SOLID ECN LLC

Solid ECN Representative

- Messages

- 515

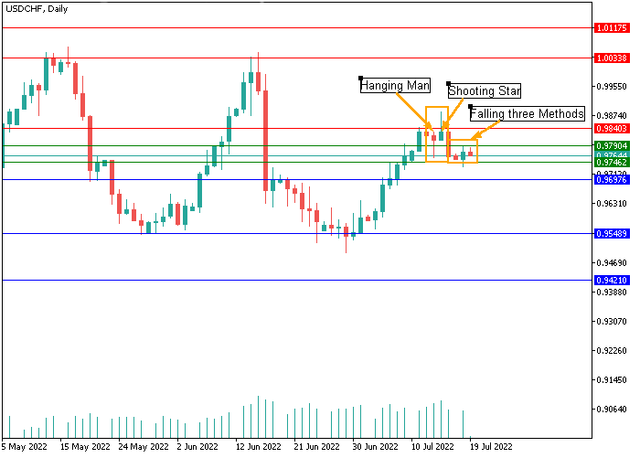

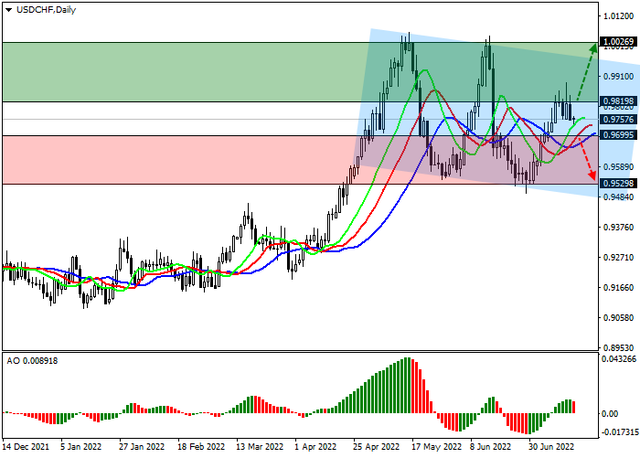

USDCHF - lateral channel correction

The strengthening of the franc was supported by data on Imports volumes, which in June reflected an increase of 0.3% compared with the previous month, while the Producer Price Index reached 109.8 points, adding 6.9% compared to the same period a year earlier. The real estate market is mixed, with Civil Construction Spending up 0.1% year-over-year and Construction Overall Spending reduced by 0.4%, resulting in a 0.1% decrease in Total Investment in the sector.

On the global chart of the asset, the price is correcting within the side channel, preparing to continue the global growth. Technical indicators maintain a steady buy signal: the fast EMAs of the Alligator indicator are significantly above the signal line, and the histogram of the AO oscillator is held in the buy zone, forming local corrective bars.

Support levels: 0.9699, 0.9529 | Resistance levels: 0.9819, 1

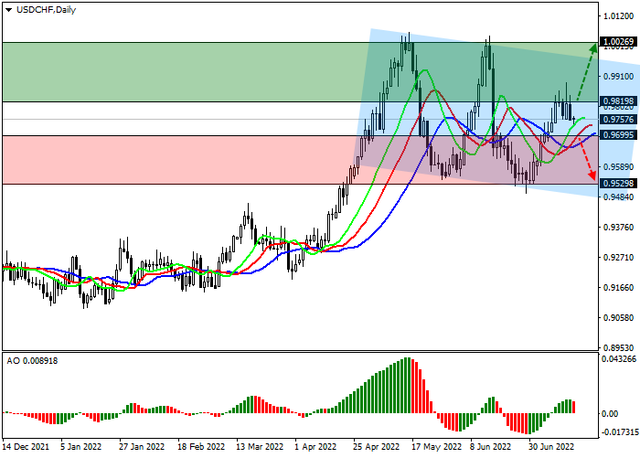

The strengthening of the franc was supported by data on Imports volumes, which in June reflected an increase of 0.3% compared with the previous month, while the Producer Price Index reached 109.8 points, adding 6.9% compared to the same period a year earlier. The real estate market is mixed, with Civil Construction Spending up 0.1% year-over-year and Construction Overall Spending reduced by 0.4%, resulting in a 0.1% decrease in Total Investment in the sector.

On the global chart of the asset, the price is correcting within the side channel, preparing to continue the global growth. Technical indicators maintain a steady buy signal: the fast EMAs of the Alligator indicator are significantly above the signal line, and the histogram of the AO oscillator is held in the buy zone, forming local corrective bars.

Support levels: 0.9699, 0.9529 | Resistance levels: 0.9819, 1