SOLID ECN LLC

Solid ECN Representative

- Messages

- 515

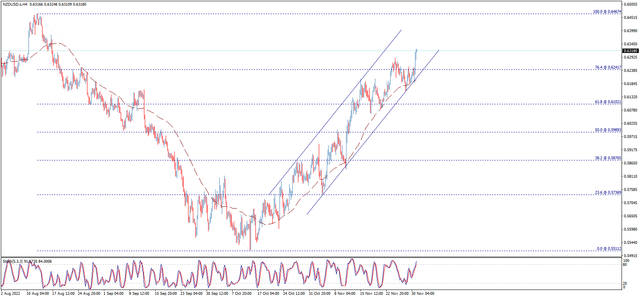

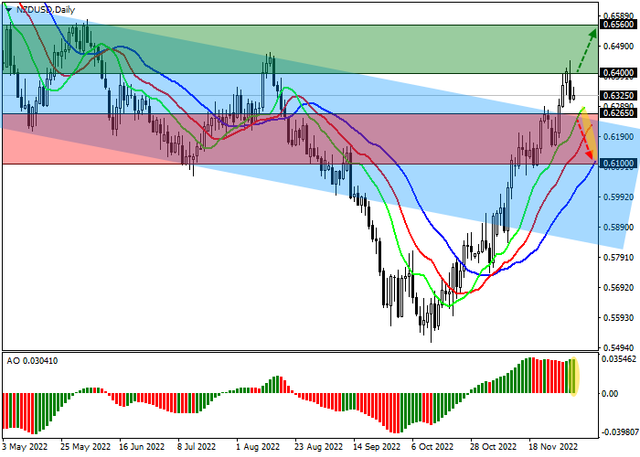

NZDUSD -Quotes remain within the downward channel

Thus, according to the report of Statistics New Zealand (Stats.nz), employment in the main sectors of the economy in October adjusted to 2.32M jobs, but the decrease in the indicator in the primary sectors was 1.7%, in the commodity-producing sector, growth reached 0.6%, while the service sector showed no change. Regarding age groups, the largest increase in the value was observed in the category of 15–19 years old, which added 18.5%, and the maximum outflow of workers was in the category of 25–29 years old, which amounted to –3.3%. Considering that the first category includes mainly part-time jobs, the increase in this category had little effect on economic activity. The situation in the asset may change tomorrow when the data on building permits is published, the positive dynamics of which reached 3.8% last month.

The trading instrument moves within the downward channel on the daily chart, steadily near the resistance line. Technical indicators maintain a stable buy signal, working out a slight correction.

Resistance levels: 0.6265, 0.6467 | Support levels: 0.61, 0.5878

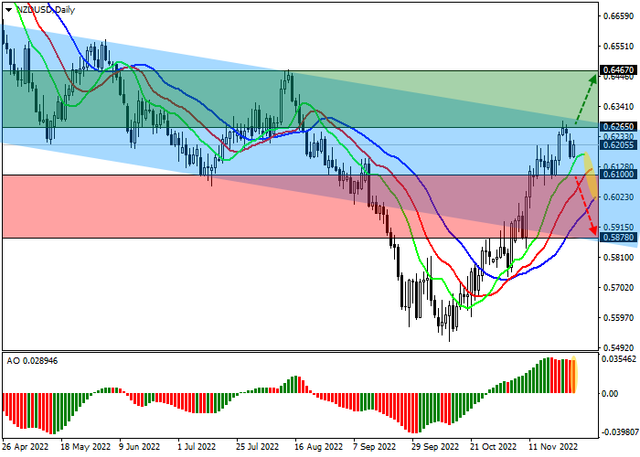

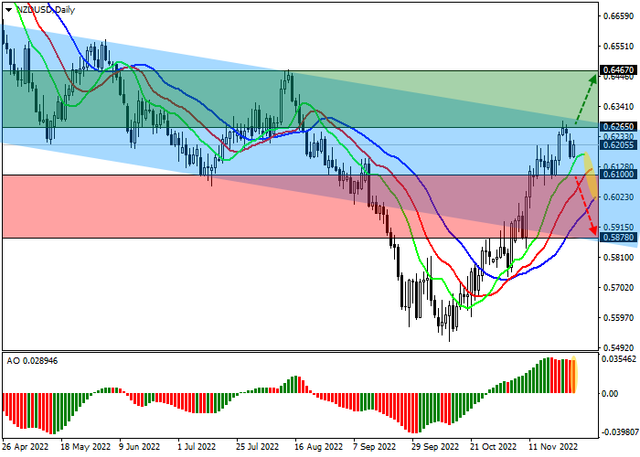

Thus, according to the report of Statistics New Zealand (Stats.nz), employment in the main sectors of the economy in October adjusted to 2.32M jobs, but the decrease in the indicator in the primary sectors was 1.7%, in the commodity-producing sector, growth reached 0.6%, while the service sector showed no change. Regarding age groups, the largest increase in the value was observed in the category of 15–19 years old, which added 18.5%, and the maximum outflow of workers was in the category of 25–29 years old, which amounted to –3.3%. Considering that the first category includes mainly part-time jobs, the increase in this category had little effect on economic activity. The situation in the asset may change tomorrow when the data on building permits is published, the positive dynamics of which reached 3.8% last month.

The trading instrument moves within the downward channel on the daily chart, steadily near the resistance line. Technical indicators maintain a stable buy signal, working out a slight correction.

Resistance levels: 0.6265, 0.6467 | Support levels: 0.61, 0.5878