SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

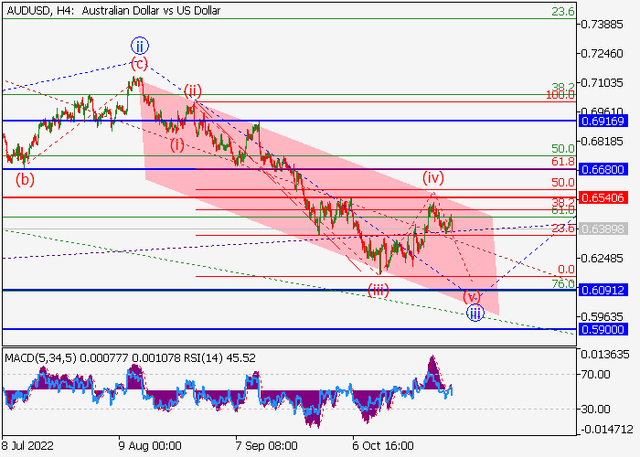

USDCHF - Growth is possible.

On the daily chart, the first upward wave of the higher level (1) of 3 develops, within which the wave 5 of (1) forms. Now, the third wave of the lower level iii of 5 is developing, within which a local correction is developing as the wave (iv) of iii.

If the assumption is correct, the USDCHF pair will grow to the area of 1.02 – 1.03. In this scenario, critical stop loss level is 0.9908.

If the assumption is correct, the USDCHF pair will grow to the area of 1.02 – 1.03. In this scenario, critical stop loss level is 0.9908.