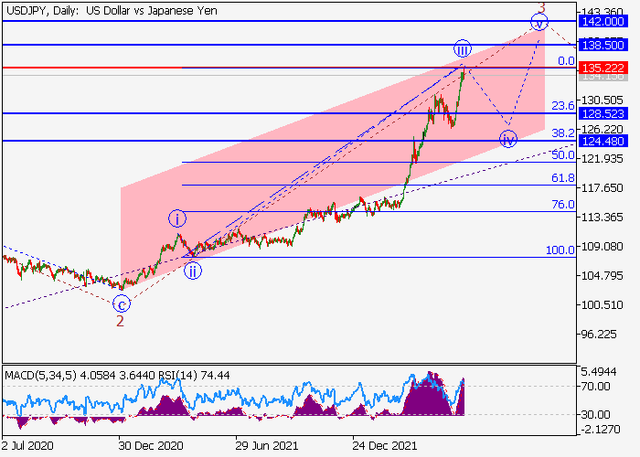

The US dollar shows mixed trading dynamics, consolidating near new record highs and the level of 134 and continuing the development of the general uptrend since May 30.

The pressure on the positions of the yen is exerted by the prospect of maintaining the current soft monetary policy of the Bank of Japan. While virtually all major financial regulators have moved on to sharply raise interest rates (the European Central Bank (ECB) is expected to launch the program in July), the Japanese authorities are pushing for continued stimulus. Such statements were made by the Deputy Governor of the regulator Masazumi Wakatabe, who also admitted the possibility of introducing new incentives if the economic situation so requires.

Macroeconomic statistics released yesterday in Japan did not provide any noticeable support to the yen. Revised data on the dynamics of gross domestic product for Q1 2022 were revised upward from –0.2% to –0.1% in quarterly terms and from –1.0% to –0.5% in annual terms, and the Eco Watchers Survey on Current Situation in May rose from 50.4 to 54.0 points, while the forecast was for a decline to 49.2 points.

Meanwhile, the Japanese authorities announced the continuation of work in the Russian oil and gas projects Sakhalin-1 and Sakhalin-2. The decision is contained in the national Energy White Paper. It is emphasized that in the current high energy prices, the country needs stable supplies of liquefied gas, and long-term contracts can reduce the negative effect on energy security. Mitsui & Co., Ltd. and Mitsubishi Corp. own 12.5% and 10% shares of the Sakhalin-2 project, and most of the gas produced here is supplied to Japan.

Bollinger Bands in D1 chart show quite active growth. The price range is expanding, but still does not keep pace with the development of "bullish" sentiment in the market. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic has been near its highs for a long time, indicating high risks of the US dollar being overbought in the ultra-short term.

Resistance levels: 134.54, 135.55, 136 | Support levels: 133.7, 133, 132, 131