SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

USDCAD - The pair is retreating from local highs

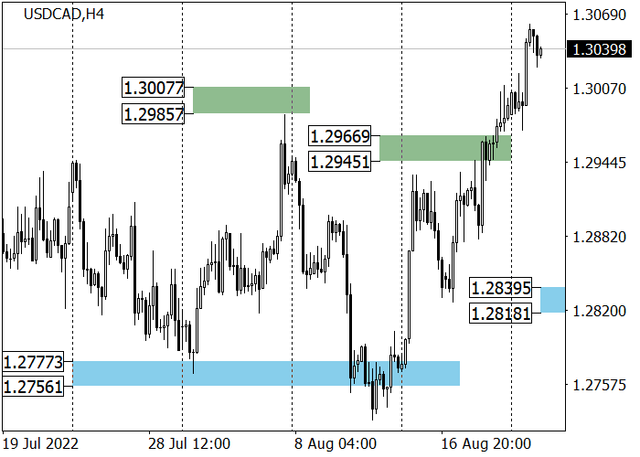

Last Friday, renewed June data on retail sales in Canada was published, which provided little support to the national currency: the core index was 0.8% MoM against the forecast of 0.9%, but in annual terms, the indicator consolidated around 1.1% against the background of preliminary estimates of experts at 0.3%. Retail sales excluding cars for the same period adjusted from 1.9% to 0.8%. Another negative factor that influenced the dynamics of the trading instrument was the publication of the July index of prices for new housing in Canada, which rose by 0.1% but did not live up to the forecast of 0.3% and was worse than the previous value of 0.2%.

As for the US economy, the core retail sales index for July added 0.4%, exceeding the forecast of –0.1%. However, the volume of retail sales for July remained unchanged, showing a value of 0.0%, against the preliminary estimates of 0.1%. Next month, traders expect the US Federal Reserve to raise interest rates in the range of 0.50% to 0.75%, and the market is already pricing this scenario into the value of assets, primarily the US dollar. If the experts' expectations are justified, the US dollar will continue to strengthen, and, accordingly, the USD/CAD pair will rise with the target at the July high of 1.3218.

The long-term trend is upwards. The key support area formed in the price range 1.2780–1.2740, and the buyers held it. As a result, the upward dynamics will continue to 1.3157 and 1.3218. The mid-term trend changed to an uptrend last week. The trading instrument broke the target zone 1.2966–1.2945, and the next target is zone 2 (1.3192–1.3170). The key trend support is shifting to 1.2839–1.2818, and in case of correction of quotes to this area, it will be possible to open new long positions.

Resistance levels: 1.3065, 1.3157, 1.3218 | Support levels: 1.2935, 1.2780, 1.2740

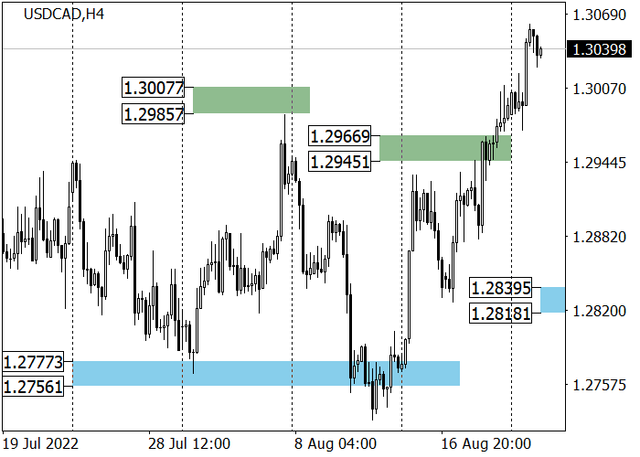

Last Friday, renewed June data on retail sales in Canada was published, which provided little support to the national currency: the core index was 0.8% MoM against the forecast of 0.9%, but in annual terms, the indicator consolidated around 1.1% against the background of preliminary estimates of experts at 0.3%. Retail sales excluding cars for the same period adjusted from 1.9% to 0.8%. Another negative factor that influenced the dynamics of the trading instrument was the publication of the July index of prices for new housing in Canada, which rose by 0.1% but did not live up to the forecast of 0.3% and was worse than the previous value of 0.2%.

As for the US economy, the core retail sales index for July added 0.4%, exceeding the forecast of –0.1%. However, the volume of retail sales for July remained unchanged, showing a value of 0.0%, against the preliminary estimates of 0.1%. Next month, traders expect the US Federal Reserve to raise interest rates in the range of 0.50% to 0.75%, and the market is already pricing this scenario into the value of assets, primarily the US dollar. If the experts' expectations are justified, the US dollar will continue to strengthen, and, accordingly, the USD/CAD pair will rise with the target at the July high of 1.3218.

The long-term trend is upwards. The key support area formed in the price range 1.2780–1.2740, and the buyers held it. As a result, the upward dynamics will continue to 1.3157 and 1.3218. The mid-term trend changed to an uptrend last week. The trading instrument broke the target zone 1.2966–1.2945, and the next target is zone 2 (1.3192–1.3170). The key trend support is shifting to 1.2839–1.2818, and in case of correction of quotes to this area, it will be possible to open new long positions.

Resistance levels: 1.3065, 1.3157, 1.3218 | Support levels: 1.2935, 1.2780, 1.2740