SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

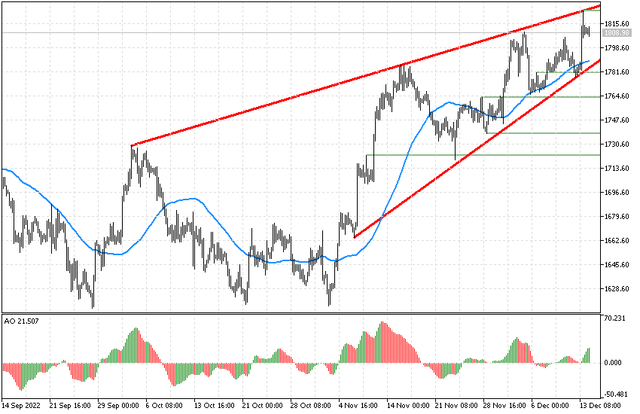

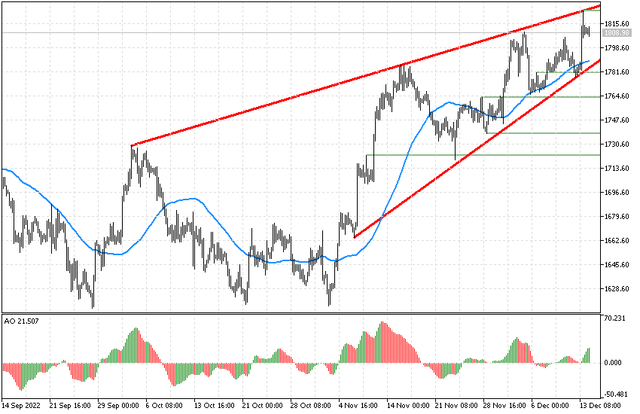

Gold price resumes the bullish trend

Gold price ended yesterday above 1810 level, to open the way to achieve more gains in the upcoming sessions, as it resumes the main bullish trend within the bullish channel that has positive targets that start at 1838.1 and extend to 1900. Therefore, we expect to witness more rise on the intraday and short term basis, noting that breaking 1810 will stop the positive scenario and press on the price to test the bullish channel’s support line around 1784.50 before any new attempt to rise.

The expected trading range for today is between 1795 support and 1835 resistance.

Gold price ended yesterday above 1810 level, to open the way to achieve more gains in the upcoming sessions, as it resumes the main bullish trend within the bullish channel that has positive targets that start at 1838.1 and extend to 1900. Therefore, we expect to witness more rise on the intraday and short term basis, noting that breaking 1810 will stop the positive scenario and press on the price to test the bullish channel’s support line around 1784.50 before any new attempt to rise.

The expected trading range for today is between 1795 support and 1835 resistance.