Tifia FX

TifiaFx Representative

- Messages

- 30

GBP/USD: macro statistics remain in the background

01/22/2019

Current dynamics

British Prime Minister Theresa May on Monday presented her new plan for secession from the European Union, which is very similar to the previous one.

The leader of the Labor Party of Great Britain, Jeremy Corbin, said that "it really starts to sound like something like Groundhog Day" and called for a vote in the House of Commons on the second Brexit referendum.

In Brussels, it was repeatedly repeated that the transaction could not be subjected to significant changes. "This withdrawal agreement cannot be changed", said Irish Foreign Minister Simon Coveney on Monday.

It seems that the situation again comes to a standstill, and the likelihood of "hard" Brexit is growing every day. This puts pressure on the pound, not allowing the uptrend to develop above the key resistance levels of 1.2955, 1.3030.

According to the data of the National Bureau of Statistics of the United Kingdom published on Tuesday, the number of employed citizens in the period from September to November increased by 141,000 compared with the previous three-month period, while the employment rate reached a record 75.8%.

The Bank of England expects that a decrease in free resources in the labor market will contribute to wage growth and keeping inflation above the target level in the coming years. However, until the situation with Brexit is resolved, the Bank of England will remain neutral in relation to changes in monetary policy, despite the high inflation rate in the country after the Brexit referendum held in June 2016.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

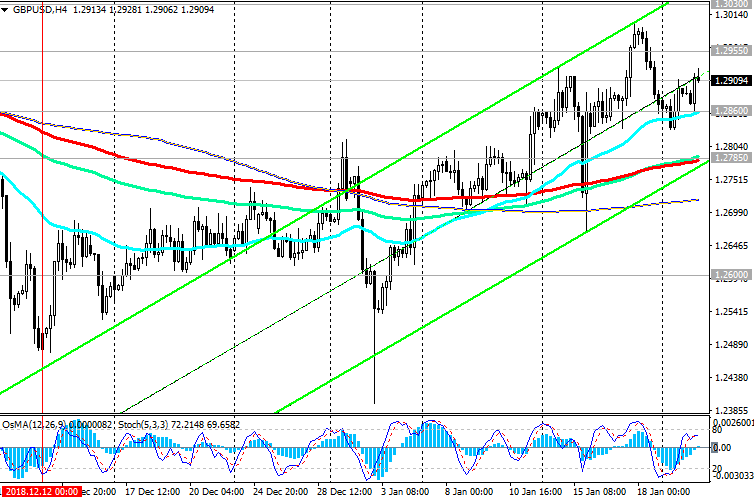

Despite the failure of the Brexit vote in the British parliament, GBP / USD continues to develop an upward correction, trading above the important short-term support levels of 1.2860 (ЕМА200 on the 1-hour chart), 1.2785 (ЕМА200 on the 4-hour chart).

However, GBP / USD remains below key resistance levels of 1.2955 (EMA144 on the daily chart), 1.3030 (EMA200 on the daily chart).

Above the resistance level of 1.3030, GBP / USD growth is unlikely. The pound remains under pressure due to the domestic political crisis in the UK and Brexit.

In the event of a breakdown of the support level of 1.2785, the GBP / USD will go into the downstream channels on the daily and weekly charts to the support levels of 1.2600 (June 2017 lows), 1.2485, 1.2365. The main trend is still bearish. Below the key resistance levels of 1.3210 (Fibonacci 23.6% of the correction to the decline of the GBP / USD pair in the wave that started in July 2014 near 1.7200), 1.3030 (ЕМА200 on the daily chart) negative dynamics prevail and short positions are preferable.

Support Levels: 1.2860, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365, 1.2110, 1.2000

Resistance Levels: 1.2955, 1.3030, 1.3125, 1.3210, 1.3300, 1.3470, 1.3740

Trading recommendations

Sell in the market. Stop Loss 1.3040. Take-Profit 1.2860, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365

Buy Stop 1.2930. Stop Loss 1.2850. Take-Profit 1.2955, 1.3030

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

01/22/2019

Current dynamics

British Prime Minister Theresa May on Monday presented her new plan for secession from the European Union, which is very similar to the previous one.

The leader of the Labor Party of Great Britain, Jeremy Corbin, said that "it really starts to sound like something like Groundhog Day" and called for a vote in the House of Commons on the second Brexit referendum.

In Brussels, it was repeatedly repeated that the transaction could not be subjected to significant changes. "This withdrawal agreement cannot be changed", said Irish Foreign Minister Simon Coveney on Monday.

It seems that the situation again comes to a standstill, and the likelihood of "hard" Brexit is growing every day. This puts pressure on the pound, not allowing the uptrend to develop above the key resistance levels of 1.2955, 1.3030.

According to the data of the National Bureau of Statistics of the United Kingdom published on Tuesday, the number of employed citizens in the period from September to November increased by 141,000 compared with the previous three-month period, while the employment rate reached a record 75.8%.

The Bank of England expects that a decrease in free resources in the labor market will contribute to wage growth and keeping inflation above the target level in the coming years. However, until the situation with Brexit is resolved, the Bank of England will remain neutral in relation to changes in monetary policy, despite the high inflation rate in the country after the Brexit referendum held in June 2016.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

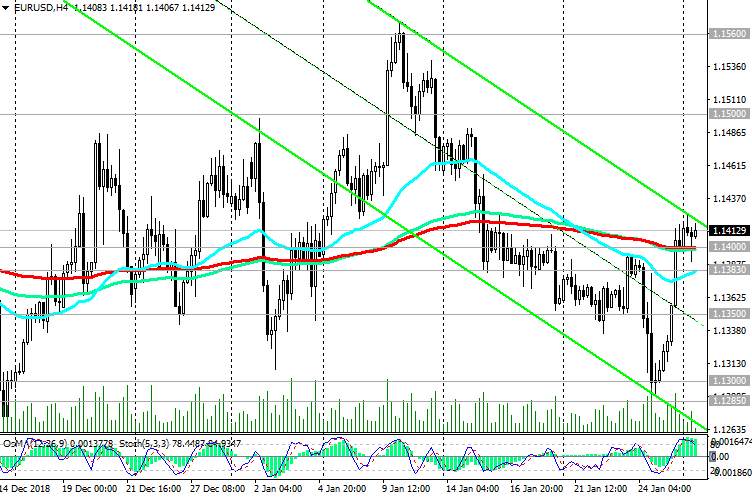

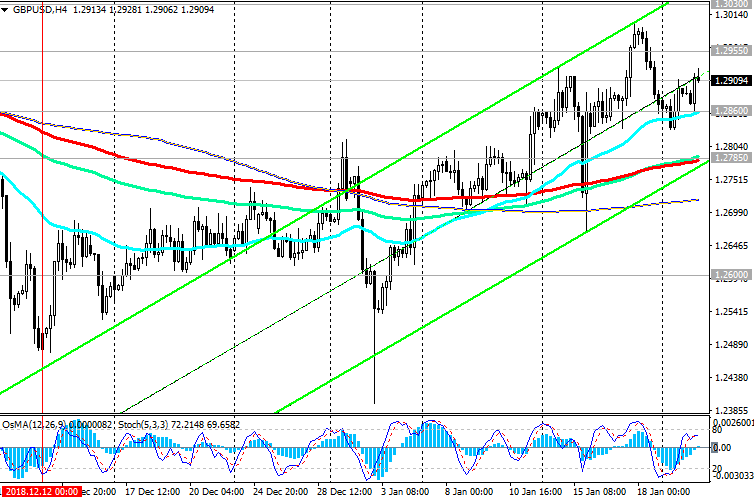

Despite the failure of the Brexit vote in the British parliament, GBP / USD continues to develop an upward correction, trading above the important short-term support levels of 1.2860 (ЕМА200 on the 1-hour chart), 1.2785 (ЕМА200 on the 4-hour chart).

However, GBP / USD remains below key resistance levels of 1.2955 (EMA144 on the daily chart), 1.3030 (EMA200 on the daily chart).

Above the resistance level of 1.3030, GBP / USD growth is unlikely. The pound remains under pressure due to the domestic political crisis in the UK and Brexit.

In the event of a breakdown of the support level of 1.2785, the GBP / USD will go into the downstream channels on the daily and weekly charts to the support levels of 1.2600 (June 2017 lows), 1.2485, 1.2365. The main trend is still bearish. Below the key resistance levels of 1.3210 (Fibonacci 23.6% of the correction to the decline of the GBP / USD pair in the wave that started in July 2014 near 1.7200), 1.3030 (ЕМА200 on the daily chart) negative dynamics prevail and short positions are preferable.

Support Levels: 1.2860, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365, 1.2110, 1.2000

Resistance Levels: 1.2955, 1.3030, 1.3125, 1.3210, 1.3300, 1.3470, 1.3740

Trading recommendations

Sell in the market. Stop Loss 1.3040. Take-Profit 1.2860, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365

Buy Stop 1.2930. Stop Loss 1.2850. Take-Profit 1.2955, 1.3030

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com