SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

BTC USD - short-term price correction possible

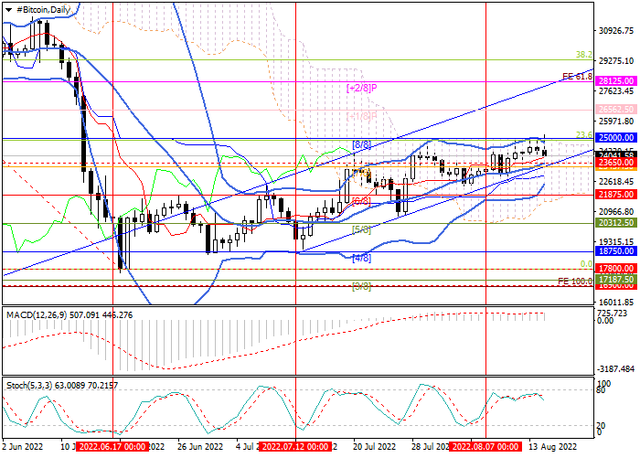

The main driver of positive dynamics was the July data on US inflation: a slowdown in its growth to 8.5% made many investors hope that the peak of consumer price growth in the country has passed, and the indicator will now begin to move towards the target level of 2.0%, which may force the US Federal Reserve to abandon a sharp rate hike of 75 or 100 percentage points at the next meetings. It, in turn, became a catalyst for the active decline of the dollar against its main competitors. Also, the transition of the Ethereum network to the Proof-of-Stake (PoS) proof algorithm, scheduled for mid-September, arouses the interest of traders in the entire cryptocurrency market and “digital gold” in particular.

The price has rolled back down and not consolidated above 25000. Judging by the reversal of Stochastic near the overbought zone, the decline may continue to the middle line of Bollinger bands around 23650, and in case the quotes consolidate below it and 23437.5, return to 21875. Otherwise, growth will resume towards 25000, 26562.5, and 28125.

Resistance levels: 25000, 26562.5, 28125 | Support levels: 23437.5, 21875, 20312

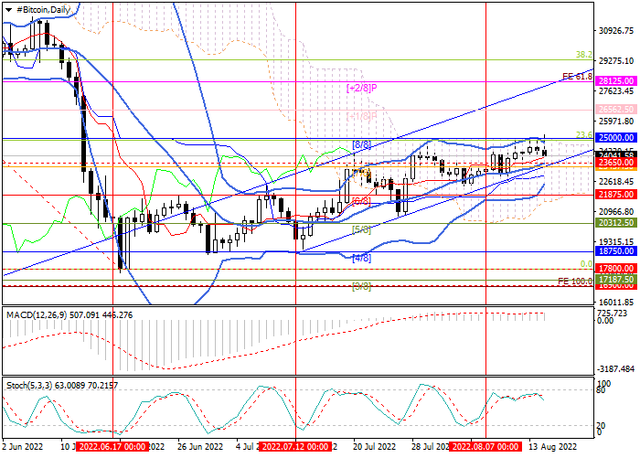

The main driver of positive dynamics was the July data on US inflation: a slowdown in its growth to 8.5% made many investors hope that the peak of consumer price growth in the country has passed, and the indicator will now begin to move towards the target level of 2.0%, which may force the US Federal Reserve to abandon a sharp rate hike of 75 or 100 percentage points at the next meetings. It, in turn, became a catalyst for the active decline of the dollar against its main competitors. Also, the transition of the Ethereum network to the Proof-of-Stake (PoS) proof algorithm, scheduled for mid-September, arouses the interest of traders in the entire cryptocurrency market and “digital gold” in particular.

The price has rolled back down and not consolidated above 25000. Judging by the reversal of Stochastic near the overbought zone, the decline may continue to the middle line of Bollinger bands around 23650, and in case the quotes consolidate below it and 23437.5, return to 21875. Otherwise, growth will resume towards 25000, 26562.5, and 28125.

Resistance levels: 25000, 26562.5, 28125 | Support levels: 23437.5, 21875, 20312