Tifia FX

TifiaFx Representative

- Messages

- 30

AUD/USD: Support and resistance levels

20/08/2018

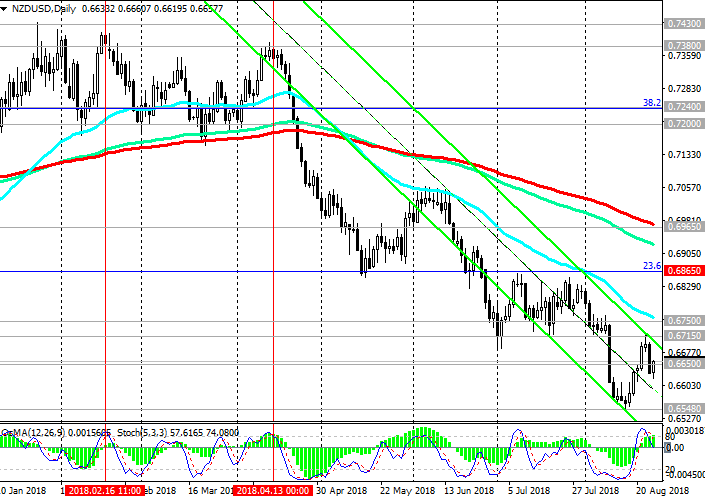

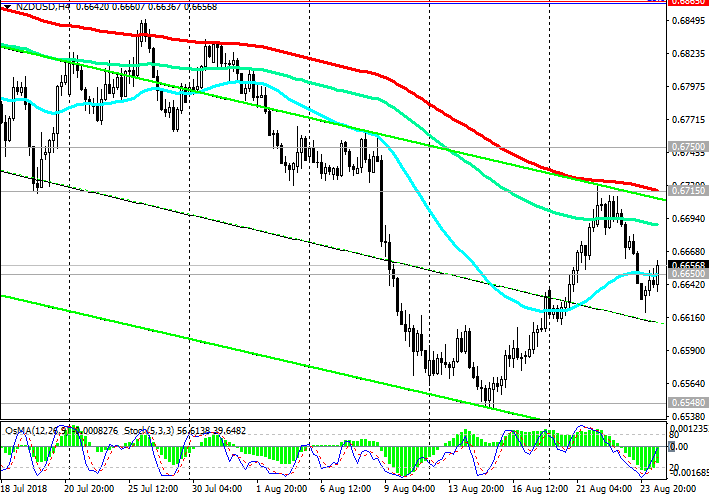

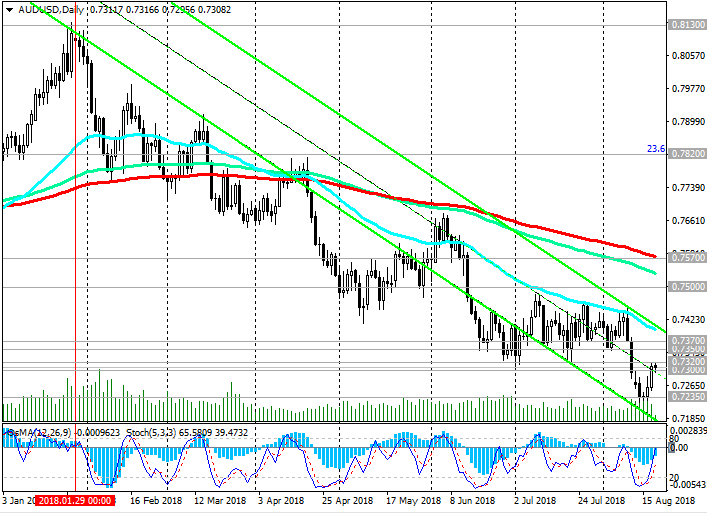

The different focus of monetary policy of central banks in the US and Australia will be the main most important long-term factor in favor of weakening the AUD / USD pair.

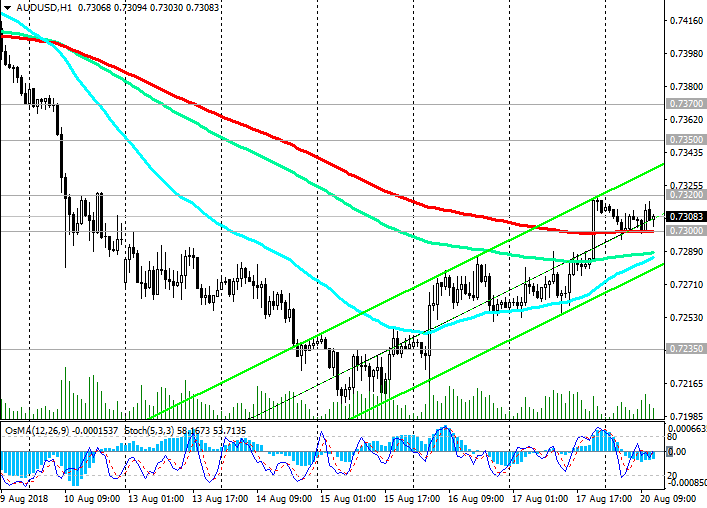

Since the beginning of the year, the AUD / USD has been actively declining. AUD / USD develops a downward trend, trading in the downward channel on the daily chart, the lower limit of which near the support level of 0.7155 passes.

Indicators OsMA and Stochastics on long-term periods (weekly and monthly) indicate short positions.

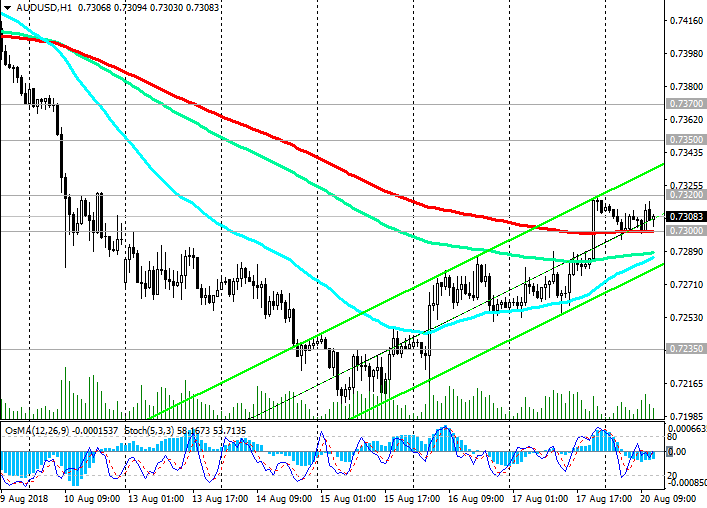

In case of further decrease in AUD / USD, the targets will be support levels of 0.7235 (August lows), 0.7155 (the bottom line of the descending channel on the daily chart). Only in case of the return of AUD / USD to the zone above the key resistance level of 0.7570 (EMA200 on the daily chart) long-term long positions can be considered with targets at the levels of 0.7820 (EMA200 on the weekly chart and Fibonacci level of 23.6% of the correction to the fall wave from August 2011 year and level 1.1030. The minimum of this wave is near the level of 0.6830). The signal for purchases may be a breakdown of the short-term resistance level 0.7370 (EMA200 on the 4-hour chart). So far, negative dynamics prevails. Short positions are preferred. The immediate goal of the decline is the support level of 0.7235 (the lows of the year and August). The AUD / USD is returning to the global downtrend, which began in August 2011.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7300, 0.7235, 0.7200, 0.7155, 0.7100

Resistance levels: 0.7320, 0.7350, 0.7370, 0.7500, 0.7570

Trading Scenarios

Sell Stop 0.7290. Stop-Loss 0.7330. Take-Profit 0.7235, 0.7200, 0.7155, 0.7100

Buy Stop 0.7330. Stop-Loss 0.7290. Take-Profit 0.7350, 0.7370, 0.7500, 0.7570

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

20/08/2018

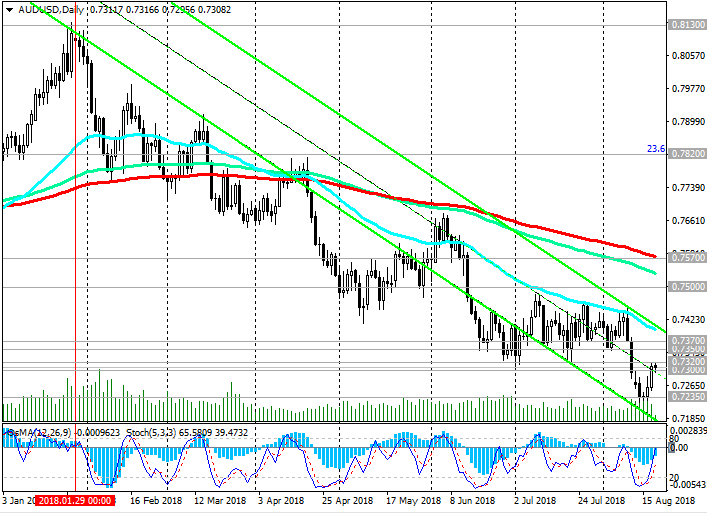

The different focus of monetary policy of central banks in the US and Australia will be the main most important long-term factor in favor of weakening the AUD / USD pair.

Since the beginning of the year, the AUD / USD has been actively declining. AUD / USD develops a downward trend, trading in the downward channel on the daily chart, the lower limit of which near the support level of 0.7155 passes.

Indicators OsMA and Stochastics on long-term periods (weekly and monthly) indicate short positions.

In case of further decrease in AUD / USD, the targets will be support levels of 0.7235 (August lows), 0.7155 (the bottom line of the descending channel on the daily chart). Only in case of the return of AUD / USD to the zone above the key resistance level of 0.7570 (EMA200 on the daily chart) long-term long positions can be considered with targets at the levels of 0.7820 (EMA200 on the weekly chart and Fibonacci level of 23.6% of the correction to the fall wave from August 2011 year and level 1.1030. The minimum of this wave is near the level of 0.6830). The signal for purchases may be a breakdown of the short-term resistance level 0.7370 (EMA200 on the 4-hour chart). So far, negative dynamics prevails. Short positions are preferred. The immediate goal of the decline is the support level of 0.7235 (the lows of the year and August). The AUD / USD is returning to the global downtrend, which began in August 2011.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7300, 0.7235, 0.7200, 0.7155, 0.7100

Resistance levels: 0.7320, 0.7350, 0.7370, 0.7500, 0.7570

Trading Scenarios

Sell Stop 0.7290. Stop-Loss 0.7330. Take-Profit 0.7235, 0.7200, 0.7155, 0.7100

Buy Stop 0.7330. Stop-Loss 0.7290. Take-Profit 0.7350, 0.7370, 0.7500, 0.7570

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com