SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

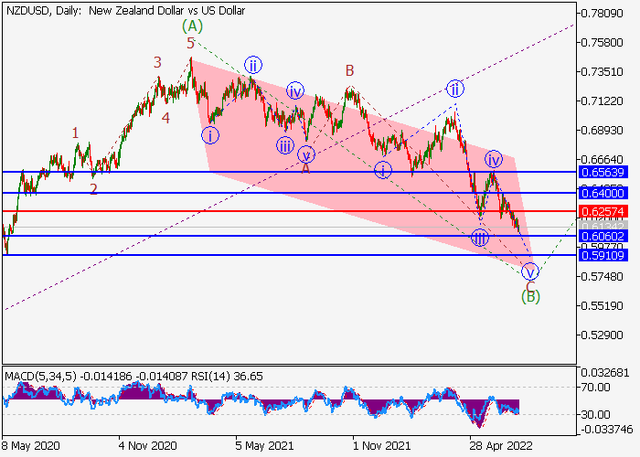

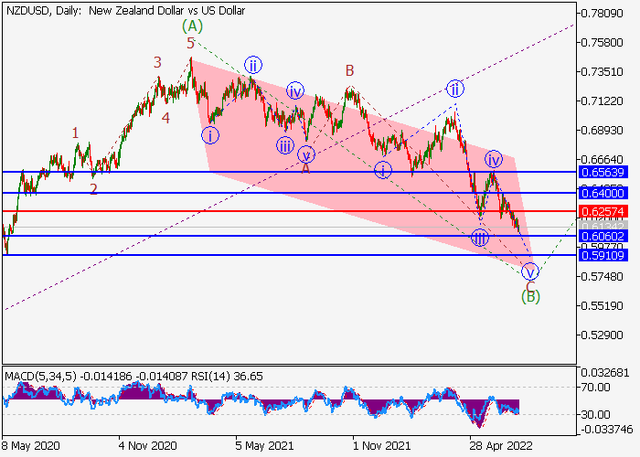

NZDUSD - The pair may fall.

If the assumption is correct, the NZDUSD pair will fall to the levels of 0.6060–0.5910. In this scenario, critical stop loss level is 0.6257.

If the assumption is correct, the NZDUSD pair will fall to the levels of 0.6060–0.5910. In this scenario, critical stop loss level is 0.6257.