SOLID ECN LLC

Solid ECN Representative

- Messages

- 516

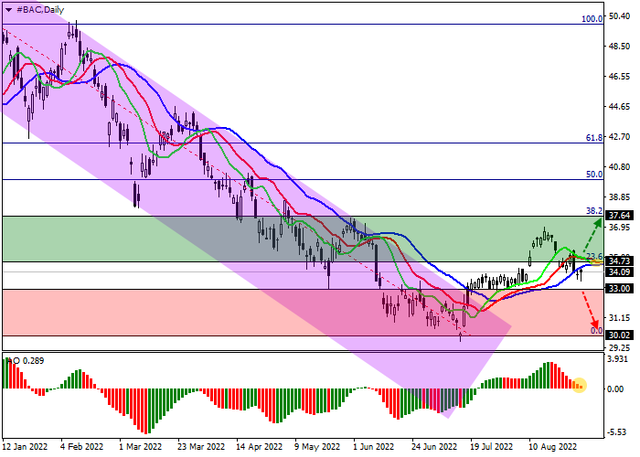

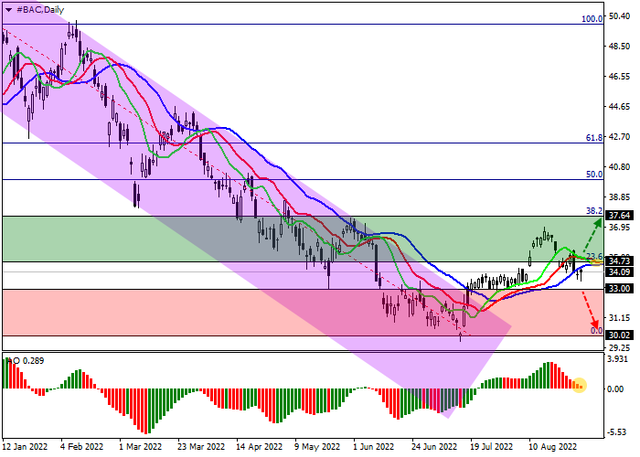

The shares of Bank of America, the largest financial conglomerate in the US, are moving within the corrective trend of around 34.

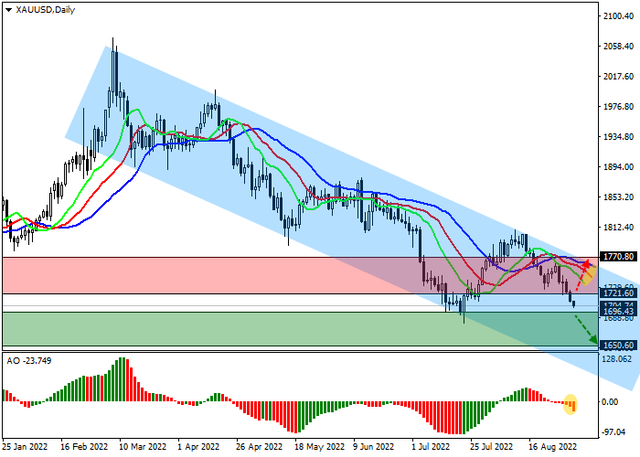

On the daily chart, the price has left the global downward channel with dynamic boundaries at 27 – 33 and is trying to stay within the corrective trend that began after overcoming the initial 23.6% Fibonacci correction at 34.7. On the four-hour chart, it is seen that the upward impulse has high prospects for implementation. However, they are relevant only after the quotes reconsolidation above 34.70.

Technical indicators keep a buy signal: indicator Alligator’s EMA oscillation range is directed upwards, although it is narrowing, and the histogram of the AO oscillator forms downward bars in the buying zone.

On the daily chart, the price has left the global downward channel with dynamic boundaries at 27 – 33 and is trying to stay within the corrective trend that began after overcoming the initial 23.6% Fibonacci correction at 34.7. On the four-hour chart, it is seen that the upward impulse has high prospects for implementation. However, they are relevant only after the quotes reconsolidation above 34.70.

Technical indicators keep a buy signal: indicator Alligator’s EMA oscillation range is directed upwards, although it is narrowing, and the histogram of the AO oscillator forms downward bars in the buying zone.