Part I. Market Sentiment and COT report

Pipruit: Well, by their positions, I suppose, that they have opened already…

Commander in Pips: … and?

Pipruit: Oh, and with orders that they have placed by intention to open some position in the nearest future.

Commander in Pips: So, looking at any trading approach from a probability point of view, each trader meets such situations when the market moves in the opposite direction absolutely negating the fact that you see the clearest and safest pattern or some exceptionally perfect pattern or something – you still could lose money.

Why? Because market direction is a result of the overall opinion of all participants – in other words, the opinion of all traders together. This total assessment, some average feeling of the market that weighted on the value of positions is a market sentiment. And the market will move in the direction where sentiment points it to go. Particularly, sentiment explains the direction of the market. Market sentiment can’t tell us where we have to enter, take profit and place a stop order. Still it could be useful, since you can assess the current move from the perspective of the majority – should you follow the current trend or not. This is extremely important for cycle commodities markets, by the way, such as Corn, Wheat and similar. So, where do I stop? Right. So, it’s obvious that we can’t force the market to turn, just since MACD shows a bull trend, but our task here is to react and follow market sentiment.

Pipruit: So, does it mean that we have to develop some kind of sentiment analysis, to involve it in overall market picture?

Commander in Pips: Absolutely right. Mostly it is necessary for long-term positional traders or traders, who deal with macro data releases, but probably it will not be needless for others. Hence the first task is to find a measurement of market sentiment. Without that how can you build a strategy that will involve it, if you even can’t measure it?

Pipruit: And how we can do that?

Commander in Pips: If you remember, when we’ve spoken about comparison of futures and forex markets, the one major difference was in type of trading. Futures trade on exchanges while forex is not. One of the sentiment indicators is a trading or tick volume. And futures do have it.

Commander in Pips: Although we have not discussed volume indicators, the major point of the classical approach tells us that any significant move should be confirmed by trading volume. If the market moves up, but trading volume reduces – it tells us that the majority does not support this move – market sentiment is not on the side of the upward move. So, retracement or even reversal is near. Here is another example – let’s suppose some asset shows a drastic reversal with a huge move and this counter-direction is supported by trading volume. It tells us that sentiment is on the side of that move and most participants agree with it.

But we can’t use trading volumes for forex market…

Commander in Pips: There is something that is called the Commitment of Traders (COT) report.

Commitment of Traders (COT) report

This report is released by the Commodity Futures Trading Commission and they publishe it weekly (on Friday between 14:00-15:00 EST). Here is the link for the page of the report:

Commitments of Traders - CFTC

Commander in Pips: If you remember, when we’ve spoken about comparison of futures and forex markets, the one major difference was in type of trading. Futures trade on exchanges while forex is not. One of the sentiment indicators is a trading or tick volume. And futures do have it.

Pipruit: And how it could help us?

But we can’t use trading volumes for forex market…

Pipruit: Oh, so, what are we going to do then?

Commitment of Traders (COT) report

This report is released by the Commodity Futures Trading Commission and they publishe it weekly (on Friday between 14:00-15:00 EST). Here is the link for the page of the report:

Commitments of Traders - CFTC

Pipruit: Ok, I see, but how we can use it, and why is this report so valuable?

Commander in Pips: Well, in general this report contains two big parts – net positions (Long-shorts) of commercial traders and speculative traders. So, based on them you can gauge about strength and weight of positions. You can see either investors net short or long and how much. In general this report shows positions of really big whales, like hedgers, then stands large speculators or speculative departments of the same big whales and then stands us - retail traders.

Commander in Pips: Well, although, the futures market is much thinner than spot, its trading activity is clearly a copy (although of smaller value) of the spot market. You have to use the numbers not in absolute value but in relative value, because moving of real trading volumes on the spot market has it’s proportional reflection on the futures market. That’s why futures trading volume and positions are very useful for us.

And second answer is more critical – you have no choice, since you do not have any other sources of such kind of information.

Commander in Pips: Yes. Now let’s discuss how to read that report properly.

Finding and reading COT Report

When you click on the link that we’ve given to you to access the report you’ll see the followed page:

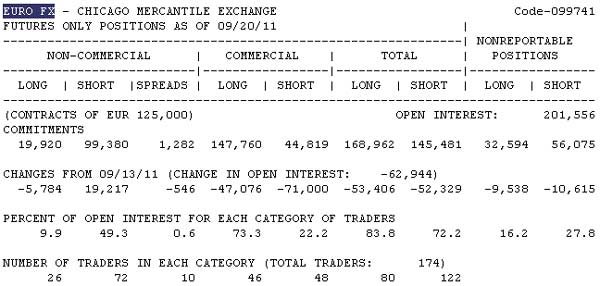

Now scroll down the page a bit lower, until you’ll see the followed table – “Current Legacy Report”. Depending on what you particularly do want to see you may choose different exchanges, since different assets and commodities are traded at different exchanges.

Now scroll down the page a bit lower, until you’ll see the followed table – “Current Legacy Report”. Depending on what you particularly do want to see you may choose different exchanges, since different assets and commodities are traded at different exchanges.

Since we need currency futures positions – they are mostly traded on Chicago Mercantile Exchange, then choose “short format”.

Then you’ll see text tables, dedicated to each asset that is in listing of this exchange. CME list particularly starts from Butter, but we need currencies, so scroll page lower, until you will find the currency that you need to. Let it be EURO:

If you do not want to scroll the page manually, just use search function of your browser and type the currency whatever you want to find, but keep in mind that not each currency pair trades on CME. Second, pairs that involve CHF, JPY are JPY/USD and CHF/USD but not vice versa as on spot market. That’s important. It will be much better, if you will visit the CME web-site and read futures contract specification first, since any contract could have other nuances. For instance, take a look at picture above – see the text in brackets – “Contracts of EUR 125,000” . The point is that the lot of this futures contract is 125,000 EUR and not 100,000 as on the spot market. In other words – be careful and be sure that you understand all the details.

If you do not want to scroll the page manually, just use search function of your browser and type the currency whatever you want to find, but keep in mind that not each currency pair trades on CME. Second, pairs that involve CHF, JPY are JPY/USD and CHF/USD but not vice versa as on spot market. That’s important. It will be much better, if you will visit the CME web-site and read futures contract specification first, since any contract could have other nuances. For instance, take a look at picture above – see the text in brackets – “Contracts of EUR 125,000” . The point is that the lot of this futures contract is 125,000 EUR and not 100,000 as on the spot market. In other words – be careful and be sure that you understand all the details.

So, how to translate all these markings?

Non-Commercial – includes large financial firms, hedge funds and individuals. Positions of this group of market’s participants are mostly speculative;

Commercial – usually they are big companies, that use futures to hedge currency risk on their export oriented transactions and other businesses;

Long – I think you understand that. Right? - this is a number of long contracts reported to the CFTC;

Short – number of short contracts reported to CFTC;

Open interest – shows total number of contracts that have not been exercised yet or delivered;

Number of traders – just specifies the number of traders that take part in the report for each category;

Reportable positions – those that have to be reported for CFTC due to its regulations;

Non-reportable positions – positions of those traders that do not have strict obligation to report their positions, for instance, retail traders.

Also in the main menu on this site you can find historical data for that reports…

Commander in Pips: Ok, I see. So, if you do not want to dig in all that text tables – here is Wall Street courier source, that have all the history and charts where you can see in visually:

In general, the major sense of that report is in picture of overall market positions, i.e. sentiment – does the market sentiment lean bullish, bearish or neutral and in what degree.

Groups of COT Report and their value

As we’ve said COT Report classifies total positions by different groups:

1. Commercial traders (mostly hedgers);

2. Non-commercial (speculatest speculators);

3. Retailers (just speculators, like you and me).

So, why do we have to keep an eye on positions of the first two groups? Let’s discuss what kind of transactions and positions each group holds and why they give us important information about market sentiment.

Hedgers

These guys do not use Forex for speculative income but for controlling currency risk – unwelcome change in currency rate. This could be large corporations (importers or exporters), those who realize some long-term project that involves currency risk and banks. Just for further clarification let’s discuss some examples.

1. Let’s suppose that some wheat producer has a contract on delivery some amount of wheat to some Japanese buyer. But this delivery should happen not now, but after some time, say, 9 month. The price has been fixed in contract in JPY. But producer worries that JPY will fall compared to the USD and so he will get less money in USD. This is a risk for him, since he counts on some minimum return ratio and he needs to compensate some fixed expenses that do not depend on revenues. This compensation is possible at price in contract but with current USD/JPY ratio.

1 continued. So, he could buy USD/JPY futures. If yen will fall – he will get additional surplus on futures and will get necessary amount of revenues by converting profit from futures into USD. If JPY will rise, then he doesn’t care – although he will fix loss on futures position – it will be compensated by revenues at higher USD/JPY rate and it will get necessary revenue in USD anyway.

2. Imagine that Cisco has a contract on purchase some machines with some EU supplier. But this contract is long-term and Cisco has to pay for the machines in EUR by equal transfers during the year. The cost of the contract in EUR is fixed. In the beginning of the year, Cisco assesses investment, say, in $10mln at 1.20 EUR/USD rate. If EUR will rise during the year, Cisco will have to overpay for that machines and it does not want to do that. Cisco could hedge currency risk with EUR/USD futures and buy it. Acting like that, Cisco will compensate EUR growth and it’s overpaying by profit on futures. If EUR will fall to USD, then Cisco will get loss on futures, but it will pay less in USD since contract price is fixed in EUR. As a result it will meet expenses precisely how it has planned them.

3. The last example with some US Bank, that loan from Swiss Bank in CHF, say for couple of years at some fix percent rate. I allow you to investigate that problem by yourself, just to not solve for you any task. Just think, what will happen if CHF will rise or fall and how can the US Bank hedge this risk.

I think you’ve got an idea of hedging. Now I want you to imagine possible values of such transactions, since the major participants here are large banks, some transnational companies, solid producers, retailers etc. This is just huge amount of money.

But rule to understand their positions is simple:

Commercials are usually extremely short at market tops and extremely long at market bottoms

Speculatest speculators

In fact they could be the same large banks, just another branch of them, since you know that transnational banks, such as JP Morgan, Deutsche Bank, Goldman Sachs and others have a lot of different branches – classical services, assets management, private banking, brokerage etc. So they can act on Forex as hedgers as speculators – just remember the table in earlier chapter who are most active on Forex…

Since they can trade will really huge volumes their positions couldn’t be just stopped and reversed suddenly. They need some time to not shake the market, they gradually adding to position more and more until the trend holds and gradually exit or reverse it when it changes. It means that their trading is medium-term or even long-term, mostly based on following the trend strategy. Simple example of “following the trend” strategy is trading based on some medium-term or long-term MA.

Retailers or feeders

They are me and you – those who risk to be crushed in churning almost every minute. If you will take a look at profit of huge speculators from currency operations, you can imagine how many feeders we need to feed just one big bank. That’s the reason, why 90% of retailers lose money on Forex. Their money is necessary to feed the big speculators. Since many of them trade reversals and retracements – i.e. trade against big whales, they mostly lose instead of win. Still, if retailers join big banks and understand what they are doing currently, they have chances to succeed.

Commander in Pips: Well, in general this report contains two big parts – net positions (Long-shorts) of commercial traders and speculative traders. So, based on them you can gauge about strength and weight of positions. You can see either investors net short or long and how much. In general this report shows positions of really big whales, like hedgers, then stands large speculators or speculative departments of the same big whales and then stands us - retail traders.

Pipruit: But this report shows position of futures market, not of spot forex, right? So, how could I be sure that these positions adequately show the real flows on the spot market?

Commander in Pips: Well, although, the futures market is much thinner than spot, its trading activity is clearly a copy (although of smaller value) of the spot market. You have to use the numbers not in absolute value but in relative value, because moving of real trading volumes on the spot market has it’s proportional reflection on the futures market. That’s why futures trading volume and positions are very useful for us.

And second answer is more critical – you have no choice, since you do not have any other sources of such kind of information.

Pipruit: Right. That’s fine, let it be the COT report…

Commander in Pips: Yes. Now let’s discuss how to read that report properly.

Finding and reading COT Report

When you click on the link that we’ve given to you to access the report you’ll see the followed page:

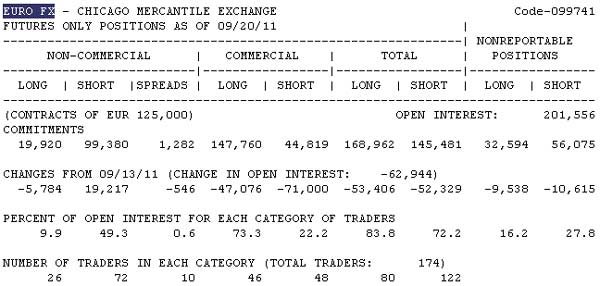

Since we need currency futures positions – they are mostly traded on Chicago Mercantile Exchange, then choose “short format”.

Then you’ll see text tables, dedicated to each asset that is in listing of this exchange. CME list particularly starts from Butter, but we need currencies, so scroll page lower, until you will find the currency that you need to. Let it be EURO:

So, how to translate all these markings?

Non-Commercial – includes large financial firms, hedge funds and individuals. Positions of this group of market’s participants are mostly speculative;

Commercial – usually they are big companies, that use futures to hedge currency risk on their export oriented transactions and other businesses;

Long – I think you understand that. Right? - this is a number of long contracts reported to the CFTC;

Short – number of short contracts reported to CFTC;

Open interest – shows total number of contracts that have not been exercised yet or delivered;

Number of traders – just specifies the number of traders that take part in the report for each category;

Reportable positions – those that have to be reported for CFTC due to its regulations;

Non-reportable positions – positions of those traders that do not have strict obligation to report their positions, for instance, retail traders.

Also in the main menu on this site you can find historical data for that reports…

Pipruit: Hm, it still looks very confusing to me…

Commander in Pips: Ok, I see. So, if you do not want to dig in all that text tables – here is Wall Street courier source, that have all the history and charts where you can see in visually:

In general, the major sense of that report is in picture of overall market positions, i.e. sentiment – does the market sentiment lean bullish, bearish or neutral and in what degree.

Groups of COT Report and their value

As we’ve said COT Report classifies total positions by different groups:

1. Commercial traders (mostly hedgers);

2. Non-commercial (speculatest speculators);

3. Retailers (just speculators, like you and me).

So, why do we have to keep an eye on positions of the first two groups? Let’s discuss what kind of transactions and positions each group holds and why they give us important information about market sentiment.

Hedgers

These guys do not use Forex for speculative income but for controlling currency risk – unwelcome change in currency rate. This could be large corporations (importers or exporters), those who realize some long-term project that involves currency risk and banks. Just for further clarification let’s discuss some examples.

1. Let’s suppose that some wheat producer has a contract on delivery some amount of wheat to some Japanese buyer. But this delivery should happen not now, but after some time, say, 9 month. The price has been fixed in contract in JPY. But producer worries that JPY will fall compared to the USD and so he will get less money in USD. This is a risk for him, since he counts on some minimum return ratio and he needs to compensate some fixed expenses that do not depend on revenues. This compensation is possible at price in contract but with current USD/JPY ratio.

1 continued. So, he could buy USD/JPY futures. If yen will fall – he will get additional surplus on futures and will get necessary amount of revenues by converting profit from futures into USD. If JPY will rise, then he doesn’t care – although he will fix loss on futures position – it will be compensated by revenues at higher USD/JPY rate and it will get necessary revenue in USD anyway.

2. Imagine that Cisco has a contract on purchase some machines with some EU supplier. But this contract is long-term and Cisco has to pay for the machines in EUR by equal transfers during the year. The cost of the contract in EUR is fixed. In the beginning of the year, Cisco assesses investment, say, in $10mln at 1.20 EUR/USD rate. If EUR will rise during the year, Cisco will have to overpay for that machines and it does not want to do that. Cisco could hedge currency risk with EUR/USD futures and buy it. Acting like that, Cisco will compensate EUR growth and it’s overpaying by profit on futures. If EUR will fall to USD, then Cisco will get loss on futures, but it will pay less in USD since contract price is fixed in EUR. As a result it will meet expenses precisely how it has planned them.

3. The last example with some US Bank, that loan from Swiss Bank in CHF, say for couple of years at some fix percent rate. I allow you to investigate that problem by yourself, just to not solve for you any task. Just think, what will happen if CHF will rise or fall and how can the US Bank hedge this risk.

I think you’ve got an idea of hedging. Now I want you to imagine possible values of such transactions, since the major participants here are large banks, some transnational companies, solid producers, retailers etc. This is just huge amount of money.

But rule to understand their positions is simple:

Commercials are usually extremely short at market tops and extremely long at market bottoms

Speculatest speculators

In fact they could be the same large banks, just another branch of them, since you know that transnational banks, such as JP Morgan, Deutsche Bank, Goldman Sachs and others have a lot of different branches – classical services, assets management, private banking, brokerage etc. So they can act on Forex as hedgers as speculators – just remember the table in earlier chapter who are most active on Forex…

Since they can trade will really huge volumes their positions couldn’t be just stopped and reversed suddenly. They need some time to not shake the market, they gradually adding to position more and more until the trend holds and gradually exit or reverse it when it changes. It means that their trading is medium-term or even long-term, mostly based on following the trend strategy. Simple example of “following the trend” strategy is trading based on some medium-term or long-term MA.

Retailers or feeders

They are me and you – those who risk to be crushed in churning almost every minute. If you will take a look at profit of huge speculators from currency operations, you can imagine how many feeders we need to feed just one big bank. That’s the reason, why 90% of retailers lose money on Forex. Their money is necessary to feed the big speculators. Since many of them trade reversals and retracements – i.e. trade against big whales, they mostly lose instead of win. Still, if retailers join big banks and understand what they are doing currently, they have chances to succeed.

Comments

F

fzepeda

12 years ago,

Registered user

do you know where can I find an indicator or EA to track this information for mt4?for Market Sentiment and COT Report

PistolDave

12 years ago,

Registered user

> do you know where can I find an indicator or EA to track this information for mt4?for Market Sentiment and COT Report

I don't know of any indicator, but you can see an updated chart on

COT Charts | Commitment Of Traders Charts | Free COT Data

and use it to see most of what is in the tables, in a graphical form. You still have to interpret it to be able to use it for forecasting the likely direction of the market.

Another one you can use is:

http://www.timingcharts.com/charts

but the COT part of the charts are a little small and hard to read.

I don't know of any indicator, but you can see an updated chart on

COT Charts | Commitment Of Traders Charts | Free COT Data

and use it to see most of what is in the tables, in a graphical form. You still have to interpret it to be able to use it for forecasting the likely direction of the market.

Another one you can use is:

http://www.timingcharts.com/charts

but the COT part of the charts are a little small and hard to read.

R

Red Herring

10 years ago,

Registered user

Its time to have some knowledge about market sentiments! I hope newbies who are not through the School will also find it helpful.

Good job FPA

Good job FPA

Y

ysaemidred

5 years ago,

Registered user

Hey Sive, thanks for your insights on the report but will appreciate if you can discuss how to do an in-depth analysis and interpretation of the data on the COT report to gauge market sentiment. you mentioned that we should focus on the non commercial and commercial data but what data under this category should we focus on and how do we interpret the data. I am wondering if the open interest is what we need to interpret or how and what data exactly should we intepret?

Also , wall street courier and COT link is not available. the page returns an error message

Also , wall street courier and COT link is not available. the page returns an error message

Table of Contents

- Introduction

- FOREX - What is it ?

- Why FOREX?

- The structure of the FOREX market

- Trading sessions

- Where does the money come from in FOREX?

- Different types of market analysis

- Chart types

- Support and Resistance

-

Candlesticks – what are they?

- Part I. Candlesticks – what are they?

- Part II. How to interpret different candlesticks?

- Part III. Simple but fundamental and important patterns

- Part IV. Single Candlestick Patterns

- Part V. Double Deuce – dual candlestick patterns

- Part VI. Triple candlestick patterns

- Part VII - Summary: Japanese Candlesticks and Patterns Sheet

-

Mysterious Fibonacci

- Part I. Mysterious Fibonacci

- Part II. Fibonacci Retracement

- Part III. Advanced talks on Fibonacci Retracement

- Part IV. Sometimes Mr. Fibonacci could fail...really

- Part V. Combination of Fibonacci levels with other lines

- Part VI. Combination of Fibonacci levels with candle patterns

- Part VII. Fibonacci Extensions

- Part VIII. Advanced view on Fibonacci Extensions

- Part IX. Using Fibonacci for placing orders

- Part X. Fibonacci Summary

-

Introduction to Moving Averages

- Part I. Introduction to Moving Averages

- Part II. Simple Moving Average

- Part III. Exponential Moving Average

- Part IV. Which one is better – EMA or SMA?

- Part V. Using Moving Averages. Displaced MA

- Part VI. Trading moving averages crossover

- Part VII. Dynamic support and resistance

- Part VIII. Summary of Moving Averages

-

Bollinger Bands

- Part I. Bollinger Bands

- Part II. Moving Average Convergence Divergence - MACD

- Part III. Parabolic SAR - Stop And Reversal

- Part IV. Stochastic

- Part V. Relative Strength Index

- Part VI. Detrended Oscillator and Momentum Indicator

- Part VII. Average Directional Move Index – ADX

- Part VIII. Indicators: Tightening All Together

- Leading and Lagging Indicators

- Basic chart patterns

- Pivot points – description and calculation

- Elliot Wave Theory

- Intro to Harmonic Patterns

- Divergence Intro

- Harmonic Approach to Recognizing a Trend Day

- Intro to Breakouts and Fakeouts

- Again about Fundamental Analysis

- Cross Pair – What the Beast is That?

- Multiple Time Frame Intro

- Market Sentiment and COT report

- Dealing with the News

- Let's Start with Carry

- Let’s Meet with Dollar Index

- Intermarket Analysis - Commodities

- Trading Plan Framework – Common Thoughts

- A Bit More About Personality

- Mechanical Trading System Intro

- Tracking Your Performance

- Risk Management Framework

- A Bit More About Leverage

- Why Do We Need Stop-Loss Orders?

- Scaling of Position

- Intramarket Correlations

- Some Talk About Brokers

- Forex Scam - Money Managers

- Graduation!