Tifia FX

TifiaFx Representative

- Messages

- 30

XAU/USD: demand for gold will be supported as for an asset-shelter

15/06/2018

Current dynamics

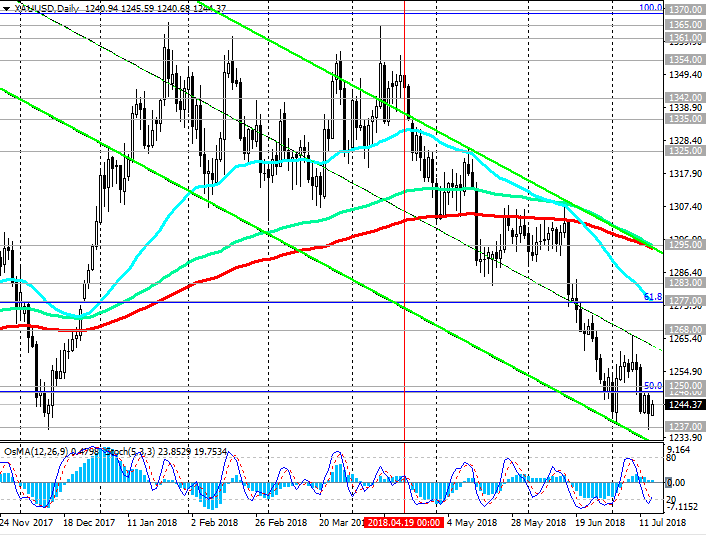

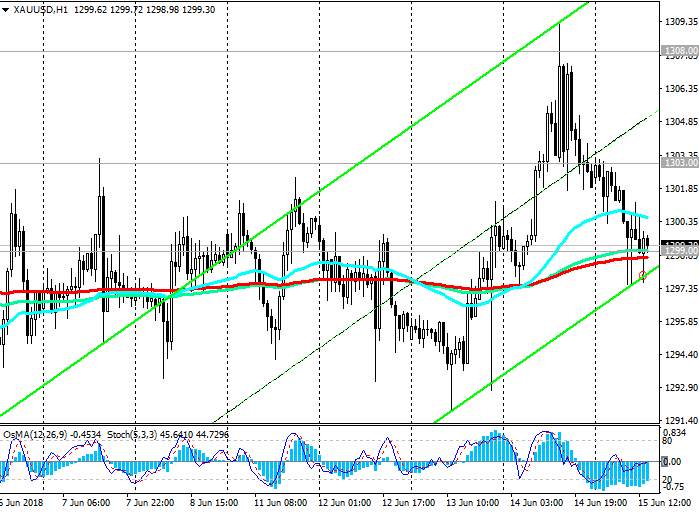

Despite the decision of the Fed to raise the rate and a statement of intent to further tighten monetary policy in the US, gold prices on Thursday reached the highest level for the month near the mark of 1309.00 dollars per ounce.

Investors once again remembered geopolitical tensions and the threat of a large-scale world trade war.

President of the United States Donald Trump approved the introduction of duties on the import of goods from China worth about 50 billion dollars.

On Thursday, high-ranking representatives of the White House, officials responsible for state security, representatives of the Ministry of Finance and the US Department of Commerce held a 90-minute meeting. On Friday, the US Trade Mission intends to make public the list of goods for which duties will be distributed.

Trump does not intend to back away from taking the course to support local producers and pursuing a protectionist policy towards American goods abroad.

As you know, from June 1, the US began to apply import duties on steel and aluminum from China, the EU, and Canada. Other countries, suppliers of these goods to the United States, were sanctioned in March.

June gold futures on COMEX closed on Thursday with an increase of 0.6%, at USD 1304.00 per troy ounce, which is the maximum closing level since May 14.

US President Donald Trump's administration announced plans to introduce import duties on Chinese goods worth tens of billions of dollars in the next few days, which led traders to prepare for a new wave of geopolitical tensions.

As you know, in the context of an increase in the interest rate, the price of gold is falling, because it is more difficult for him to compete with other objects for long-term investments that generate revenue, such as, for example, government bonds. At the same time, the investment attractiveness of the dollar is growing.

In periods of aggravation of the geopolitical situation or international trade contradictions, the "swing" moves in the opposite direction and the demand for gold rises again, as investors see it as an safe-asset.

Nevertheless, despite the growth, prices in the future will face resistance of sellers of gold in favor of the dollar against the background of further tightening of the monetary policy of the Fed.

Only weak macro data from the United States, as well as an even greater strengthening of geopolitical tensions in the world, can push gold quotes higher. So far, negative dynamics prevails.

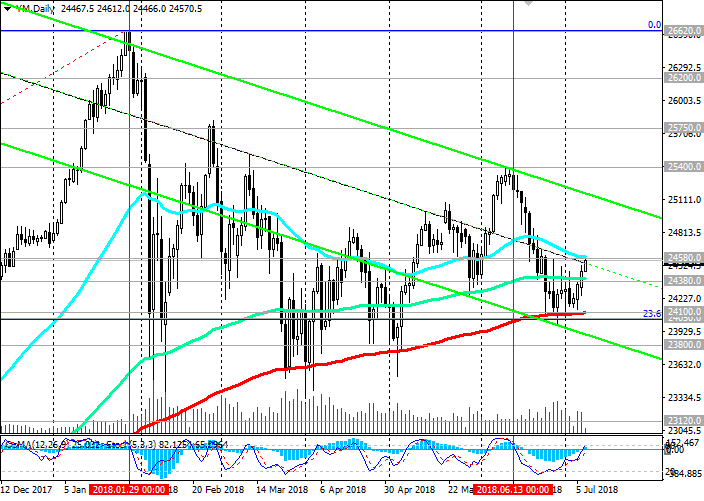

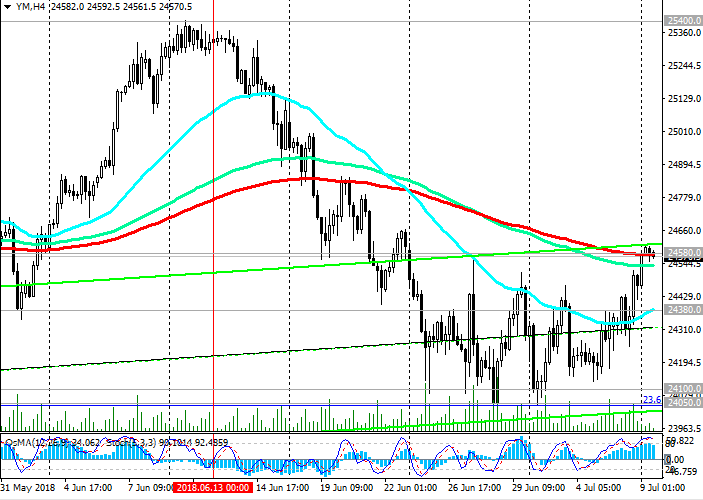

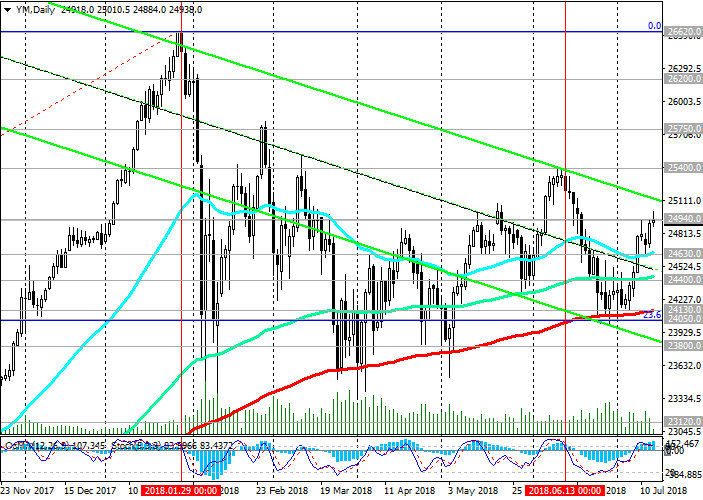

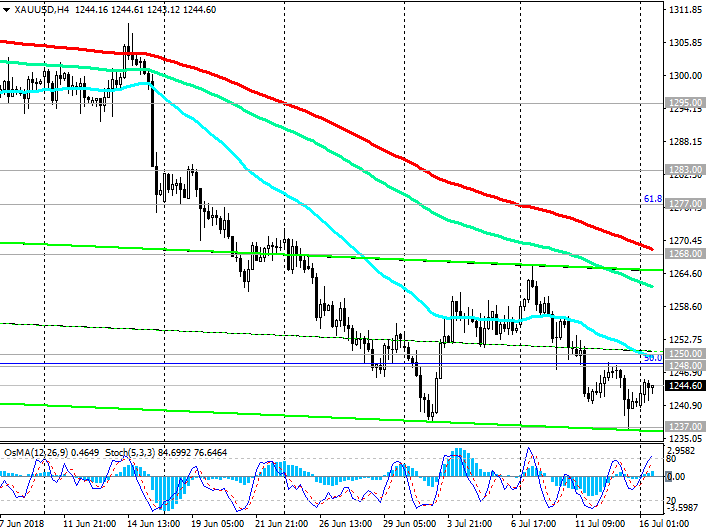

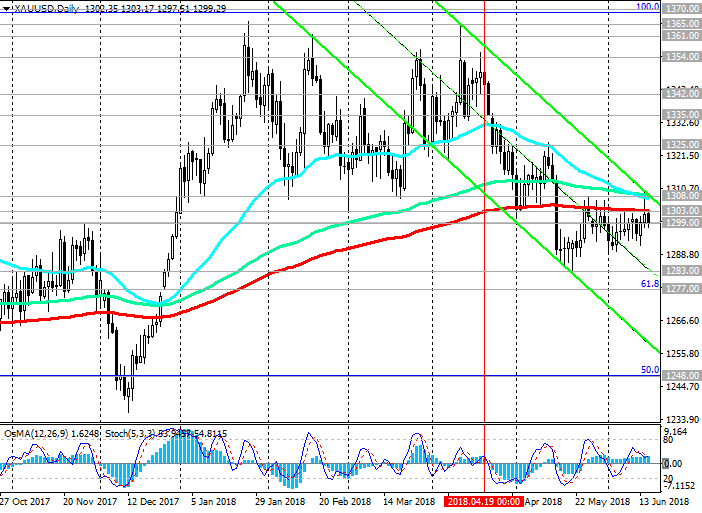

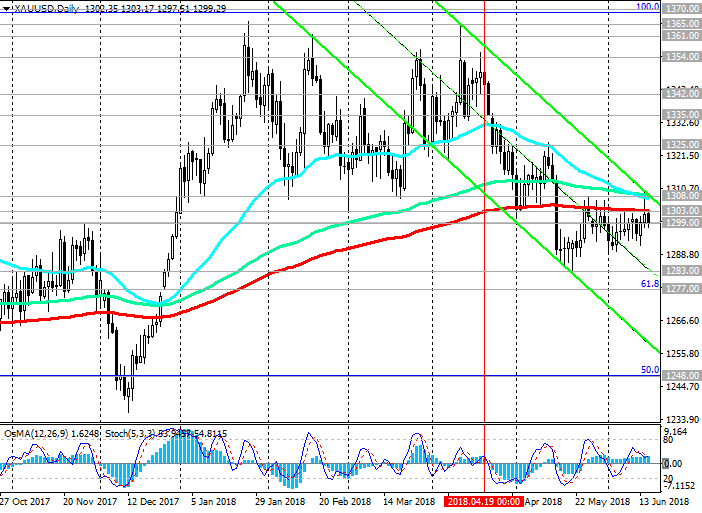

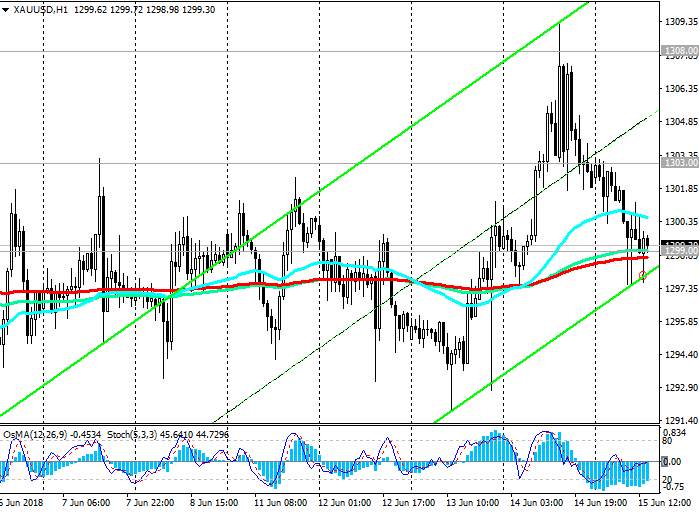

Level 1303.00 (EMA200 on the daily chart) is still a strong resistance for the XAU / USD pair.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1299.00, 1283.00, 1277.00, 1248.00

Resistance levels: 1308.00, 1325.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00

Trading Scenarios

Sell in the market. Stop-Loss 1309.00. Take-Profit 1290.00, 1283.00, 1277.00, 1270.00, 1248.00

Buy Stop 1309.00. Stop-Loss 1298.00. Take-Profit 1325.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

15/06/2018

Current dynamics

Despite the decision of the Fed to raise the rate and a statement of intent to further tighten monetary policy in the US, gold prices on Thursday reached the highest level for the month near the mark of 1309.00 dollars per ounce.

Investors once again remembered geopolitical tensions and the threat of a large-scale world trade war.

President of the United States Donald Trump approved the introduction of duties on the import of goods from China worth about 50 billion dollars.

On Thursday, high-ranking representatives of the White House, officials responsible for state security, representatives of the Ministry of Finance and the US Department of Commerce held a 90-minute meeting. On Friday, the US Trade Mission intends to make public the list of goods for which duties will be distributed.

Trump does not intend to back away from taking the course to support local producers and pursuing a protectionist policy towards American goods abroad.

As you know, from June 1, the US began to apply import duties on steel and aluminum from China, the EU, and Canada. Other countries, suppliers of these goods to the United States, were sanctioned in March.

June gold futures on COMEX closed on Thursday with an increase of 0.6%, at USD 1304.00 per troy ounce, which is the maximum closing level since May 14.

US President Donald Trump's administration announced plans to introduce import duties on Chinese goods worth tens of billions of dollars in the next few days, which led traders to prepare for a new wave of geopolitical tensions.

As you know, in the context of an increase in the interest rate, the price of gold is falling, because it is more difficult for him to compete with other objects for long-term investments that generate revenue, such as, for example, government bonds. At the same time, the investment attractiveness of the dollar is growing.

In periods of aggravation of the geopolitical situation or international trade contradictions, the "swing" moves in the opposite direction and the demand for gold rises again, as investors see it as an safe-asset.

Nevertheless, despite the growth, prices in the future will face resistance of sellers of gold in favor of the dollar against the background of further tightening of the monetary policy of the Fed.

Only weak macro data from the United States, as well as an even greater strengthening of geopolitical tensions in the world, can push gold quotes higher. So far, negative dynamics prevails.

Level 1303.00 (EMA200 on the daily chart) is still a strong resistance for the XAU / USD pair.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1299.00, 1283.00, 1277.00, 1248.00

Resistance levels: 1308.00, 1325.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00

Trading Scenarios

Sell in the market. Stop-Loss 1309.00. Take-Profit 1290.00, 1283.00, 1277.00, 1270.00, 1248.00

Buy Stop 1309.00. Stop-Loss 1298.00. Take-Profit 1325.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com