Tifia FX

TifiaFx Representative

- Messages

- 30

S&P500: The threat of a nearly 10-year bull trend breaking down is high

12/27/2018

Current situation

On Wednesday, US stock indexes showed a sharp increase after falling for 4 consecutive sessions before.

DJIA rose 1086 points, or 5%, to 22878 points, which in percentage terms was the most significant one-day increase since March 2009. S&P500 added 5%, while the Nasdaq Composite rose 5.8%.

On Tuesday, US financial markets were closed due to the celebration of Catholic Christmas, while most European markets on Wednesday were still closed due to Boxing Day. On Monday, the DJIA and S&P500 fell by 2.5%, and on Wednesday the DJIA declined at the opening of the trading day to around 21620, losing more than 1,800 points in four sessions. At the opening of the trading day on Wednesday, futures on the S&P500 stood at 2333.0, however, it increased during the day, closing the trading day on Wednesday at 2467.0.

Financial markets continue to be feverish at the end of the year. Investors were nervous about the rising interest rates of the Federal Reserve and the US-China trade conflict. Also on the dynamics of stock markets and the dollar in recent days reflected the continuing criticism of the Fed and its head Powell by US President Donald Trump, as well as the uncertainty associated with the closure of the US government.

On Wednesday, Kevin Hasset, Chairman of the Council of Economic Advisers at the White House, said there was no likelihood of the dismissal of Fed Chairman Jerome Powell, despite criticism of the central bank by President Donald Trump. The recovery of stock market quotes and the dollar on Wednesday also was helped by the positive macro data, according to which, retail sales in the US excluding cars for the period from November 1 to December 24 increased by 5.1% compared with the same period of the previous year, which was the most significant increase in six years.

On Thursday, investors' pessimism returns to the markets. US stock indexes are falling. All 11 sectors of the S&P500 are moving towards ending the year with losses, for the first time since 2008. The threat of breaking a nearly 10-year bull trend is higher than ever before.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

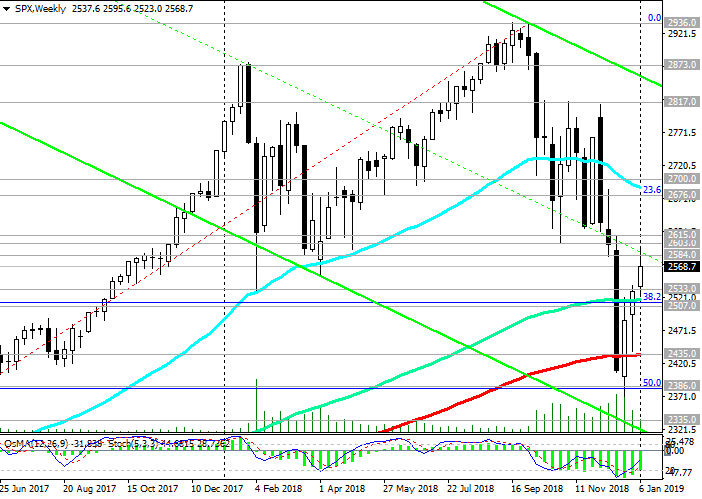

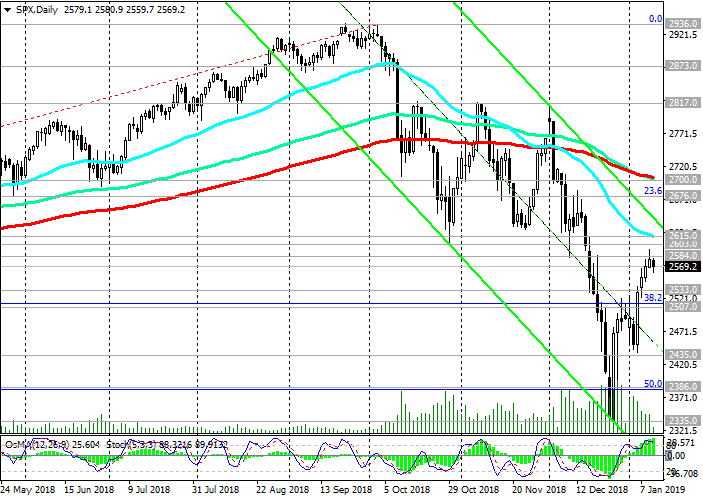

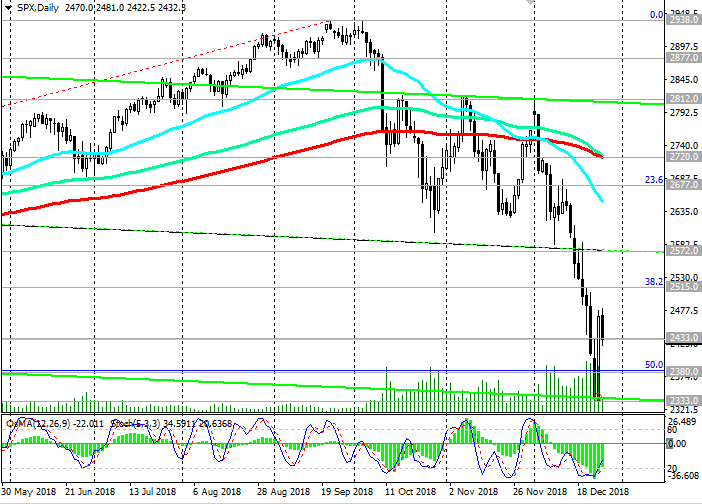

Support and Resistance Levels

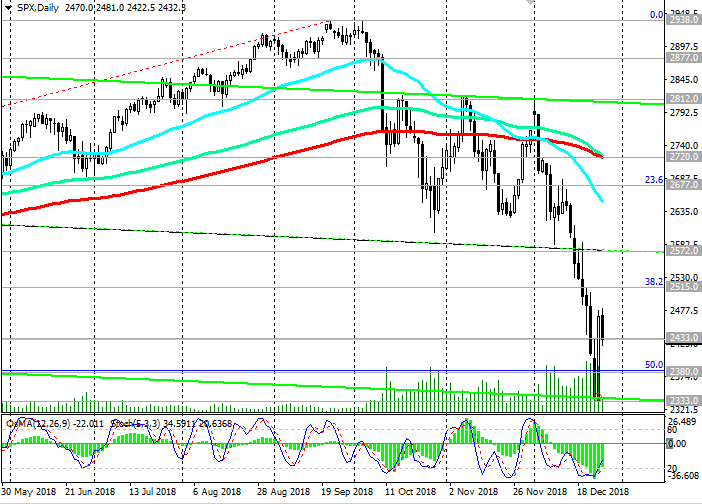

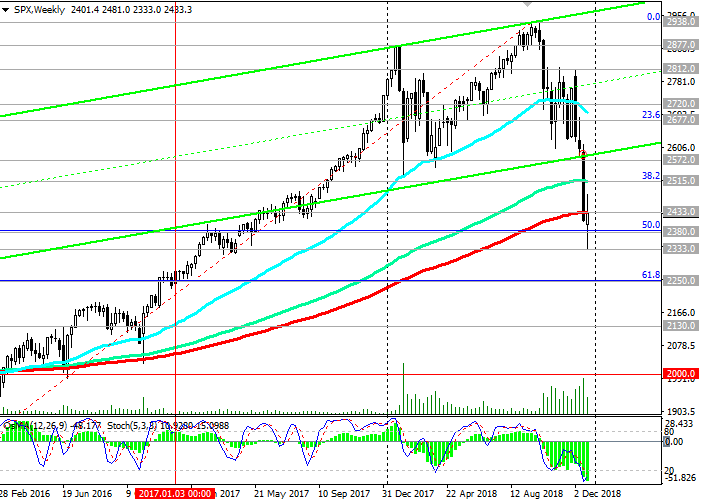

In October, the S&P500 rose to an absolute maximum near the 2938.0 mark. However, a sharp decline in the index began later. Having broken through the strong support levels of 2720.0 (ЕМА200 on the daily chart), 2677.0 (Fibonacci 23.6% of the correction to the growth since February 2016), the S&P500 reached a local minimum near 2333.0 on Wednesday. The last time near this mark S&P500 was in May 2017.

Negative dynamics and pessimism of investors still prevail. On Thursday, the S&P500 declined again after rising the previous day, trading at a key support level of 2433.0 (ЕМА200 on the weekly chart). Fixing below the support level of 2380.0 (Fibonacci level 50%) and a further decline will speak about breaking the bullish trend of the S&P500.

Only after returning to the zone above the resistance level of 2720.0, it will be possible to talk about the resumption of the bull trend. In the current situation, short positions are preferred.

Support Levels: 2433.0, 2380.0, 2333.0, 2250.0, 2130.0

Resistance Levels: 2515.0, 2572.0, 2677.0, 2720.0, 2812.0, 2877.0, 2900.0, 2938.0

Trading Scenarios

Sell Stop 2410.0. Stop Loss 2490.0. Goals 2380.0, 2333.0, 2250.0, 2130.0

Buy Stop 2490.0. Stop-Loss 2410.0. Goals 2515.0, 2572.0, 2677.0, 2720.0, 2812.0, 2877.0, 2900.0, 2938.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

12/27/2018

Current situation

On Wednesday, US stock indexes showed a sharp increase after falling for 4 consecutive sessions before.

DJIA rose 1086 points, or 5%, to 22878 points, which in percentage terms was the most significant one-day increase since March 2009. S&P500 added 5%, while the Nasdaq Composite rose 5.8%.

On Tuesday, US financial markets were closed due to the celebration of Catholic Christmas, while most European markets on Wednesday were still closed due to Boxing Day. On Monday, the DJIA and S&P500 fell by 2.5%, and on Wednesday the DJIA declined at the opening of the trading day to around 21620, losing more than 1,800 points in four sessions. At the opening of the trading day on Wednesday, futures on the S&P500 stood at 2333.0, however, it increased during the day, closing the trading day on Wednesday at 2467.0.

Financial markets continue to be feverish at the end of the year. Investors were nervous about the rising interest rates of the Federal Reserve and the US-China trade conflict. Also on the dynamics of stock markets and the dollar in recent days reflected the continuing criticism of the Fed and its head Powell by US President Donald Trump, as well as the uncertainty associated with the closure of the US government.

On Wednesday, Kevin Hasset, Chairman of the Council of Economic Advisers at the White House, said there was no likelihood of the dismissal of Fed Chairman Jerome Powell, despite criticism of the central bank by President Donald Trump. The recovery of stock market quotes and the dollar on Wednesday also was helped by the positive macro data, according to which, retail sales in the US excluding cars for the period from November 1 to December 24 increased by 5.1% compared with the same period of the previous year, which was the most significant increase in six years.

On Thursday, investors' pessimism returns to the markets. US stock indexes are falling. All 11 sectors of the S&P500 are moving towards ending the year with losses, for the first time since 2008. The threat of breaking a nearly 10-year bull trend is higher than ever before.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and Resistance Levels

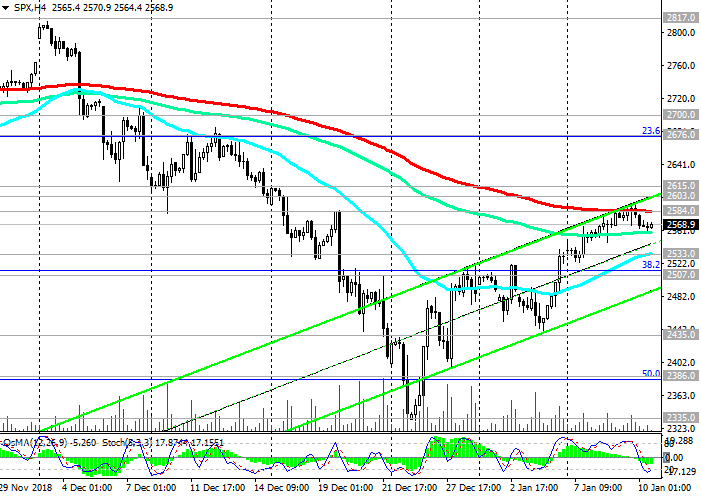

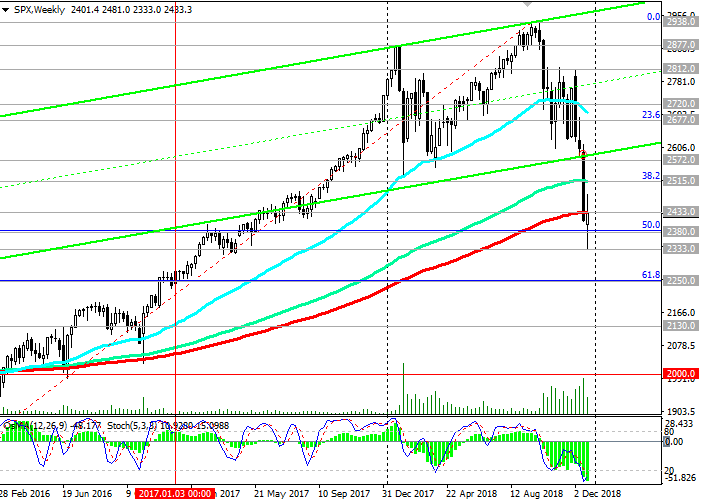

In October, the S&P500 rose to an absolute maximum near the 2938.0 mark. However, a sharp decline in the index began later. Having broken through the strong support levels of 2720.0 (ЕМА200 on the daily chart), 2677.0 (Fibonacci 23.6% of the correction to the growth since February 2016), the S&P500 reached a local minimum near 2333.0 on Wednesday. The last time near this mark S&P500 was in May 2017.

Negative dynamics and pessimism of investors still prevail. On Thursday, the S&P500 declined again after rising the previous day, trading at a key support level of 2433.0 (ЕМА200 on the weekly chart). Fixing below the support level of 2380.0 (Fibonacci level 50%) and a further decline will speak about breaking the bullish trend of the S&P500.

Only after returning to the zone above the resistance level of 2720.0, it will be possible to talk about the resumption of the bull trend. In the current situation, short positions are preferred.

Support Levels: 2433.0, 2380.0, 2333.0, 2250.0, 2130.0

Resistance Levels: 2515.0, 2572.0, 2677.0, 2720.0, 2812.0, 2877.0, 2900.0, 2938.0

Trading Scenarios

Sell Stop 2410.0. Stop Loss 2490.0. Goals 2380.0, 2333.0, 2250.0, 2130.0

Buy Stop 2490.0. Stop-Loss 2410.0. Goals 2515.0, 2572.0, 2677.0, 2720.0, 2812.0, 2877.0, 2900.0, 2938.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com