SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

USDCHF - A fall is possible.

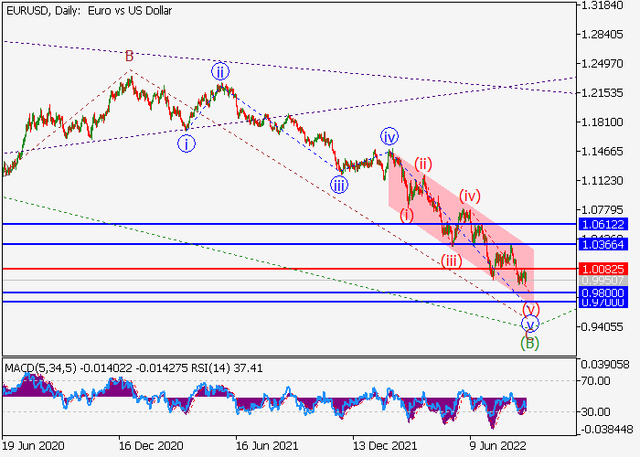

On the daily chart, the downward fifth wave of the higher level 5 develops, within which the first wave (1) of 5 forms. Now, the first wave of the lower level 1 of (1) has formed and a local correction is developing as the second wave 2 of (1).

If the assumption is correct, after the end of the correction, the USDCHF pair will fall to the area of 0.8916 – 0.8730. In this scenario, critical stop loss level is 0.9889.

On the daily chart, the downward fifth wave of the higher level 5 develops, within which the first wave (1) of 5 forms. Now, the first wave of the lower level 1 of (1) has formed and a local correction is developing as the second wave 2 of (1).

If the assumption is correct, after the end of the correction, the USDCHF pair will fall to the area of 0.8916 – 0.8730. In this scenario, critical stop loss level is 0.9889.